This version of the form is not currently in use and is provided for reference only. Download this version of

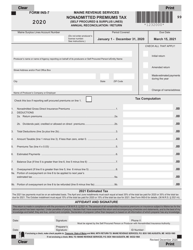

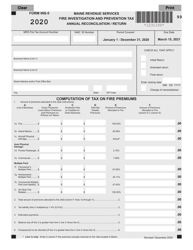

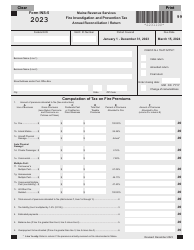

Form INS-7

for the current year.

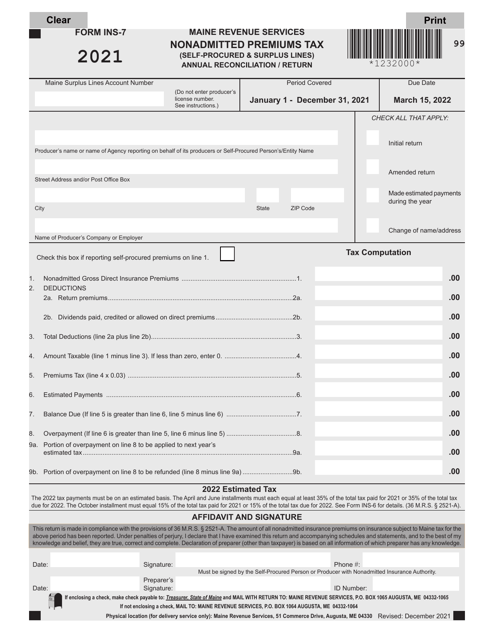

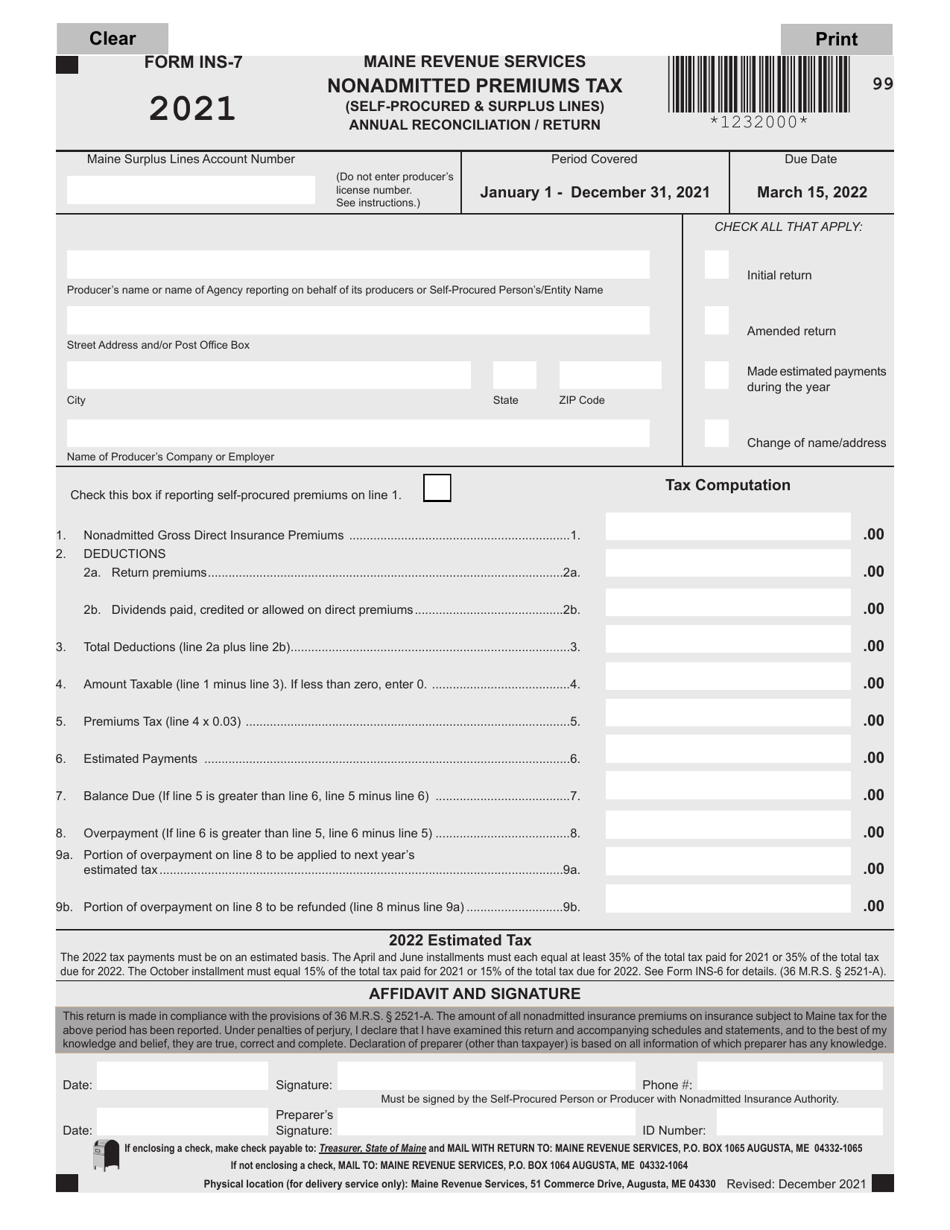

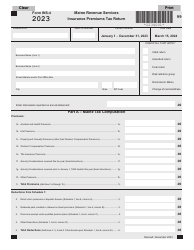

Form INS-7 Nonadmitted Premiums Tax (Self-procured & Surplus Lines) Annual Reconciliation / Return - Maine

What Is Form INS-7?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INS-7?

