Form 1040ME Worksheet A, B Residency Information Worksheet and Income Allocation Worksheet for Part-Year Residents / Nonresidents / "safe Harbor" Residents - Maine

What Is Form 1040ME Worksheet A, B?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME?

A: Form 1040ME is a tax form used in the state of Maine to report your income and calculate your state taxes.

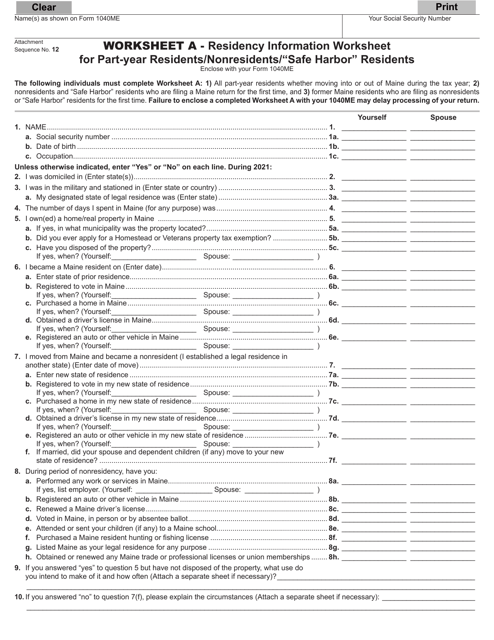

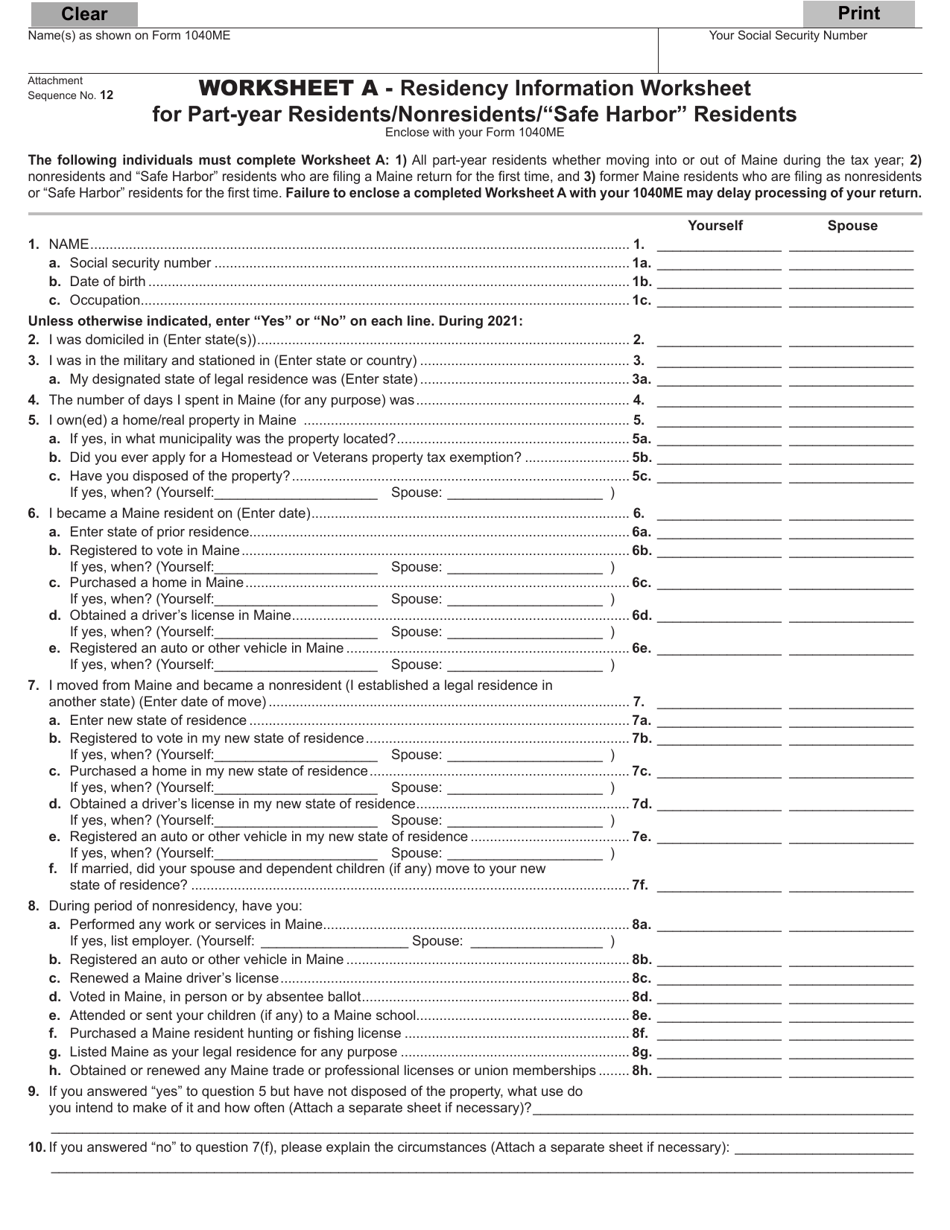

Q: What is Worksheet A?

