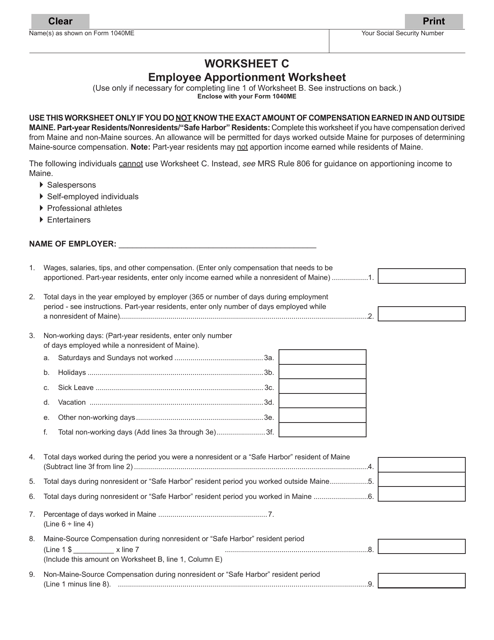

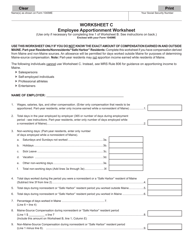

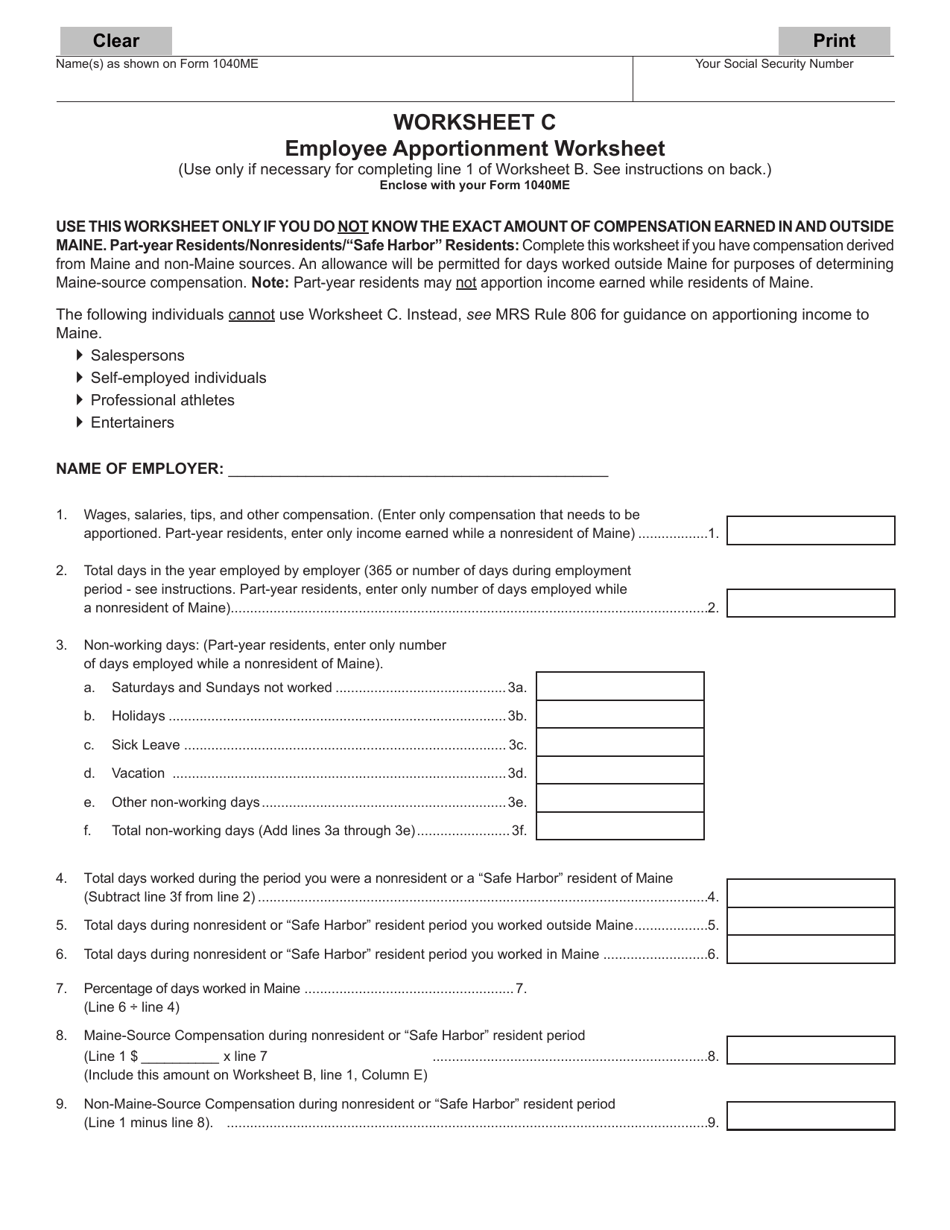

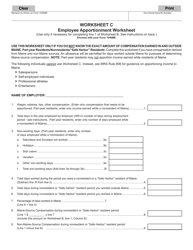

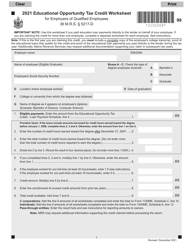

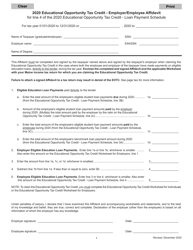

Form 1040ME Worksheet C Employee Apportionment Worksheet - Maine

What Is Form 1040ME Worksheet C?

