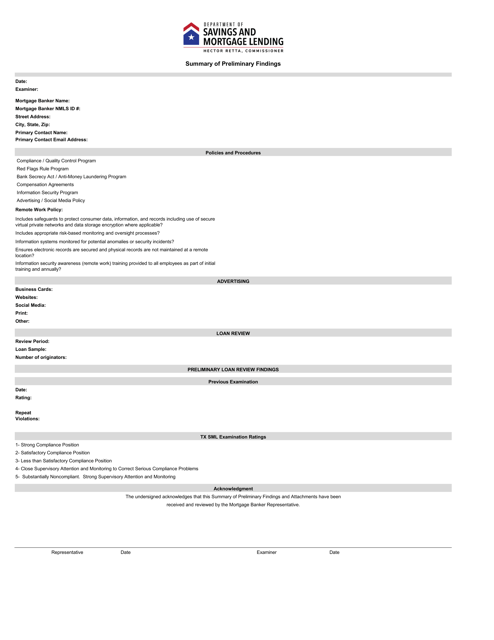

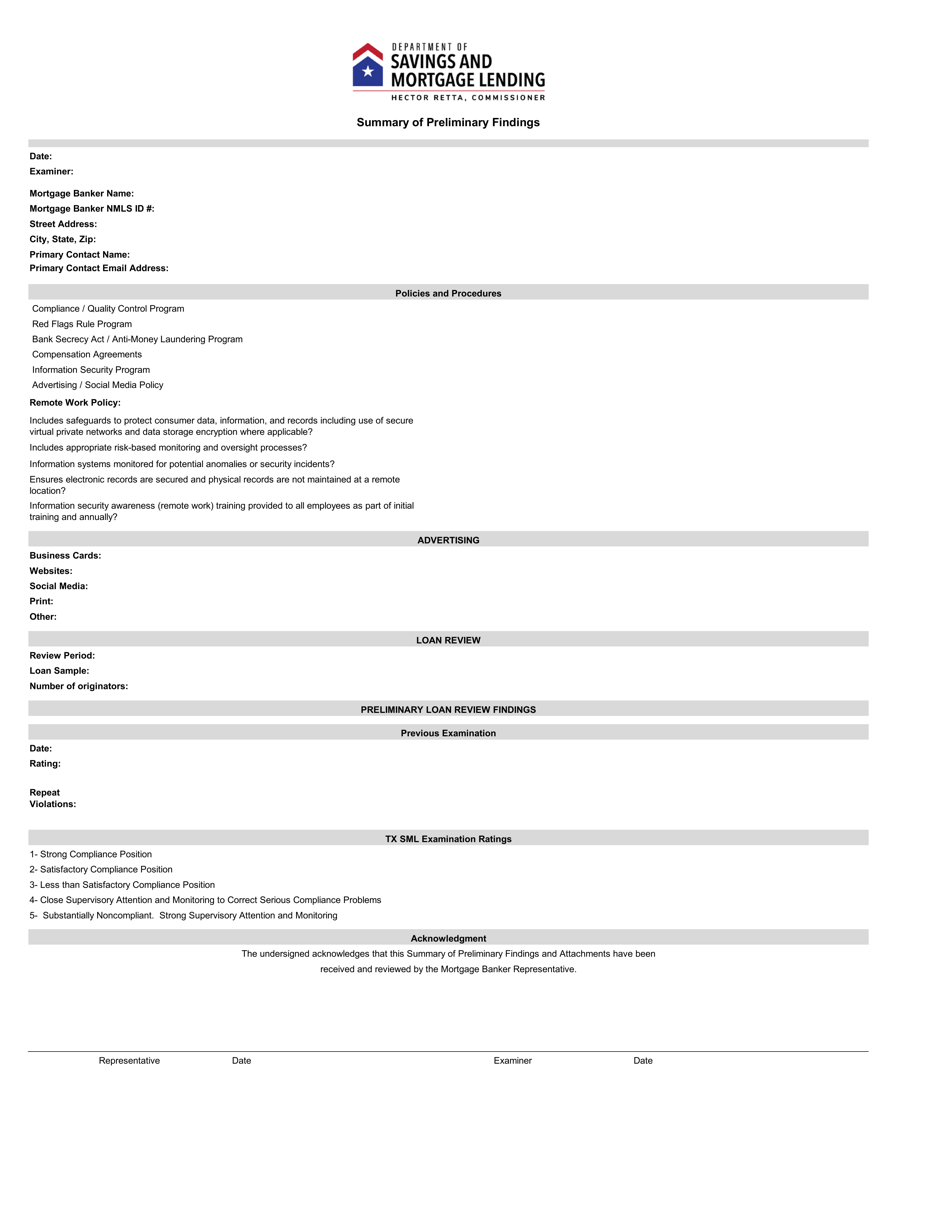

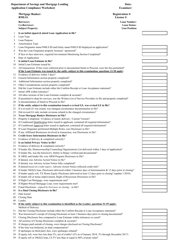

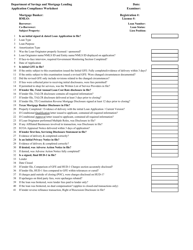

Summary of Preliminary Findings - Mortgage Banker - Texas

Summary of Preliminary Findings - Mortgage Banker is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What is the role of a Mortgage Banker?

A: A Mortgage Banker helps clients secure mortgage loans for purchasing or refinancing a property.

Q: What are the preliminary findings?

A: The preliminary findings refer to the initial results or conclusions of a study or investigation conducted by the Mortgage Banker.

Q: What is the focus of the Mortgage Banker's findings?

A: The focus of the Mortgage Banker's findings is related to mortgage lending in Texas.

Q: Are the findings final?

A: No, the preliminary findings are not final and may be subject to further analysis or revision.

Q: Who benefits from the services of a Mortgage Banker?

A: Homebuyers and homeowners who need mortgage financing benefit from the services of a Mortgage Banker.

Q: Is a Mortgage Banker different from a Mortgage Broker?

A: Yes, a Mortgage Banker works directly for a bank or lending institution, while a Mortgage Broker acts as an intermediary between borrowers and lenders.

Q: What is the significance of the Mortgage Banker being in Texas?

A: The Mortgage Banker being in Texas indicates a focus on the local mortgage market and regulations specific to the state.

Q: What type of properties can a Mortgage Banker help with?

A: A Mortgage Banker can help with residential and commercial properties.

Q: What services does a Mortgage Banker offer?

A: A Mortgage Banker offers mortgage loan origination, underwriting, and assistance with the loan application process.

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.