This version of the form is not currently in use and is provided for reference only. Download this version of

Worksheet PTE

for the current year.

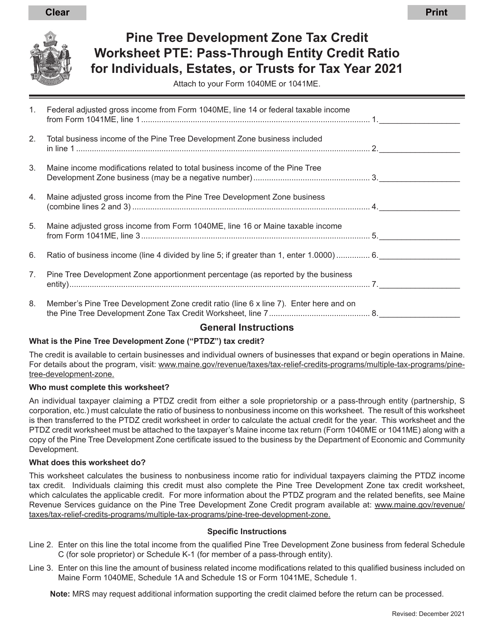

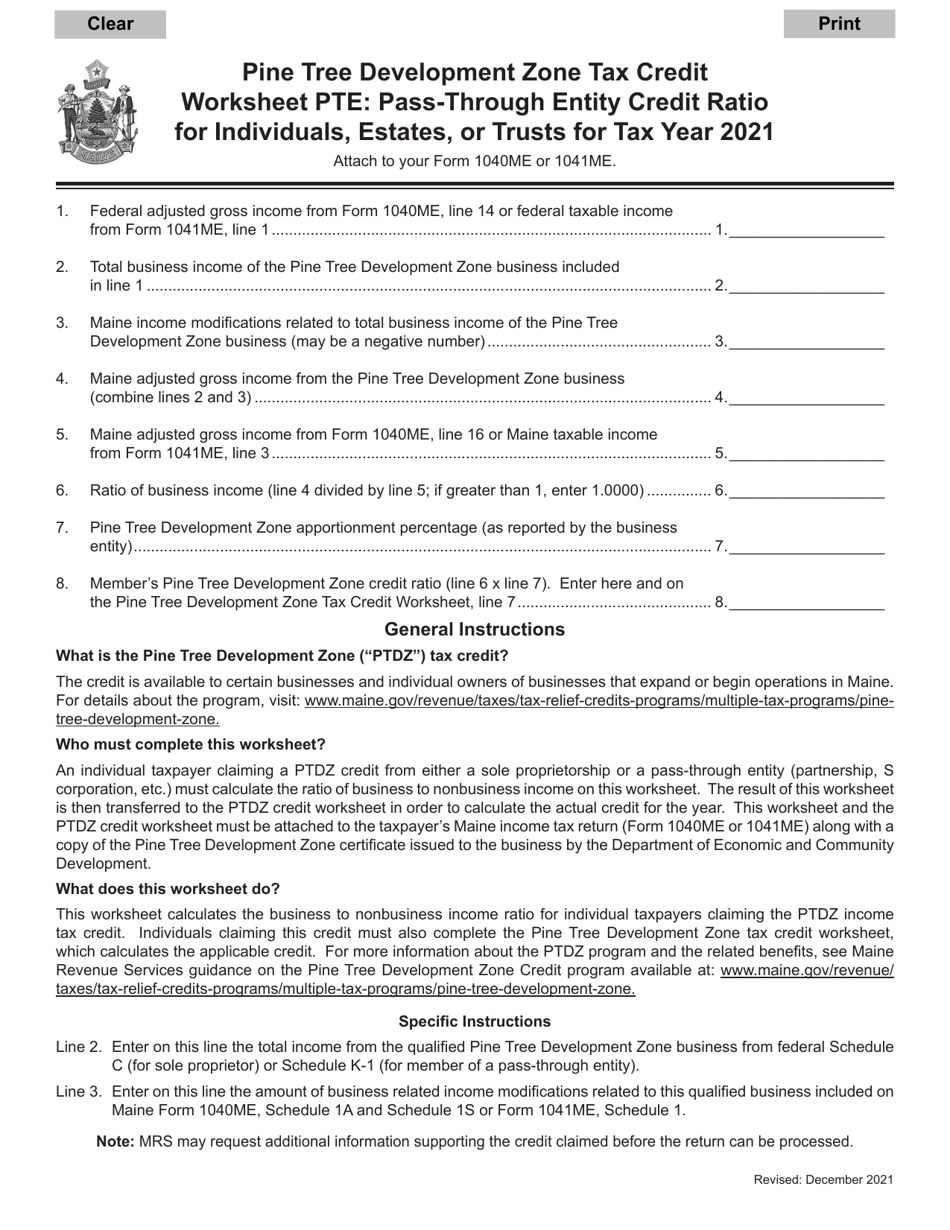

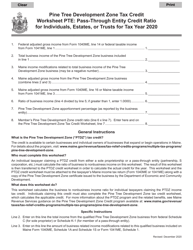

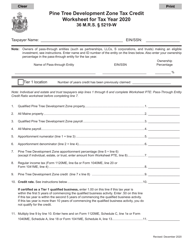

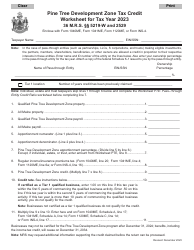

Worksheet PTE Pine Tree Development Zone Tax Credit Worksheet - Pass-Through Entity Credit Ratio for Individuals, Estates, or Trusts - Maine

What Is Worksheet PTE?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PTE Pine Tree Development Zone Tax Credit Worksheet?

A: The PTE Pine Tree Development Zone Tax Credit Worksheet is a document that calculates the tax credit ratio for individuals, estates, or trusts in Maine.

Q: What is the purpose of the pass-through entity credit ratio?

A: The pass-through entity credit ratio is used to determine the amount of tax credit that individuals, estates, or trusts can claim under the Pine Tree Development Zone Tax Credit program.

Q: Who is eligible for the Pine Tree Development Zone Tax Credit?

A: Individuals, estates, or trusts that meet the eligibility requirements set by the Pine Tree Development Zone Tax Credit program are eligible for the tax credit.

Q: What is the Pine Tree Development Zone Tax Credit program?

A: The Pine Tree Development Zone Tax Credit program is a program in Maine that offers tax credits to businesses that create new jobs and make investments in designated Pine Tree Development Zones.

Q: What are Pine Tree Development Zones?

A: Pine Tree Development Zones are designated areas in Maine that have been targeted for economic development and job creation. Businesses located in these zones are eligible for various tax incentives and credits, including the Pine Tree Development Zone Tax Credit.

Q: How is the pass-through entity credit ratio calculated?

A: The pass-through entity credit ratio is calculated by dividing the total amount of qualifying wages paid by the pass-through entity by the total amount of qualifying wages paid by all pass-through entities in the Pine Tree Development Zone.

Q: How can individuals, estates, or trusts claim the Pine Tree Development Zone Tax Credit?

A: Individuals, estates, or trusts can claim the Pine Tree Development Zone Tax Credit by calculating the credit ratio using the PTE Pine Tree Development Zone Tax Credit Worksheet and applying it to their Maine tax return.

Q: What other tax incentives are available for businesses in Pine Tree Development Zones?

A: In addition to the Pine Tree Development Zone Tax Credit, businesses located in Pine Tree Development Zones may be eligible for property tax abatements, sales tax exemptions, and other incentives offered by the state of Maine.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet PTE by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.