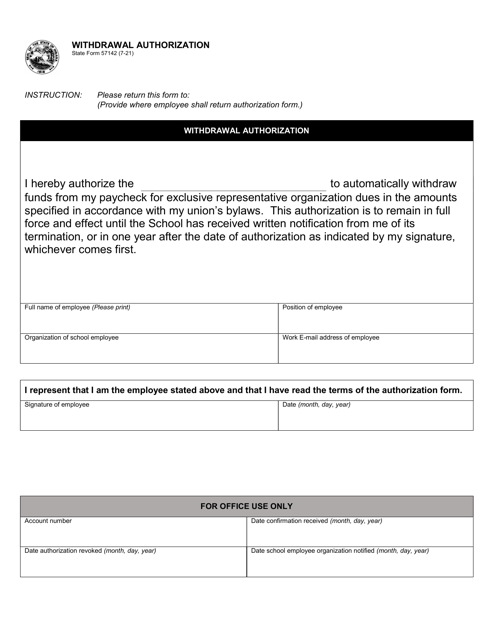

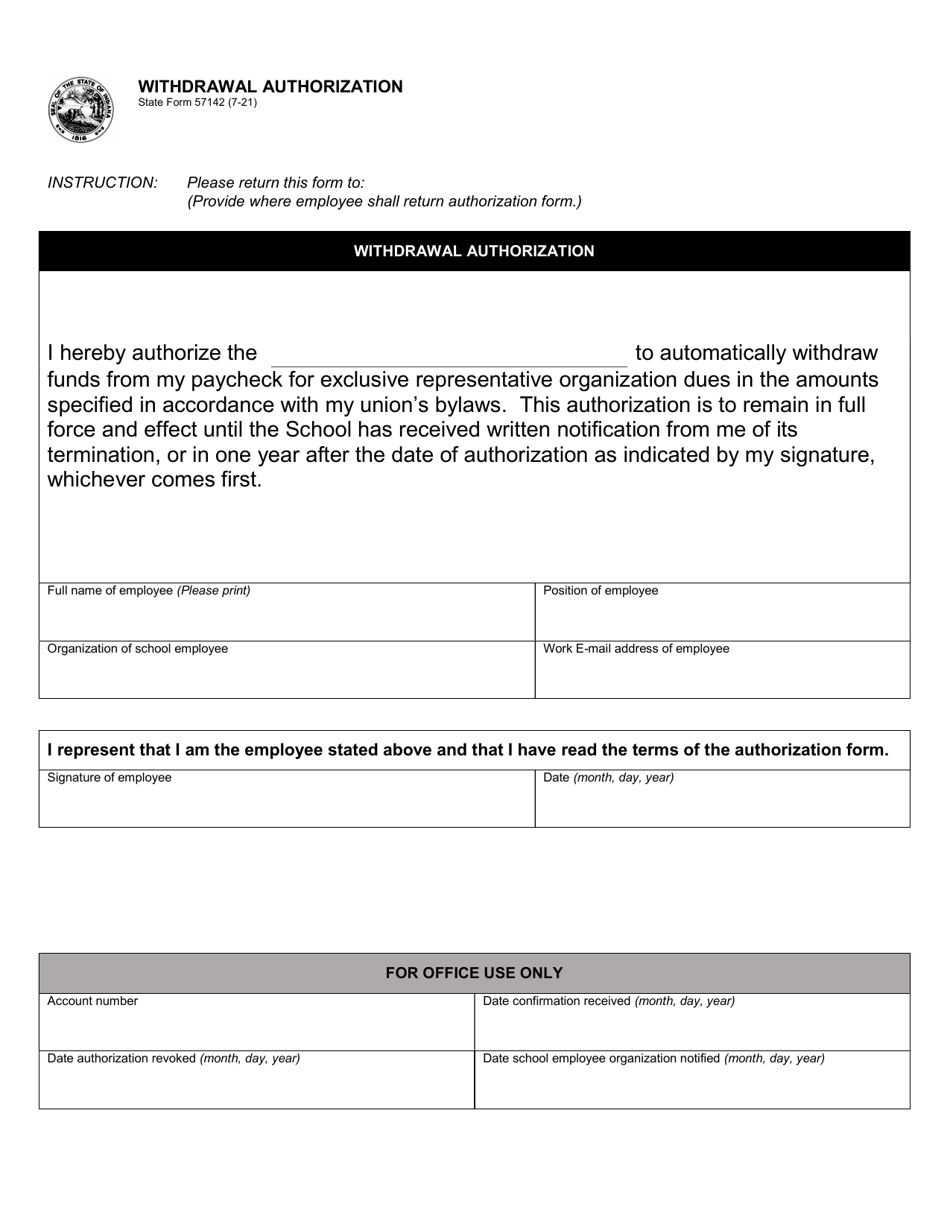

State Form 57142 Withdrawal Authorization - Indiana

What Is State Form 57142?

This is a legal form that was released by the Indiana Attorney General - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57142 Withdrawal Authorization?

A: Form 57142 Withdrawal Authorization is a state form used in Indiana.

Q: What is the purpose of Form 57142 Withdrawal Authorization?

A: The purpose of Form 57142 Withdrawal Authorization is to authorize the withdrawal of funds from a business entity.

Q: Who needs to fill out Form 57142 Withdrawal Authorization?

A: Anyone who wants to withdraw funds from a business entity in Indiana needs to fill out Form 57142 Withdrawal Authorization.

Q: Is there a fee for filing Form 57142 Withdrawal Authorization?

A: There is no fee for filing Form 57142 Withdrawal Authorization.

Q: What information is required on Form 57142 Withdrawal Authorization?

A: Form 57142 Withdrawal Authorization requires information such as the business entity name, address, federal employer identification number (FEIN), and the amount to be withdrawn.

Q: How should Form 57142 Withdrawal Authorization be submitted?

A: Form 57142 Withdrawal Authorization should be submitted by mail to the Indiana Department of Revenue.

Q: Are there any deadlines for filing Form 57142 Withdrawal Authorization?

A: There are no specific deadlines for filing Form 57142 Withdrawal Authorization, but it should be submitted in a timely manner.

Q: Can Form 57142 Withdrawal Authorization be used for multiple withdrawals?

A: Yes, Form 57142 Withdrawal Authorization can be used for multiple withdrawals as long as the total amount does not exceed the available funds.

Q: Is Form 57142 Withdrawal Authorization required for personal bank accounts?

A: No, Form 57142 Withdrawal Authorization is only required for business entities in Indiana.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Indiana Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 57142 by clicking the link below or browse more documents and templates provided by the Indiana Attorney General.