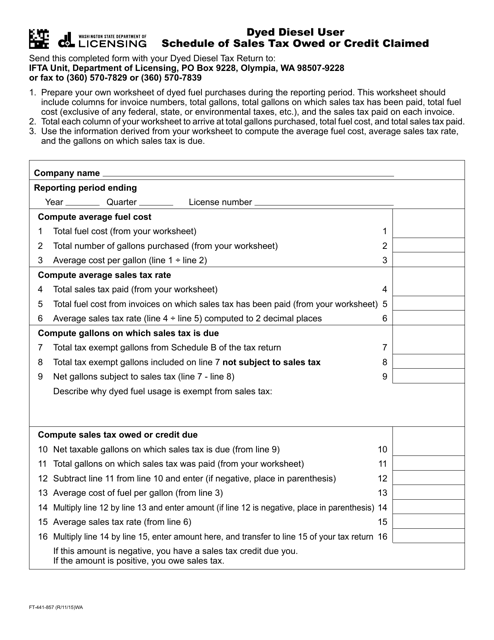

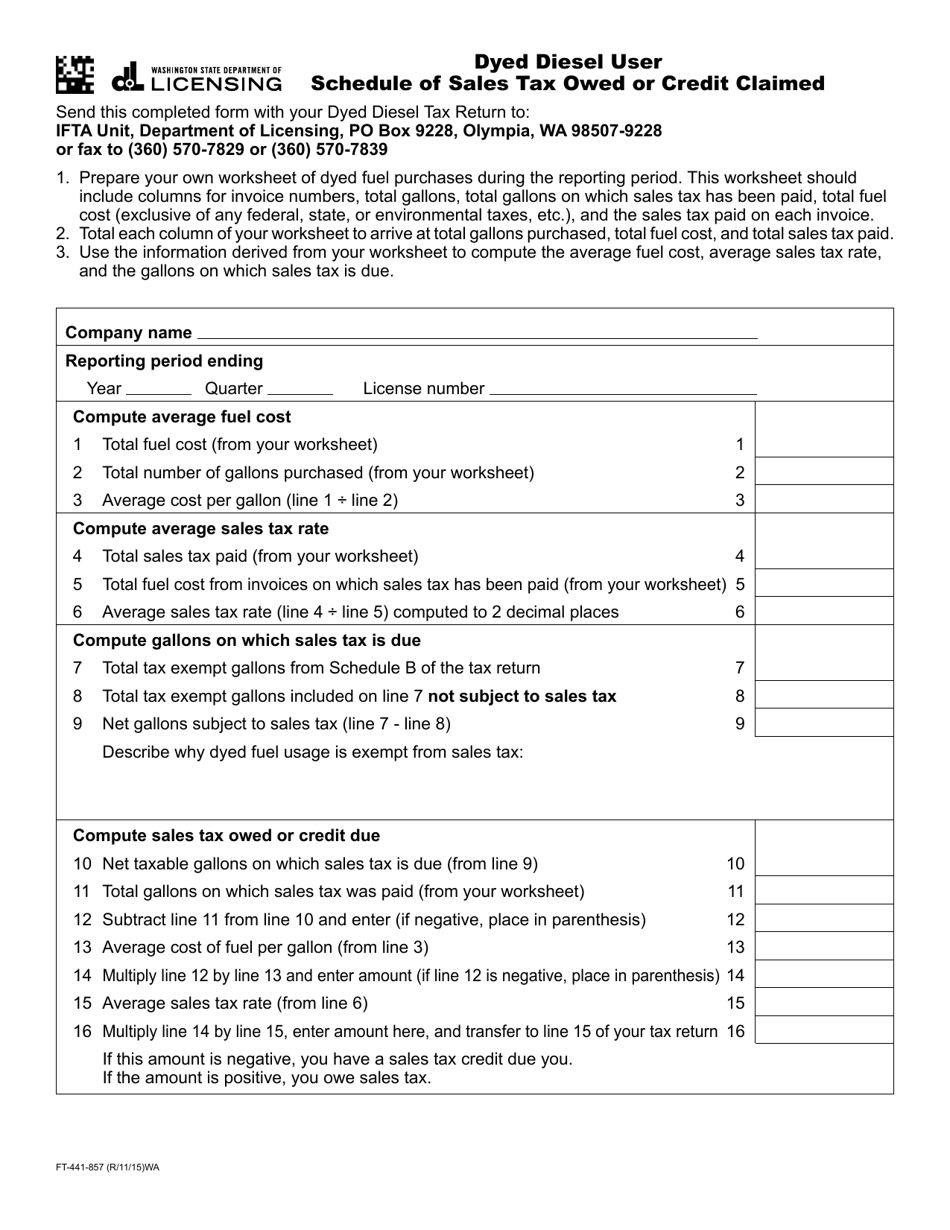

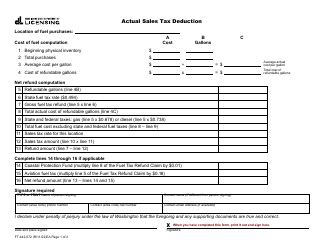

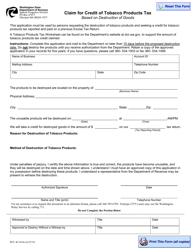

Form FT-441-857 Dyed Diesel User Schedule of Sales Tax Owed or Credit Claimed - Washington

What Is Form FT-441-857?

This is a legal form that was released by the Washington State Department of Licensing - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form FT-441-857?

A: Form FT-441-857 is the Dyed Diesel User Schedule of Sales Tax Owed or Credit Claimed in Washington.

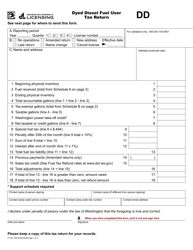

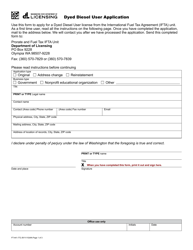

Q: Who needs to file Form FT-441-857?

A: Any entity that has purchased and used dyed diesel fuel in Washington needs to file Form FT-441-857.

Q: What is dyed diesel fuel?

A: Dyed diesel fuel is a type of fuel that has been colored with a dye to indicate that it is not intended for use on public roads.

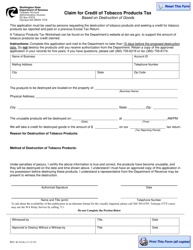

Q: What is the purpose of Form FT-441-857?

A: The purpose of Form FT-441-857 is to report the sales tax owed or credit claimed on the purchase and use of dyed diesel fuel.

Q: When is the due date for filing Form FT-441-857?

A: The due date for filing Form FT-441-857 is the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form FT-441-857?

A: Yes, failure to file Form FT-441-857 or filing it late can result in penalties and interest on the unpaid tax amounts.

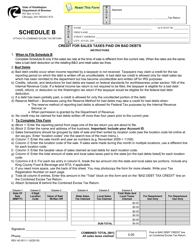

Q: Can I claim a credit for sales tax paid on dyed diesel fuel?

A: Yes, if you have paid sales tax on dyed diesel fuel that was ultimately used for an exempt purpose, you may be eligible to claim a credit.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Washington State Department of Licensing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-441-857 by clicking the link below or browse more documents and templates provided by the Washington State Department of Licensing.