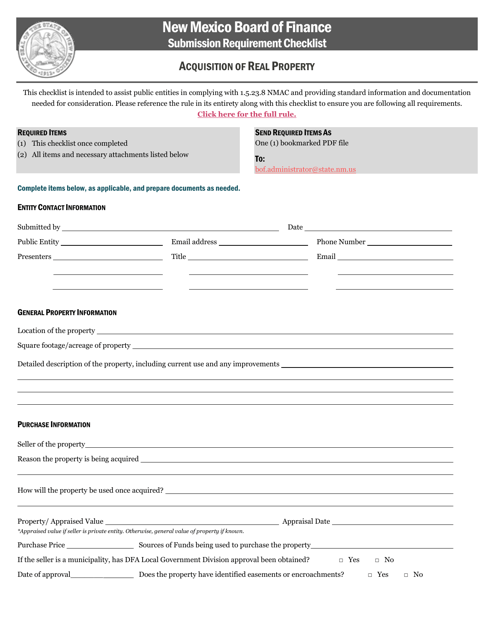

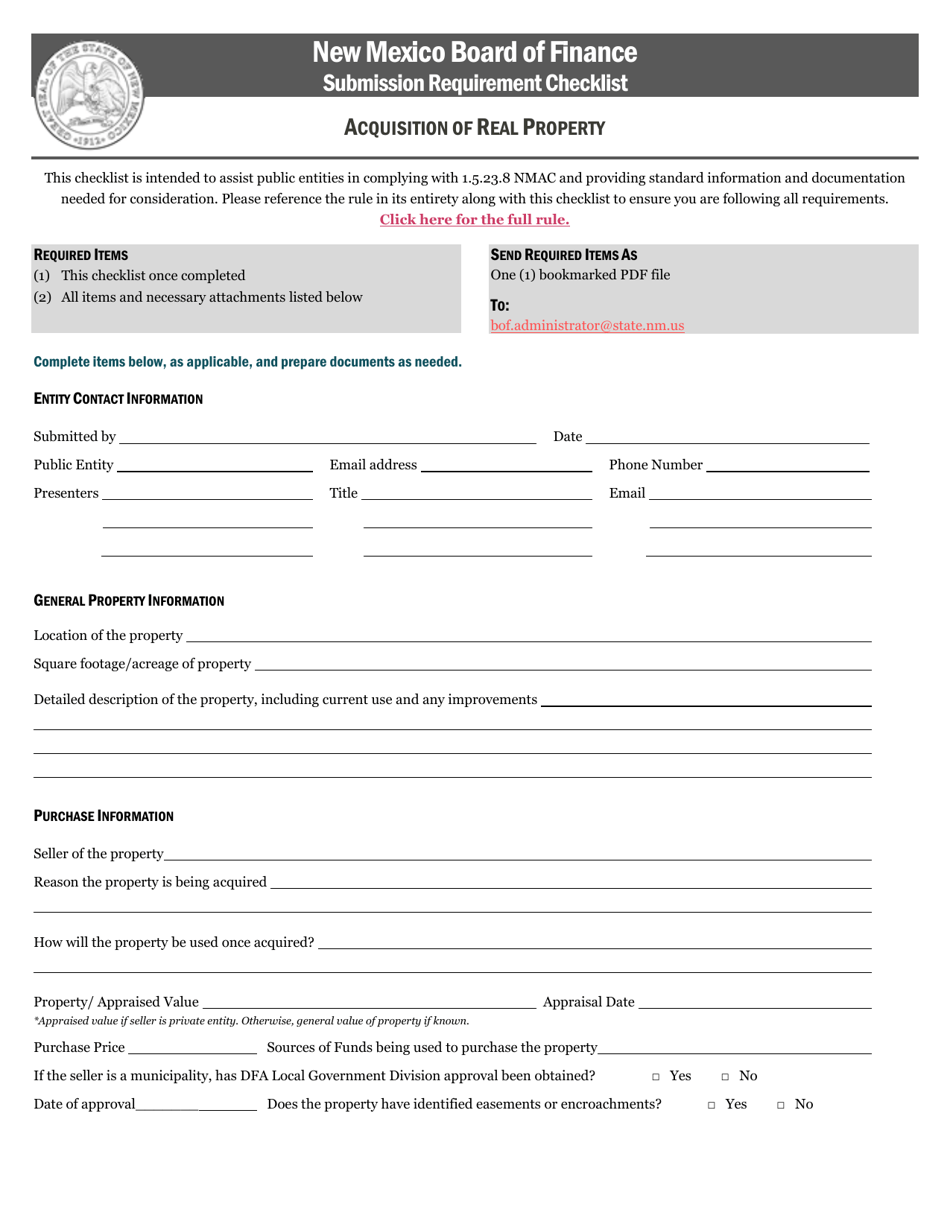

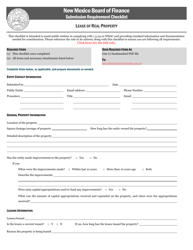

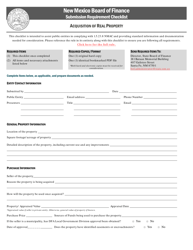

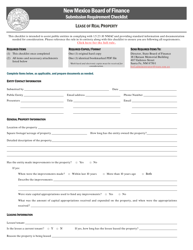

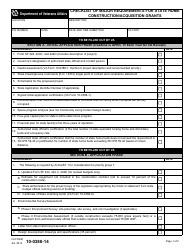

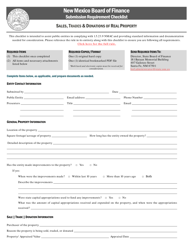

Checklist for Submission on Acquisition of Real Property - New Mexico

Checklist for Submission on Acquisition of Real Property is a legal document that was released by the New Mexico Department of Finance and Administration - a government authority operating within New Mexico.

