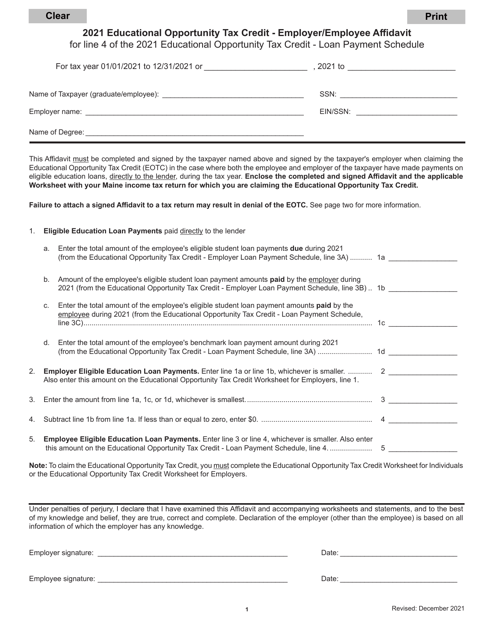

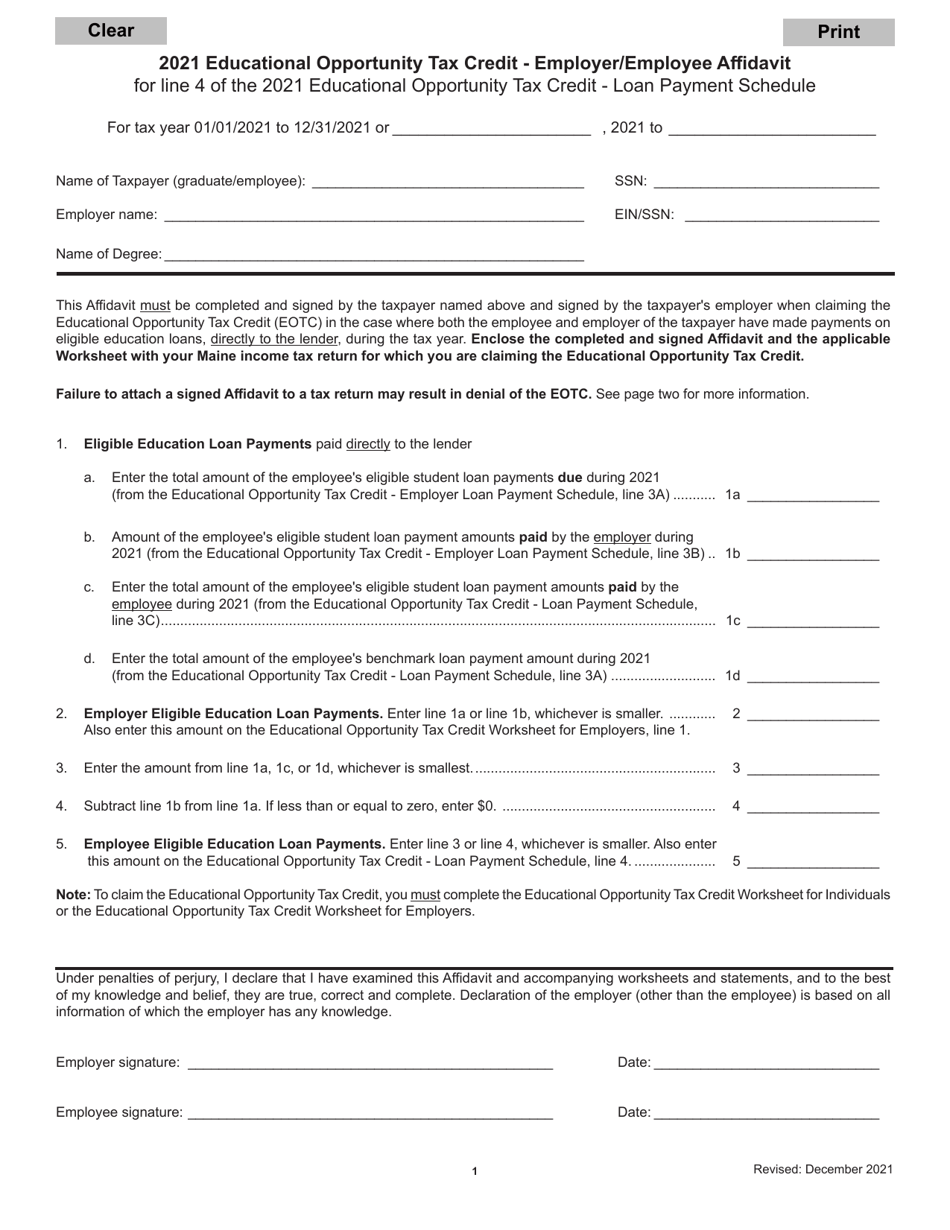

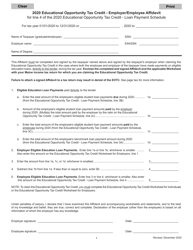

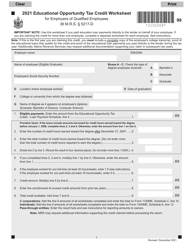

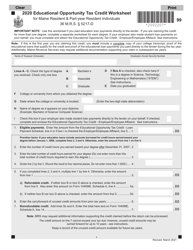

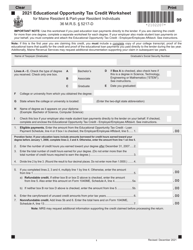

Educational Opportunity Tax Credit - Employer / Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit - Loan Payment Schedule - Maine

Educational Opportunity Tax Credit - Employer/Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit - Loan Payment Schedule is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the Educational Opportunity Tax Credit?

A: The Educational Opportunity Tax Credit is a tax credit program in Maine that provides financial assistance to eligible Maine residents who attend accredited post-secondary institutions in the state.

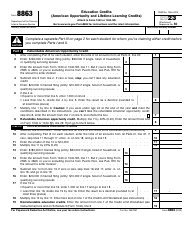

Q: What is the Employer/Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit?

A: The Employer/Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit is a form that must be completed by the employer and employee to verify the qualifying employment and earnings for the tax credit.

Q: What is the Loan Payment Schedule for the Educational Opportunity Tax Credit?

A: The Loan Payment Schedule for the Educational Opportunity Tax Credit is a document that outlines the repayment terms and schedule for any loans received under the tax credit program.

Q: Is the Educational Opportunity Tax Credit available in both Maine and Canada?

A: No, the Educational Opportunity Tax Credit is only available to eligible Maine residents attending accredited institutions in the state.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.