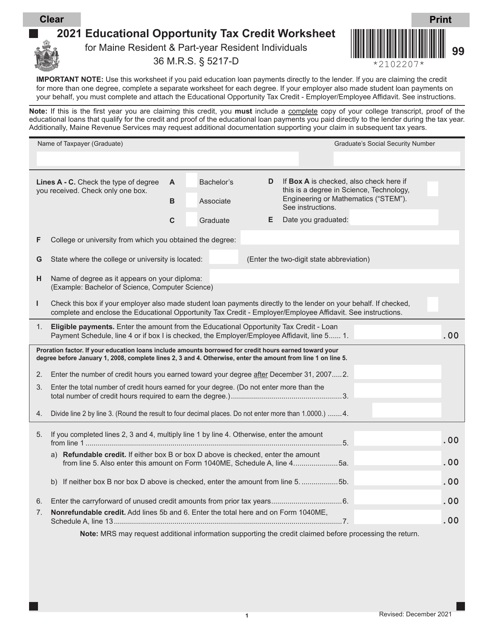

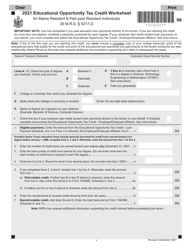

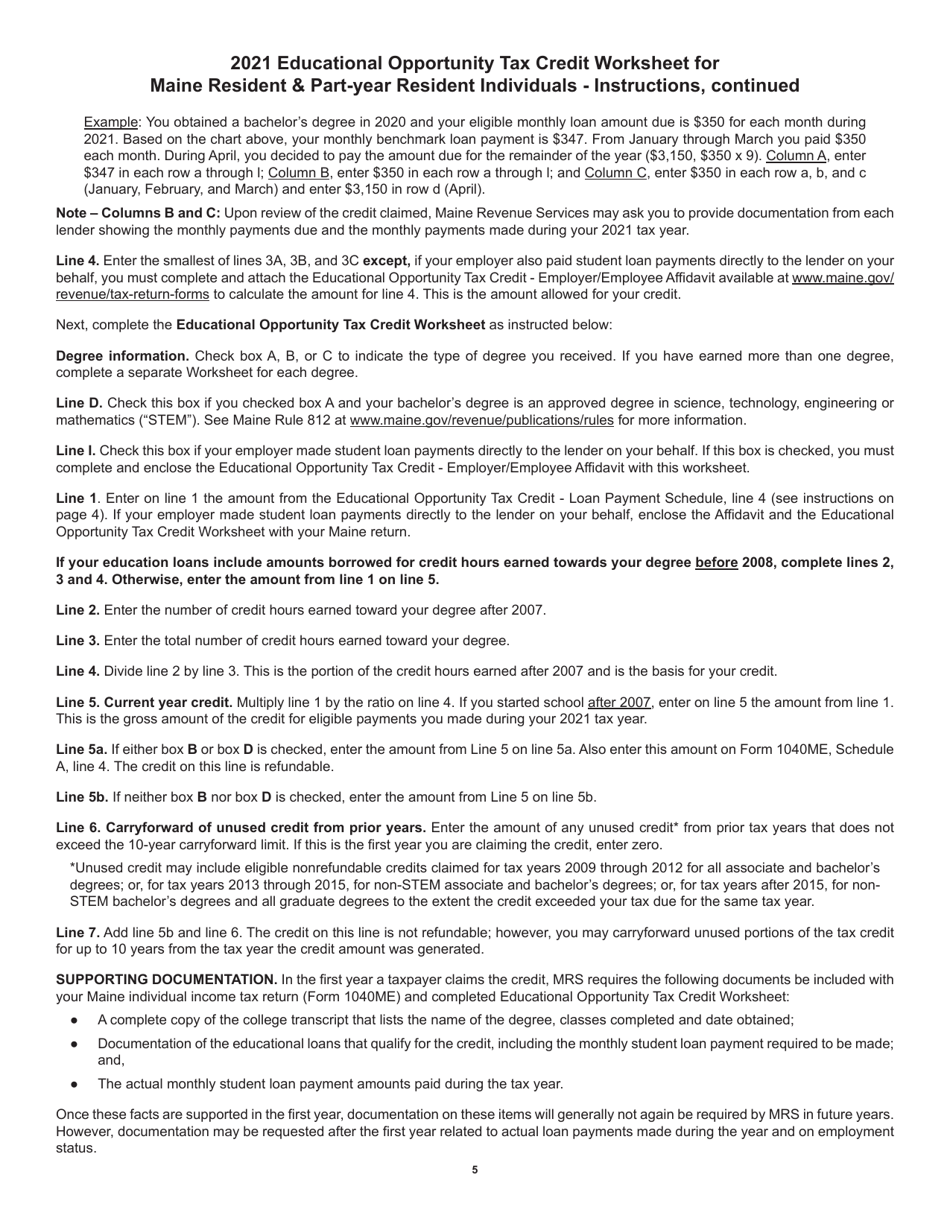

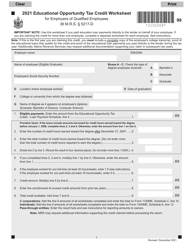

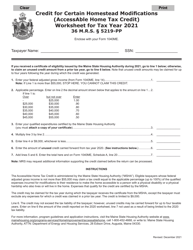

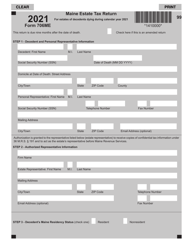

Educational Opportunity Tax Credit Worksheet for Maine Resident & Part-Year Resident Individuals - Maine

Educational Opportunity Tax Credit Worksheet for Maine Resident & Part-Year Resident Individuals is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