FAQ

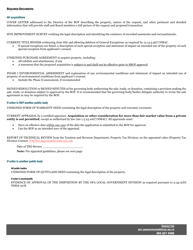

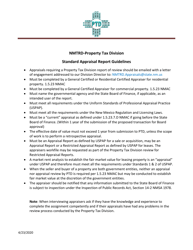

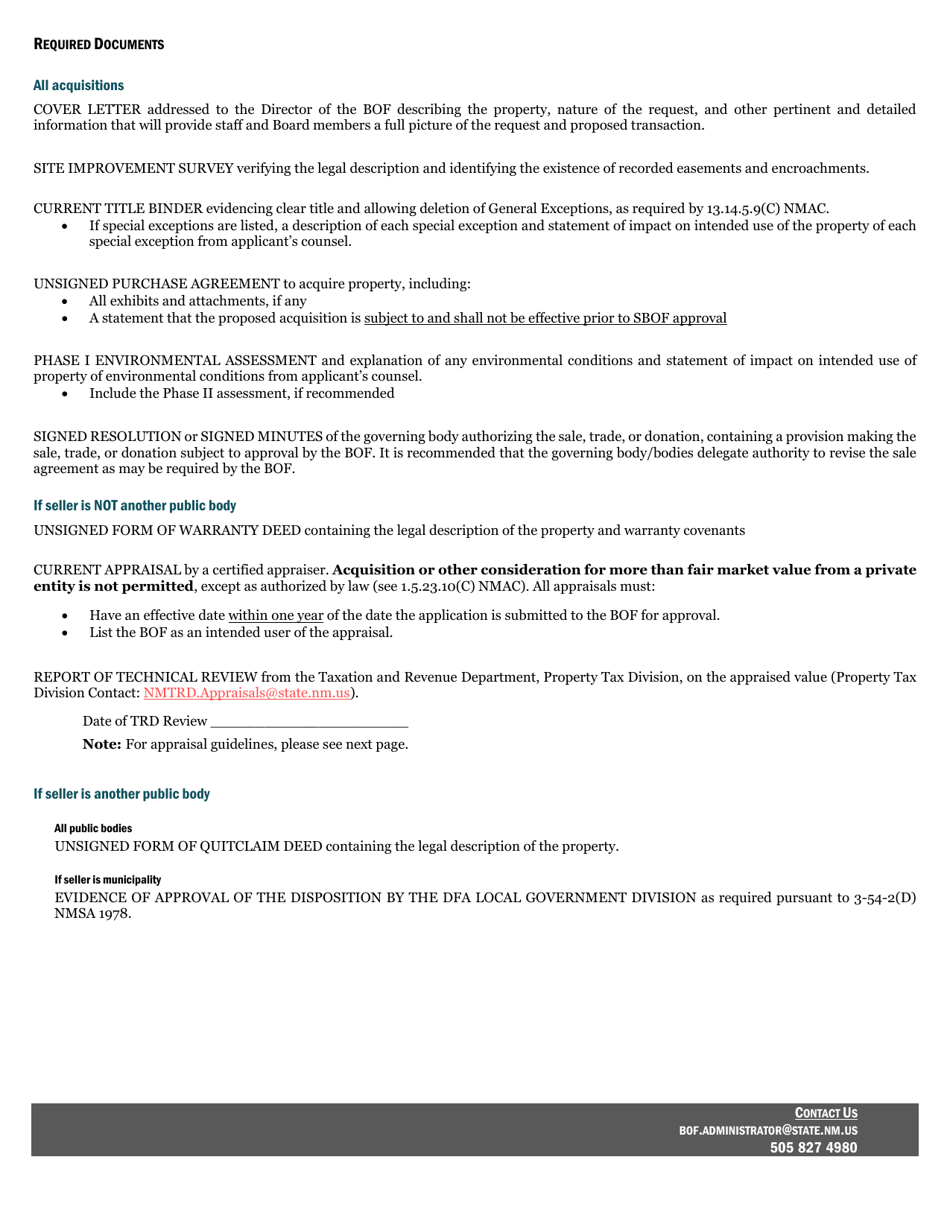

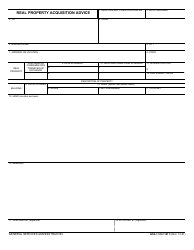

Q: What documents are required for the acquisition of real property in New Mexico?

A: The required documents may vary, but generally you will need a purchase agreement, title search report, and a deed.

Q: What is a purchase agreement?

A: A purchase agreement is a legal document that outlines the terms and conditions of the property purchase, including the purchase price, closing date, and any contingencies.

Q: What is a title search report?

A: A title search report is conducted to verify the ownership history of the property and identify any existing liens, encumbrances, or title issues.

Q: What is a deed?

A: A deed is a legal document that transfers ownership of the property from the seller to the buyer.

Q: Do I need to hire an attorney for the acquisition process?

A: While it is not legally required, it is recommended to hire an attorney experienced in real estate transactions to ensure a smooth and legally sound acquisition process.

