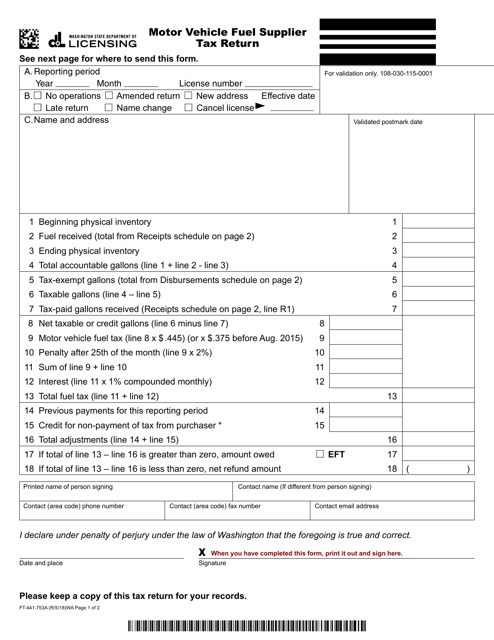

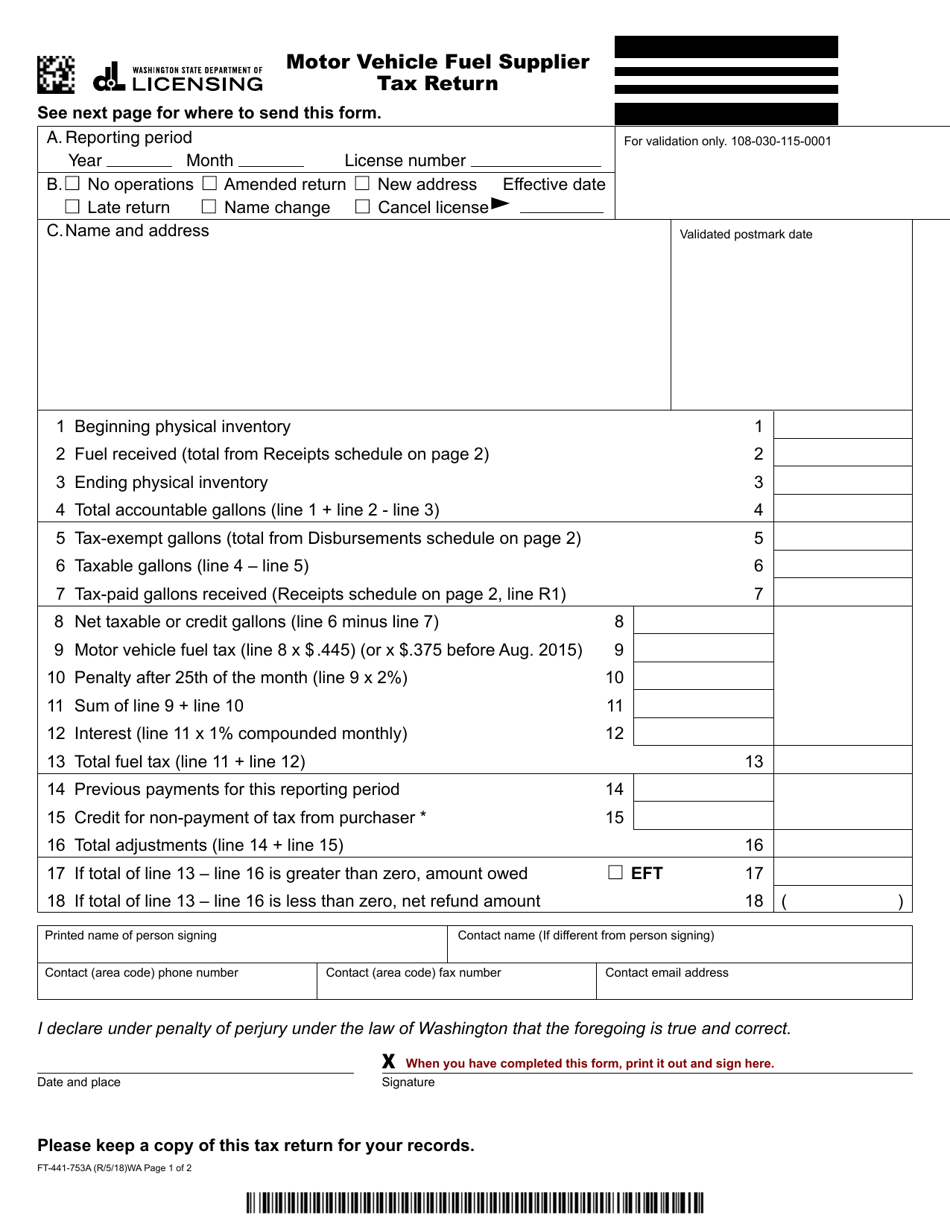

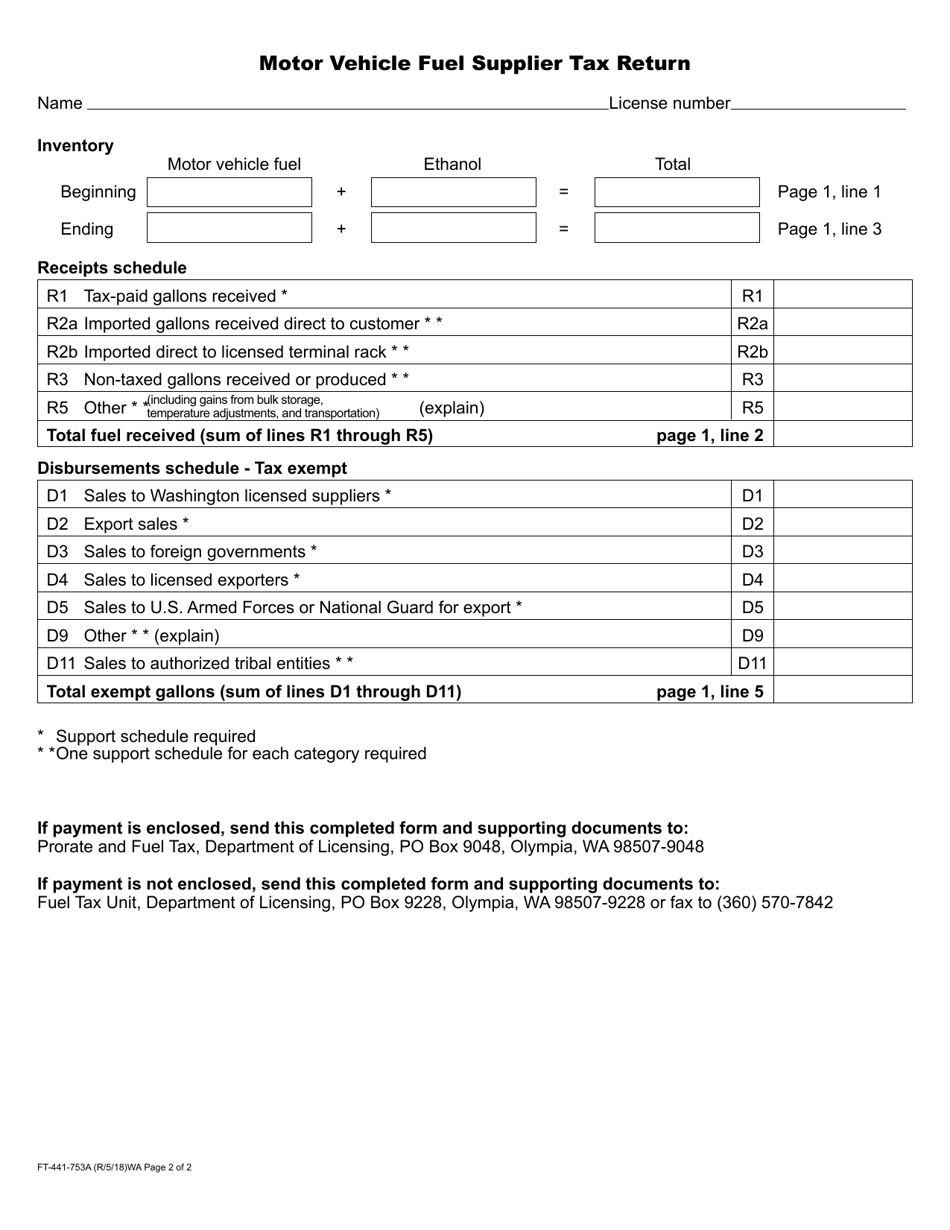

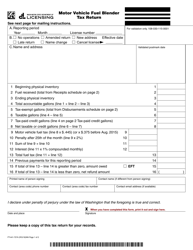

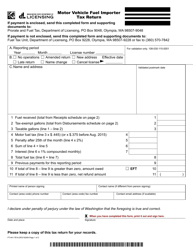

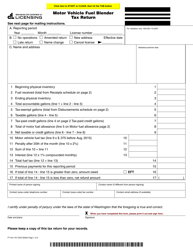

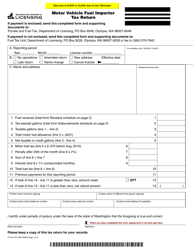

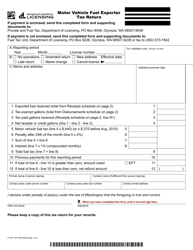

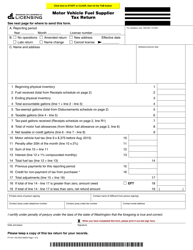

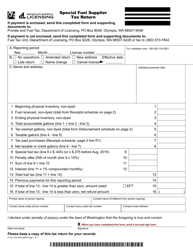

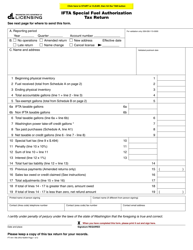

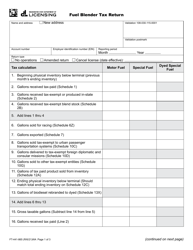

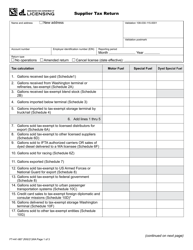

Form FT-441-753A Motor Vehicle Fuel Supplier Tax Return - Washington

What Is Form FT-441-753A?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-753A?

A: Form FT-441-753A is the Motor Vehicle Fuel Supplier Tax Return specific to the state of Washington.

Q: Who needs to file Form FT-441-753A?

A: Motor vehiclefuel suppliers in Washington need to file Form FT-441-753A.

Q: What is the purpose of Form FT-441-753A?

A: Form FT-441-753A is used to report and pay the motor vehicle fuel tax to the state of Washington.

Q: When is the due date for filing Form FT-441-753A?

A: The due date for filing Form FT-441-753A is the last day of the month following the reporting period.

Q: Is there any penalty for late filing of Form FT-441-753A?

A: Yes, there may be penalties for late filing or failure to file Form FT-441-753A in Washington.

Q: Are there any exemptions or deductions available on Form FT-441-753A?

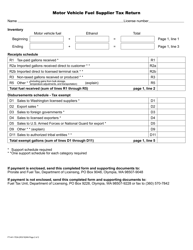

A: Yes, there may be exemptions or deductions available on Form FT-441-753A based on specific criteria.

Q: What supporting documents are required to be attached with Form FT-441-753A?

A: Specific supporting documents may be required to be attached with Form FT-441-753A based on individual circumstances.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-753A by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.