This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

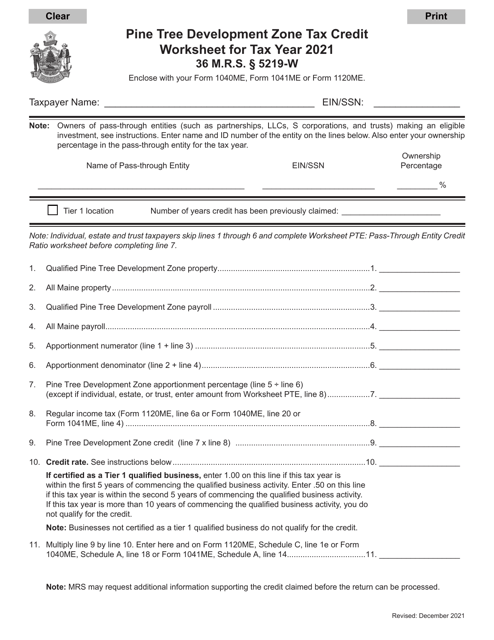

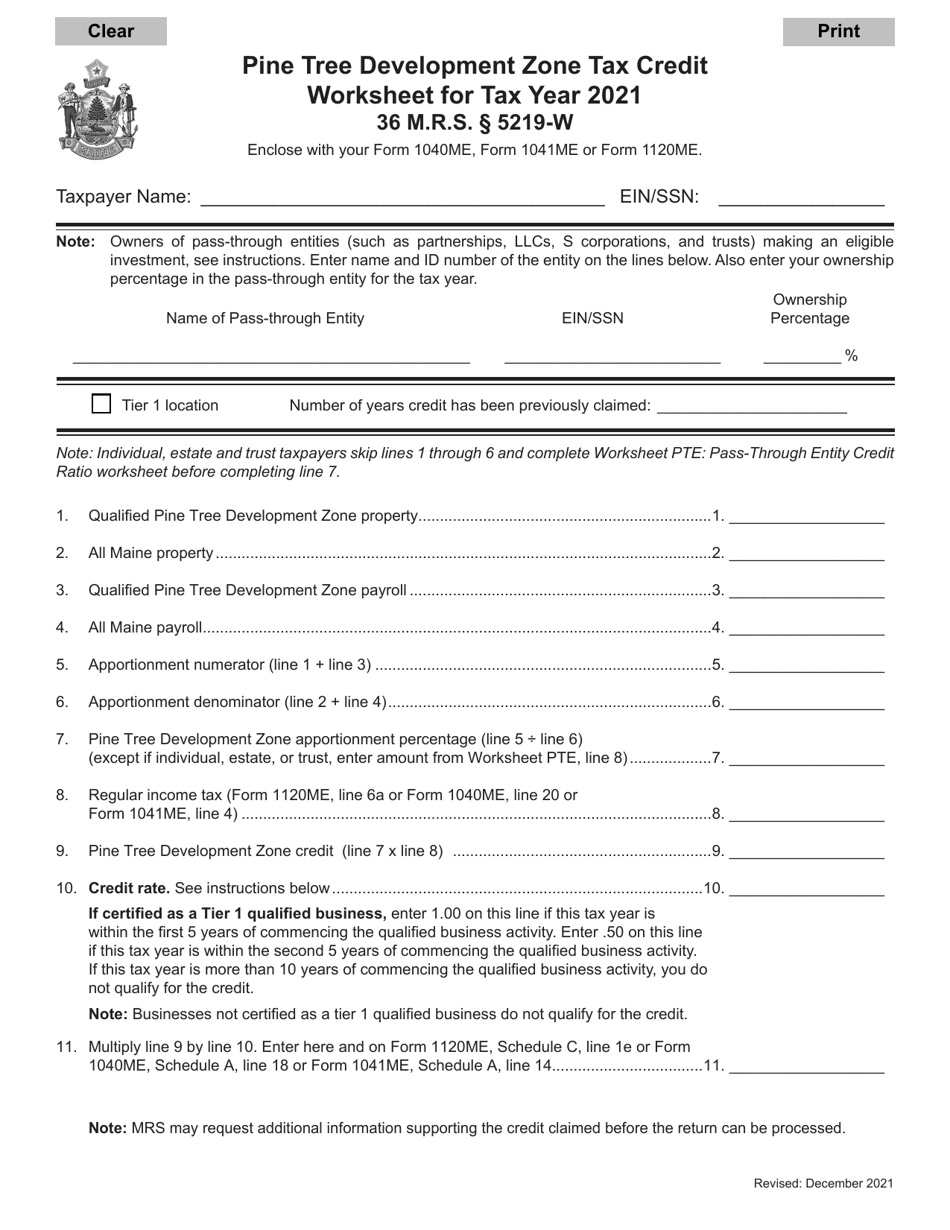

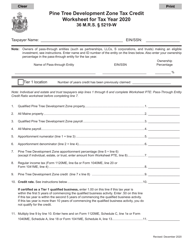

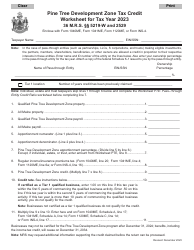

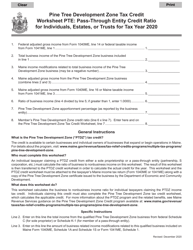

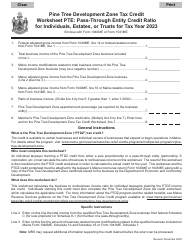

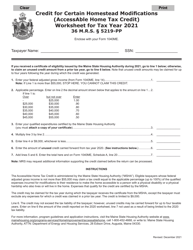

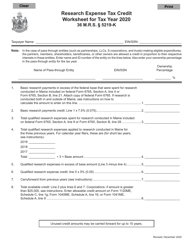

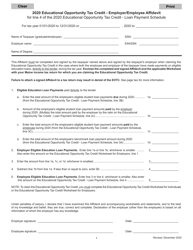

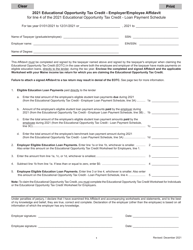

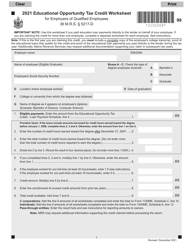

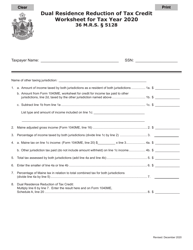

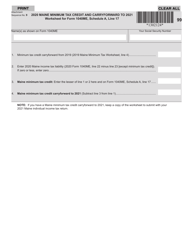

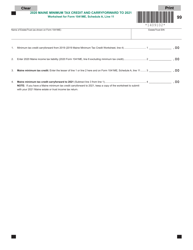

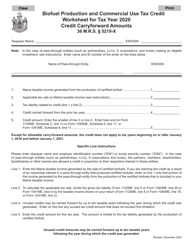

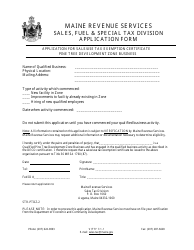

Pine Tree Development Zone Tax Credit Worksheet - Maine

Pine Tree Development Zone Tax Credit Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

