This version of the form is not currently in use and is provided for reference only. Download this version of

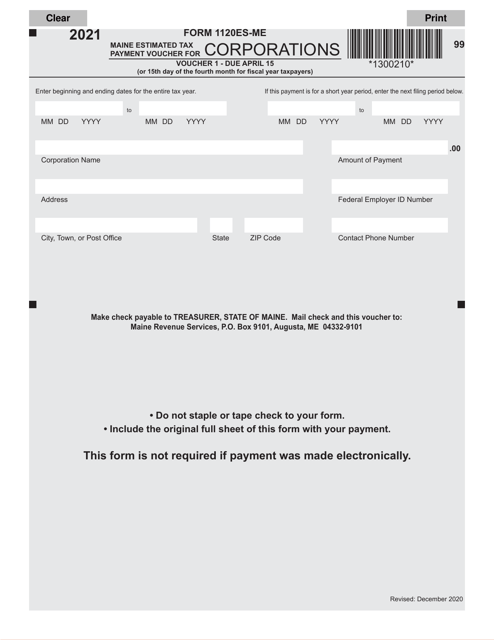

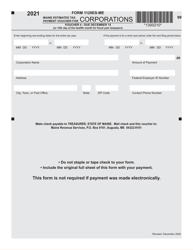

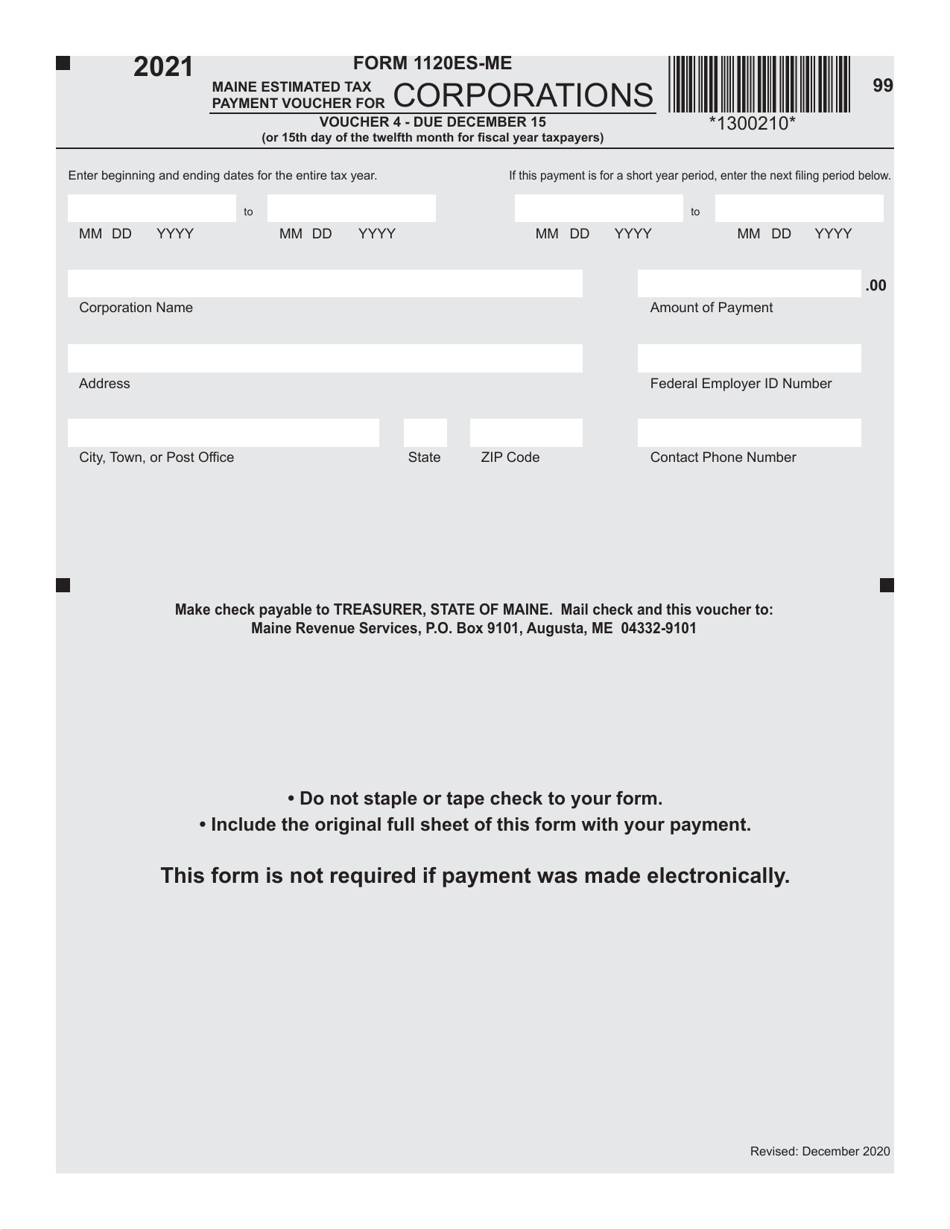

Form 1120ES-ME

for the current year.

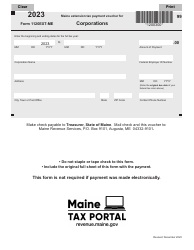

Form 1120ES-ME Maine Estimated Tax Payment Voucher for Corporations - Maine

What Is Form 1120ES-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ES-ME?

A: Form 1120ES-ME is the Maine Estimated Tax Payment Voucher for Corporations in Maine.

Q: Who needs to file Form 1120ES-ME?

A: Corporations in Maine that need to make estimated tax payments for the year.

Q: What is the purpose of Form 1120ES-ME?

A: The purpose of Form 1120ES-ME is to submit estimated tax payments for corporations in Maine.

