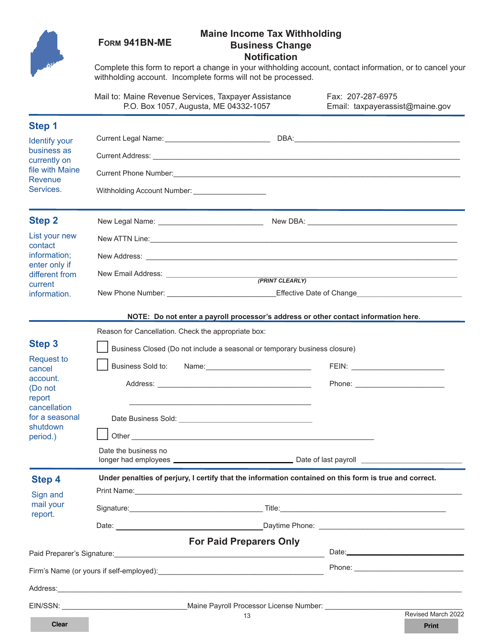

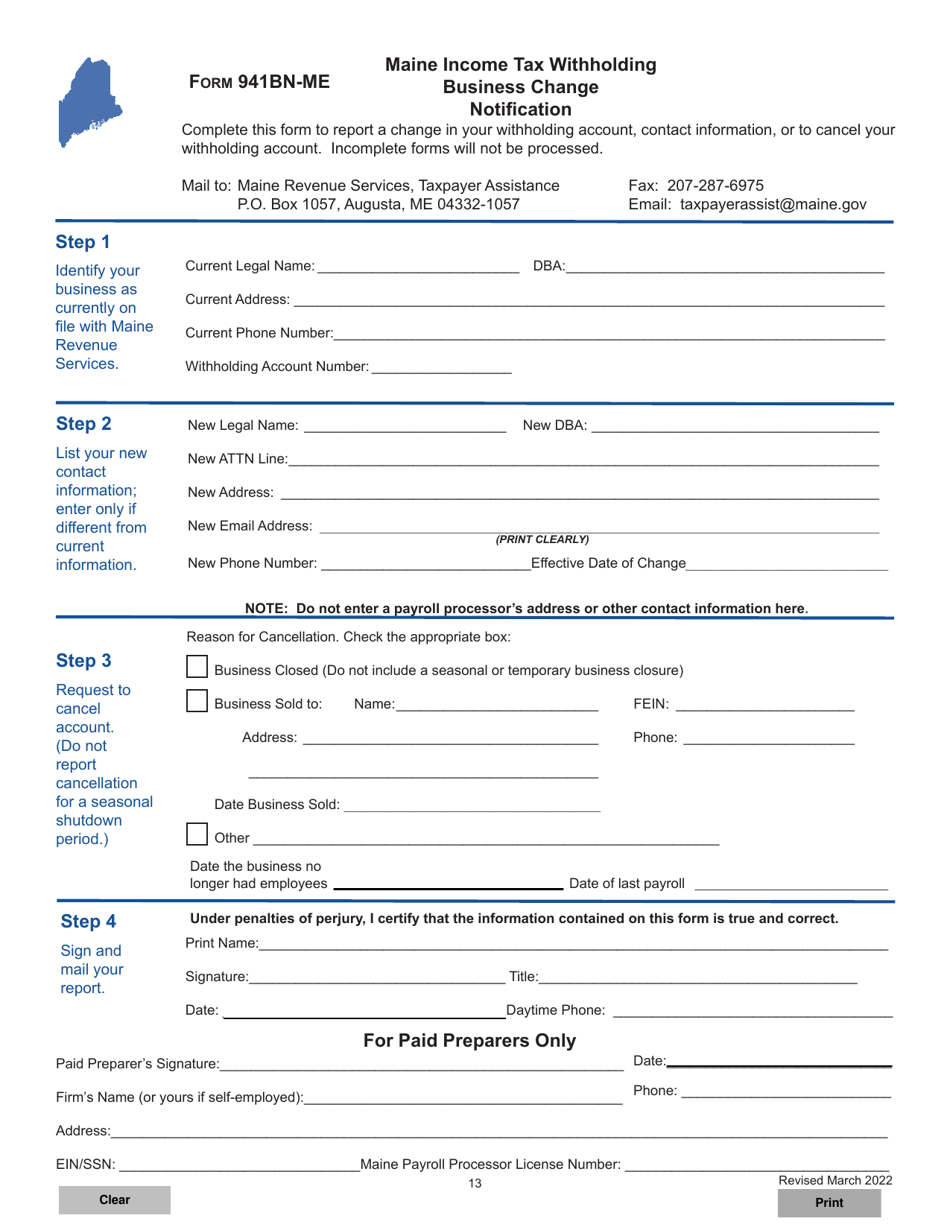

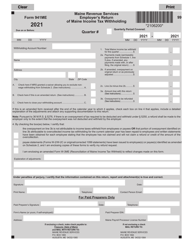

Form 941BN-ME Maine Income Tax Withholding Business Change Notification - Maine

What Is Form 941BN-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 941BN-ME?

A: Form 941BN-ME is the Maine Income Tax WithholdingBusiness Change Notification form.

Q: Who needs to file Form 941BN-ME?

A: Businesses in Maine that have changes to their income tax withholding information need to file Form 941BN-ME.

Q: What changes can be reported on Form 941BN-ME?

A: Form 941BN-ME is used to report changes to business name, address, owners, and taxpayer identification number.

Q: When is Form 941BN-ME due?

A: Form 941BN-ME is due within 10 days of the change to your income tax withholding information.

Q: Is there a penalty for not filing Form 941BN-ME?

A: Yes, failure to file Form 941BN-ME may result in penalties imposed by the Maine Revenue Services.

Q: Can Form 941BN-ME be filed electronically?

A: No, Form 941BN-ME must be filed by mail or delivered in person to the Maine Revenue Services.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 941BN-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.