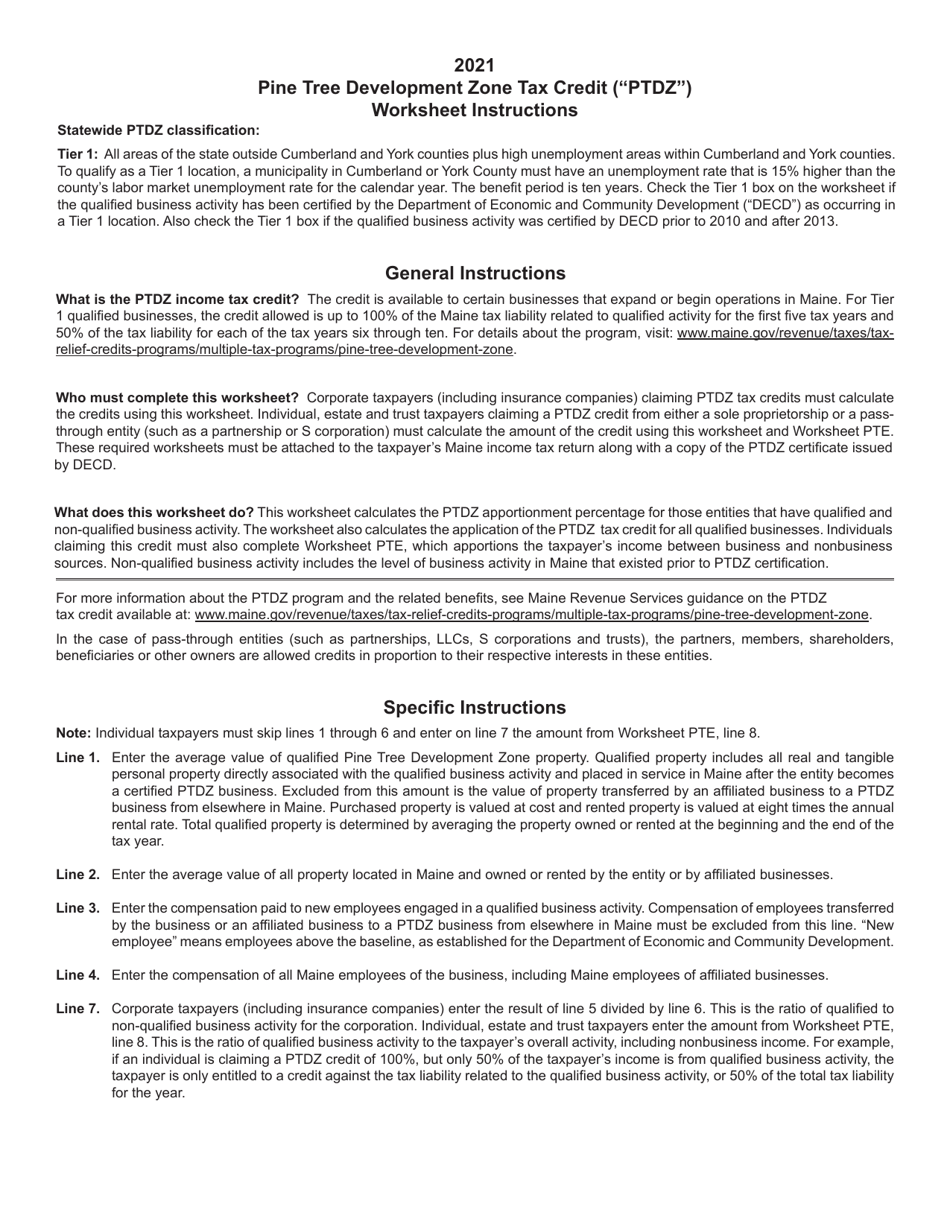

Q: What is the Pine Tree Development Zone Tax Credit?

A: The Pine Tree Development Zone Tax Credit is a tax incentive program in Maine that provides credits to businesses that create new jobs within designated zones.

Q: Who is eligible for the Pine Tree Development Zone Tax Credit?

A: Businesses that create and maintain at least one new qualified full-time job within a Pine Tree Development Zone are eligible for the tax credit.

Q: What is a Pine Tree Development Zone?

A: A Pine Tree Development Zone is a designated area in Maine that aims to promote economic development by offering tax incentives to businesses.

Q: How much tax credit can businesses receive under the program?

A: Eligible businesses can receive a tax credit of up to 100% of the state income tax withheld from the wages of qualifying employees.

Q: What are the requirements for businesses to qualify for the tax credit?

A: To qualify, businesses must create and maintain at least one new full-time job, pay at least 1.5 times the state minimum wage to qualifying employees, and meet other eligibility criteria.

Q: Can businesses claim the tax credit for part-time jobs?

A: No, the tax credit is only available for new qualified full-time jobs created within a Pine Tree Development Zone.

Q: Are there any restrictions or limitations to the tax credit?

A: Yes, the tax credit is subject to certain limitations and can vary depending on factors such as the number of new jobs created and the wages paid to qualifying employees.

Q: How can businesses apply for the Pine Tree Development Zone Tax Credit?

A: Businesses must complete and submit the Pine Tree Development Zone Tax Credit Worksheet to the Maine Revenue Services to apply for the tax credit.

Q: Is there a deadline for applying for the tax credit?

A: Yes, businesses must apply for the tax credit by the due date of their Maine income tax return for the tax year in which the credit is being claimed.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.