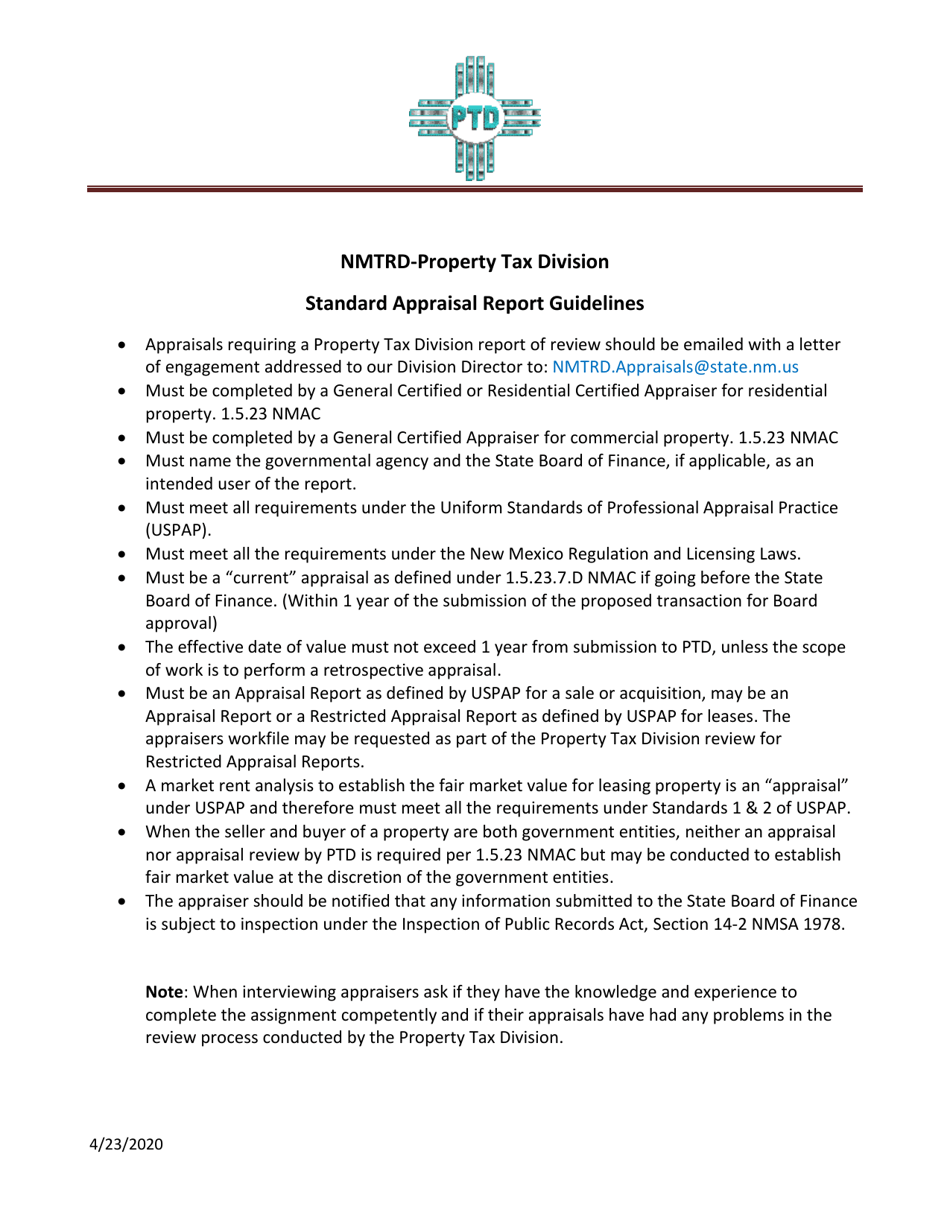

Q: Are there any specific regulations or requirements for real property acquisitions in New Mexico?

A: Yes, New Mexico has specific laws and regulations regarding real estate transactions, including disclosure requirements and property tax considerations. It is advisable to seek legal advice to ensure compliance.

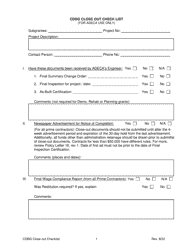

Q: What are some additional steps to consider when acquiring real property?

A: Some additional steps may include conducting a home inspection, securing financing, obtaining title insurance, and negotiating repair or contingency clauses in the purchase agreement.

Q: What are the typical closing costs associated with real property acquisition?

A: Closing costs may include fees for title search, property appraisal, credit report, loan origination, recording fees, and taxes. Costs can vary depending on the value of the property and other factors.

Q: Can I negotiate the purchase price?

A: Yes, the purchase price is typically negotiable between the buyer and the seller.

Q: Do I need to pay property taxes after acquiring real property in New Mexico?

A: Yes, property taxes are typically the responsibility of the property owner and must be paid annually to the county treasurer. The amount depends on the assessed value of the property.

Form Details:

- Released on April 23, 2020;

- The latest edition currently provided by the New Mexico Department of Finance and Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Department of Finance and Administration.