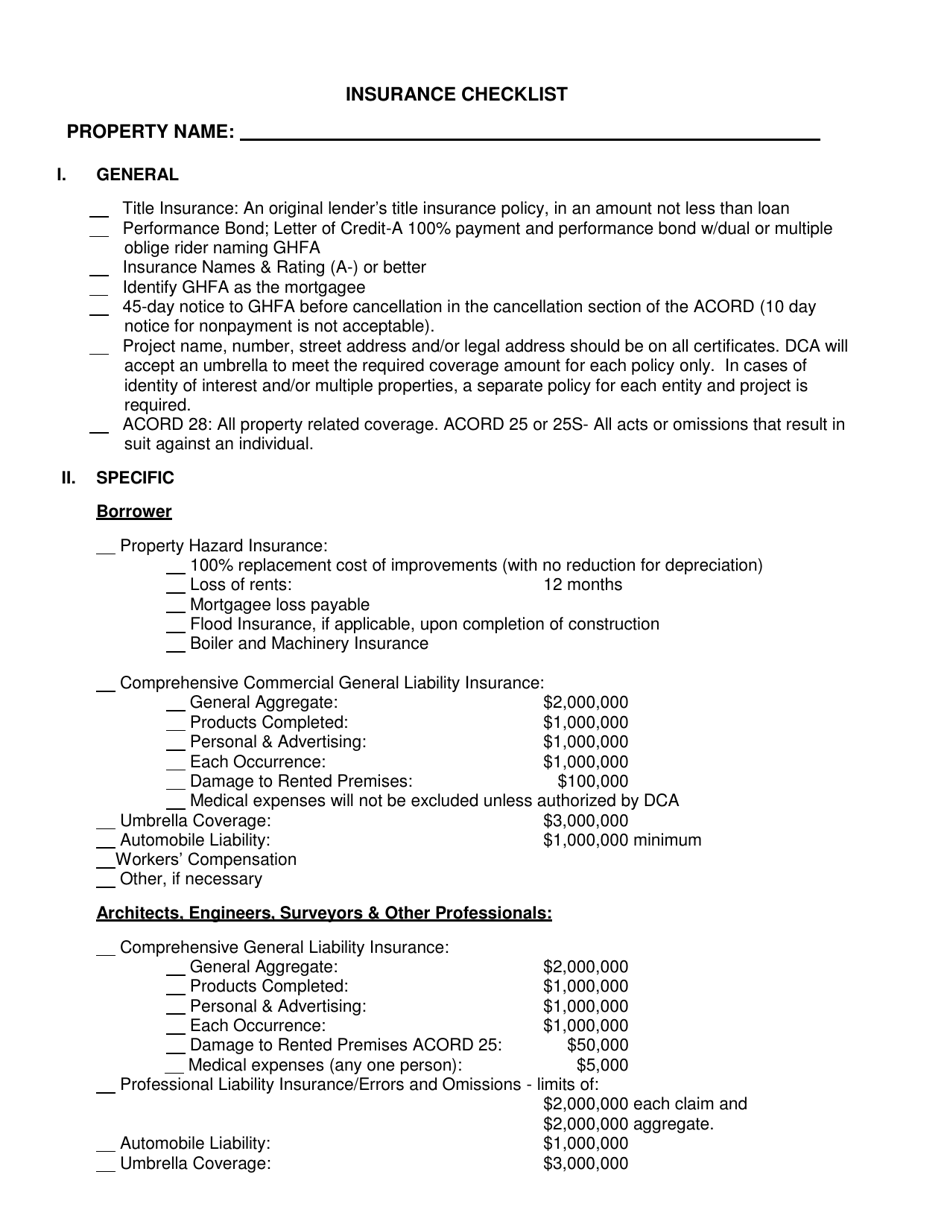

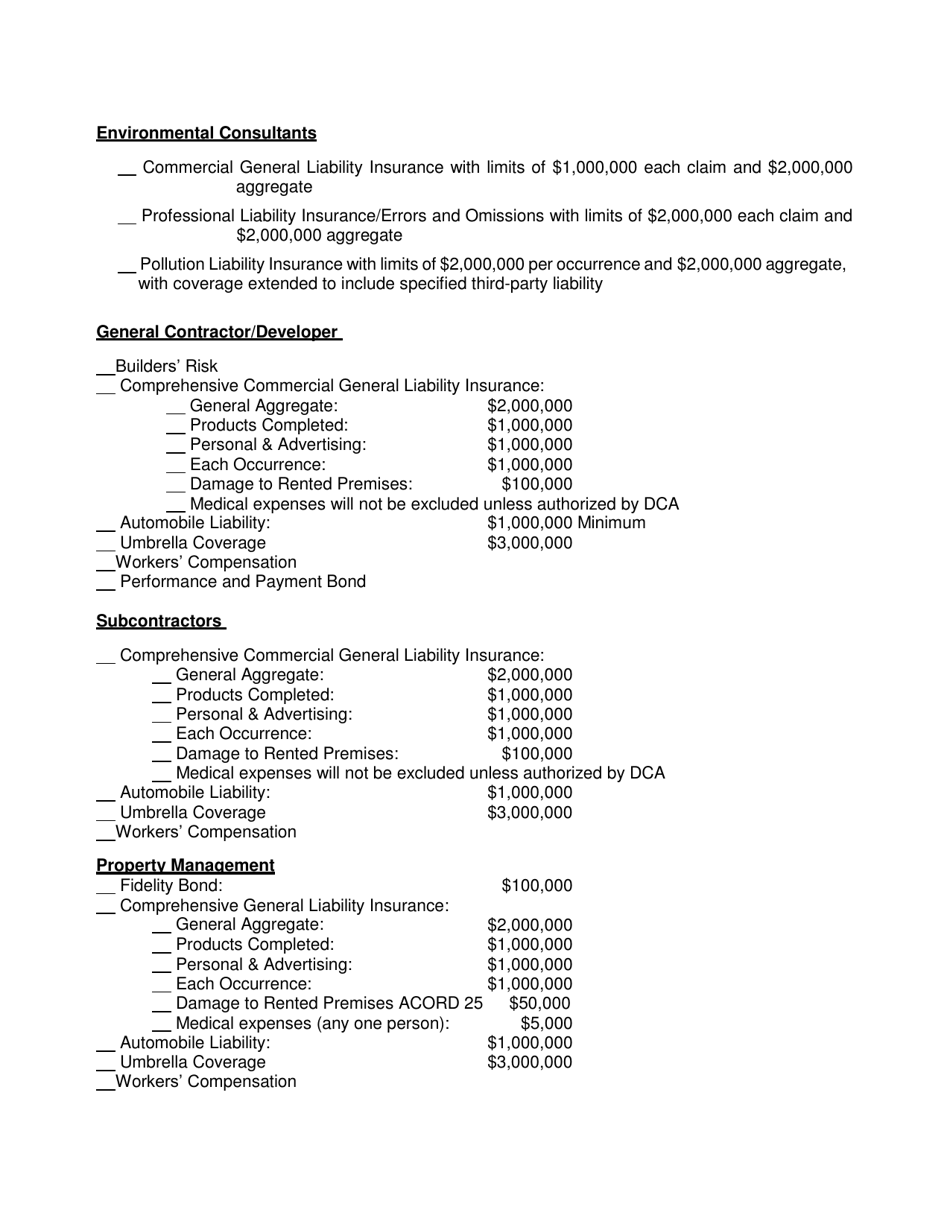

Insurance Checklist - Georgia (United States)

Insurance Checklist is a legal document that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States).

FAQ

Q: What types of insurance do I need in Georgia?

A: Auto insurance, home insurance, health insurance, and life insurance are commonly needed in Georgia.

Q: Is auto insurance mandatory in Georgia?

A: Yes, auto insurance is mandatory in Georgia.

Q: What is the minimum auto insurance coverage required in Georgia?

A: The minimum auto insurance coverage required in Georgia is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage.

Q: Do I need flood insurance in Georgia?

A: Flood insurance is not mandatory in Georgia, but it is recommended for certain areas prone to flooding.

Q: What factors can affect my home insurance premiums in Georgia?

A: Factors that can affect home insurance premiums in Georgia include the value of your home, its location, the construction materials used, and your claims history.

Q: Are there any specific health insurance requirements in Georgia?

A: There are no specific health insurance requirements in Georgia, but having health insurance is highly recommended to cover medical expenses.

Q: Is life insurance necessary in Georgia?

A: Life insurance is not mandatory in Georgia, but it can provide financial security for your loved ones in case of your death.

Q: Can I bundle my insurance policies in Georgia?

A: Yes, many insurance companies offer discounts if you bundle multiple policies such as auto, home, and life insurance.

Form Details:

- The latest edition currently provided by the Georgia Department of Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.