This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

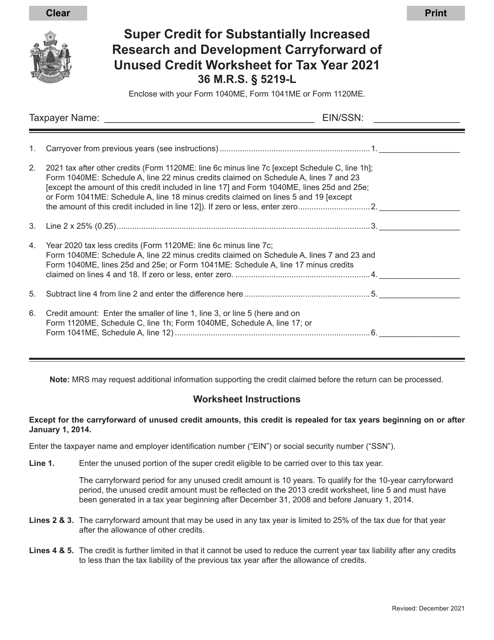

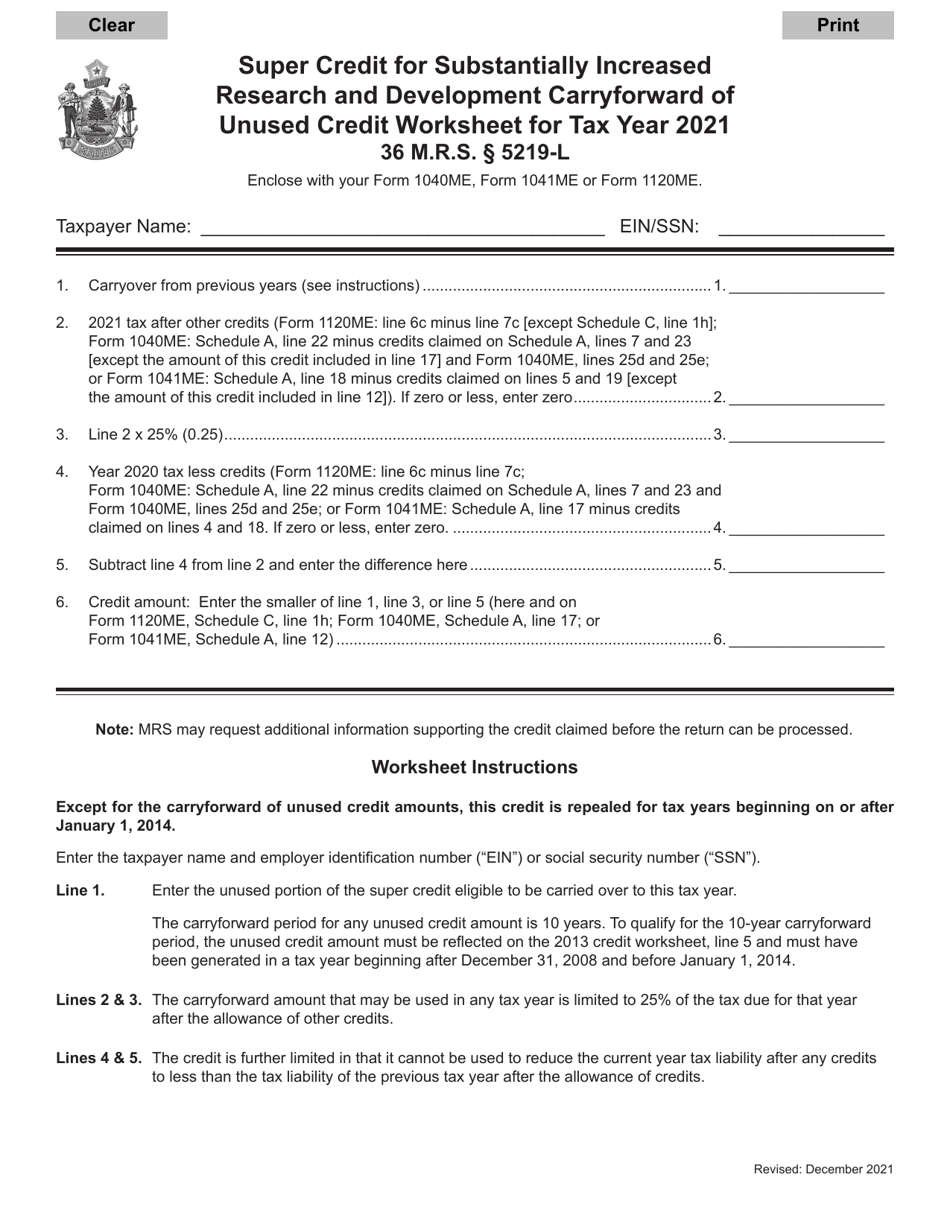

Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet - Maine

Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet?

A: The Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet is a tax form that allows businesses to carry forward any unused research and development credits.

Q: Who is eligible for the Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet?

A: Businesses that have unused research and development credits from previous years may be eligible for the Super Credit.

Q: How does the Super Credit work?

A: The Super Credit allows businesses to carry forward any unused research and development credits and claim them in future tax years.

Q: What is the purpose of the Super Credit?

A: The purpose of the Super Credit is to incentivize businesses to invest in research and development activities by allowing them to claim unused credits in future years.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.