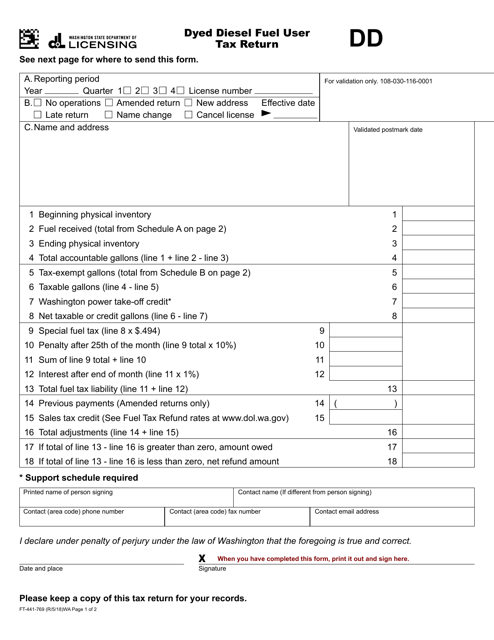

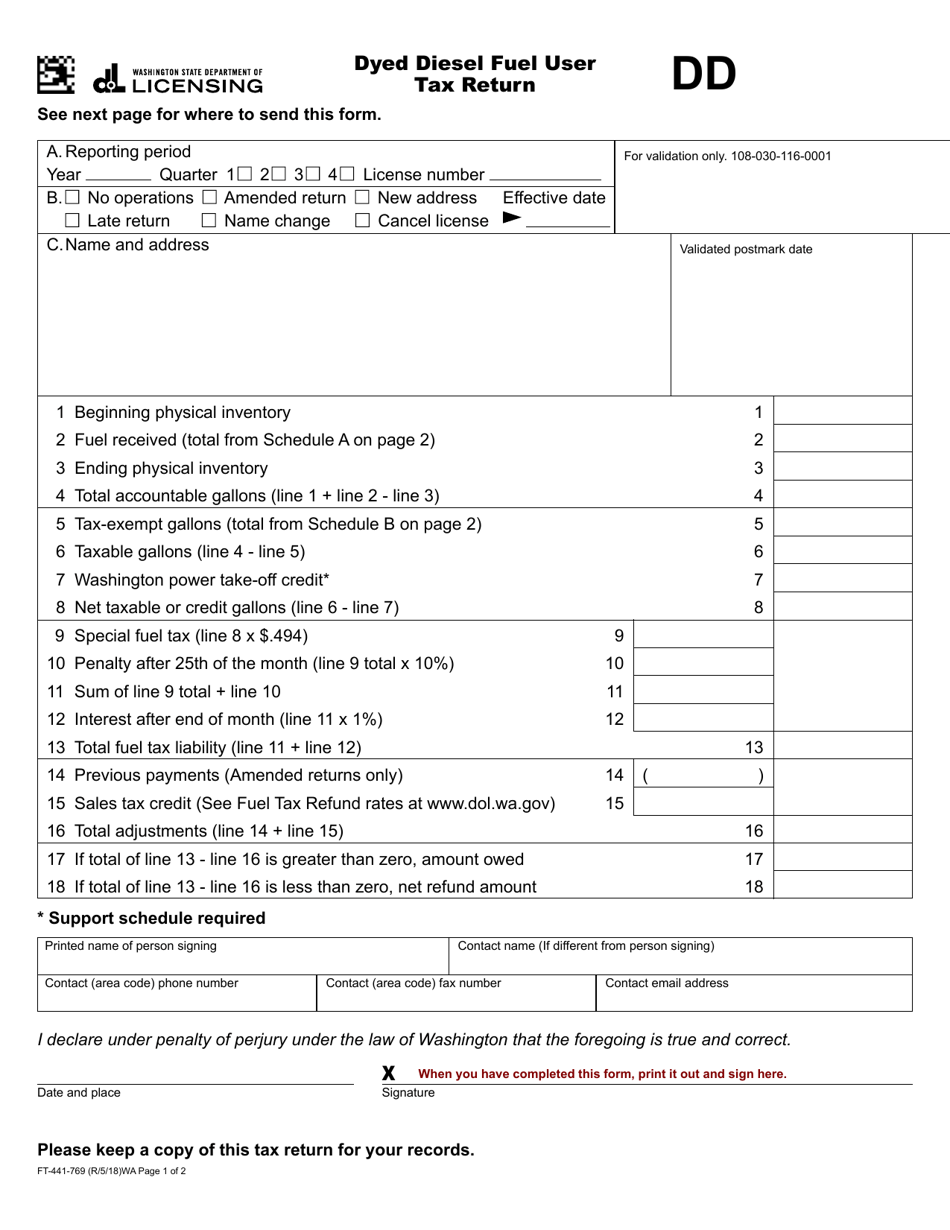

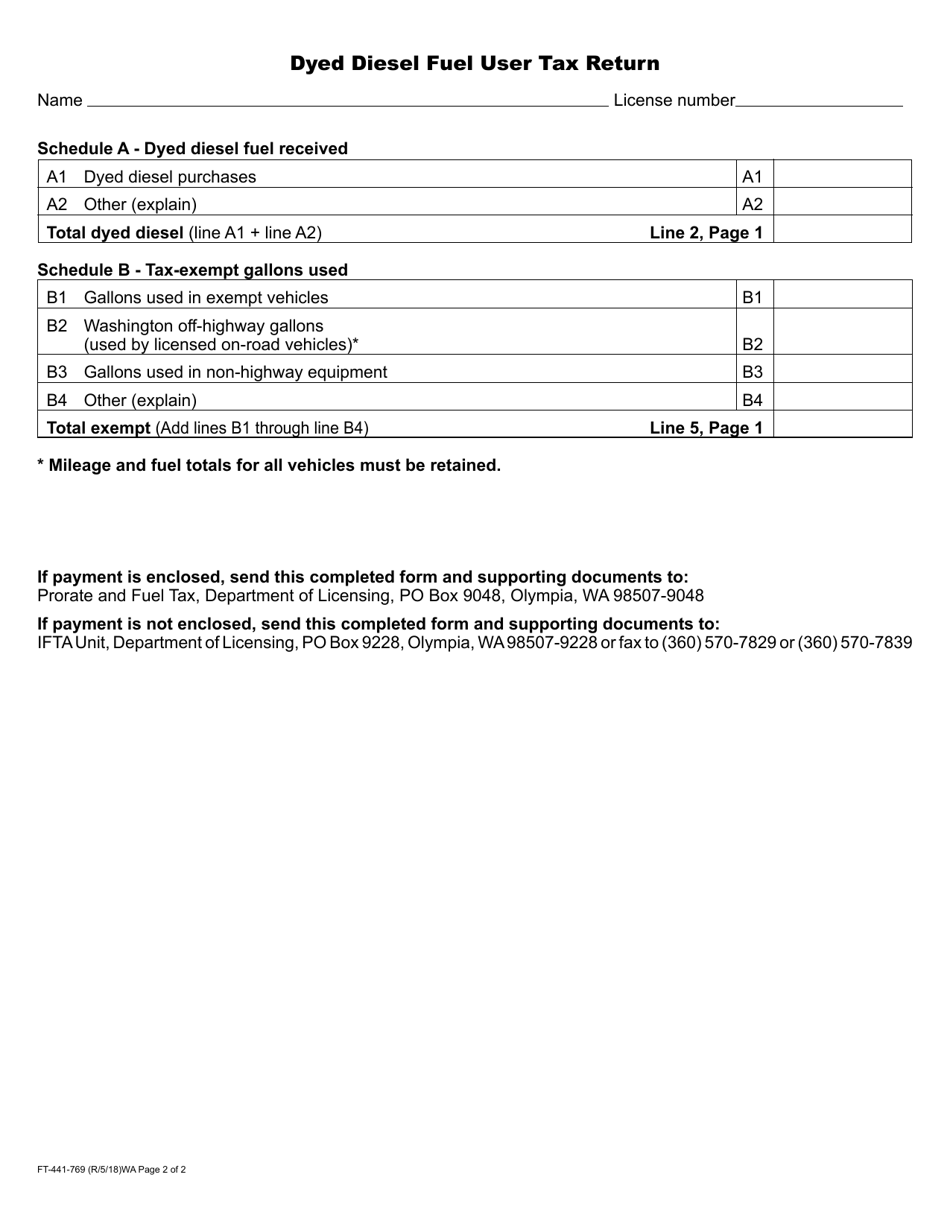

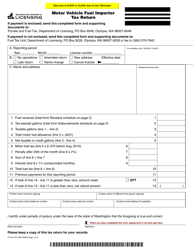

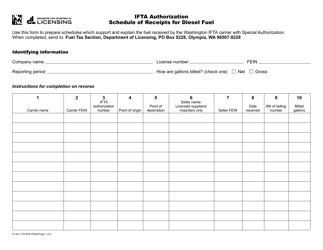

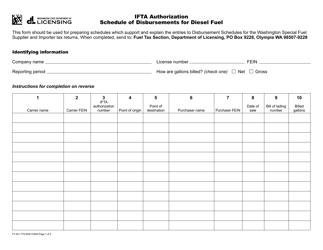

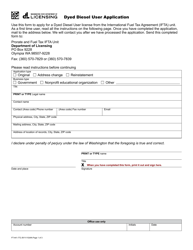

Form FT-441-769 Dyed Diesel Fuel User Tax Return - Washington

What Is Form FT-441-769?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form FT-441-769?

A: Form FT-441-769 is the Dyed Diesel Fuel User Tax Return specific to Washington.

Q: Who needs to file Form FT-441-769?

A: Any user of dyed diesel fuel in Washington needs to file Form FT-441-769.

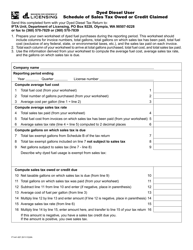

Q: What is dyed diesel fuel?

A: Dyed diesel fuel is fuel that has been colored with a dye to indicate that it is not for use on public roads.

Q: What is the purpose of Form FT-441-769?

A: The purpose of Form FT-441-769 is to report the use and pay the taxes due on dyed diesel fuel in Washington.

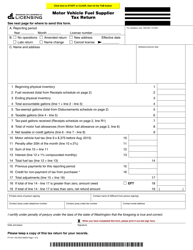

Q: How often do I need to file Form FT-441-769?

A: Form FT-441-769 must be filed on a quarterly basis.

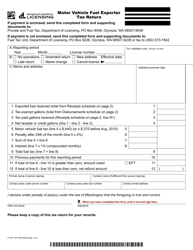

Q: What are the consequences of not filing Form FT-441-769?

A: Failure to file Form FT-441-769 or pay the taxes due can result in penalties and interest.

Q: Is there a deadline for filing Form FT-441-769?

A: Yes, Form FT-441-769 must be filed by the last day of the month following the end of the quarter.

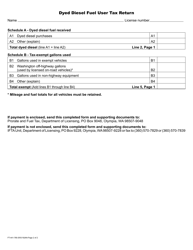

Q: Are there any exemptions or deductions available on Form FT-441-769?

A: There may be exemptions or deductions available for certain uses of dyed diesel fuel. Check the instructions for Form FT-441-769 for more information.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-769 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.