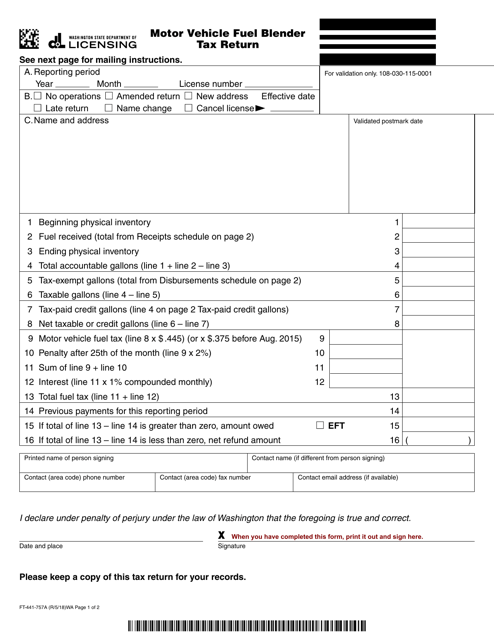

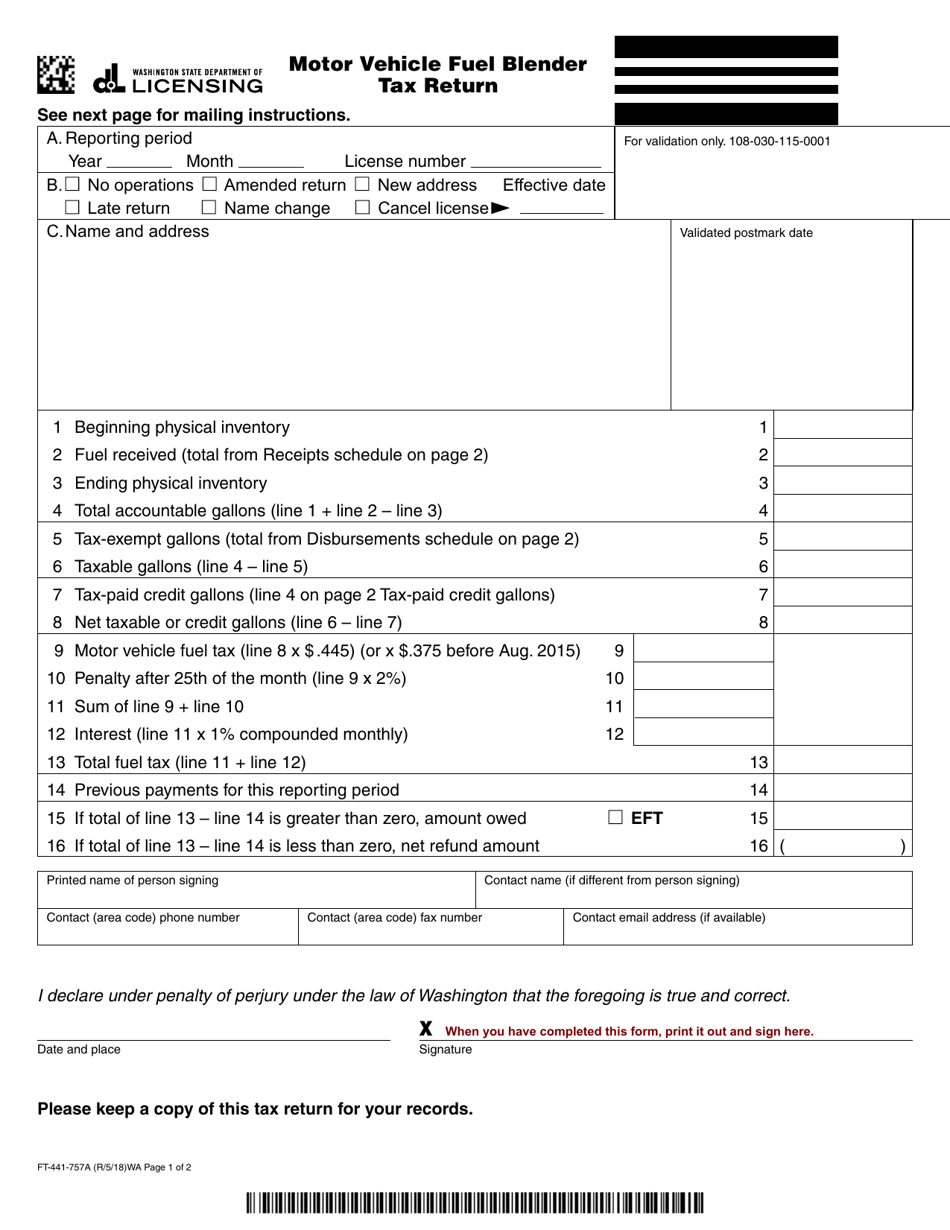

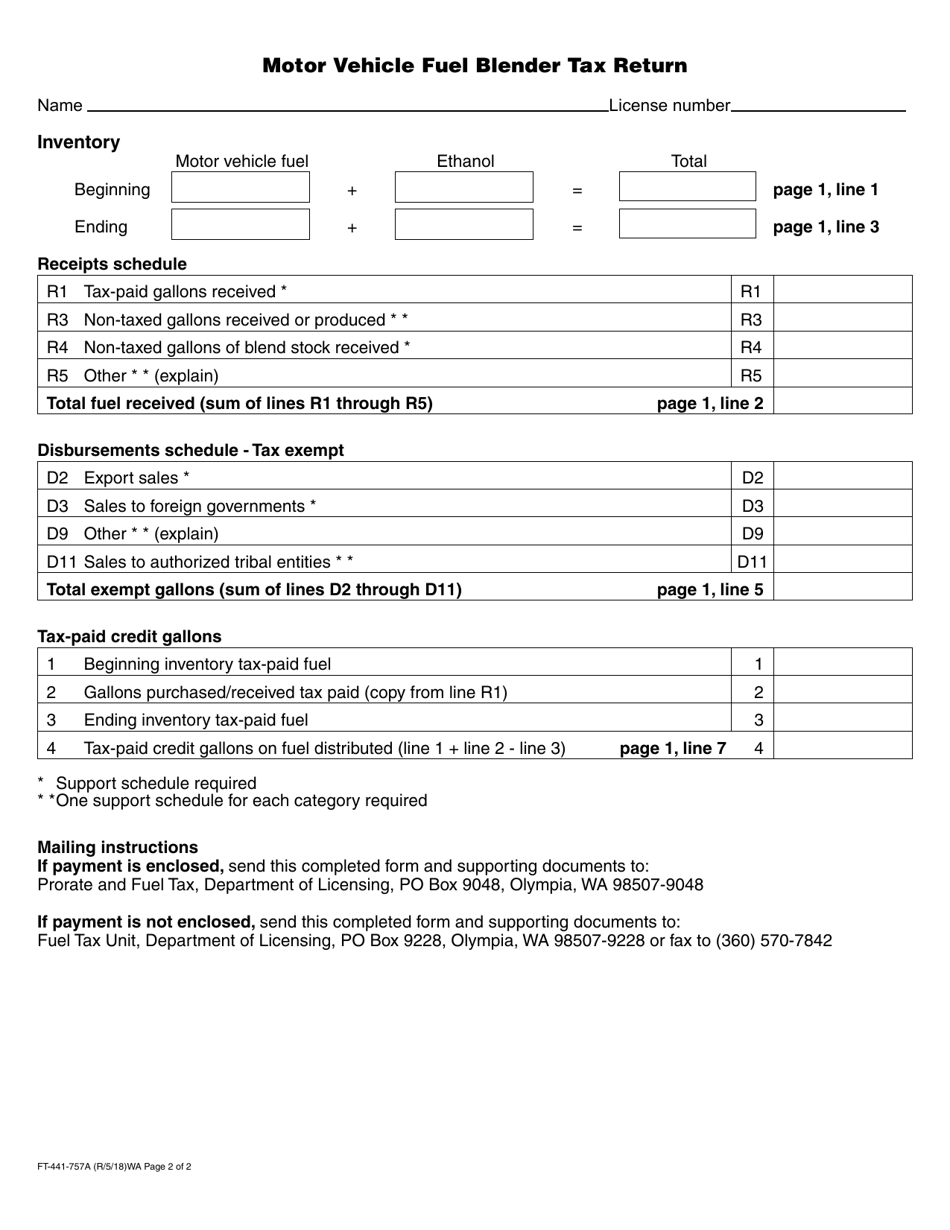

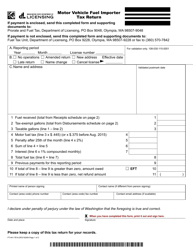

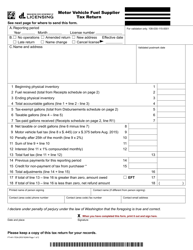

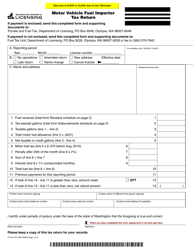

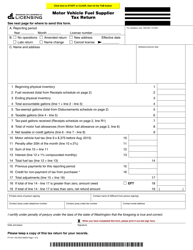

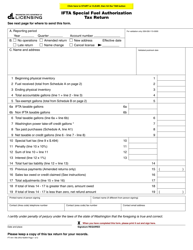

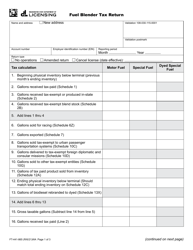

Form FT-441-757A Motor Vehicle Fuel Blender Tax Return - Washington

What Is Form FT-441-757A?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-441-757A?

A: Form FT-441-757A is the Motor Vehicle Fuel Blender Tax Return.

Q: Who should file Form FT-441-757A?

A: Motor vehicle fuel blenders in Washington should file Form FT-441-757A.

Q: What is the purpose of Form FT-441-757A?

A: The purpose of Form FT-441-757A is to report and pay the motor vehicle fuel blender tax in Washington.

Q: When is the due date for filing Form FT-441-757A?

A: The due date for filing Form FT-441-757A is the last day of the month following the end of the reporting period.

Q: What happens if I don't file Form FT-441-757A?

A: Failure to file Form FT-441-757A may result in penalties and interest.

Q: Are there any exemptions or credits available for motor vehicle fuel blenders?

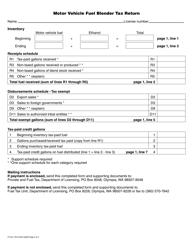

A: Yes, there are certain exemptions and credits available for motor vehicle fuel blenders. Details can be found in the instructions for Form FT-441-757A.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-757A by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.