This version of the form is not currently in use and is provided for reference only. Download this version of

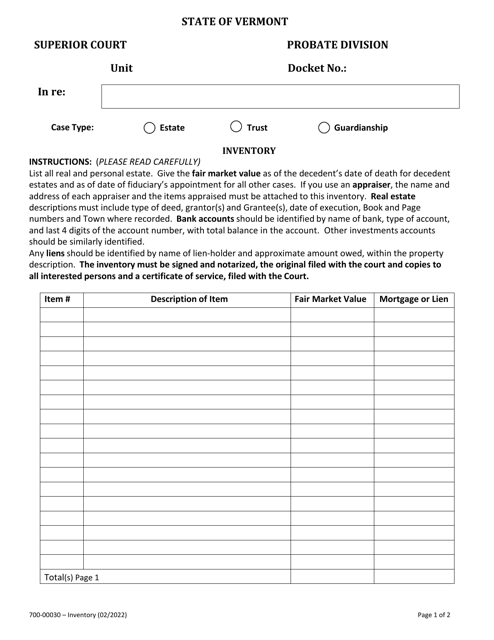

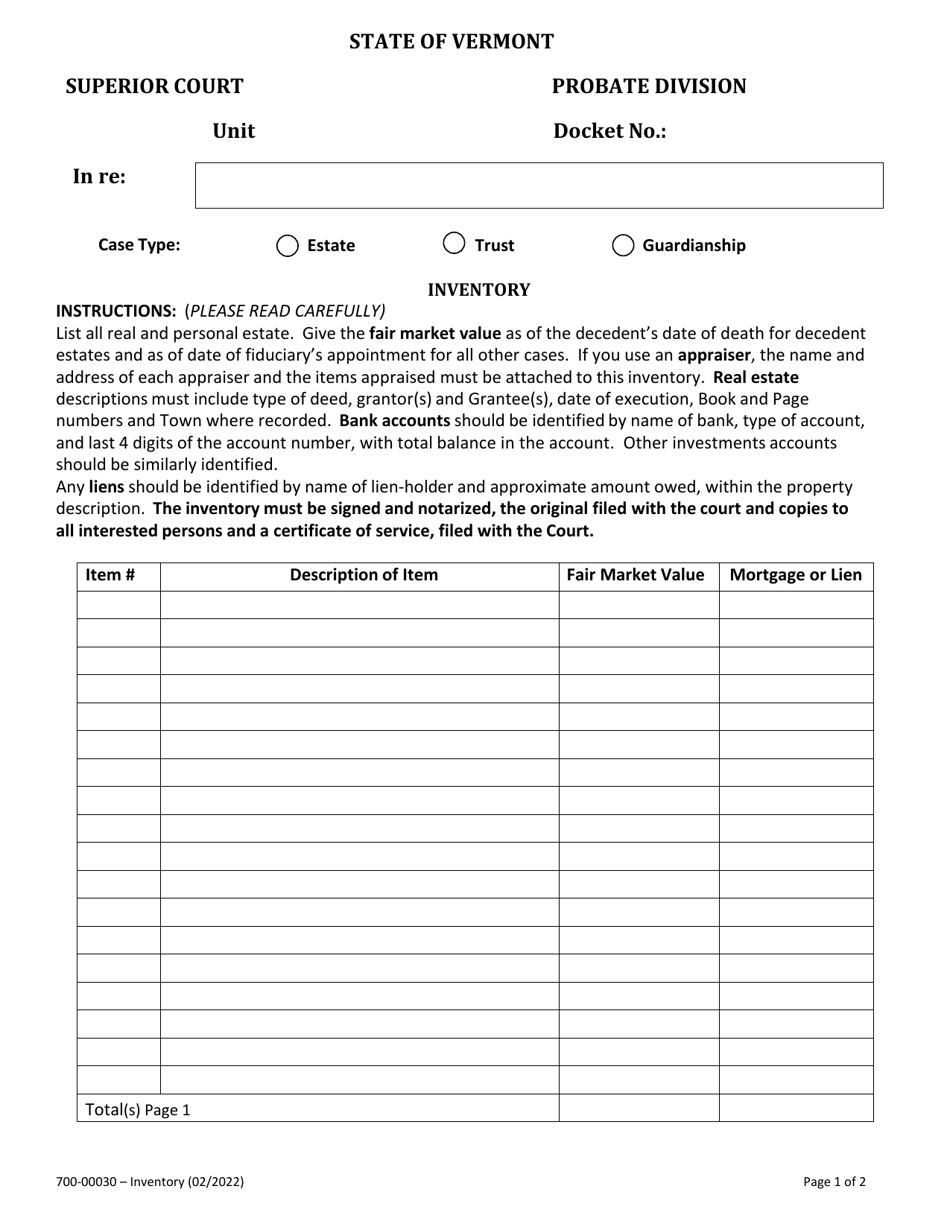

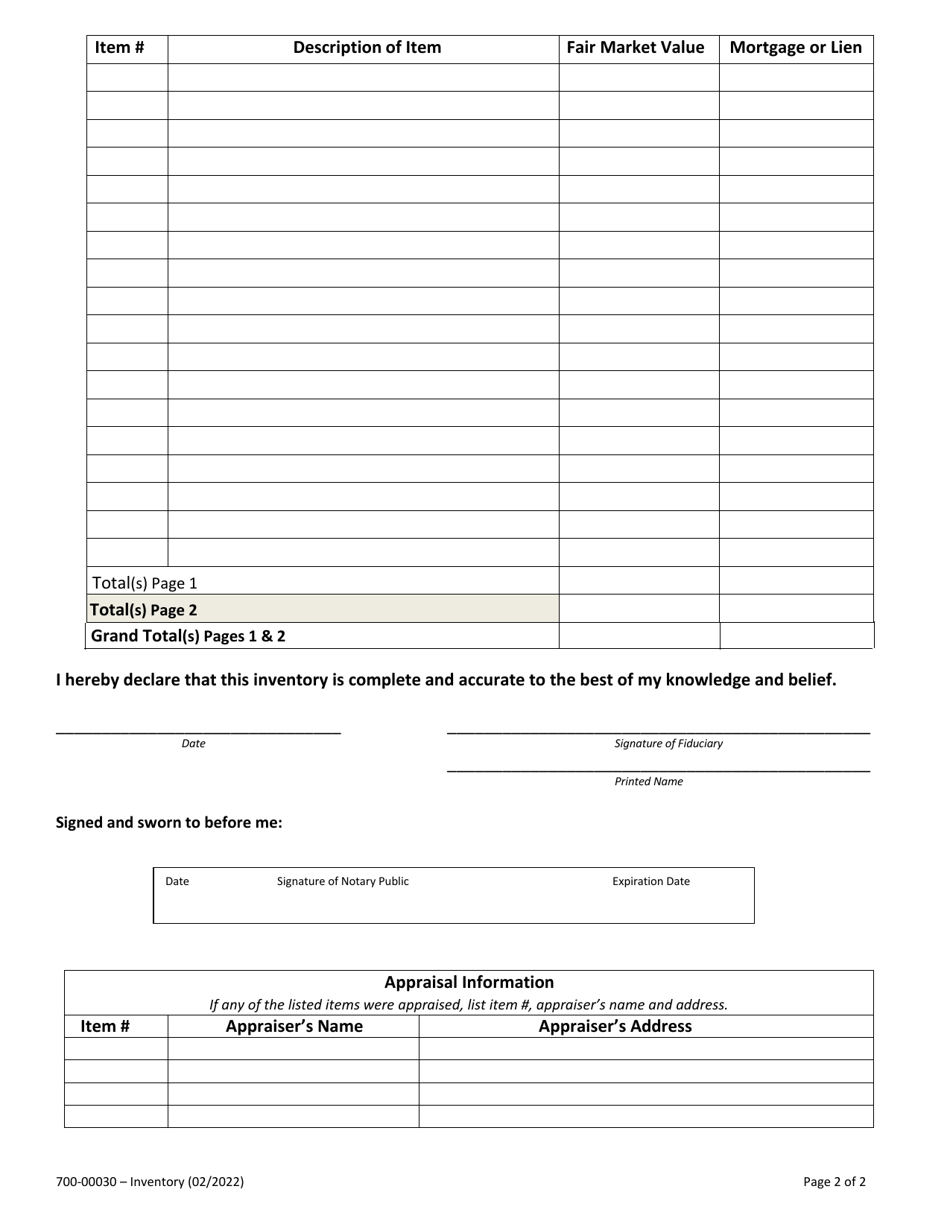

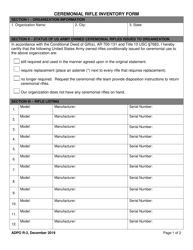

Form 700-00030

for the current year.

