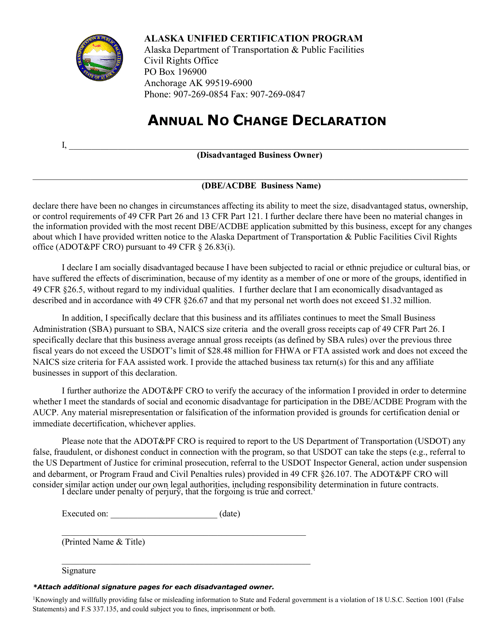

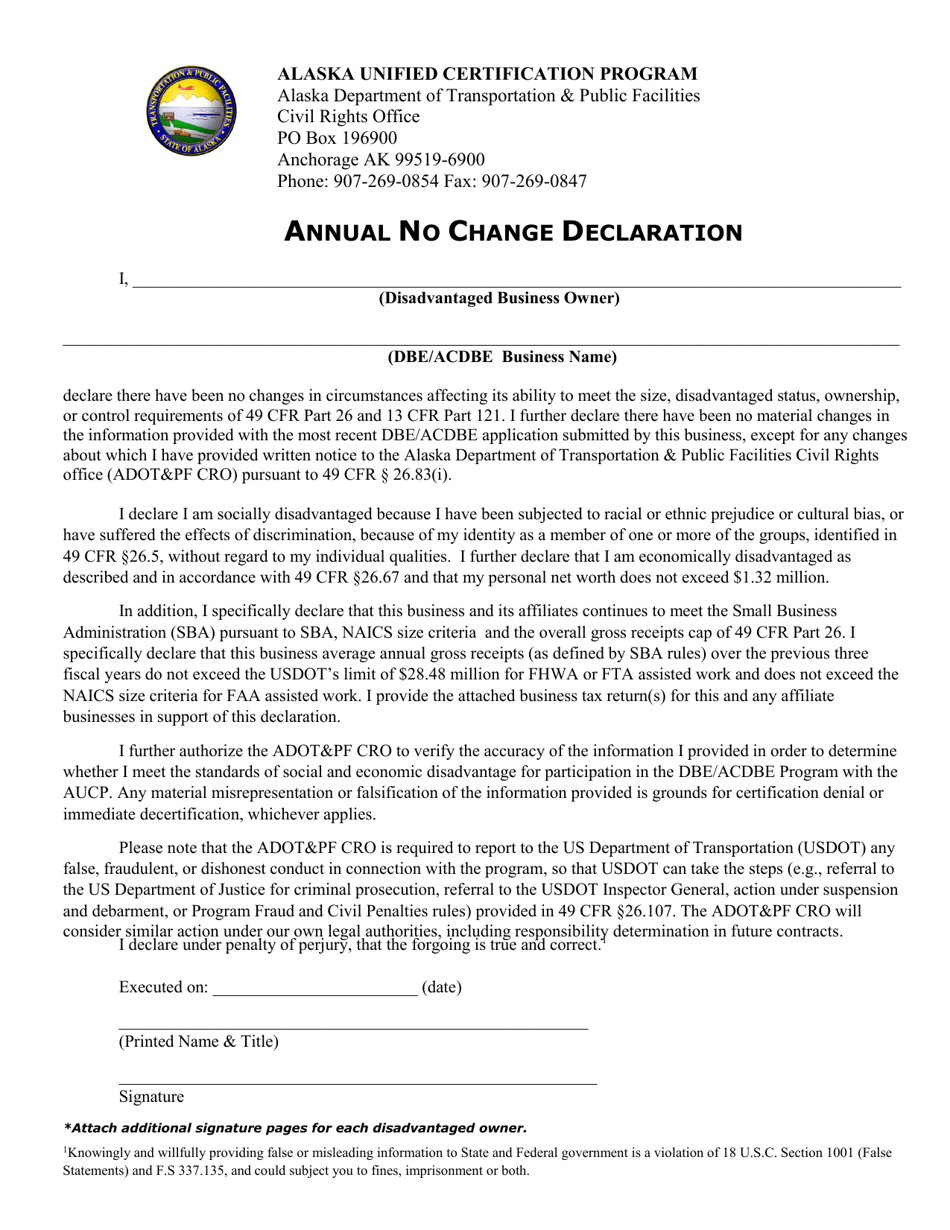

Annual No Change Declaration - Alaska

Annual No Change Declaration is a legal document that was released by the Alaska Department of Transportation and Public Facilities - a government authority operating within Alaska.

FAQ

Q: What is an Annual No Change Declaration?

A: An Annual No Change Declaration is a form that allows property owners in Alaska to declare that there have been no changes to their property's value or use during the past year.

Q: Who needs to submit an Annual No Change Declaration?

A: Property owners in Alaska who have not made any changes to their property's value or use in the past year need to submit an Annual No Change Declaration.

Q: What is the purpose of the Annual No Change Declaration?

A: The purpose of the Annual No Change Declaration is to inform the local government that there have been no changes to the property's value or use, which may affect property tax assessments.

Q: How do I submit an Annual No Change Declaration?

A: You can submit an Annual No Change Declaration form to your local tax assessor's office by mail, in person, or electronically, depending on the options available in your area.

Q: When is the deadline to submit an Annual No Change Declaration?

A: The deadline to submit an Annual No Change Declaration may vary depending on your municipality. Check with your local tax assessor's office for the specific deadline in your area.

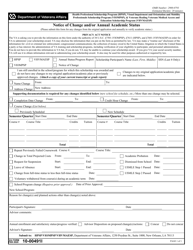

Form Details:

- The latest edition currently provided by the Alaska Department of Transportation and Public Facilities;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Transportation and Public Facilities.