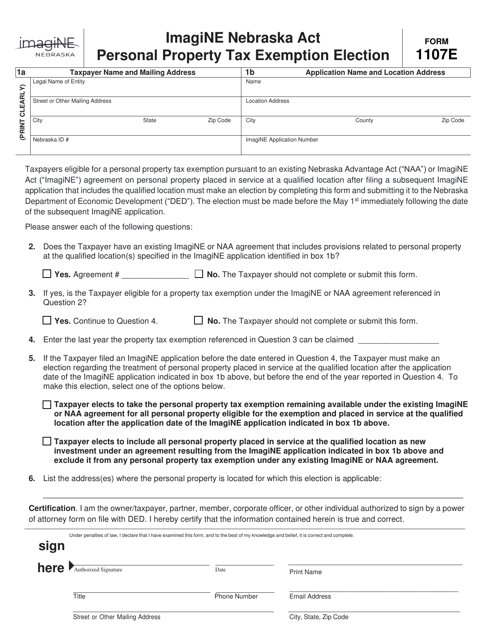

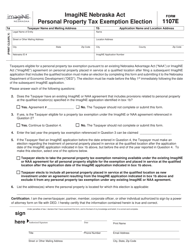

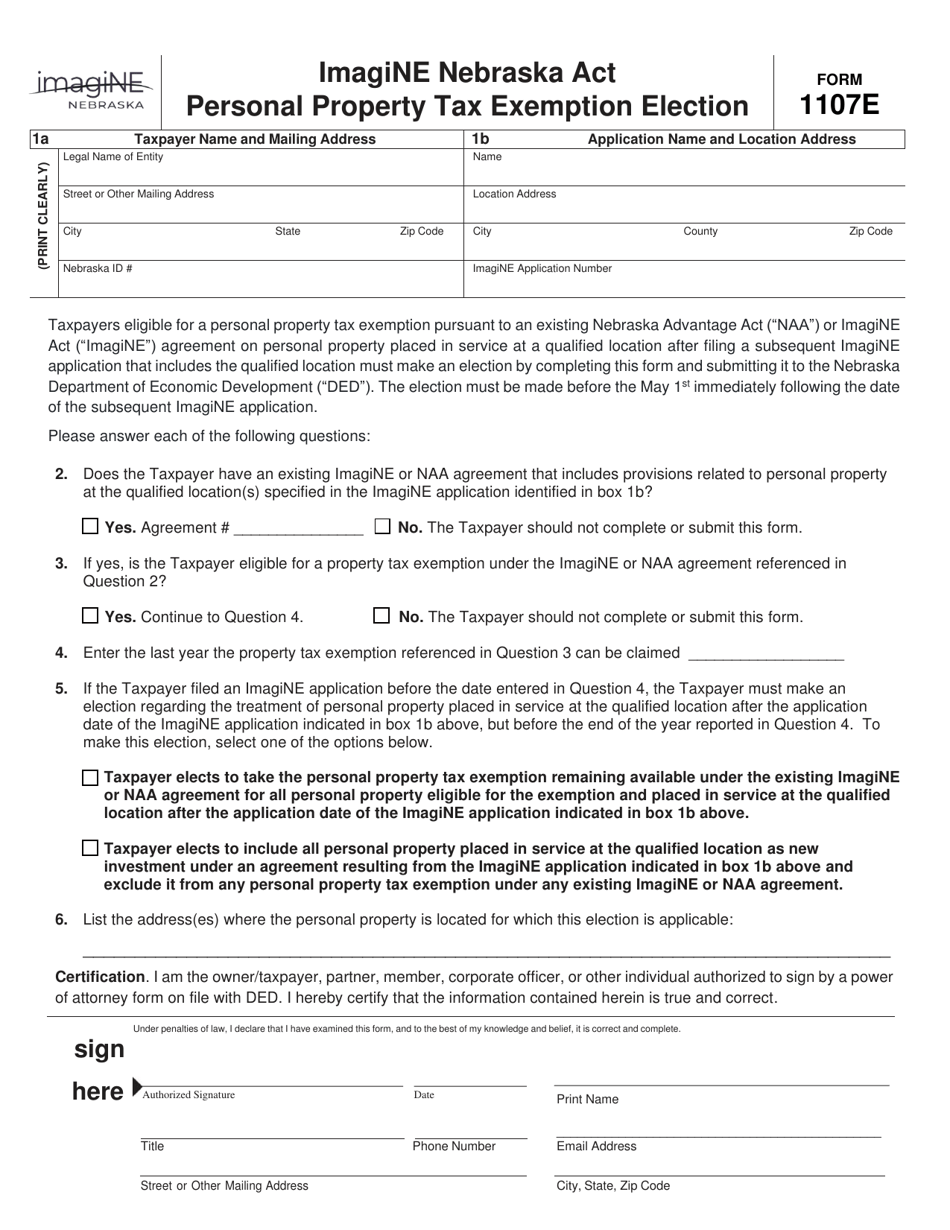

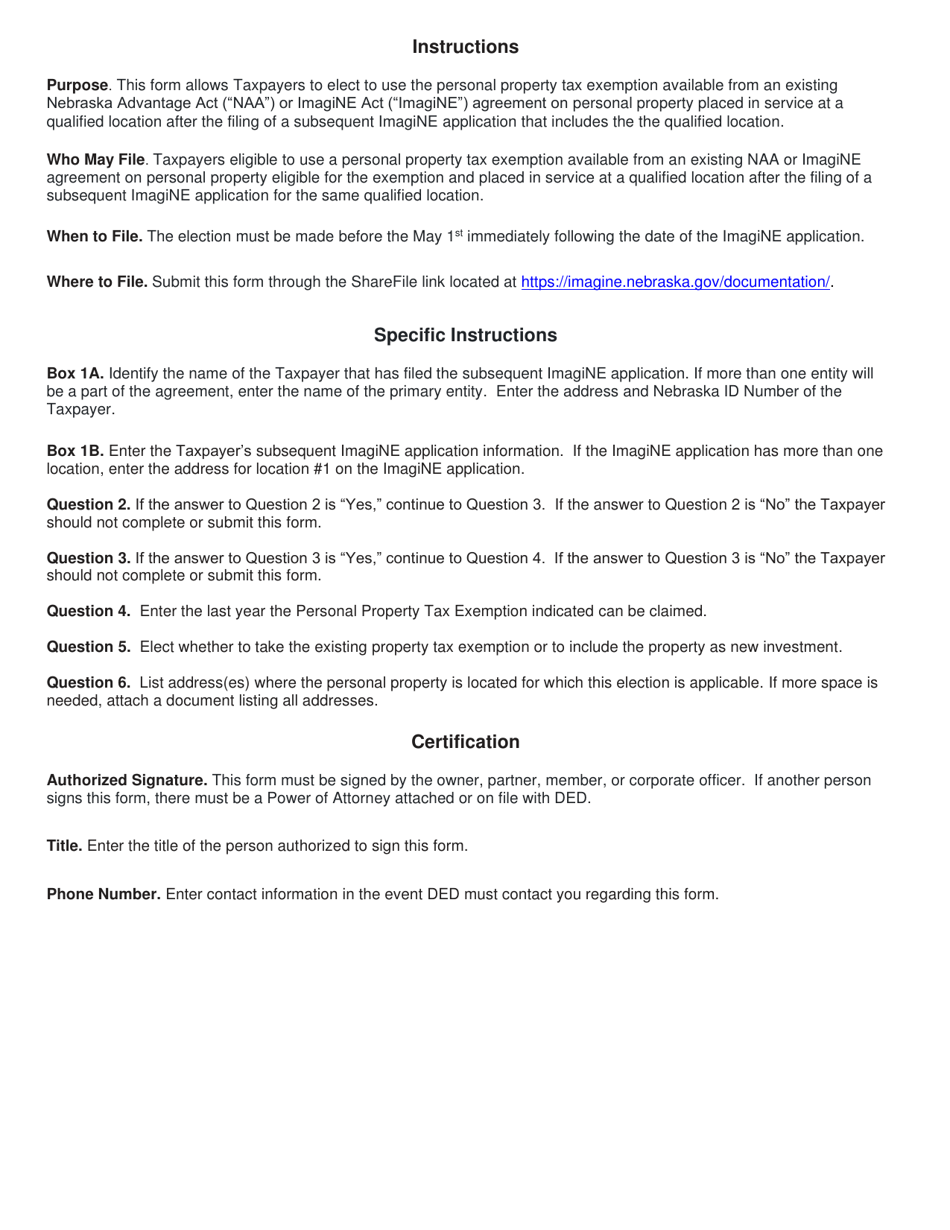

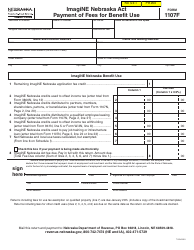

Form 1107E Imagine Nebraska Act Personal Property Tax Exemption Election - Nebraska

What Is Form 1107E?

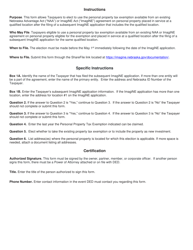

This is a legal form that was released by the Nebraska Department of Economic Development - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1107E?

A: Form 1107E is the Imagine Nebraska Act Personal Property Tax Exemption Election form.

Q: What is the Imagine Nebraska Act?

A: The Imagine Nebraska Act is a tax law in Nebraska that provides personal property tax exemptions.

Q: Who is eligible for the personal property tax exemption?

A: Individuals and businesses in Nebraska may be eligible for the personal property tax exemption.

Q: What does the Form 1107E allow you to do?

A: Form 1107E allows individuals and businesses to elect to receive the personal property tax exemption.

Q: Is there a deadline for filing Form 1107E?

A: Yes, the deadline for filing Form 1107E is July 1st of each year.

Q: What is the benefit of the personal property tax exemption?

A: The benefit of the personal property tax exemption is that it reduces the amount of taxes owed on eligible personal property.

Q: Are there any restrictions on the personal property tax exemption?

A: Yes, there are certain restrictions and qualifications that must be met in order to receive the personal property tax exemption.

Q: Can individuals and businesses opt out of the personal property tax exemption?

A: Yes, individuals and businesses have the option to elect not to receive the personal property tax exemption by not filing Form 1107E.

Q: Is the personal property tax exemption available in all counties of Nebraska?

A: No, the personal property tax exemption may not be available in all counties of Nebraska. It is important to check with your local county assessor for more information.

Form Details:

- The latest edition provided by the Nebraska Department of Economic Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1107E by clicking the link below or browse more documents and templates provided by the Nebraska Department of Economic Development.