A: Form INS-7 is the Nonadmitted Premiums Tax (Self-procured & Surplus Lines) Annual Reconciliation/Return for Maine.

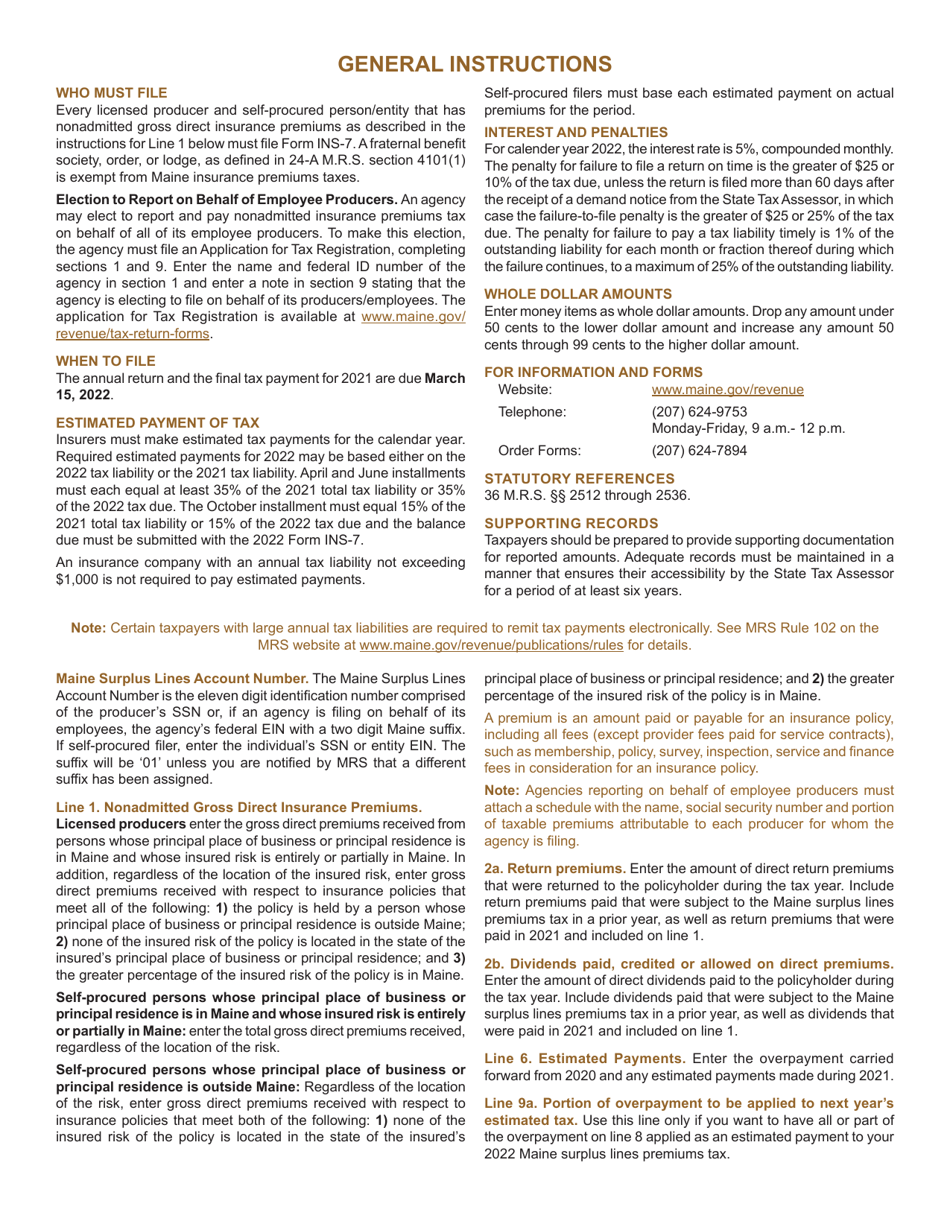

Q: Who needs to file Form INS-7?

A: Individuals or entities engaged in self-procured insurance or surplus lines insurance in Maine need to file Form INS-7.

Q: What is Nonadmitted Premiums Tax?

A: Nonadmitted Premiums Tax is a tax on insurance premiums paid to insurance companies that are not licensed in the state where the insured property or risk is located.

Q: What is self-procured insurance?

A: Self-procured insurance is when an individual or entity directly arranges and pays for insurance coverage without going through a licensed insurance company.

Q: What are surplus lines insurance?

A: Surplus lines insurance is insurance coverage obtained from an insurance company that is not licensed in the state where the insured property or risk is located.

Q: What is the purpose of Form INS-7?

A: Form INS-7 is used to reconcile and report nonadmitted premiums tax liabilities for self-procured and surplus lines insurance in Maine.

Q: When is Form INS-7 due?

A: Form INS-7 is due annually on March 15th.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INS-7 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.