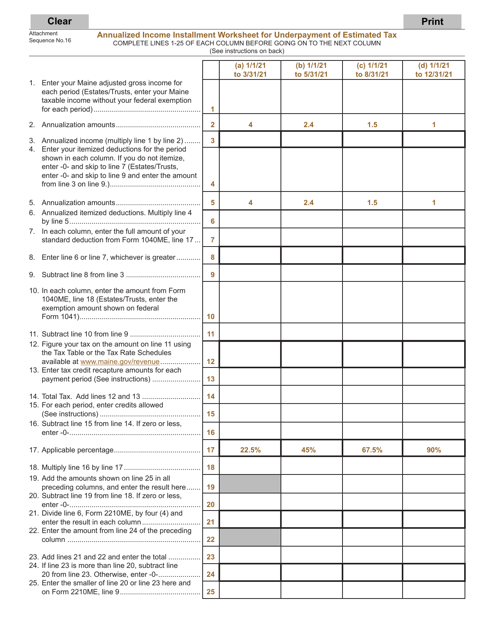

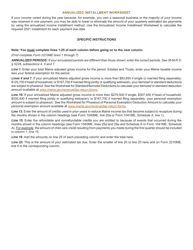

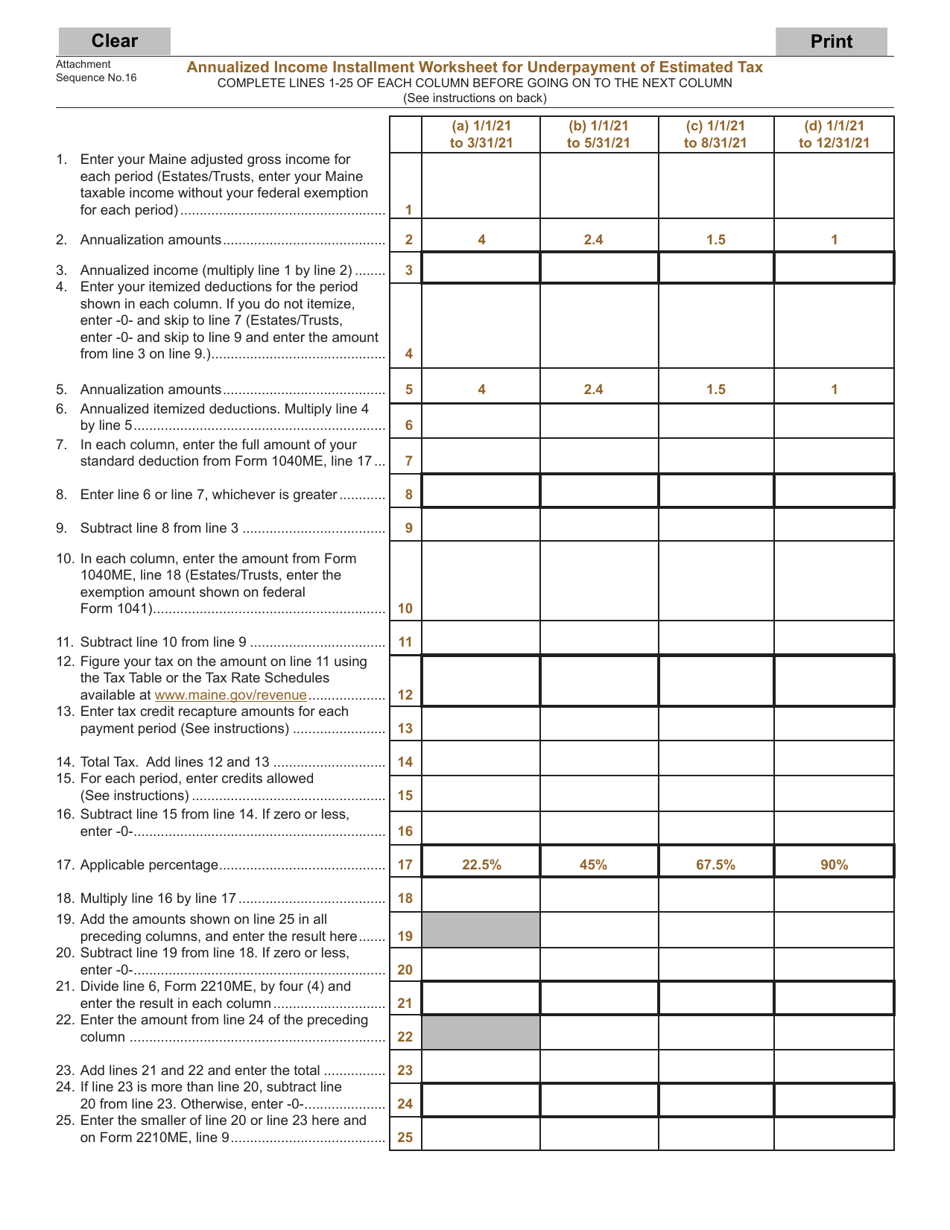

Form 2210 Annualized Income Installment Worksheet for Underpayment of Estimated Tax - Maine

What Is Form 2210МЕ?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2210?

A: Form 2210 is used to calculate and report the underpayment of estimated tax.

Q: Who files Form 2210?

A: Any individual or business that owes underpayment of estimated tax may need to file Form 2210.

Q: What is the purpose of Form 2210?

A: The purpose of Form 2210 is to calculate any penalties or interest owed on underpayment of estimated tax.

Q: Do I need to file Form 2210 if I live in Maine?

A: Yes, if you live in Maine and owe underpayment of estimated tax, you will need to file Form 2210.

Q: How do I complete Form 2210?

A: To complete Form 2210, you will need to fill out the required sections, such as the annualized income and penalties calculation.

Q: When is the deadline to file Form 2210?

A: The deadline to file Form 2210 is usually the same as the deadline for filing your annual tax return.

Q: What are the consequences of not filing Form 2210?

A: If you owe underpayment of estimated tax and fail to file Form 2210, you may be subject to penalties and interest charges.

Q: Can I e-file Form 2210?

A: Yes, you can e-file Form 2210 if you are filing your tax return electronically.

Q: Can I claim any exemptions or waivers on Form 2210?

A: Yes, there are certain exemptions and waivers available on Form 2210 that may reduce or eliminate the penalties for underpayment of estimated tax.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2210МЕ by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.