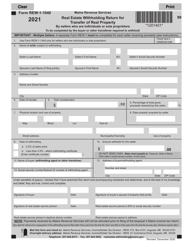

This version of the form is not currently in use and is provided for reference only. Download this version of

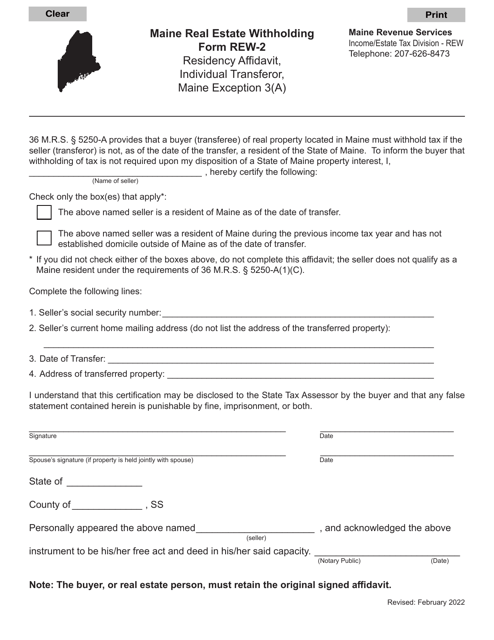

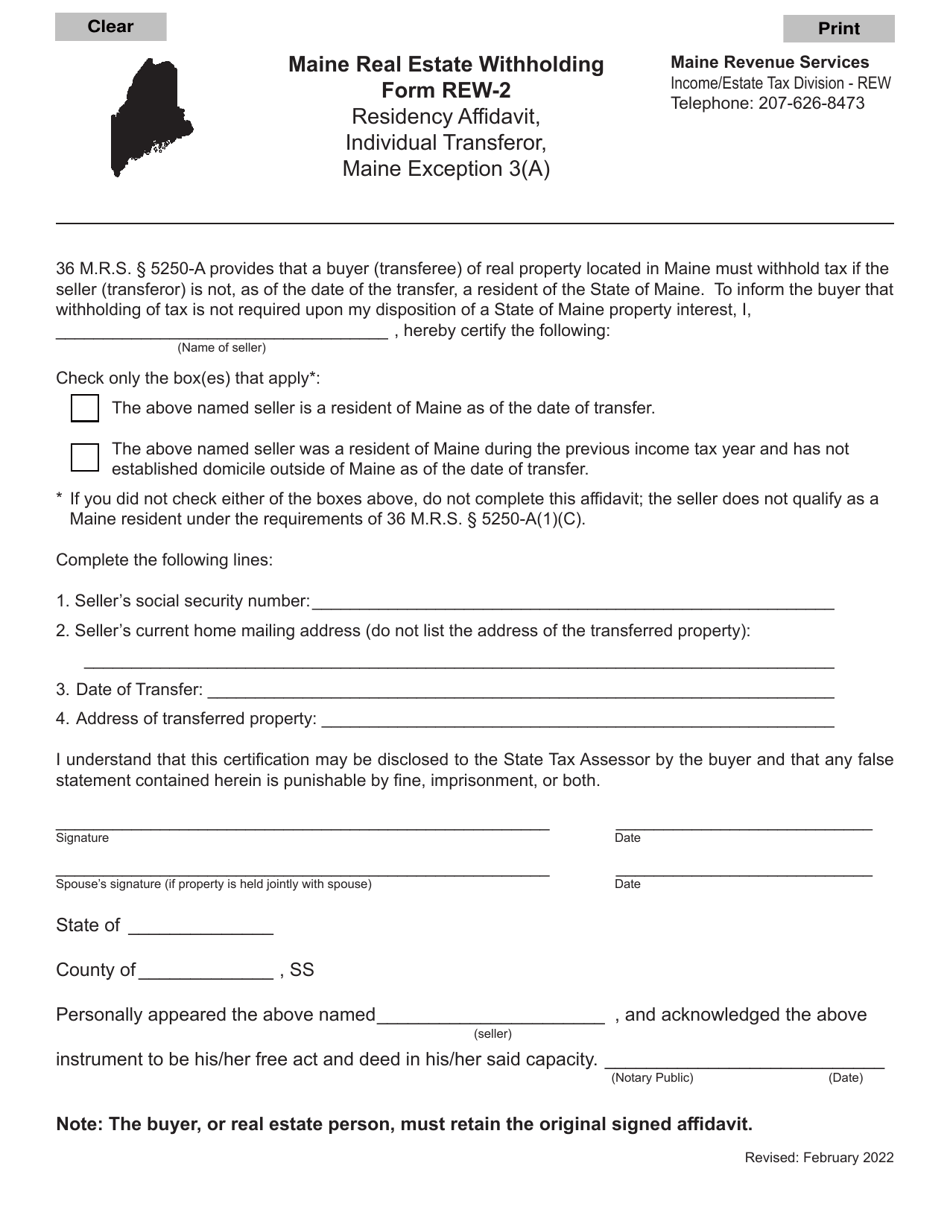

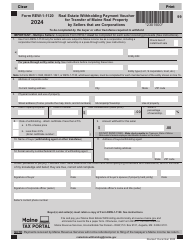

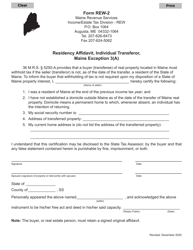

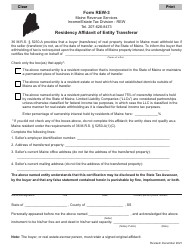

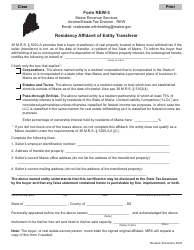

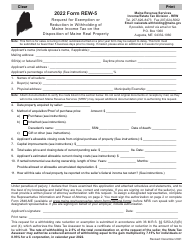

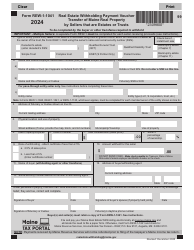

Form REW-2

for the current year.

Form REW-2 Maine Real Estate Withholding - Residency Affidavit, Individual Transferor, Maine Exception 3(A) - Maine

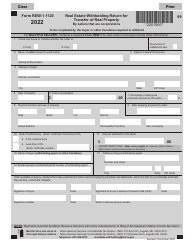

What Is Form REW-2?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

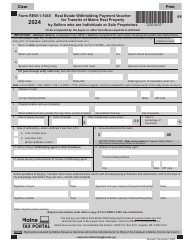

Q: What is the Form REW-2?

A: Form REW-2 is the Maine Real Estate Withholding - Residency Affidavit, Individual Transferor, Maine Exception 3(A) form.

Q: Who needs to fill out Form REW-2?

A: Individual transferors in Maine who qualify under Maine Exception 3(A) need to fill out Form REW-2.

Q: What is the purpose of Form REW-2?

A: Form REW-2 is used to determine if the individual transferor qualifies for an exception to the real estate withholding requirement in Maine.

Q: What is Maine Exception 3(A)?

A: Maine Exception 3(A) is a provision that allows certain individual transferors in Maine to be exempt from the real estate withholding requirement.

Q: When should Form REW-2 be submitted?

A: Form REW-2 should be submitted to the closing agent or the buyer before the transfer of the real estate.

Q: Are there any penalties for not submitting Form REW-2?

A: Yes, if Form REW-2 is not submitted, the closing agent or buyer may be required to withhold a percentage of the sale price as a tax withholding.

Q: Do I need to submit any supporting documents with Form REW-2?

A: It is not required to submit supporting documents with Form REW-2, unless specifically requested by the closing agent or buyer.

Q: What should I do if I am not eligible for Maine Exception 3(A)?

A: If you are not eligible for Maine Exception 3(A), you must follow the regular real estate withholding requirements in Maine.

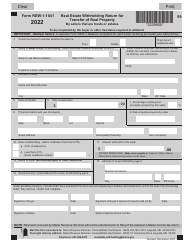

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-2 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.