This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

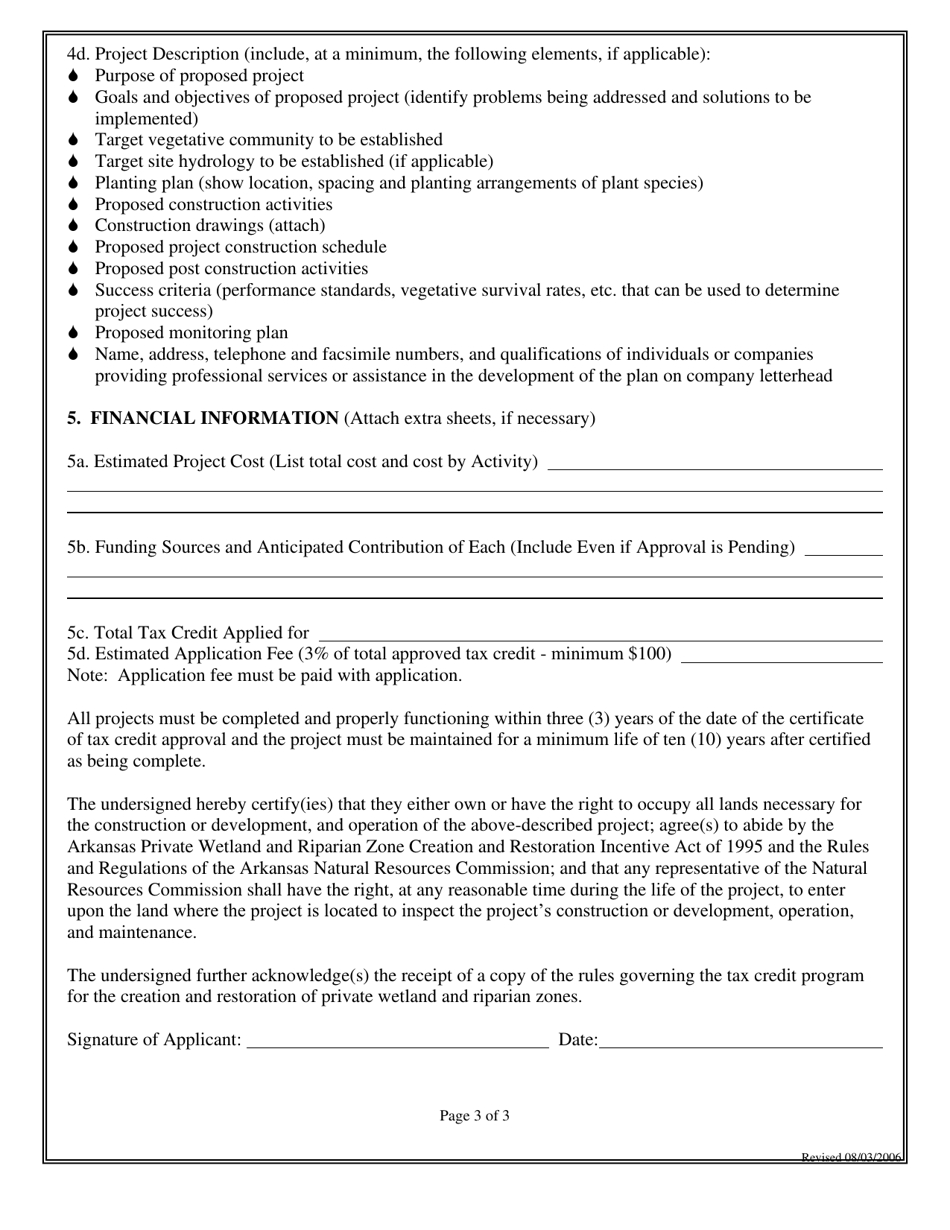

Creation and Restoration of Private Wetlands and Riparian Zones Tax Credit Application - Arkansas

Creation and Restoration of Private Wetlands and Tax Credit Application is a legal document that was released by the Arkansas Agriculture Department - a government authority operating within Arkansas.

FAQ

Q: What is the Creation and Restoration of Private Wetlands and Riparian Zones Tax Credit Application?

A: It is an application for a tax credit in Arkansas for the creation and restoration of private wetlands and riparian zones.

Q: Who is eligible to apply for this tax credit?

A: Private landowners in Arkansas who are creating or restoring wetlands and riparian zones on their properties.

Q: What is the purpose of this tax credit?

A: The tax credit aims to incentivize private landowners to contribute to the creation and restoration of wetlands and riparian zones, which can have positive environmental impacts.

Q: How much is the tax credit?

A: The tax credit is equal to 65% of the total costs incurred in creating or restoring wetlands and riparian zones, up to a maximum of $50,000 per project.

Q: What is considered as eligible costs for the tax credit?

A: Eligible costs include expenses related to engineering, design, construction, and purchasing materials for wetland and riparian zone creation or restoration.

Form Details:

- Released on August 3, 2006;

- The latest edition currently provided by the Arkansas Agriculture Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Agriculture Department.