A: Worksheet A is a residency information worksheet used by part-year residents, nonresidents, and 'safe harbor' residents in Maine to determine their residency status for tax purposes.

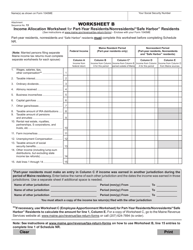

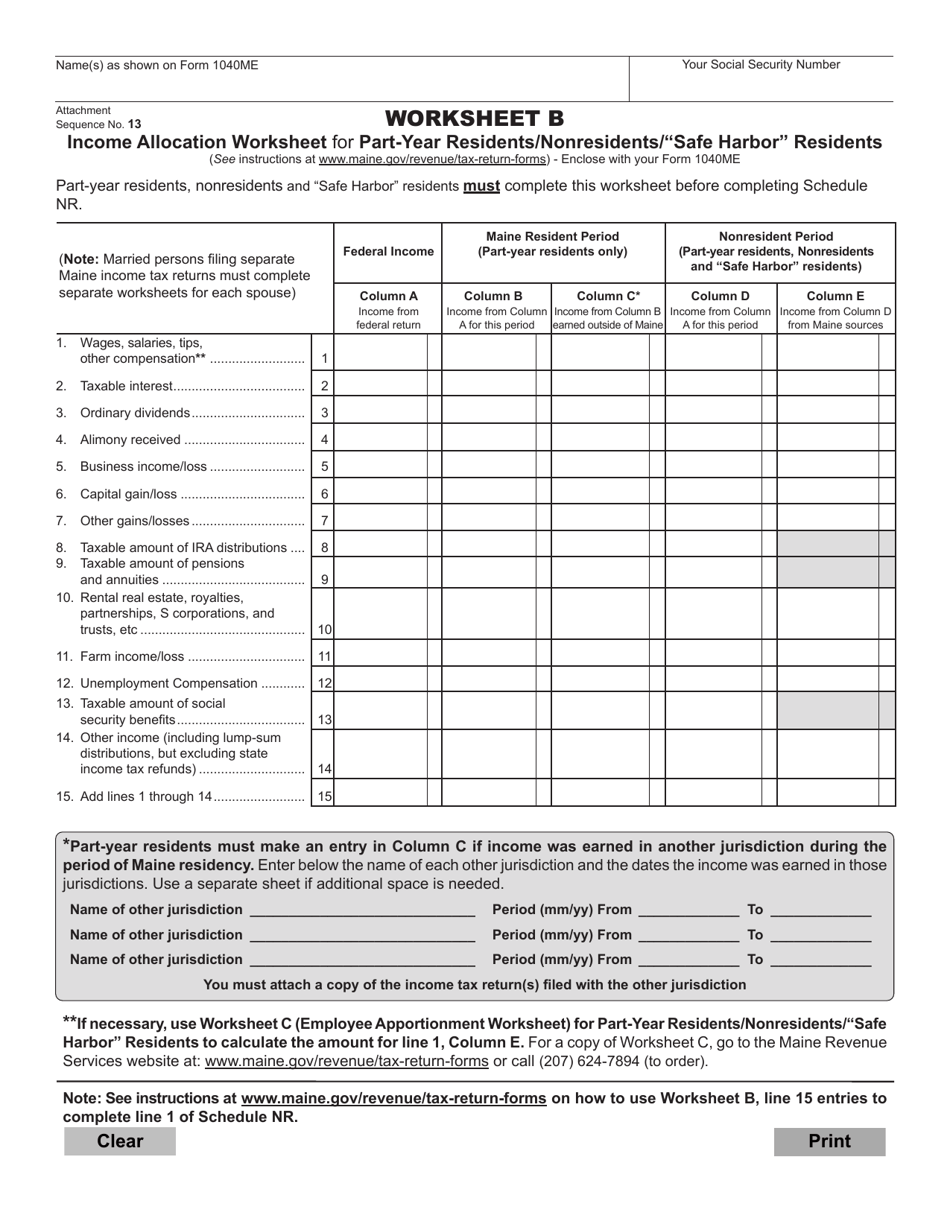

Q: What is Worksheet B?

A: Worksheet B is an income allocation worksheet used by part-year residents, nonresidents, and 'safe harbor' residents in Maine to allocate their income between Maine and other states if they have income from multiple sources.

Q: Who should use these worksheets?

A: These worksheets are used by individuals who are part-year residents, nonresidents, or 'safe harbor' residents of Maine for tax purposes.

Q: What is a part-year resident?

A: A part-year resident is an individual who moved in or out of Maine during the tax year.

Q: Who is considered a nonresident in Maine?

A: A nonresident is an individual who did not live in Maine at any point during the tax year, but earned income from Maine sources.

Q: What is a 'safe harbor' resident?

A: A 'safe harbor' resident is an individual who spent fewer than 183 days in Maine during the tax year and did not have a permanent place of abode in Maine.

Q: What is the purpose of these worksheets?

A: The purpose of these worksheets is to determine the appropriate tax treatment for individuals who have different residency statuses in Maine and to allocate income between Maine and other states if necessary.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Worksheet A, B by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.