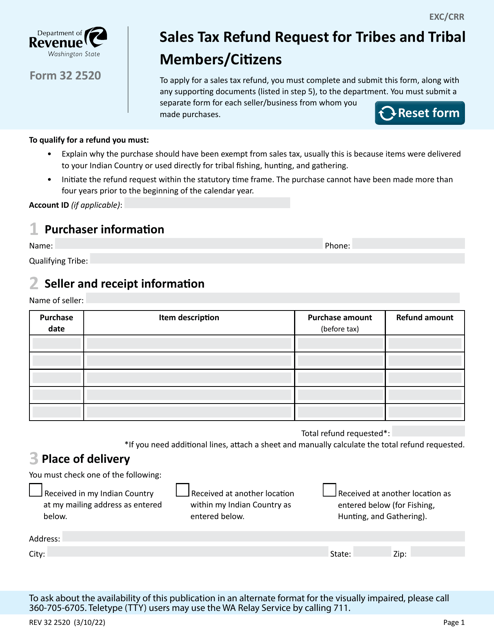

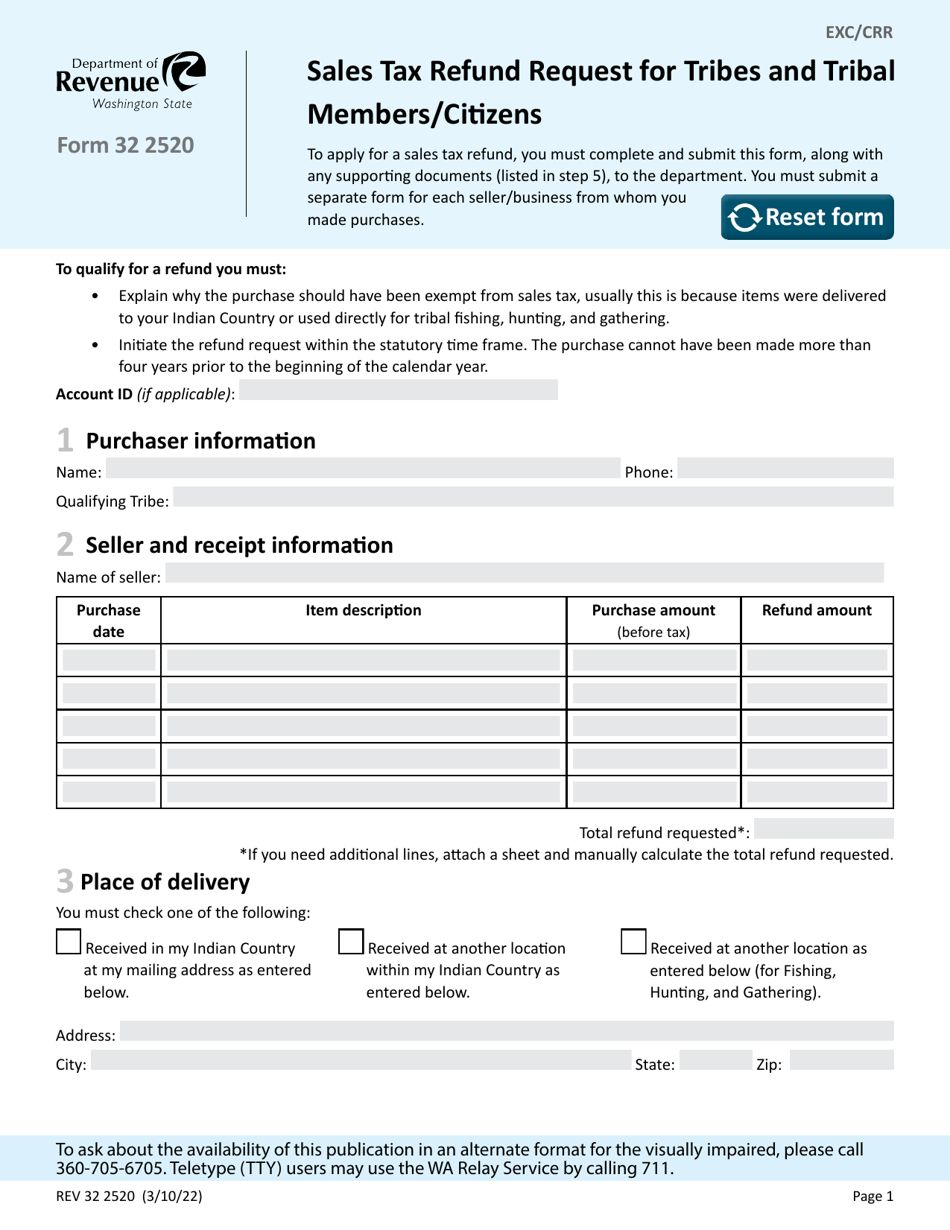

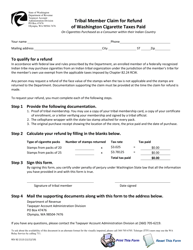

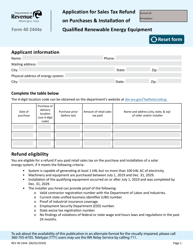

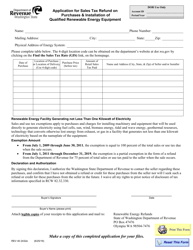

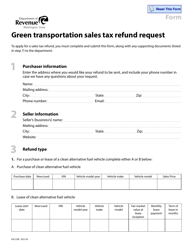

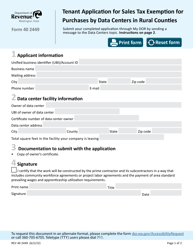

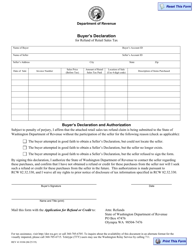

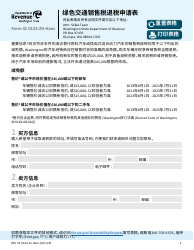

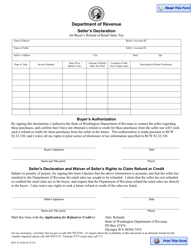

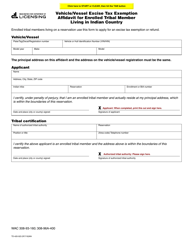

Form REV32 2520 Sales Tax Refund Request for Tribes and Tribal Members / Citizens - Washington

What Is Form REV32 2520?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV32 2520?

A: Form REV32 2520 is a Sales Tax Refund Request form specifically for Tribes and Tribal Members/Citizens in Washington.

Q: Who can use form REV32 2520?

A: Form REV32 2520 is specifically for Tribes and Tribal Members/Citizens in Washington.

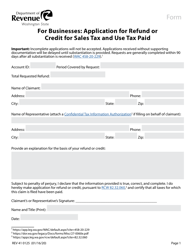

Q: What is the purpose of form REV32 2520?

A: The purpose of form REV32 2520 is to request a sales tax refund for Tribes and Tribal Members/Citizens in Washington.

