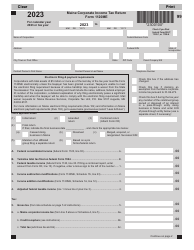

This version of the form is not currently in use and is provided for reference only. Download this version of

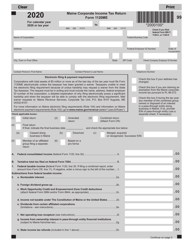

Form 1120W-ME

for the current year.

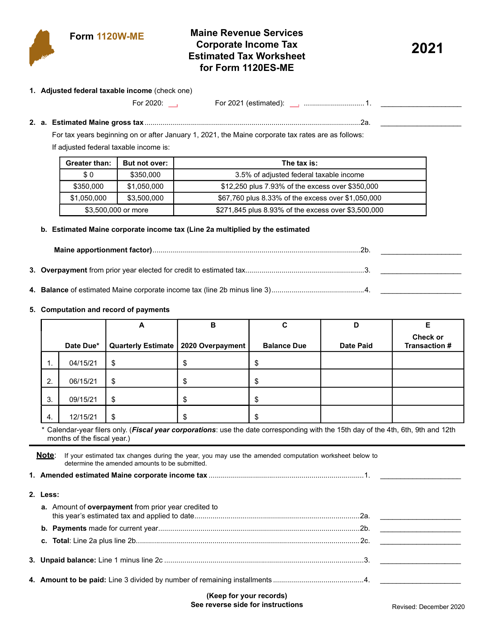

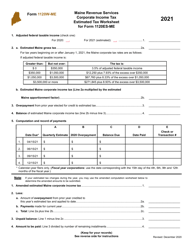

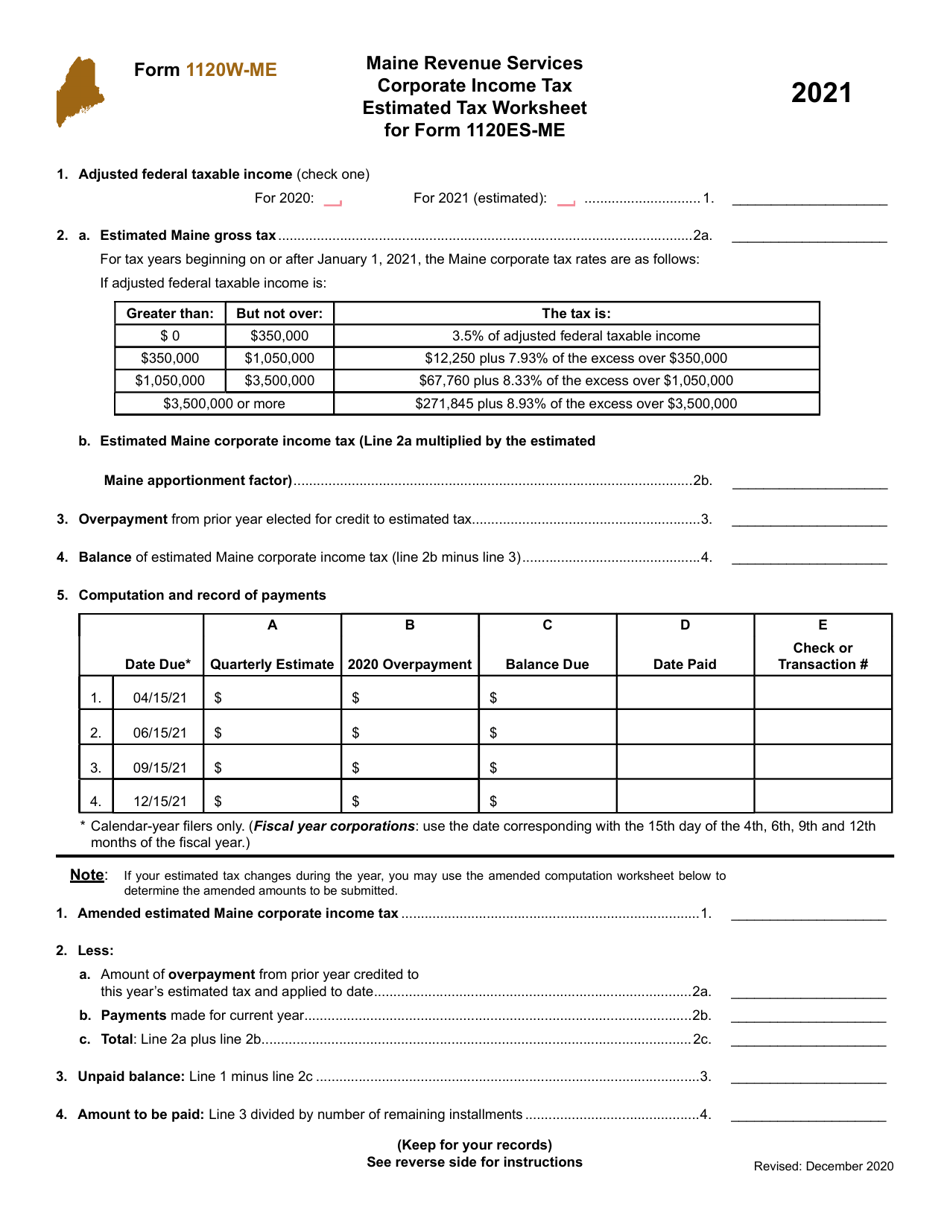

Form 1120W-ME Corporate Income Tax Estimated Tax Worksheet - Maine

What Is Form 1120W-ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120W-ME?

A: Form 1120W-ME is the Corporate Income Tax Estimated Tax Worksheet specific to the state of Maine.

Q: Who needs to file Form 1120W-ME?

A: Corporations that are required to pay estimated taxes in the state of Maine need to file Form 1120W-ME.

Q: What is the purpose of Form 1120W-ME?

A: The purpose of Form 1120W-ME is to calculate and determine the estimated tax liability for corporations in Maine.

Q: When is Form 1120W-ME due?

A: Form 1120W-ME is generally due on the same day as the federal income tax return for the corporation.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120W-ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.