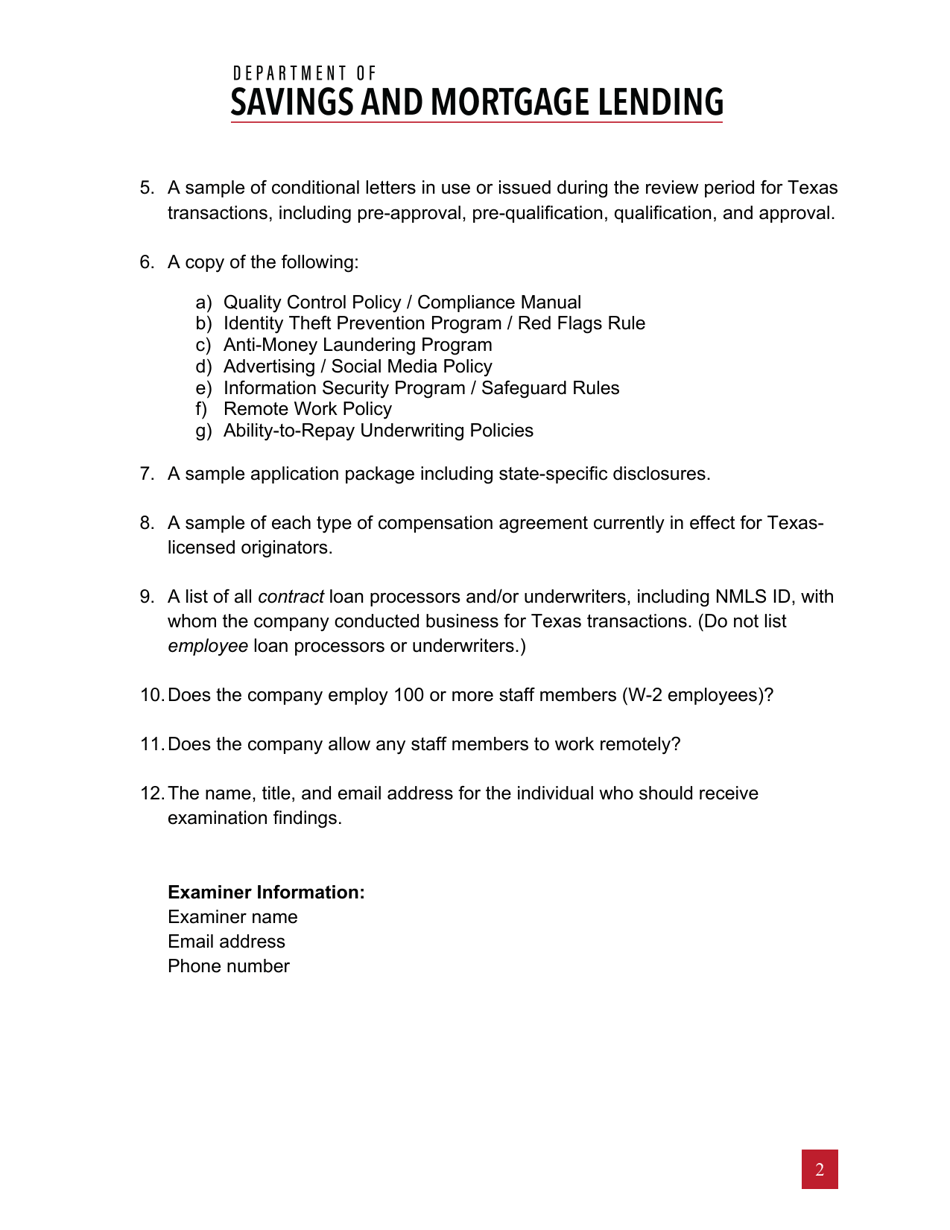

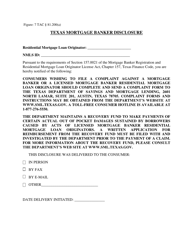

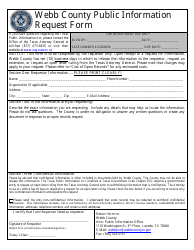

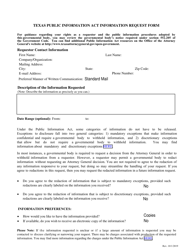

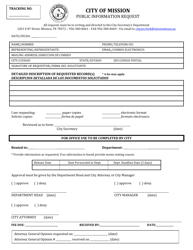

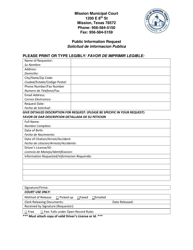

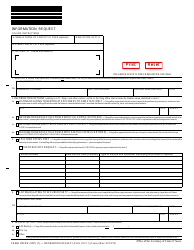

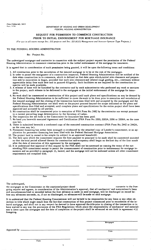

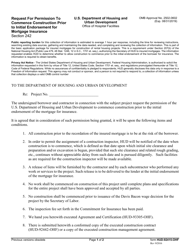

Mortgage Banker Initial Information Request - Texas

Mortgage Banker Initial Information Request is a legal document that was released by the Texas Department of Savings and Mortgage Lending - a government authority operating within Texas.

FAQ

Q: What documents do I need to provide to a mortgage banker in Texas?

A: You will typically need to provide documents such as pay stubs, tax returns, bank statements, and identification.

Q: What is the role of a mortgage banker?

A: A mortgage banker helps facilitate the mortgage process by working with borrowers to secure a home loan.

Q: What factors do mortgage bankers consider when evaluating a loan application?

A: Mortgage bankers consider factors such as credit score, income, employment history, debts, and the property's value.

Q: How long does it take to get pre-approved by a mortgage banker in Texas?

A: The timeframe can vary, but it typically takes a few days to a couple of weeks to get pre-approved for a mortgage.

Q: What is the difference between a mortgage banker and a mortgage broker?

A: A mortgage banker works for a specific financial institution and provides loans directly, while a mortgage broker acts as an intermediary, connecting borrowers with multiple lenders.

Q: Are there any specific requirements for obtaining a mortgage in Texas?

A: Each lender may have different requirements, but common factors include credit score, income, employment history, and property appraisal.

Q: Can I use a mortgage banker for both purchasing a home and refinancing in Texas?

A: Yes, you can use a mortgage banker for both purchasing a home and refinancing an existing mortgage in Texas.

Q: What are the benefits of working with a mortgage banker in Texas?

A: Working with a mortgage banker in Texas can provide personalized service, access to a variety of loan options, and expertise in the local market.

Q: How do mortgage bankers determine the interest rate for a loan in Texas?

A: Interest rates can be influenced by factors such as the borrower's credit score, loan term, economic conditions, and the type of loan being obtained.

Form Details:

- The latest edition currently provided by the Texas Department of Savings and Mortgage Lending;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Savings and Mortgage Lending.