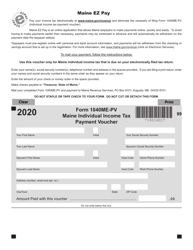

This version of the form is not currently in use and is provided for reference only. Download this version of

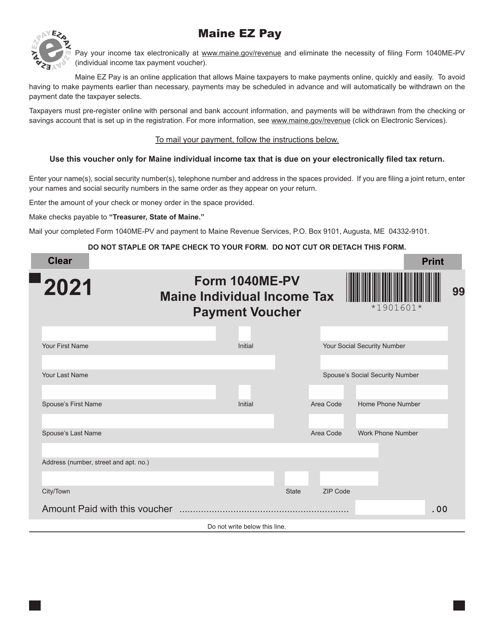

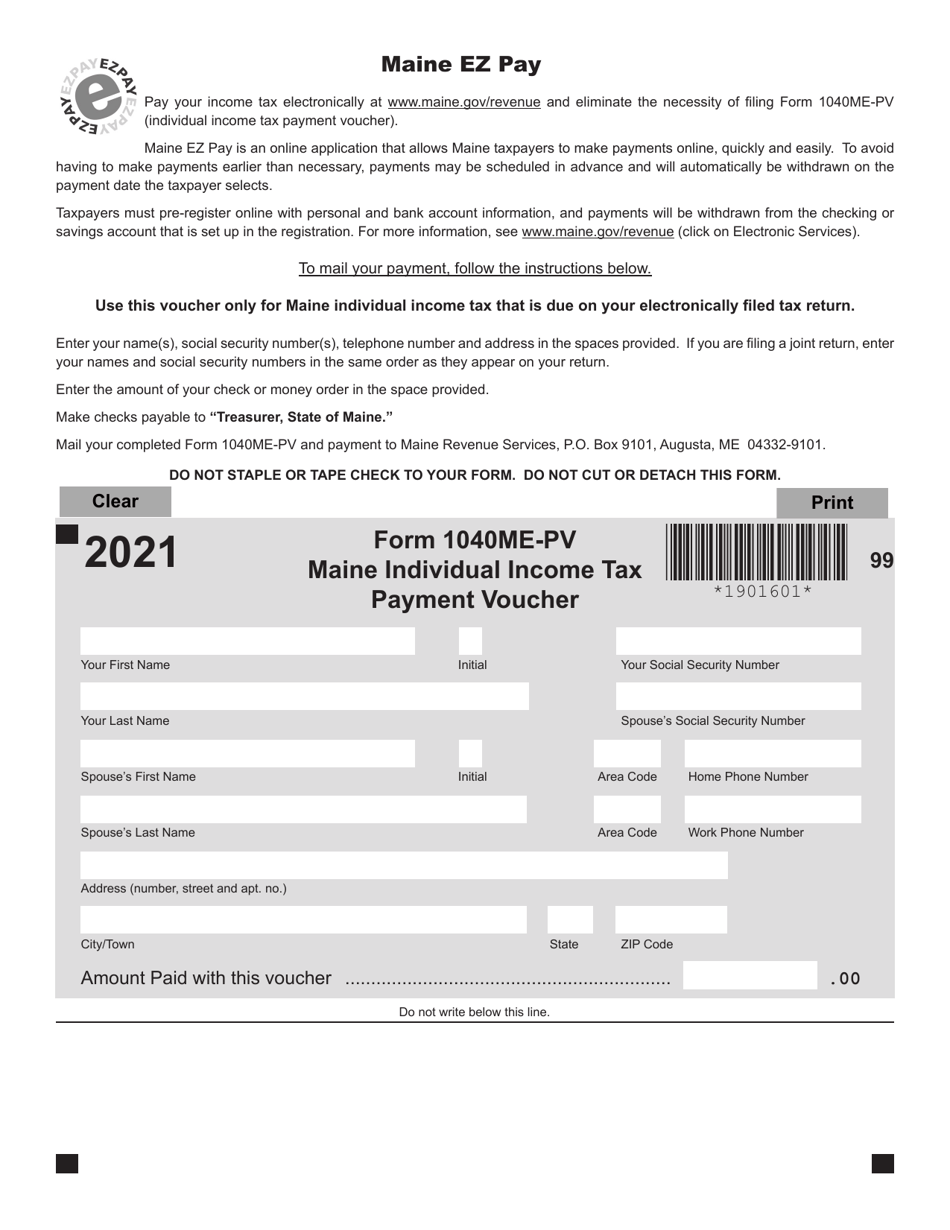

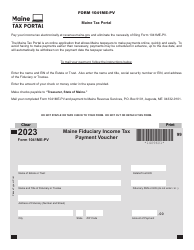

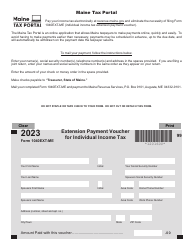

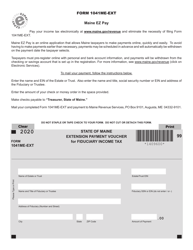

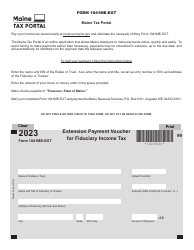

Form 1040ME-PV

for the current year.

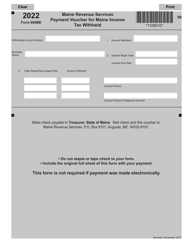

Form 1040ME-PV Maine Individual Income Tax Payment Voucher - Maine

What Is Form 1040ME-PV?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME-PV used for?

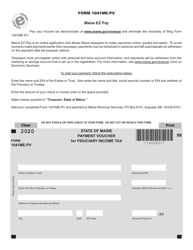

A: Form 1040ME-PV is used for making individual income tax payments in the state of Maine.

Q: Who needs to use Form 1040ME-PV?

A: Any individual who is required to pay income tax in Maine should use Form 1040ME-PV to make their tax payment.

Q: What information is required on Form 1040ME-PV?

A: Form 1040ME-PV requires the taxpayer's name, address, Social Security number, the tax year, the amount of tax owed, and the payment method.

Q: When is the deadline for filing Form 1040ME-PV?

A: The deadline for filing Form 1040ME-PV is typically the same as the deadline for filing your Maine individual income tax return, which is April 15th.

Q: What if I cannot pay the full amount of tax owed?

A: If you cannot pay the full amount of tax owed, you should still file Form 1040ME-PV and pay as much as you can. You may be able to arrange a payment plan or request a waiver of penalties and interest.

Q: Are there any penalties for not filing Form 1040ME-PV?

A: Yes, if you do not file Form 1040ME-PV or pay the full amount of tax owed by the deadline, you may be subject to penalties and interest charges.

Q: Can I use Form 1040ME-PV to make estimated tax payments?

A: No, Form 1040ME-PV is specifically used for making individual income tax payments and cannot be used for estimated tax payments.

Q: Is Form 1040ME-PV only for residents of Maine?

A: No, Form 1040ME-PV can be used by both residents and non-residents of Maine who owe income tax in the state.

Form Details:

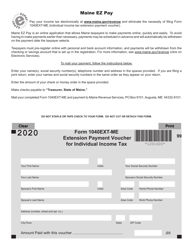

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME-PV by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.