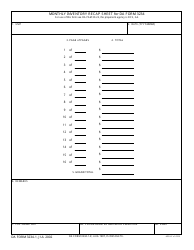

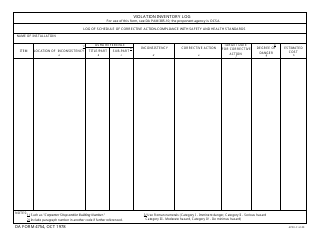

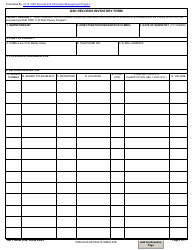

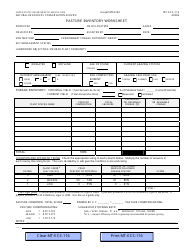

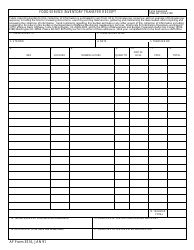

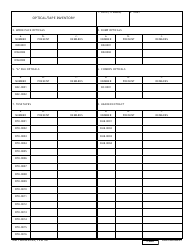

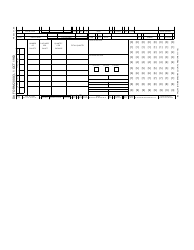

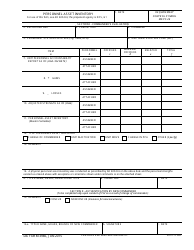

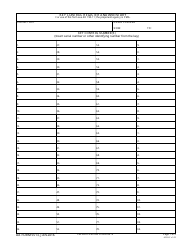

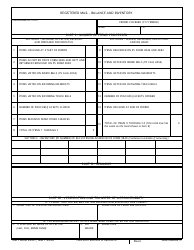

Form 700-00030 Inventory Schedule - Vermont

What Is Form 700-00030?

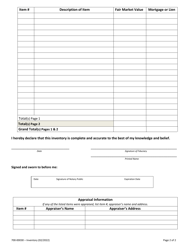

This is a legal form that was released by the Vermont Superior Court - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 700-00030?

A: Form 700-00030 is the Inventory Schedule used in Vermont.

Q: Who needs to file Form 700-00030?

A: Individuals or businesses in Vermont who are required to report their inventory must file Form 700-00030.

Q: When is Form 700-00030 due?

A: The due date for Form 700-00030 varies each year and is typically specified by the Vermont Department of Taxes.

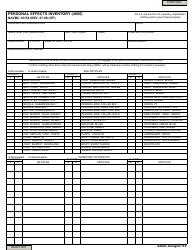

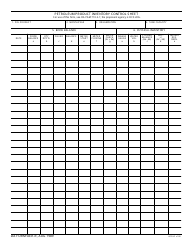

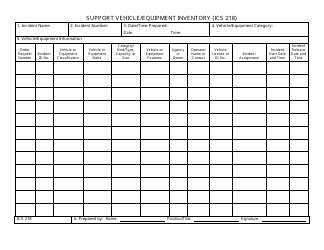

Q: What information is required on Form 700-00030?

A: Form 700-00030 requires information about the type and value of inventory held by the taxpayer.

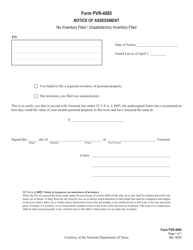

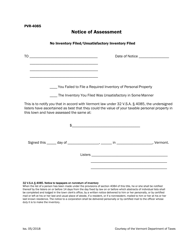

Q: Are there any penalties for not filing Form 700-00030?

A: Yes, failure to file Form 700-00030 or filing it late may result in penalties imposed by the Vermont Department of Taxes.

Q: Do I need to include supporting documentation with Form 700-00030?

A: It is advisable to keep supporting documentation for your inventory records, but you do not need to submit them with the form.

Q: What should I do if I have questions about Form 700-00030?

A: If you have specific questions about Form 700-00030, you should contact the Vermont Department of Taxes for assistance.

Q: Is Form 700-00030 specific to Vermont?

A: Yes, Form 700-00030 is specific to reporting inventory in Vermont and is not used for other states.

Q: Can I file Form 700-00030 if I don't have any inventory?

A: If you do not have any inventory to report, you may not need to file Form 700-00030, but it is advisable to confirm with the Vermont Department of Taxes.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Vermont Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 700-00030 by clicking the link below or browse more documents and templates provided by the Vermont Superior Court.