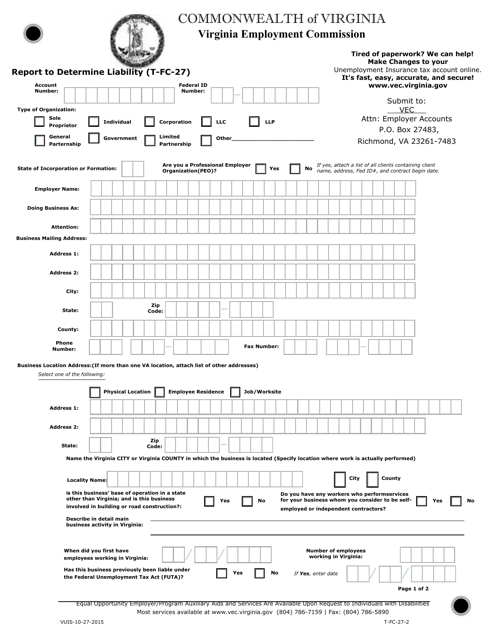

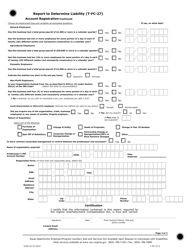

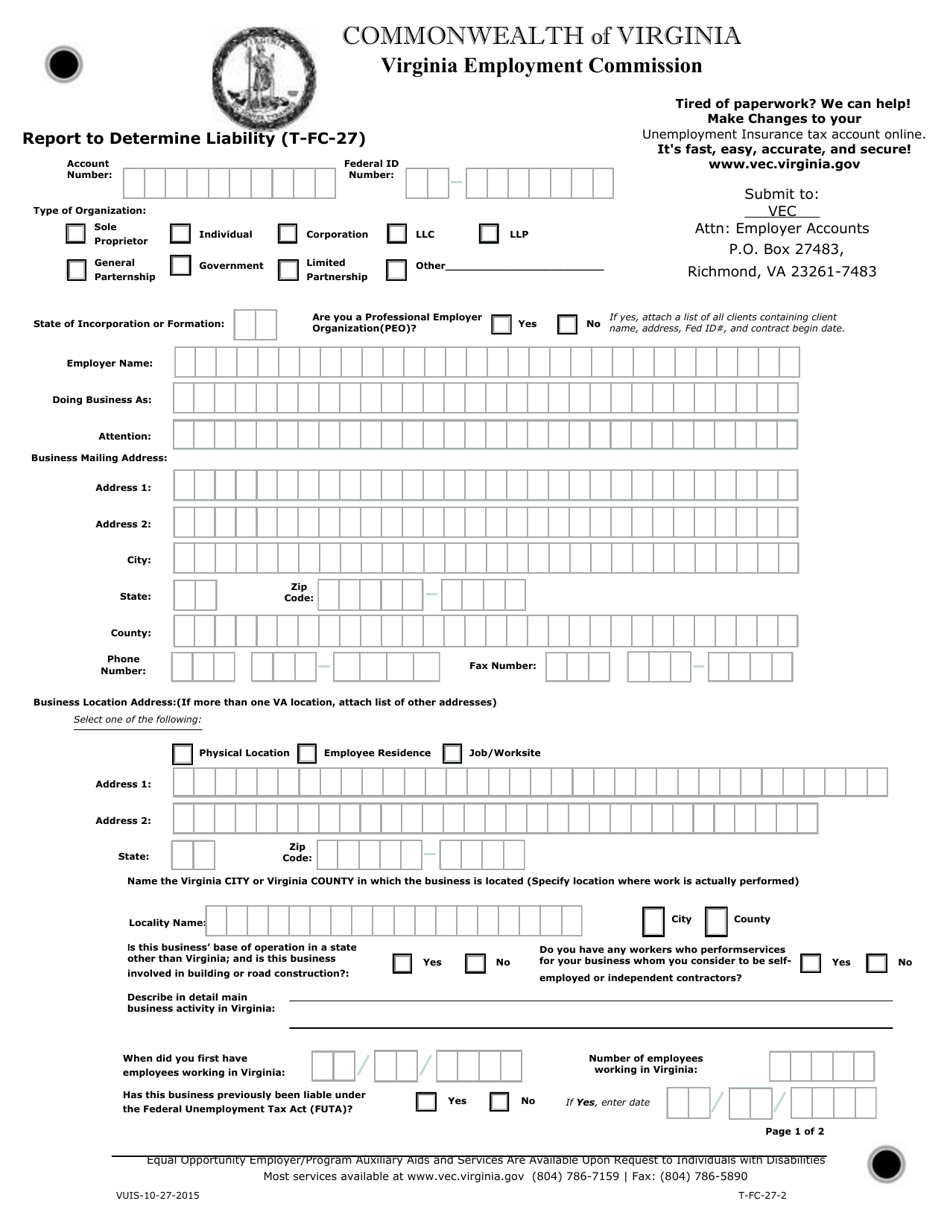

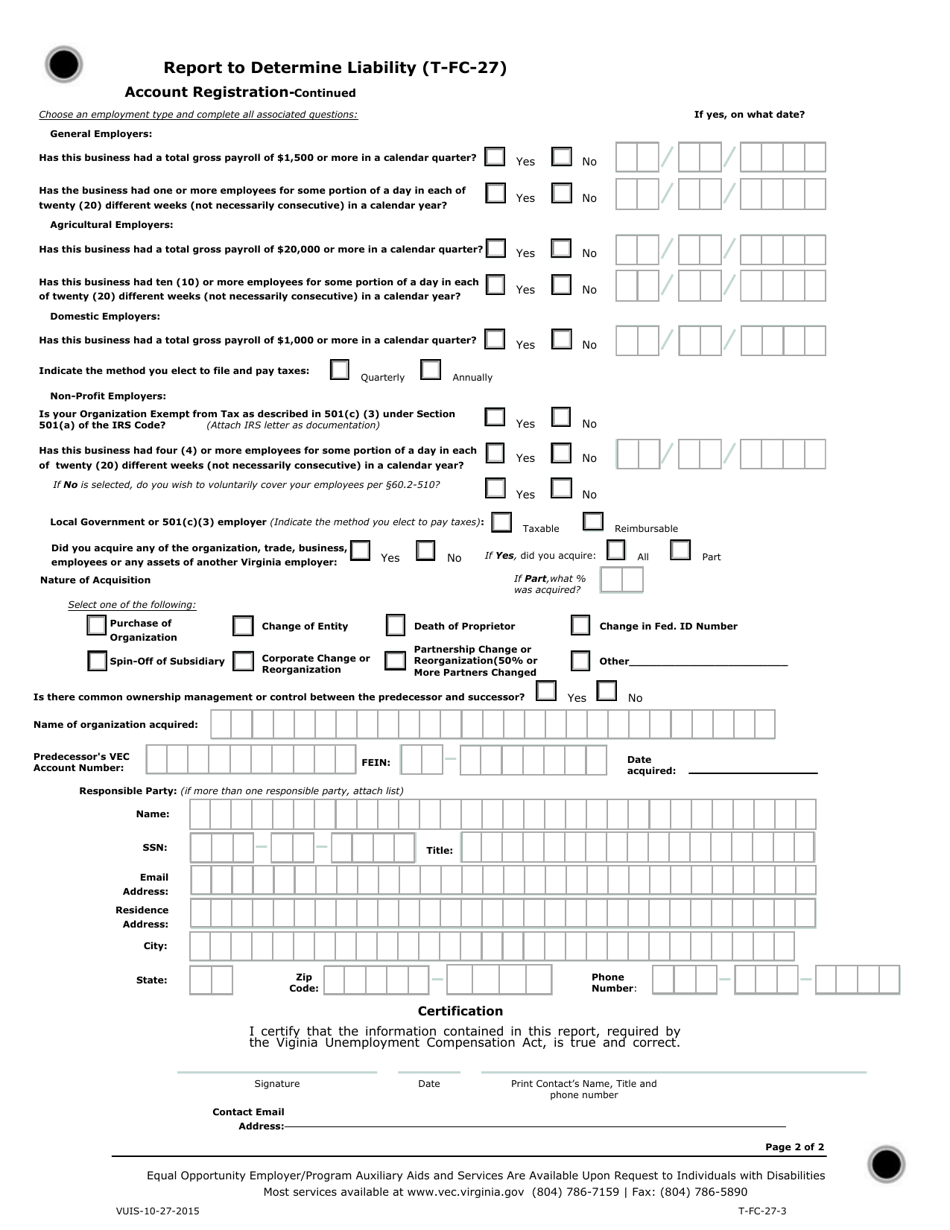

Form T-FC-27 Report to Determine Liability - Virginia

What Is Form T-FC-27?

This is a legal form that was released by the Virginia Employment Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-FC-27?

A: Form T-FC-27 is a report used to determine liability in the state of Virginia.

Q: What is the purpose of Form T-FC-27?

A: The purpose of Form T-FC-27 is to determine liability for certain taxes in Virginia.

Q: Who is required to file Form T-FC-27?

A: Individuals or businesses who are potentially liable for certain taxes in Virginia are required to file Form T-FC-27.

Q: What taxes are covered by Form T-FC-27?

A: Form T-FC-27 covers taxes such as sales tax, use tax, consumer's use tax, transient occupancy tax, and more.

Q: How often should Form T-FC-27 be filed?

A: Form T-FC-27 is typically filed on a monthly, quarterly, or annual basis, depending on the taxpayer's tax liability.

Q: What should I do if I have questions about Form T-FC-27?

A: If you have questions about Form T-FC-27, you should contact the Virginia Department of Taxation for assistance.

Form Details:

- Released on October 27, 2015;

- The latest edition provided by the Virginia Employment Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-FC-27 by clicking the link below or browse more documents and templates provided by the Virginia Employment Commission.