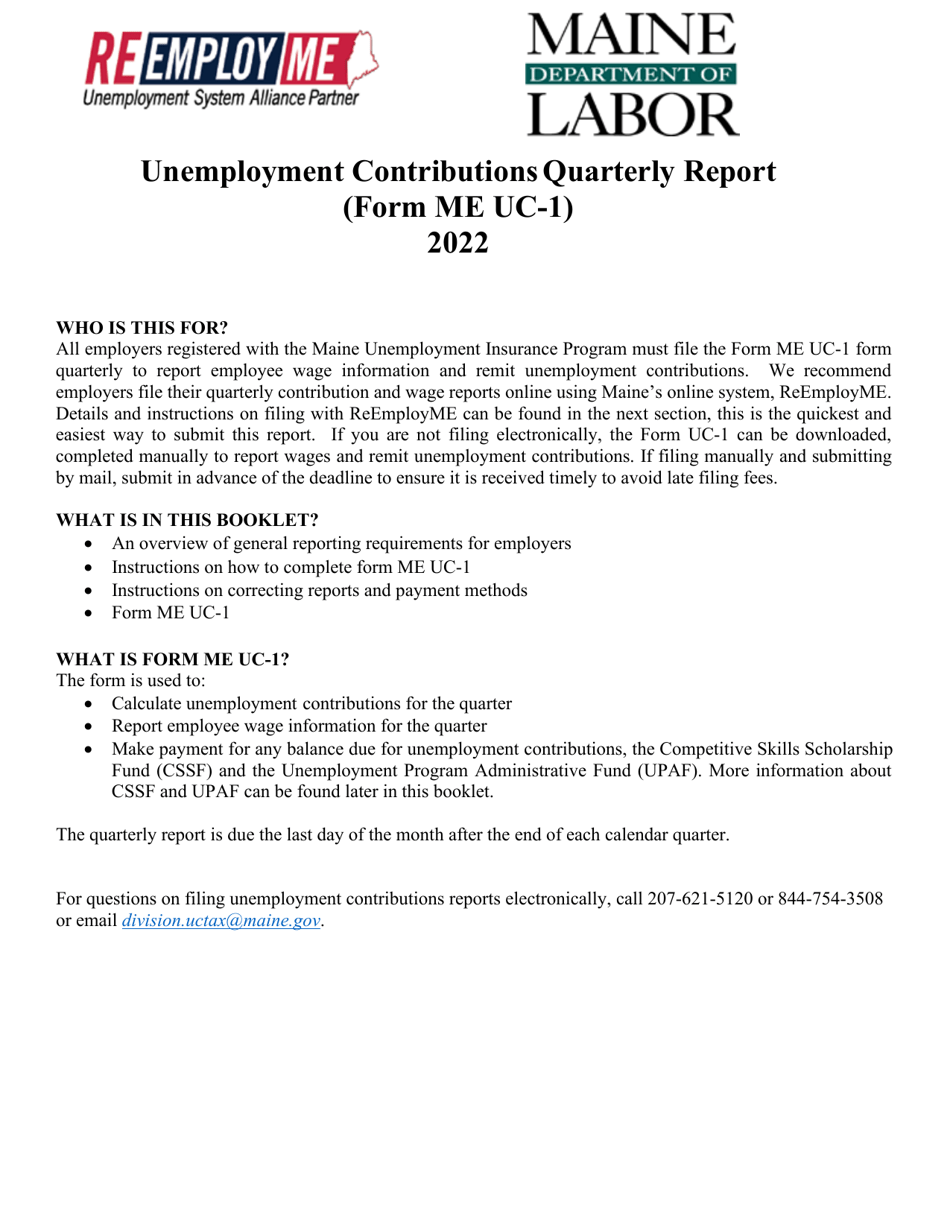

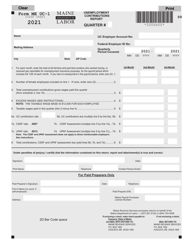

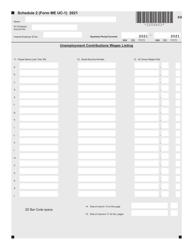

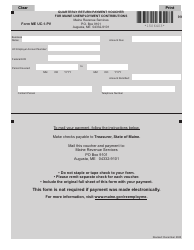

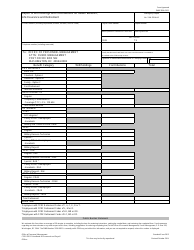

Instructions for Form ME UC-1 Unemployment Contributions Report - Maine

This document contains official instructions for Form ME UC-1 , Unemployment Contributions Report - a form released and collected by the Maine Revenue Services. An up-to-date fillable Form ME UC-1 is available for download through this link.