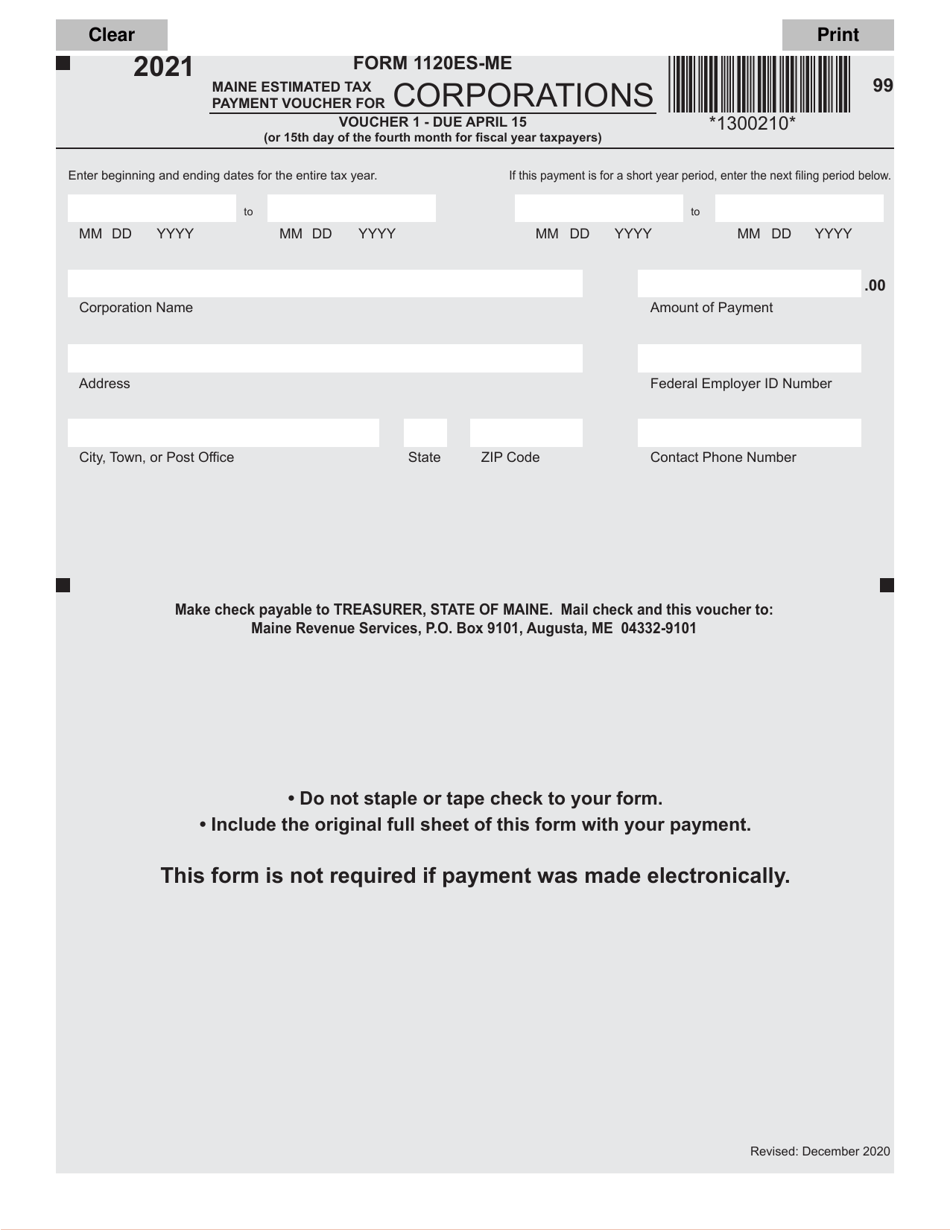

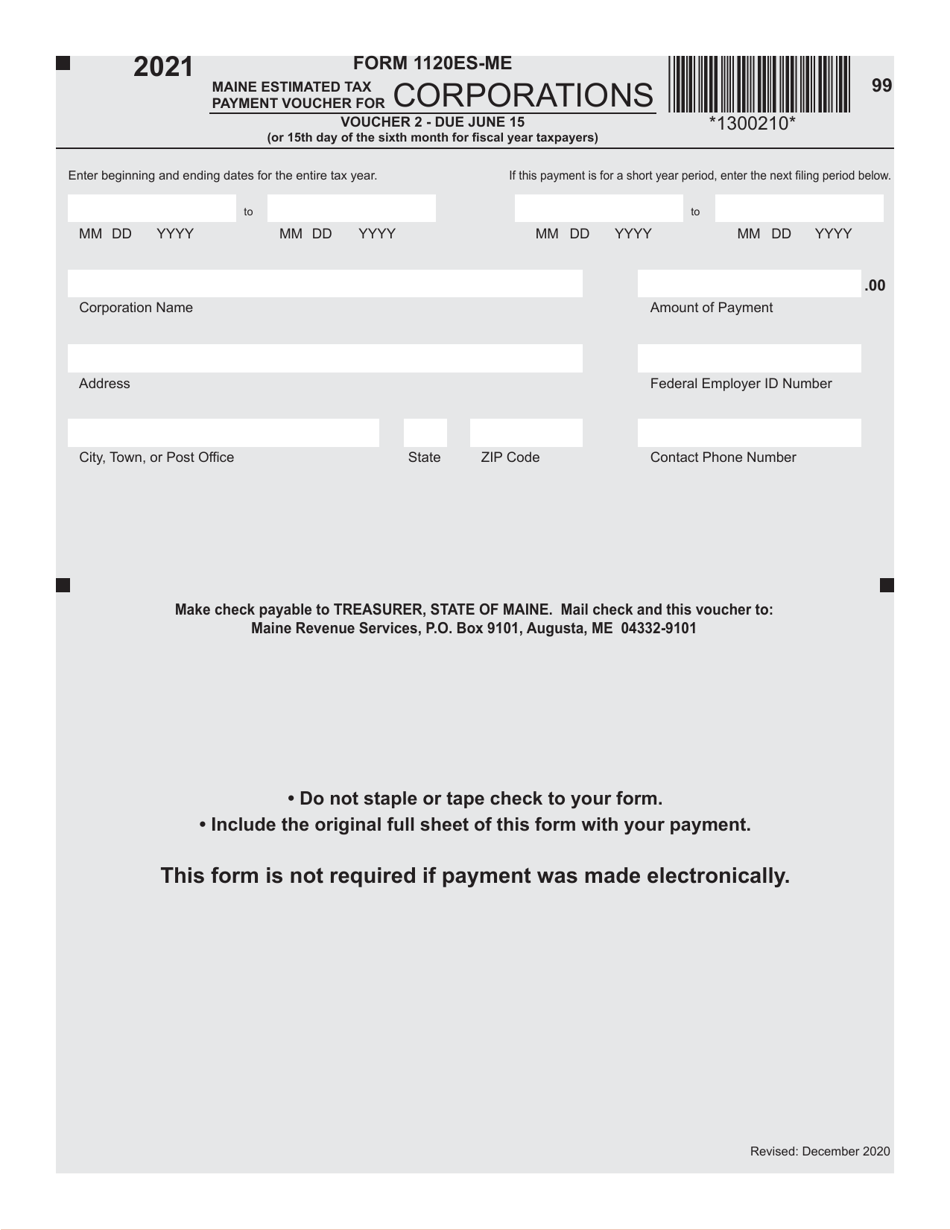

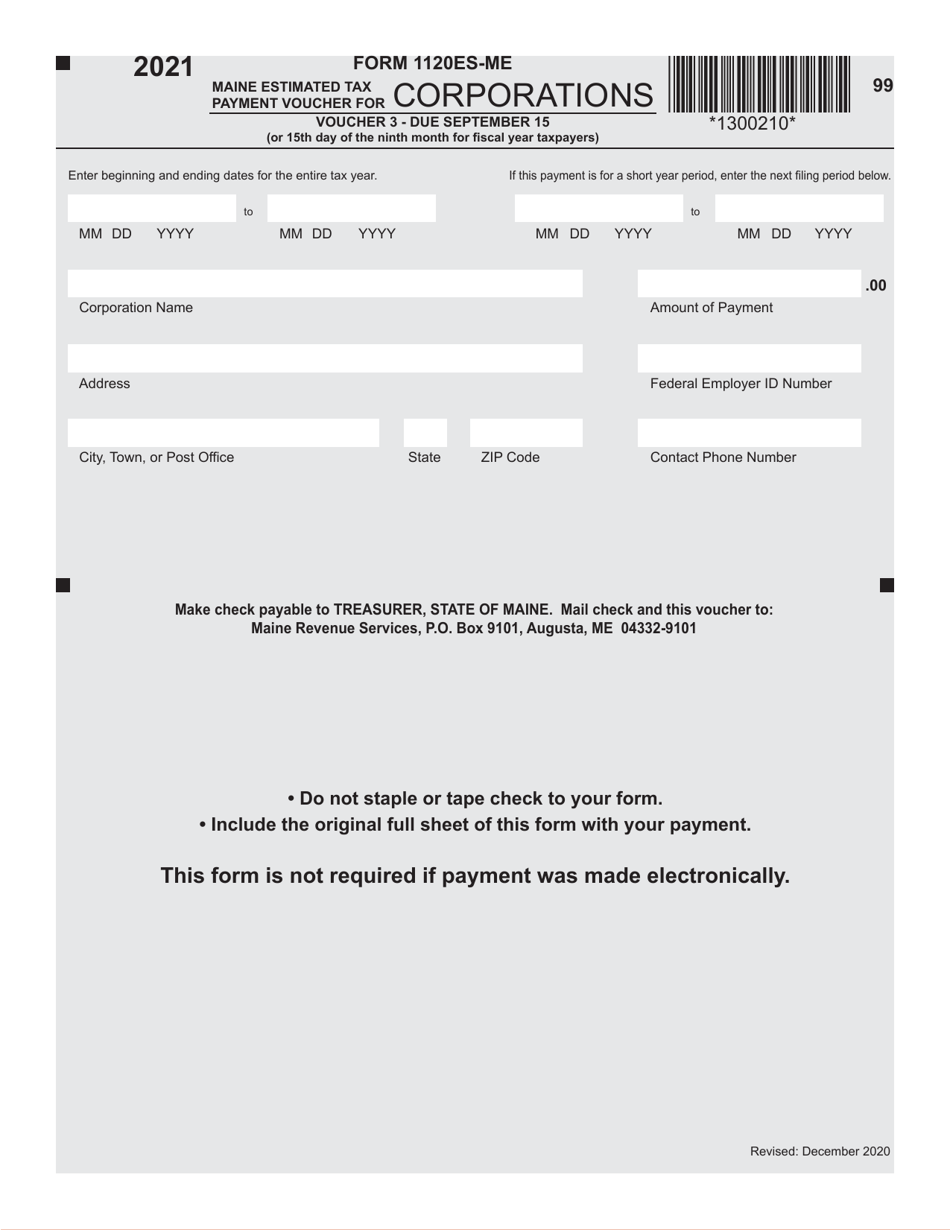

Q: When is Form 1120ES-ME due?

A: Form 1120ES-ME is due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: How do I fill out Form 1120ES-ME?

A: You need to fill out your corporation's name, address, and identification number, as well as the amount of estimated tax payment you are making.

Q: Is Form 1120ES-ME the same as federal Form 1120-ES?

A: No, Form 1120ES-ME is specifically for corporations in Maine and is separate from the federal Form 1120-ES.

Q: What happens if I don't file Form 1120ES-ME?

A: If you don't file Form 1120ES-ME or make estimated tax payments, you may be subject to penalties and interest.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120ES-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.