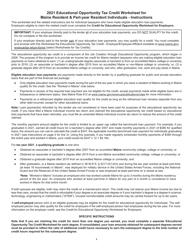

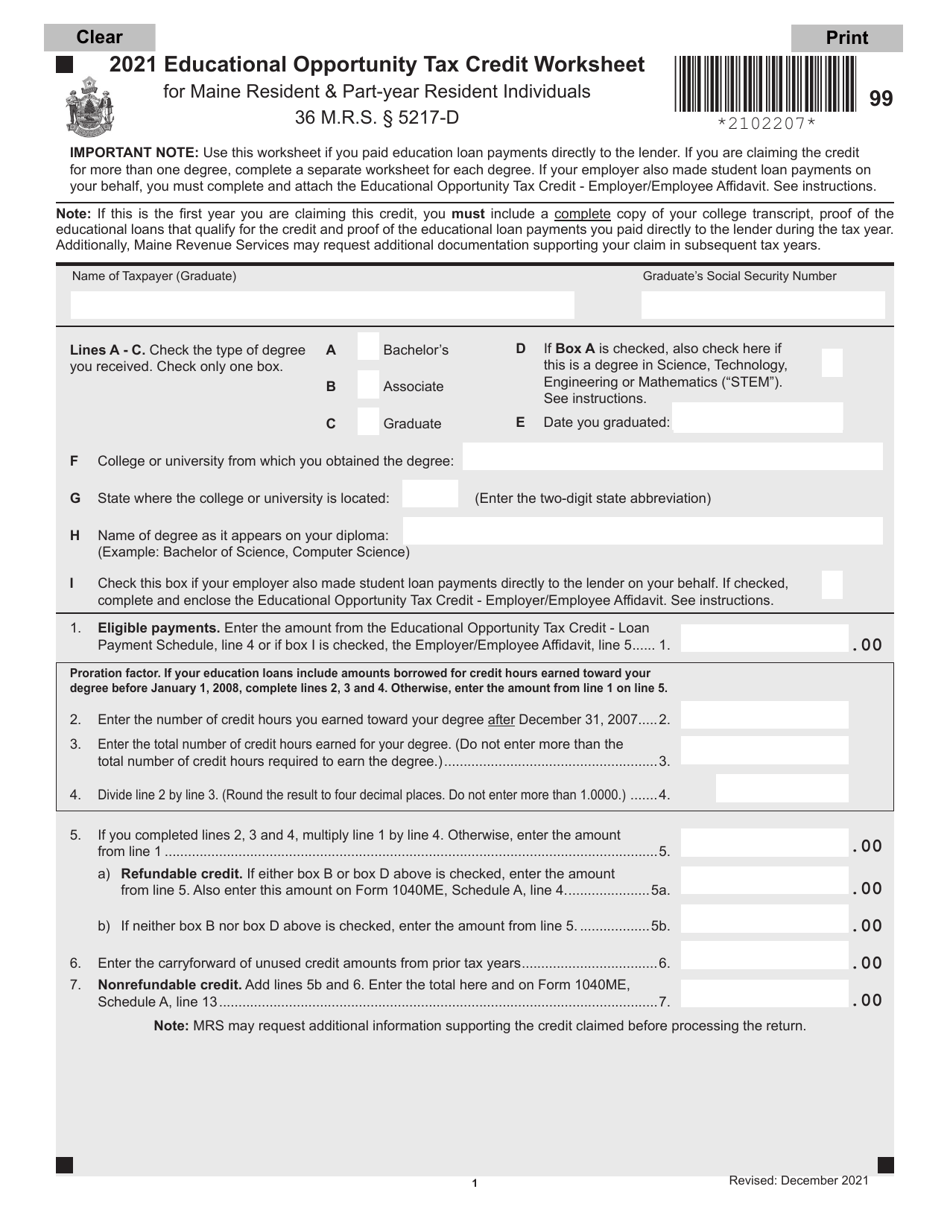

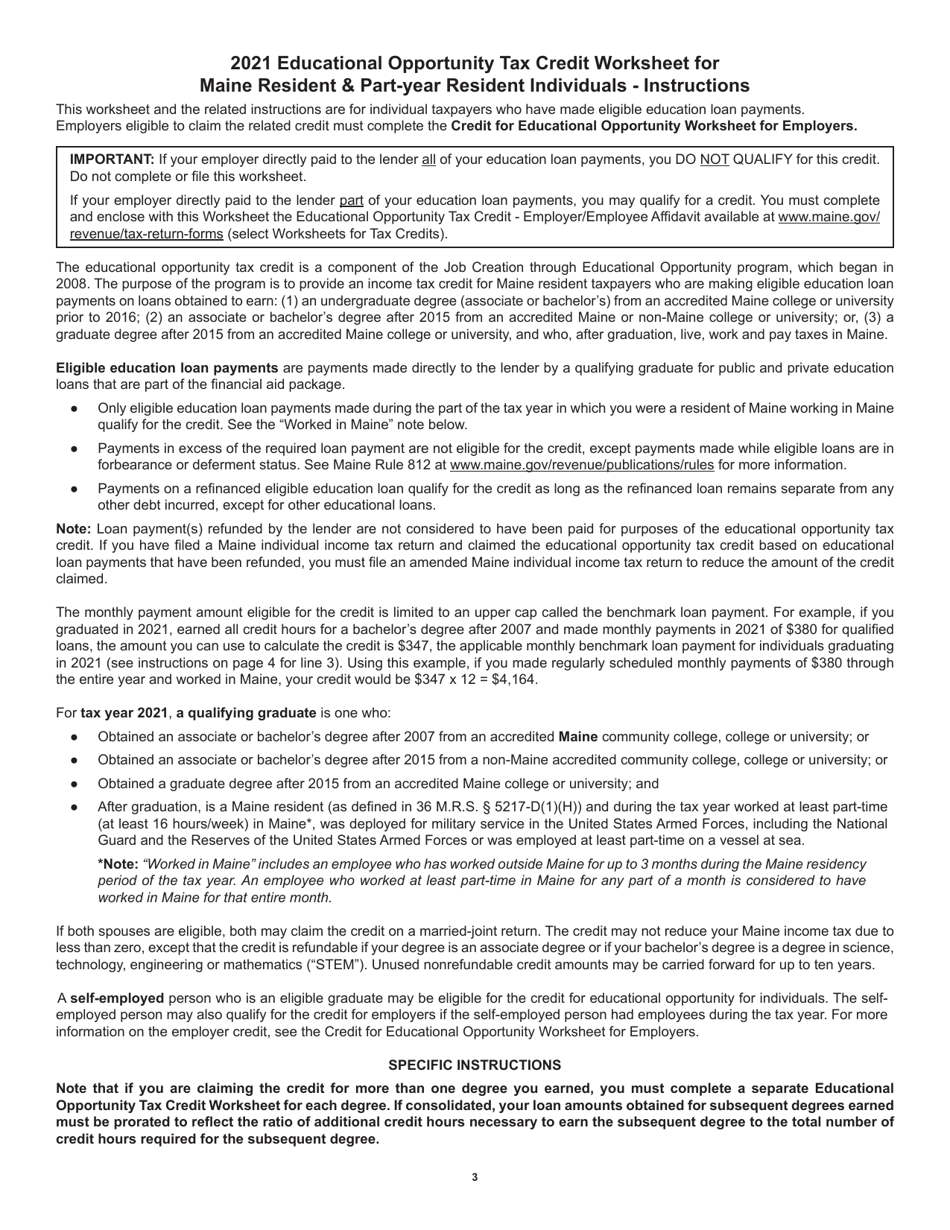

Q: What is the Educational Opportunity Tax Credit?

A: The Educational Opportunity Tax Credit is a program in Maine that provides tax benefits to eligible residents who pursue higher education.

Q: Who is eligible for the Educational Opportunity Tax Credit in Maine?

A: Maine residents and part-year residents who attend an eligible Maine postsecondary institution and meet certain criteria are eligible for the tax credit.