FAQ

Q: What is Form ME UC-1?

A: Form ME UC-1 is the Unemployment Contributions Report for Maine.

Q: Who needs to file Form ME UC-1?

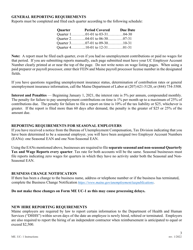

A: Employers in Maine who are liable for unemployment contributions need to file Form ME UC-1.

Q: What is the purpose of Form ME UC-1?

A: The purpose of Form ME UC-1 is to report unemployment contributions owed by employers in Maine.

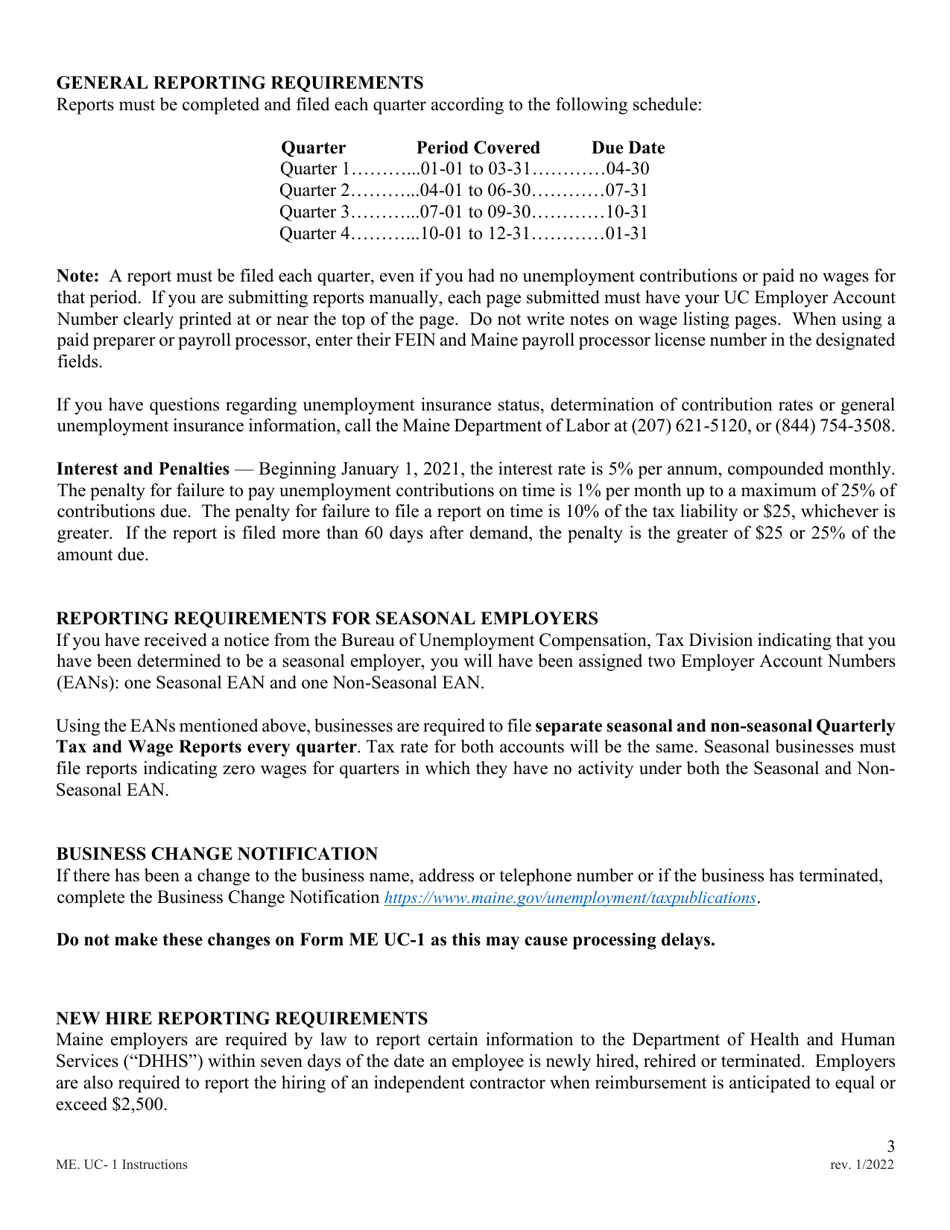

Q: When should Form ME UC-1 be filed?

