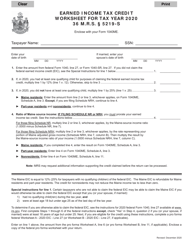

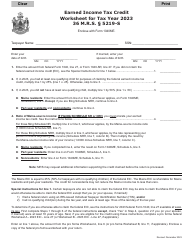

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

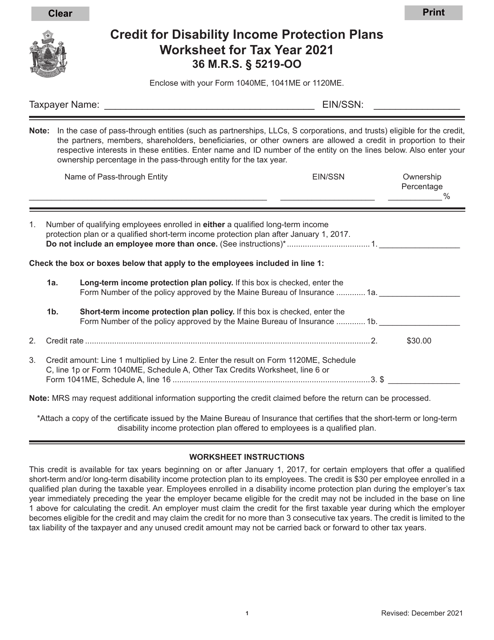

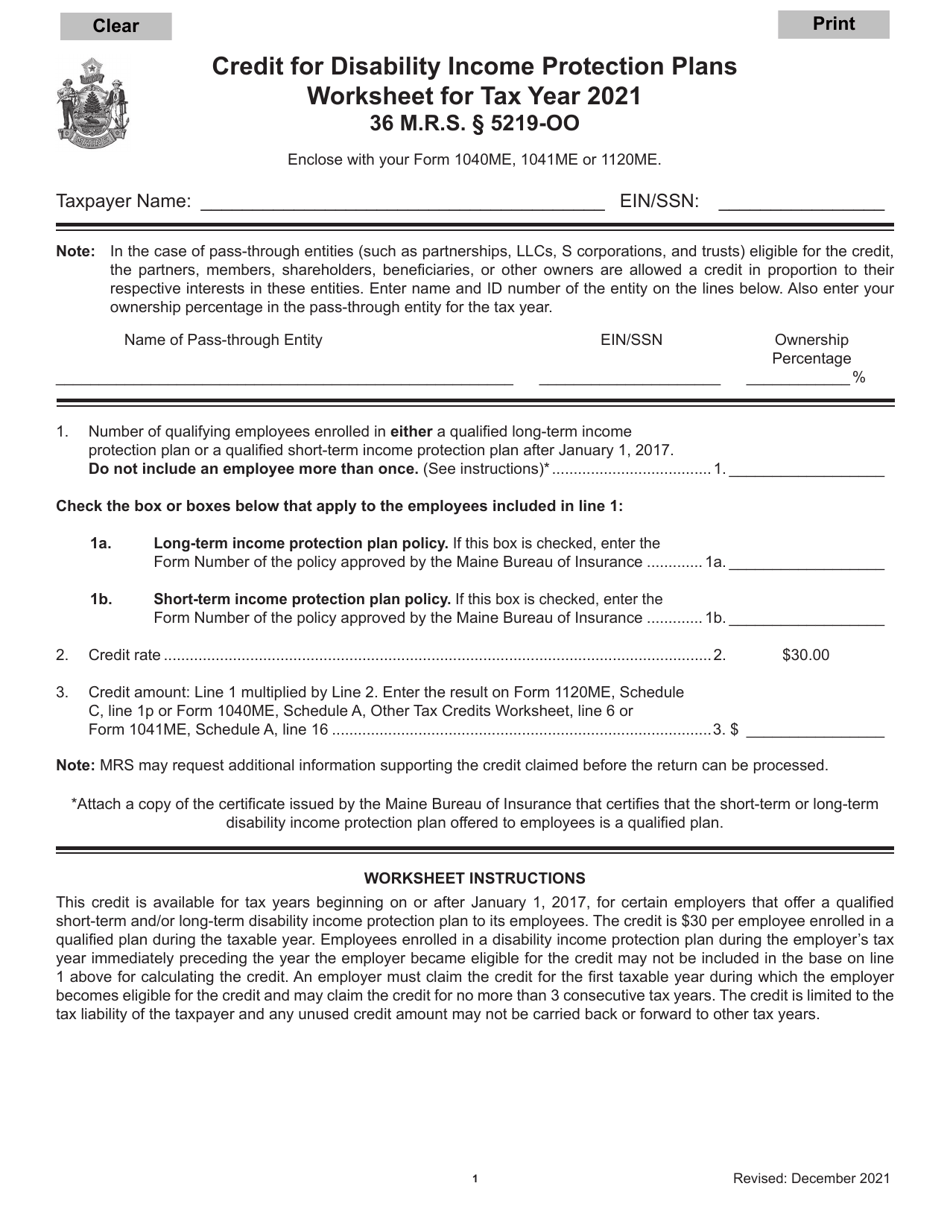

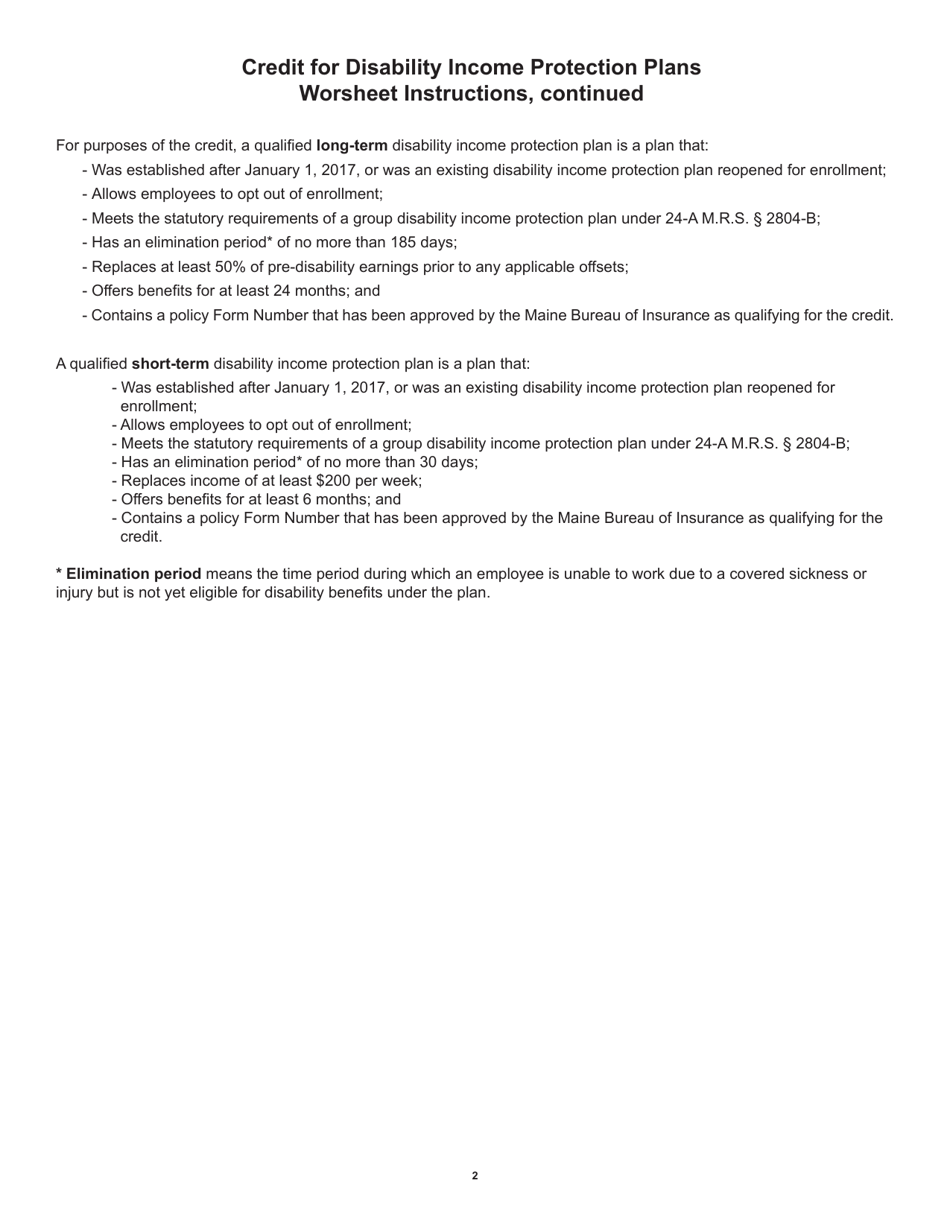

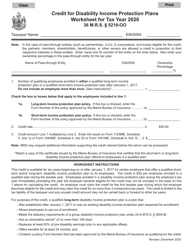

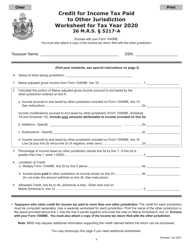

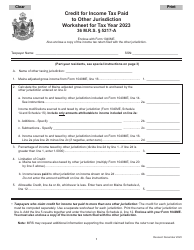

Credit for Disability Income Protection Plans Worksheet - Maine

Credit for Disability Income Protection Plans Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is a Disability Income Protection Plan?

A: A Disability Income Protection Plan is a type of insurance policy that provides financial protection in case you become disabled and are unable to work.

Q: Who needs a Disability Income Protection Plan?

A: Anyone who relies on their income to cover expenses should consider a Disability Income Protection Plan.

Q: What does a Disability Income Protection Plan cover?

A: A Disability Income Protection Plan covers a portion of your income in case you are unable to work due to a disability.

Q: How do I qualify for benefits under a Disability Income Protection Plan?

A: To qualify for benefits under a Disability Income Protection Plan, you typically need to meet the policy's definition of disability and provide medical documentation.

Q: How long do benefits last under a Disability Income Protection Plan?

A: The length of time benefits last under a Disability Income Protection Plan can vary depending on the policy, but they generally last until you can return to work or reach a certain age.

Q: Are Disability Income Protection Plan benefits taxable?

A: Disability Income Protection Plan benefits are generally taxable if your employer paid the premiums, but if you paid the premiums yourself, the benefits are usually tax-free.

Q: Can I get a Disability Income Protection Plan if I already have a pre-existing condition?

A: Some Disability Income Protection Plans may cover pre-existing conditions, while others may have exclusions or waiting periods. It's important to review the policy details.

Q: Can I purchase a Disability Income Protection Plan on my own?

A: Yes, you can purchase a Disability Income Protection Plan on your own if it's not provided by your employer.

Q: How much does a Disability Income Protection Plan cost?

A: The cost of a Disability Income Protection Plan can vary depending on factors such as your age, occupation, and desired coverage amount.

Q: Is a Disability Income Protection Plan the same as Social Security Disability benefits?

A: No, a Disability Income Protection Plan is a private insurance policy that provides additional income protection, while Social Security Disability benefits are provided by the government.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.