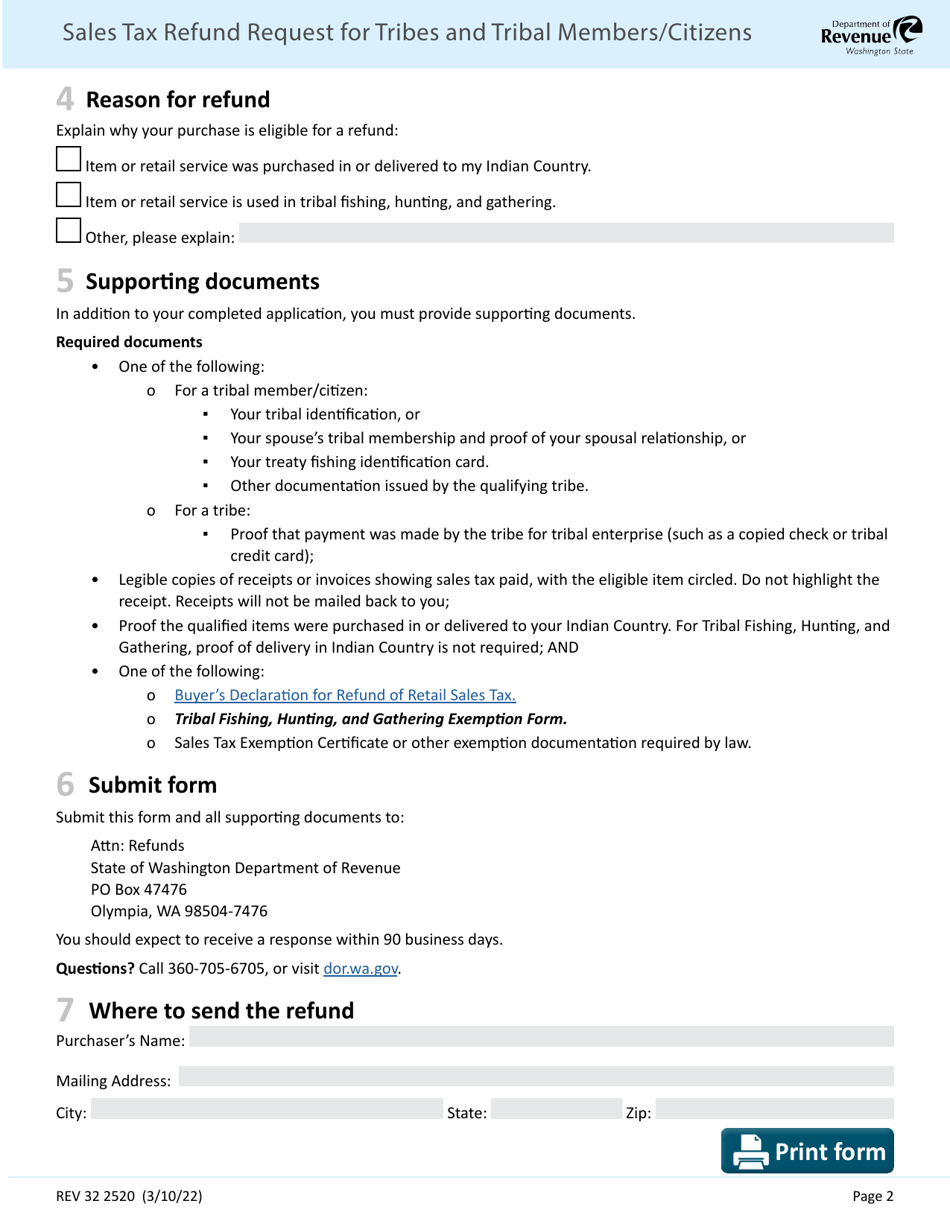

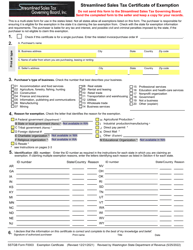

Q: How do I fill out form REV32 2520?

A: To fill out form REV32 2520, you will need to provide your basic identifying information and the details of the sales tax refund you are requesting.

Q: Are there any eligibility requirements for using form REV32 2520?

A: Yes, form REV32 2520 is specifically for Tribes and Tribal Members/Citizens in Washington.

Q: Is there a deadline for submitting form REV32 2520?

A: Yes, the deadline for submitting form REV32 2520 is typically within three years from the date of purchase.

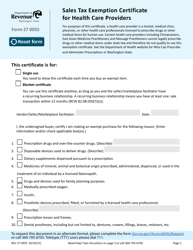

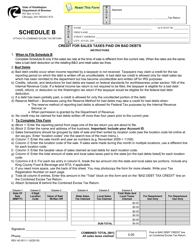

Q: What types of sales tax refunds can be requested using form REV32 2520?

A: Form REV32 2520 can be used to request sales tax refunds for qualifying purchases made by Tribes and Tribal Members/Citizens in Washington.

Q: Is there any documentation required to support a sales tax refund request using form REV32 2520?

A: Yes, you will need to provide supporting documentation such as receipts or invoices to verify your purchases and the sales tax paid.

Form Details:

- Released on March 10, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV32 2520 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.