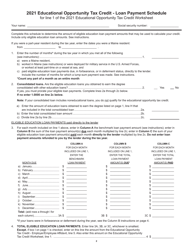

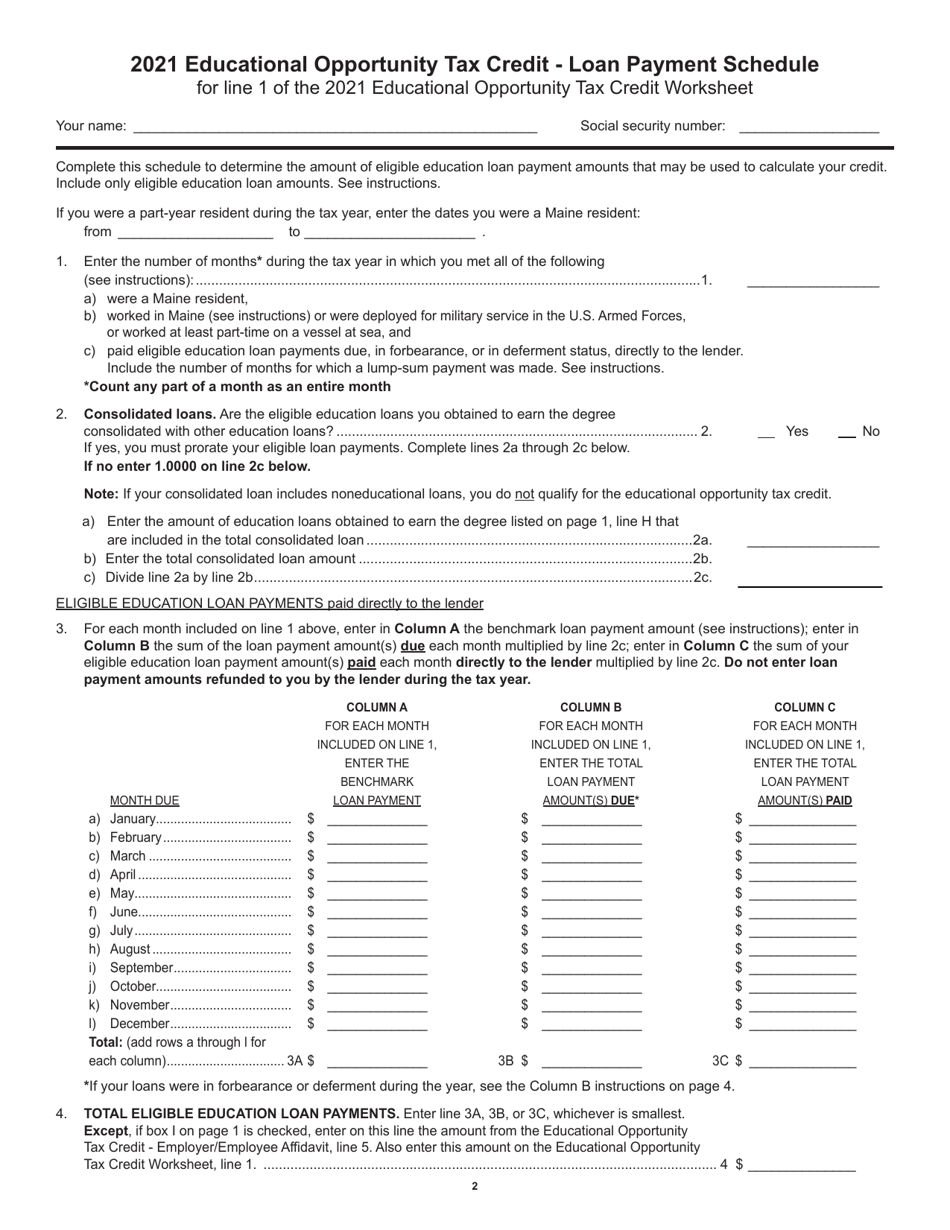

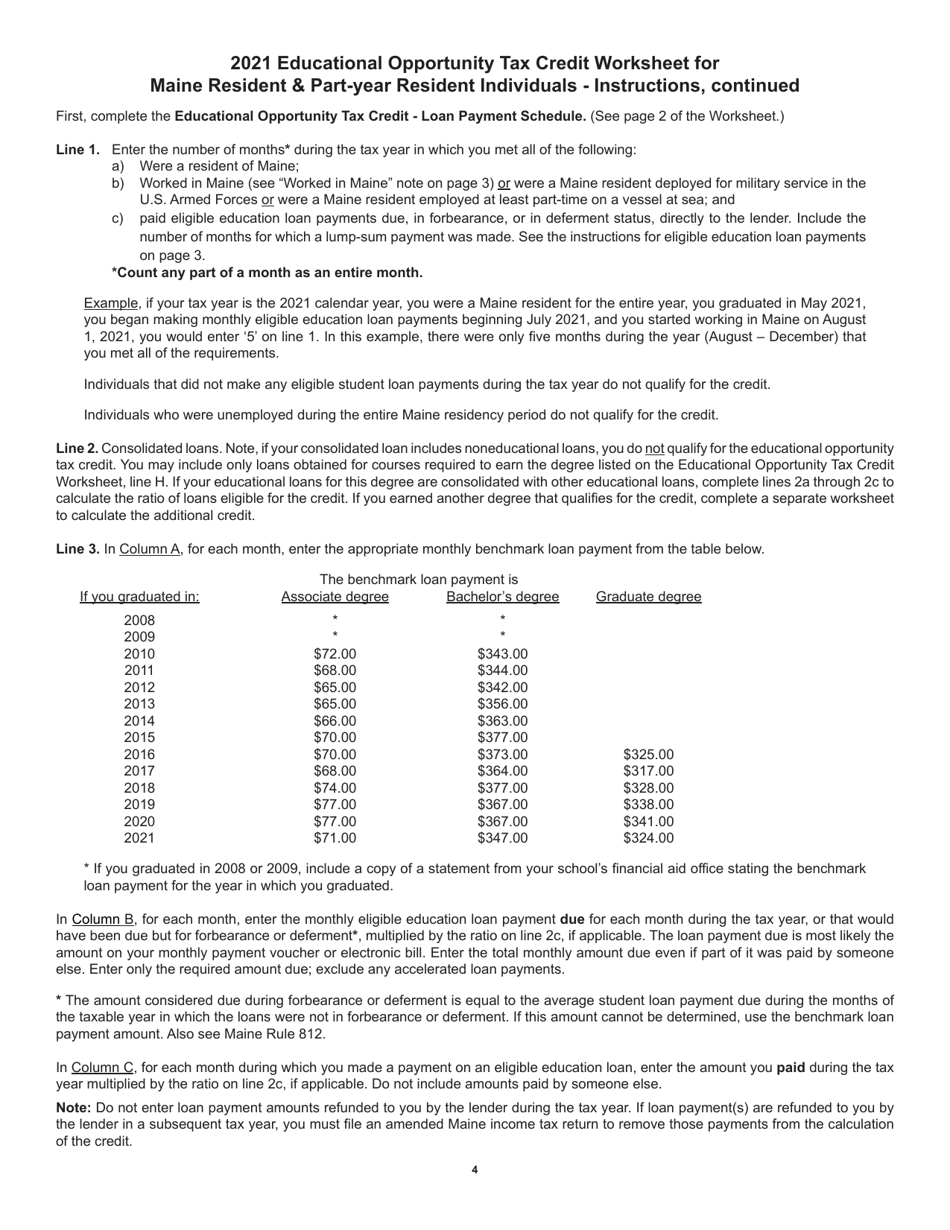

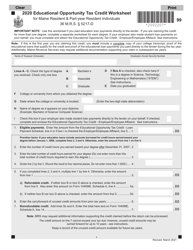

Q: What is the purpose of the Educational Opportunity Tax Credit Worksheet?

A: The Educational Opportunity Tax Credit Worksheet is used to calculate the amount of tax credit a Maine resident or part-year resident is eligible for.

Q: How do I qualify for the Educational Opportunity Tax Credit?

A: To qualify for the tax credit, you must meet specific criteria such as being a Maine resident, attending an eligible Maine postsecondary institution, and meeting certain income requirements.

Q: What expenses can be used to claim the Educational Opportunity Tax Credit?

A: Expenses such as tuition, fees, and certain course-related expenses paid to an eligible Maine postsecondary institution can be used to claim the tax credit.

Q: How much is the Educational Opportunity Tax Credit worth in Maine?

A: The amount of the tax credit varies depending on factors such as the type of education program and the amount of qualifying expenses. The maximum credit amount is $3,000.

Q: Can I claim the Educational Opportunity Tax Credit for expenses paid for my dependent's education?

A: No, the tax credit is only available for expenses paid for your own education or for your dependent's education if you are also claiming them as a dependent on your tax return.

Q: Is the Educational Opportunity Tax Credit refundable?

A: No, the tax credit is non-refundable. It can only be used to offset your tax liability.

Q: Are there any income limitations to claim the Educational Opportunity Tax Credit in Maine?

A: Yes, there are income limitations to claim the tax credit. The limits vary depending on your filing status and are subject to change each tax year.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.