This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

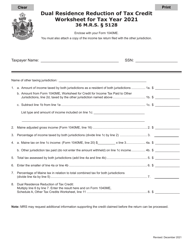

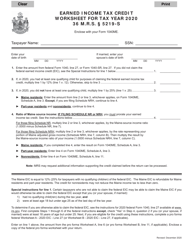

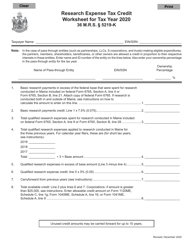

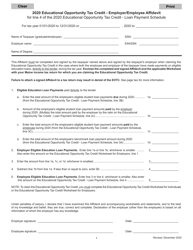

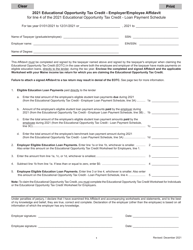

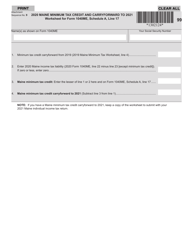

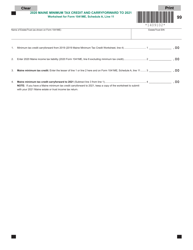

Dual Residence Reduction of Tax Credit Worksheet - Maine

Dual Residence Reduction of Tax Credit Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the Dual Residence Reduction of Tax Credit Worksheet?

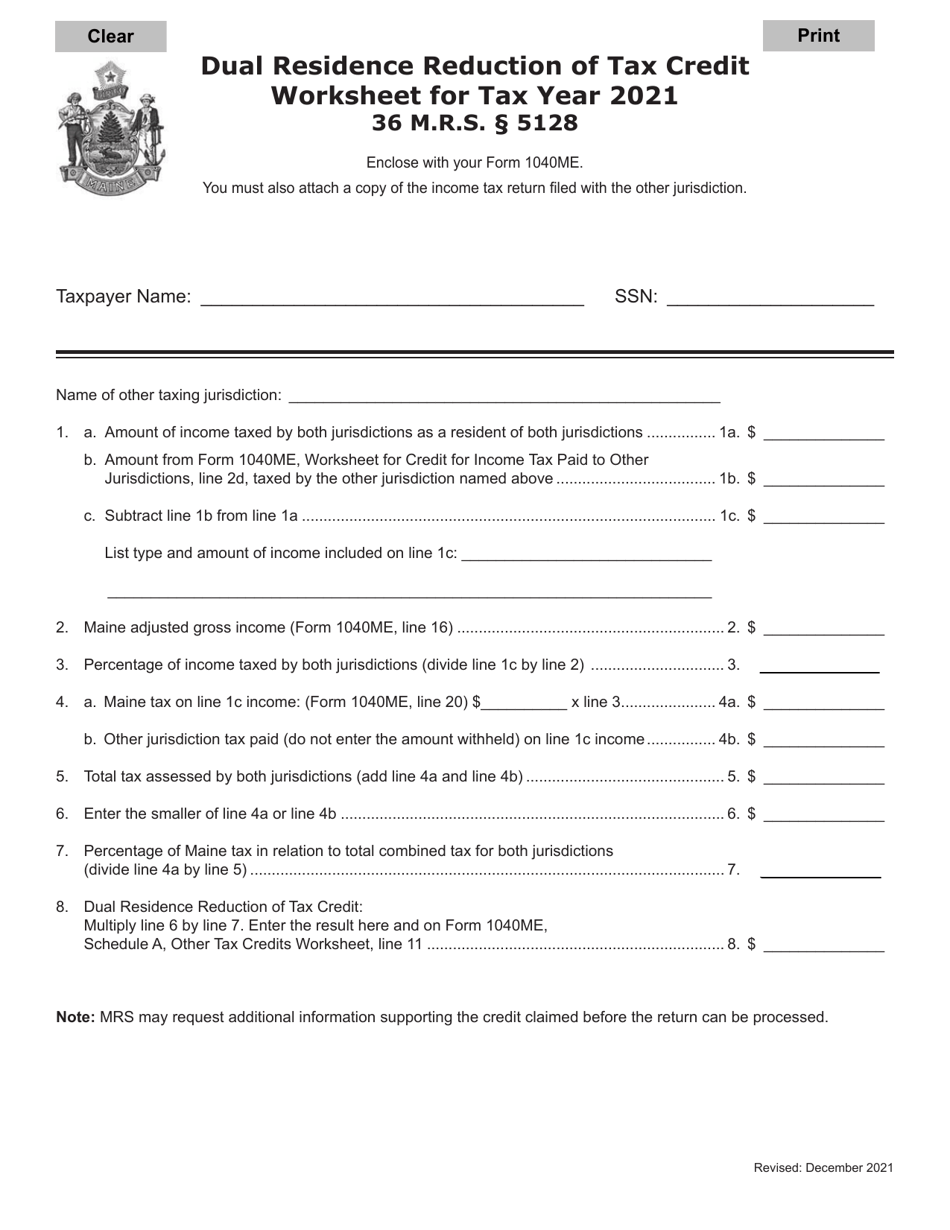

A: The Dual Residence Reduction of Tax Credit Worksheet is a form used by residents of Maine to calculate their tax credits when they have dual residency in another state.

Q: Who can use the Dual Residence Reduction of Tax Credit Worksheet?

A: Residents of Maine who have dual residency in another state can use the Dual Residence Reduction of Tax Credit Worksheet.

Q: What is dual residency?

A: Dual residency refers to the situation where an individual is considered a resident of more than one state.

Q: What is the purpose of the Dual Residence Reduction of Tax Credit Worksheet?

A: The purpose of the Dual Residence Reduction of Tax Credit Worksheet is to determine the amount of tax credits that residents of Maine are eligible for when they have dual residency.

Q: How does the Dual Residence Reduction of Tax Credit Worksheet work?

A: The Dual Residence Reduction of Tax Credit Worksheet takes into account income earned in both Maine and the other state of dual residency, and calculates the appropriate tax credits based on specific criteria.

Q: Are there any eligibility requirements to use the Dual Residence Reduction of Tax Credit Worksheet?

A: Yes, residents of Maine must meet certain criteria, such as having dual residency in another state and meeting specific income guidelines, in order to use the Dual Residence Reduction of Tax Credit Worksheet.

Q: Can the Dual Residence Reduction of Tax Credit Worksheet be used for other states?

A: No, the Dual Residence Reduction of Tax Credit Worksheet is specifically designed for residents of Maine who have dual residency in another state.

Q: Is the use of the Dual Residence Reduction of Tax Credit Worksheet mandatory?

A: No, the use of the Dual Residence Reduction of Tax Credit Worksheet is not mandatory. It is only necessary for residents of Maine who have dual residency in another state and wish to claim tax credits as a result.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.