This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

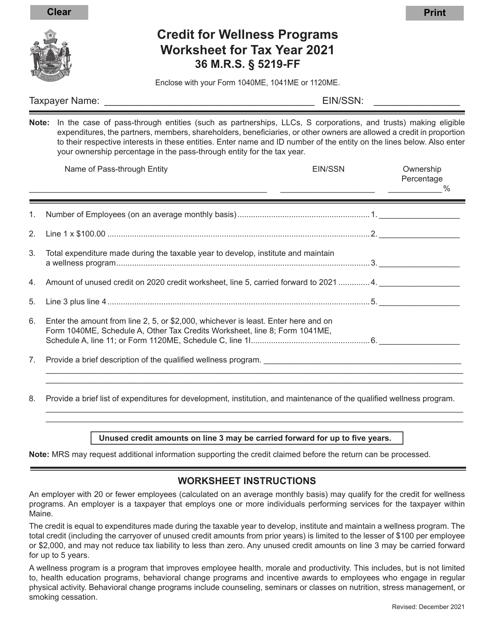

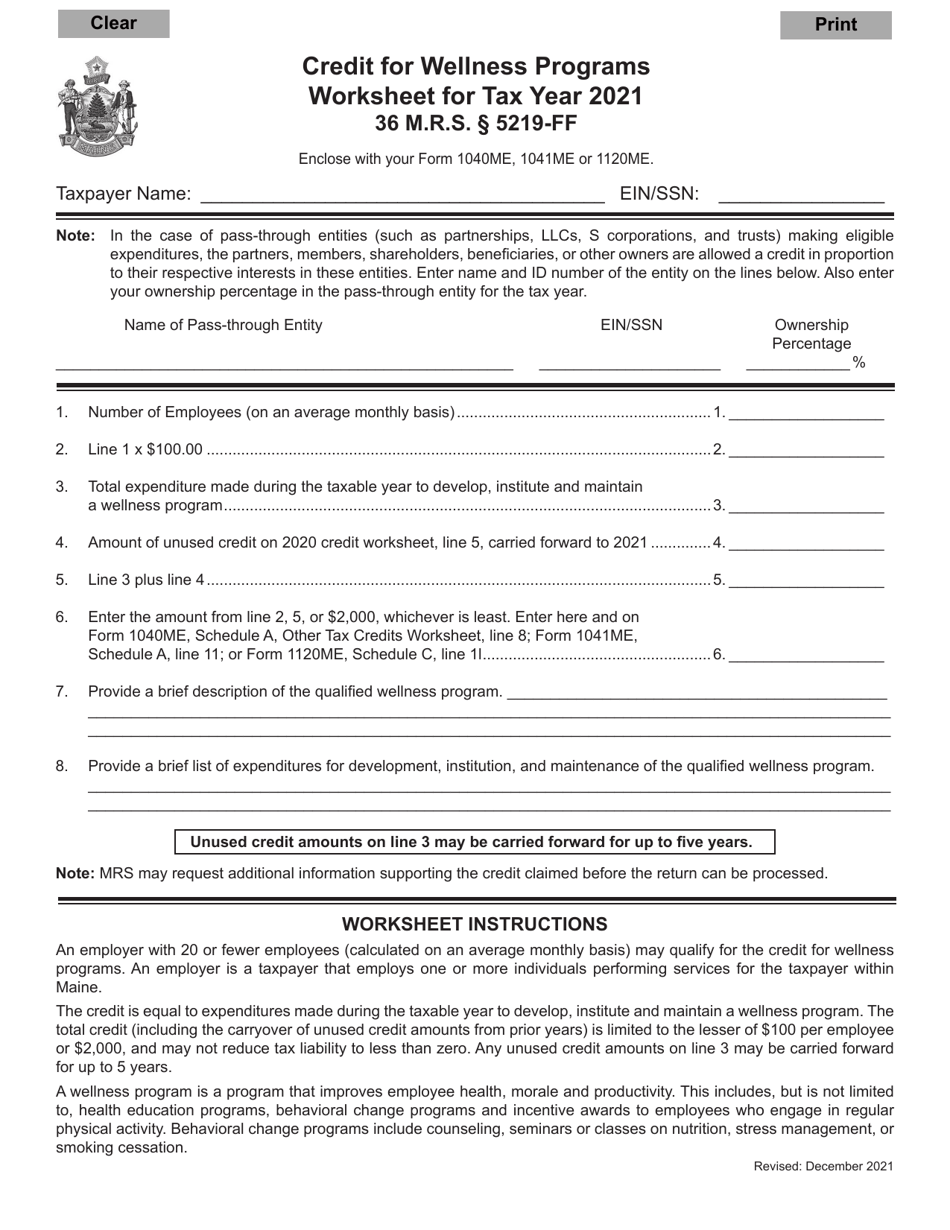

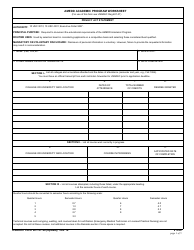

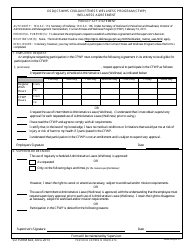

Credit for Wellness Programs Worksheet - Maine

Credit for Wellness Programs Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the purpose of the Credit for Wellness Programs Worksheet in Maine?

A: The purpose of the Credit for Wellness Programs Worksheet in Maine is to calculate the credit amount that businesses can claim for implementing wellness programs.

Q: Who is eligible to use the Credit for Wellness Programs Worksheet in Maine?

A: Businesses in Maine that have implemented wellness programs are eligible to use the Credit for Wellness Programs Worksheet.

Q: What is the credit amount that businesses can claim for implementing wellness programs?

A: The credit amount that businesses can claim for implementing wellness programs in Maine is 10% of the total costs, up to a maximum of $5,000.

Q: What expenses are eligible for the credit?

A: Expenses related to employee wellness programs, such as fitness facilities, health education, and preventive screenings, are eligible for the credit.

Q: How can businesses claim the credit?

A: Businesses can claim the credit by completing the Credit for Wellness Programs Worksheet and including it with their tax return when filing with the state of Maine.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.