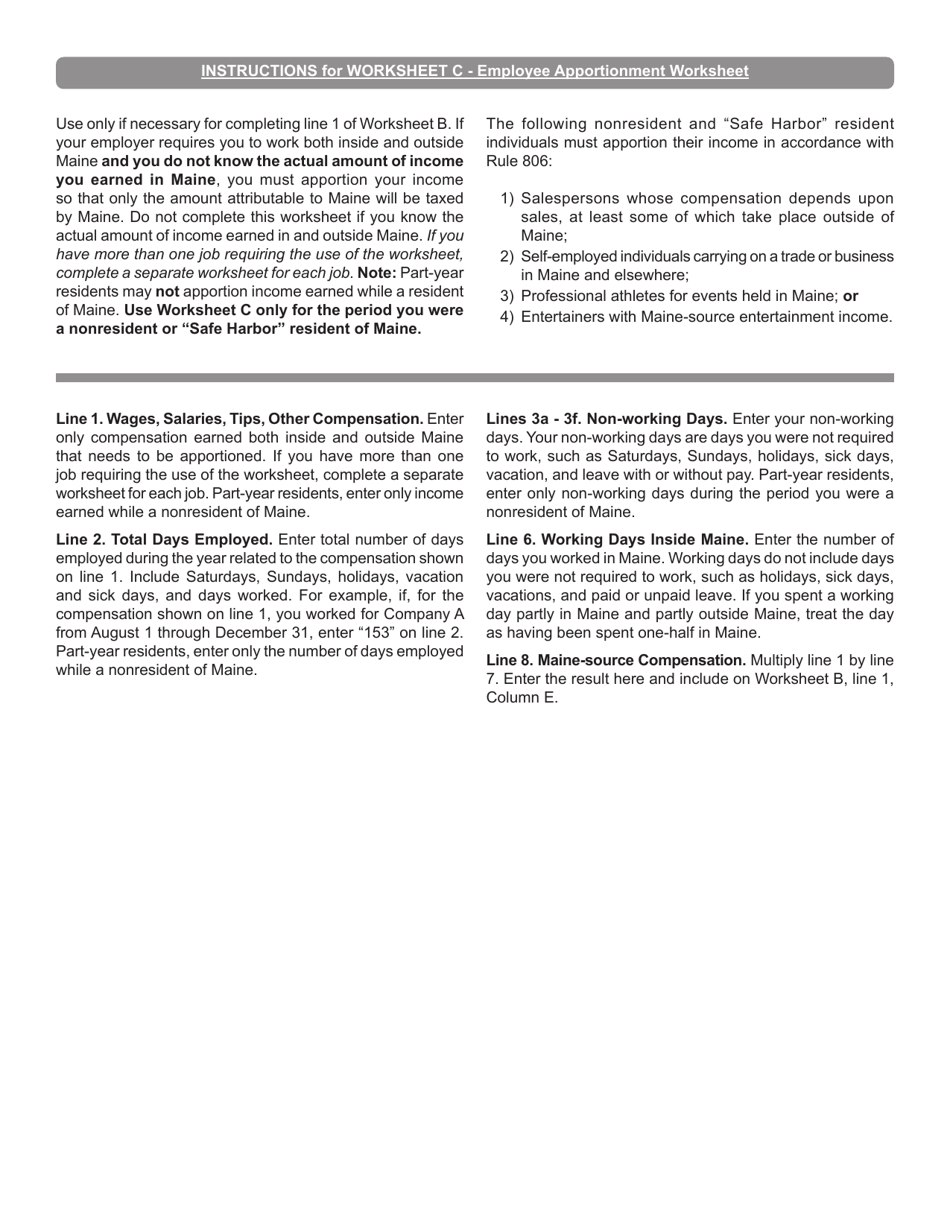

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME?

A: Form 1040ME is the individual income tax return form for residents of Maine.

Q: What is Worksheet C?

A: Worksheet C is an employee apportionment worksheet used to calculate the portion of income that should be apportioned to Maine.

Q: Who should use Worksheet C?

A: Residents of Maine who earn income both in and out of the state should use Worksheet C to determine the portion of their income attributable to Maine.

Q: What is employee apportionment?

A: Employee apportionment is the process of determining how much of an individual's income should be allocated to a specific state or jurisdiction.

Q: Why is employee apportionment important?

A: Employee apportionment is important for tax purposes, as it determines the amount of income that should be subject to state-specific taxes.

Q: Is Worksheet C mandatory?

A: Worksheet C is mandatory for residents of Maine who earn income both within and outside of the state and need to determine the portion of their income attributable to Maine.

Q: Are there any exceptions to using Worksheet C?

A: There may be exceptions or special circumstances where Worksheet C is not required. It is recommended to consult with a tax professional or refer to the instructions provided with the form for specific guidance.

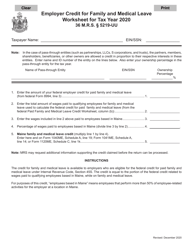

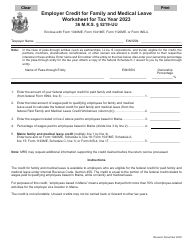

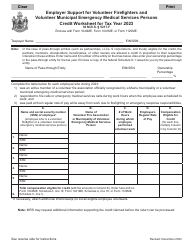

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Worksheet C by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.