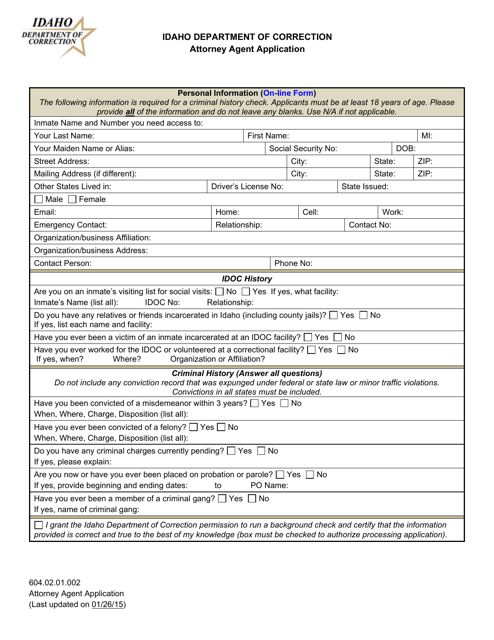

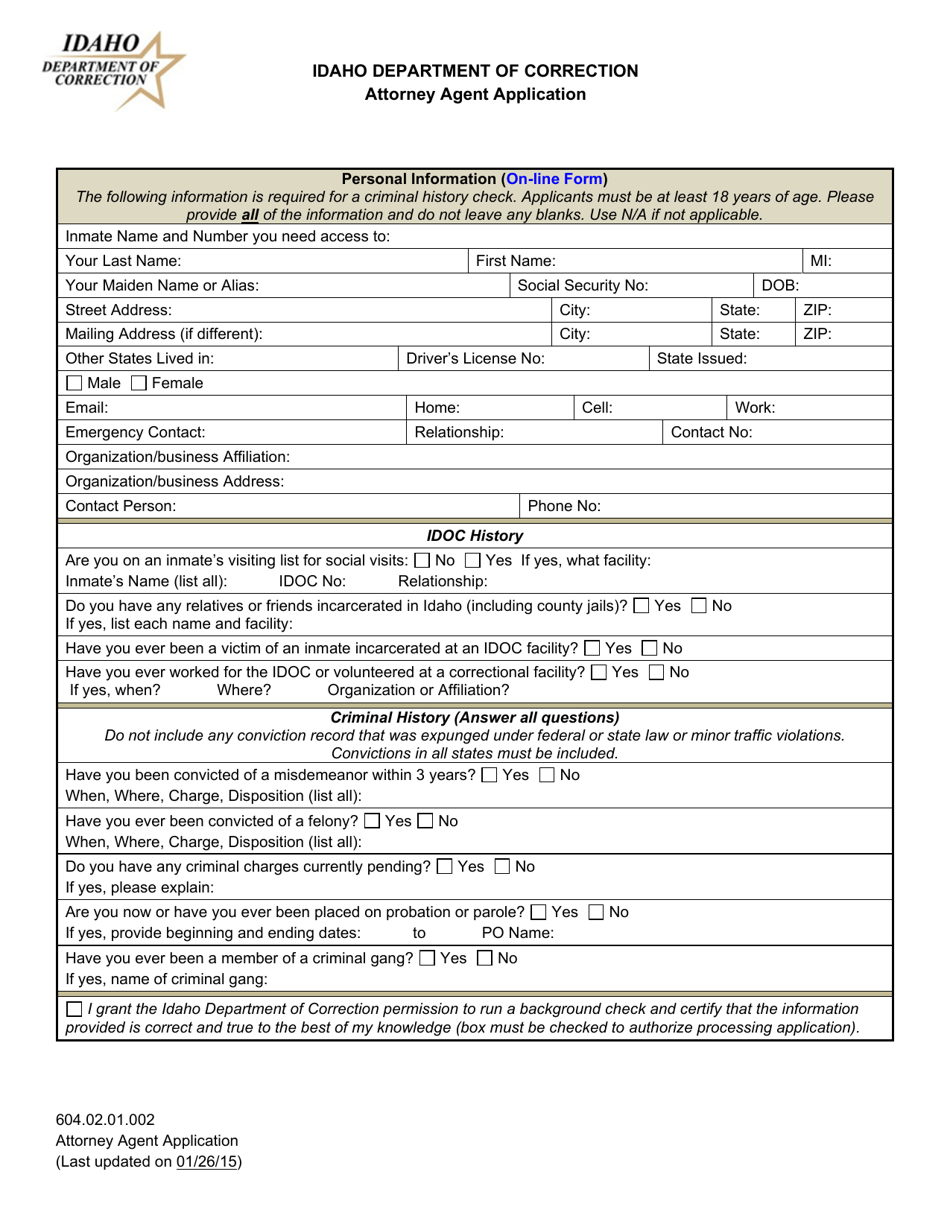

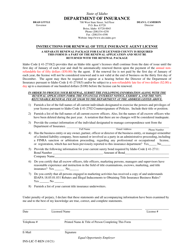

Attorney Agent Application - Idaho

Attorney Agent Application is a legal document that was released by the Idaho Department of Correction - a government authority operating within Idaho.

FAQ

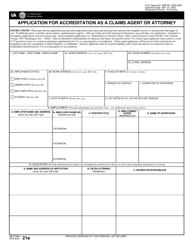

Q: What is an Attorney Agent Application?

A: An Attorney Agent Application is a legal document that allows an attorney to represent a client before the Internal Revenue Service (IRS) in Idaho.

Q: Who can file an Attorney Agent Application in Idaho?

A: Only licensed attorneys who are members of the Idaho State Bar can file an Attorney Agent Application in Idaho.

Q: What is the purpose of filing an Attorney Agent Application?

A: Filing an Attorney Agent Application allows an attorney to represent a client and act on their behalf in tax matters before the IRS in Idaho.

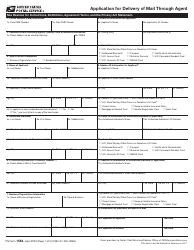

Q: How can I file an Attorney Agent Application in Idaho?

A: To file an Attorney Agent Application in Idaho, you need to complete Form 2848, Power of Attorney and Declaration of Representative, and submit it to the IRS.

Q: Is there a fee for filing an Attorney Agent Application in Idaho?

A: No, there is no fee for filing an Attorney Agent Application in Idaho.

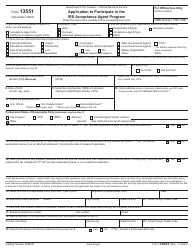

Q: What are the responsibilities of an attorney as an authorized agent?

A: As an authorized agent, an attorney has the responsibility to act in the best interest of their client and comply with IRS rules and regulations when representing them before the IRS in Idaho.

Q: Can an attorney revoke their authorization as an agent in Idaho?

A: Yes, an attorney can revoke their authorization as an agent by filing a written notice with the IRS.

Q: Can an attorney represent multiple clients in Idaho through a single Attorney Agent Application?

A: Yes, an attorney can represent multiple clients in Idaho through a single Attorney Agent Application by listing them all on Form 2848.

Form Details:

- Released on January 26, 2015;

- The latest edition currently provided by the Idaho Department of Correction;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Correction.