This version of the form is not currently in use and is provided for reference only. Download this version of

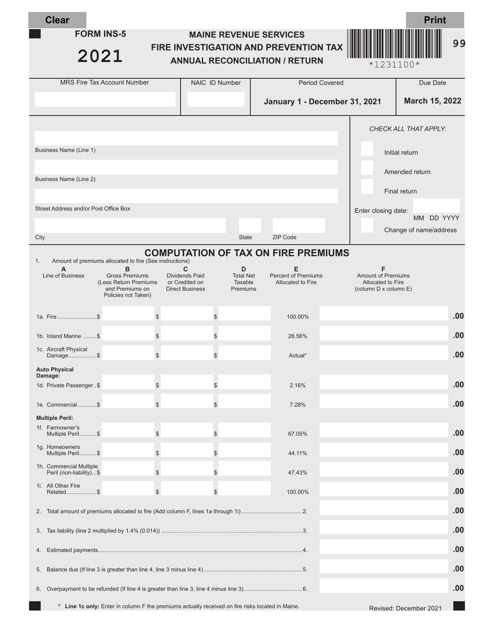

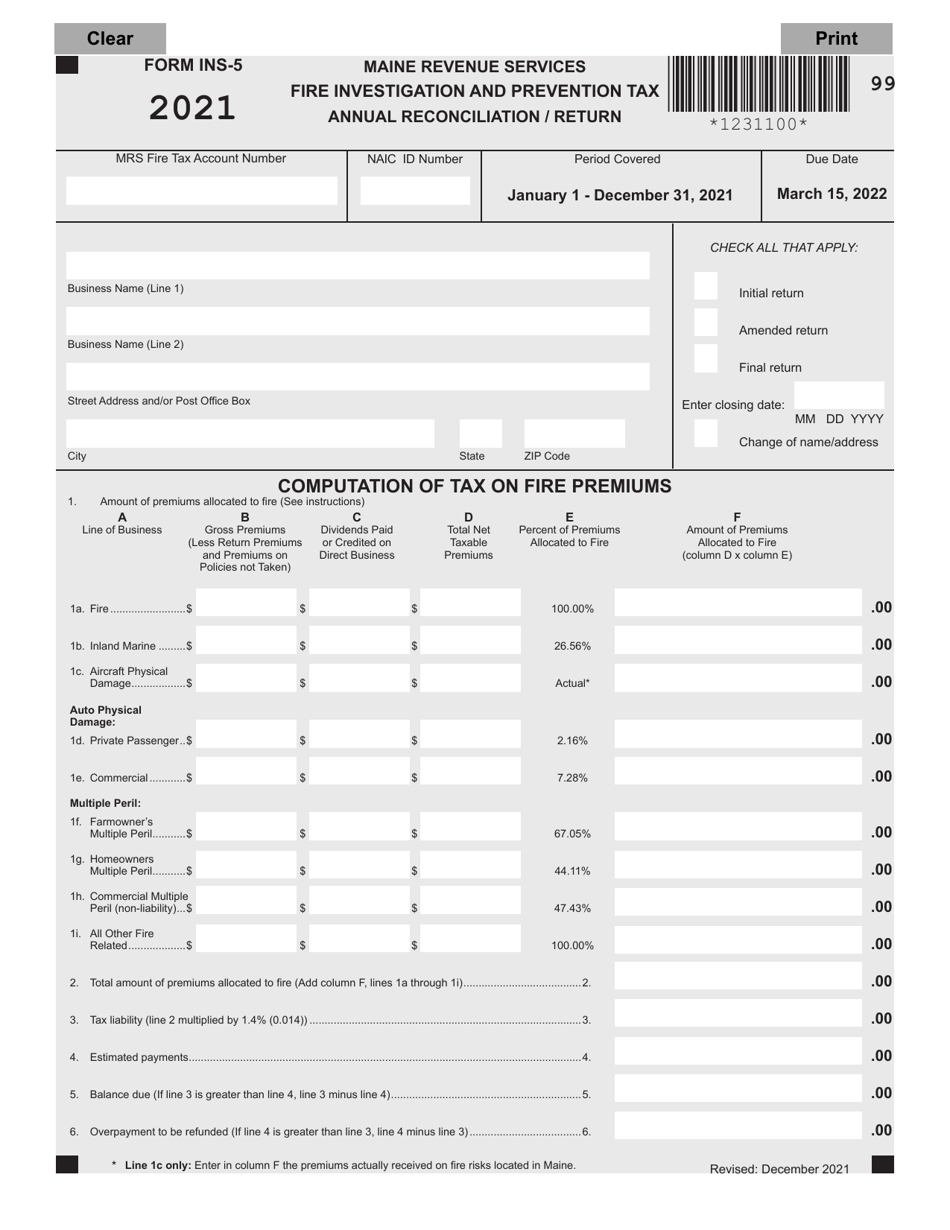

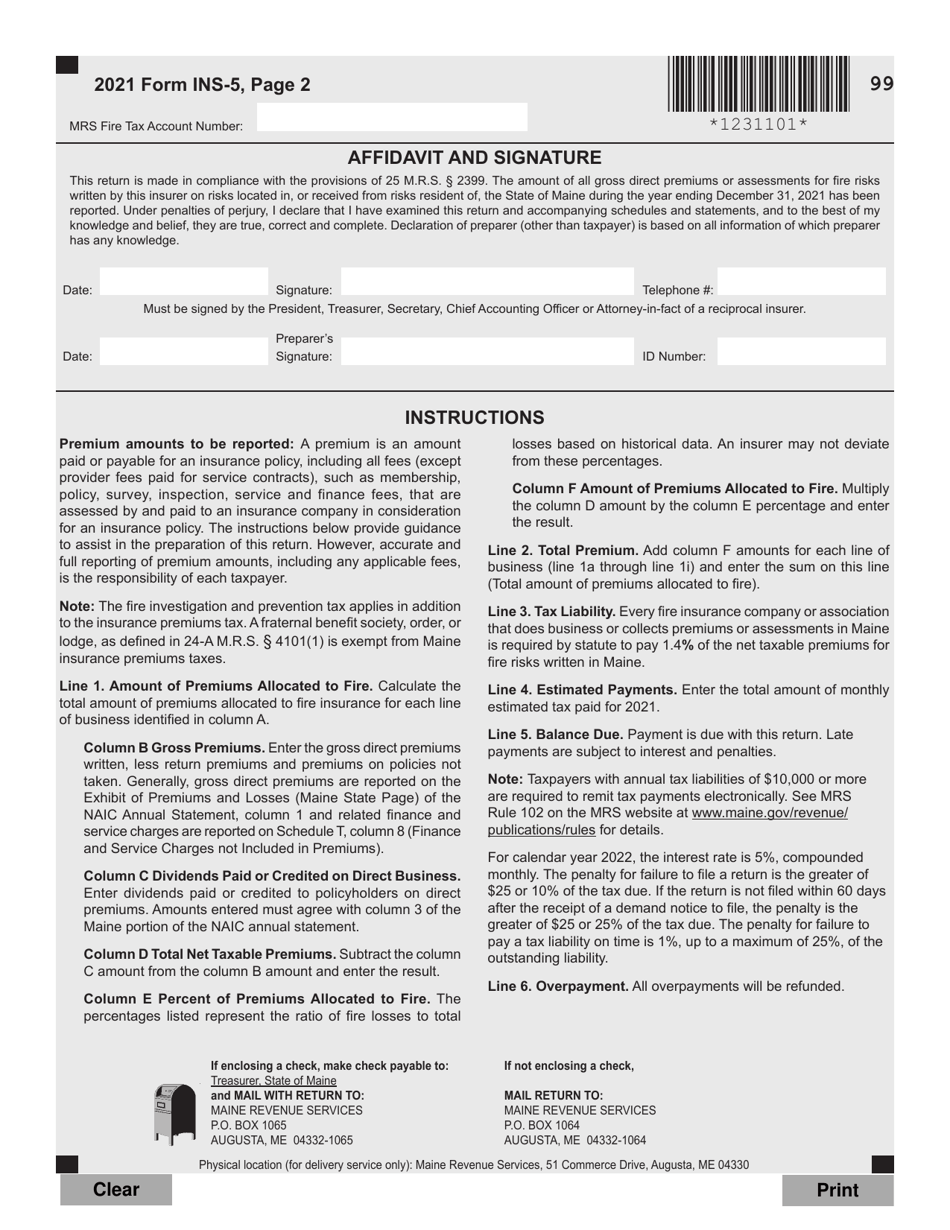

Form INS-5

for the current year.

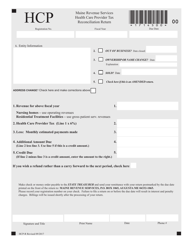

Form INS-5 Fire Investigation and Prevention Tax Annual Reconciliation / Return - Maine

What Is Form INS-5?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INS-5?

A: Form INS-5 is the Fire Investigation and Prevention Tax Annual Reconciliation/Return for the state of Maine.

Q: What is the purpose of Form INS-5?

A: The purpose of Form INS-5 is to reconcile and report the Fire Investigation and Prevention Taxes owed by businesses in Maine.

Q: Who needs to file Form INS-5?

A: Businesses in Maine that are subject to Fire Investigation and Prevention Taxes need to file Form INS-5.

Q: What are Fire Investigation and Prevention Taxes?

A: Fire Investigation and Prevention Taxes are specific taxes levied on certain businesses in Maine to fund fire investigations and prevention programs.

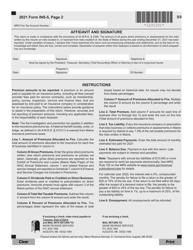

Q: What information is required on Form INS-5?

A: Form INS-5 requires businesses to provide information about their tax liabilities, payments, and any credits or deductions applicable.

Q: How often does Form INS-5 need to be filed?

A: Form INS-5 needs to be filed annually.

Q: What is the deadline to file Form INS-5?

A: The deadline to file Form INS-5 is typically April 15th of each year.

Q: Are there any penalties for not filing Form INS-5?

A: Yes, there are penalties for not filing Form INS-5 or for filing it late. It's important to file the form on time to avoid any penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INS-5 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.