A: Form ME UC-1 must be filed quarterly by the last day of the month following the end of the calendar quarter.

Q: Are electronic filings available for Form ME UC-1?

A: Yes, employers have the option to file Form ME UC-1 electronically.

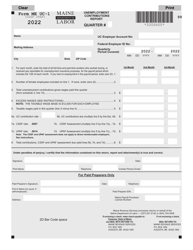

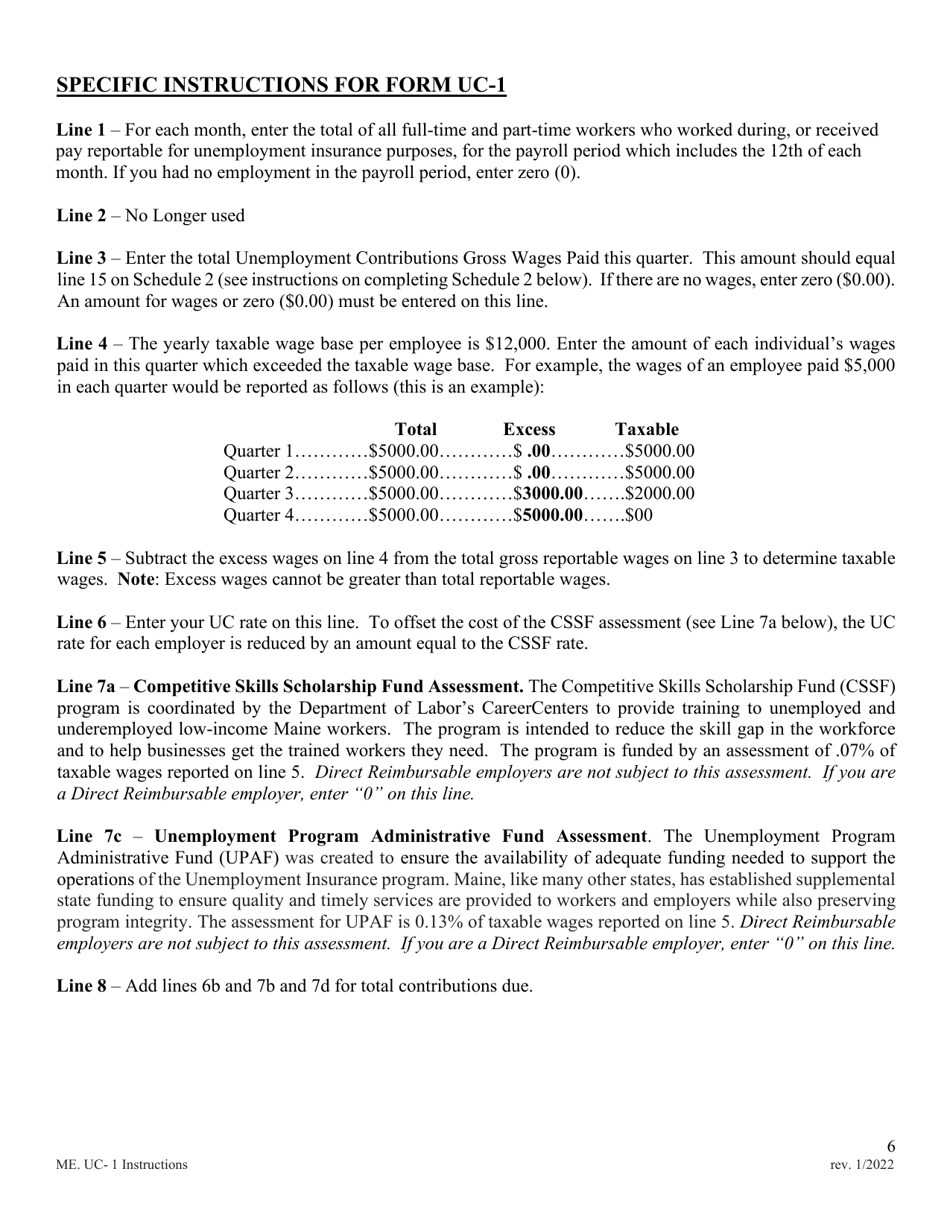

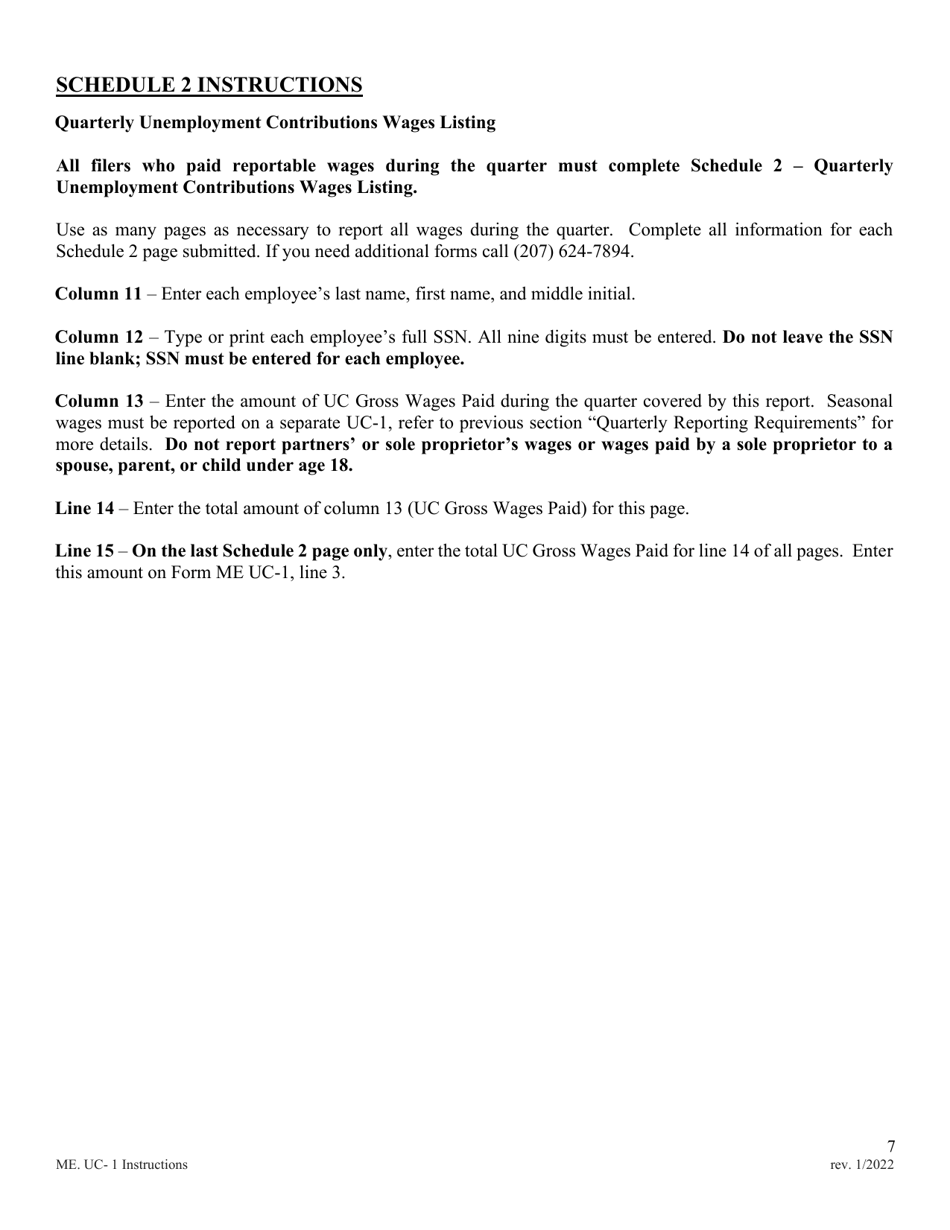

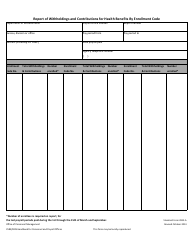

Q: What information is required on Form ME UC-1?

A: Form ME UC-1 requires employers to provide information about their total wages paid, taxable wages, and total unemployment contributions owed for the reporting period.

Q: What happens if Form ME UC-1 is not filed or filed late?

A: Failure to file Form ME UC-1 or filing it late may result in penalties and interest charges.

Q: Are there any exceptions to filing Form ME UC-1?

A: Some employers may be exempt from filing Form ME UC-1 if they meet certain criteria. It is best to check with the Maine Department of Labor for more information.

Q: Can I amend a filed Form ME UC-1?

A: Yes, if you need to correct information on a previously filed Form ME UC-1, you can file an amended return.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Revenue Services.