This version of the form is not currently in use and is provided for reference only. Download this version of

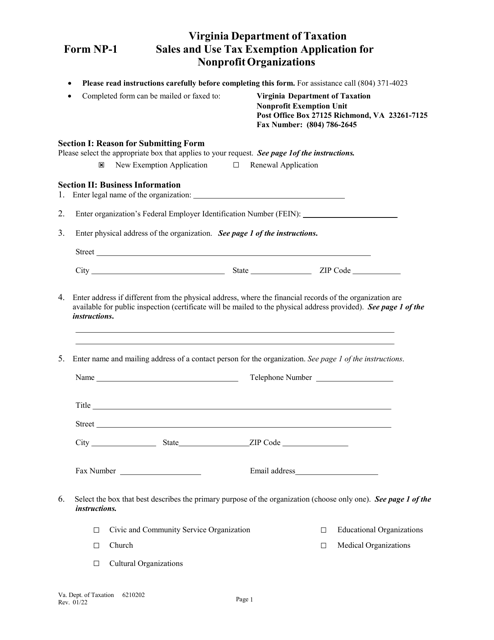

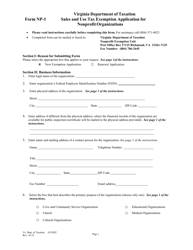

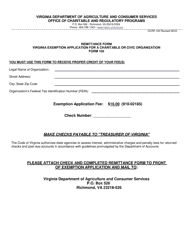

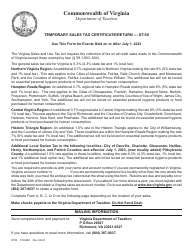

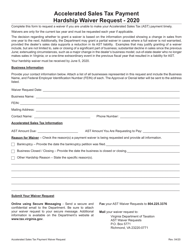

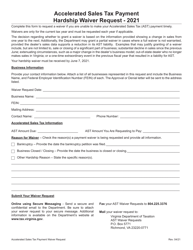

Form NP-1

for the current year.

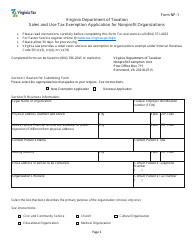

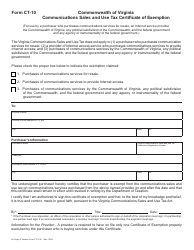

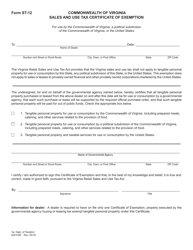

Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations - Virginia

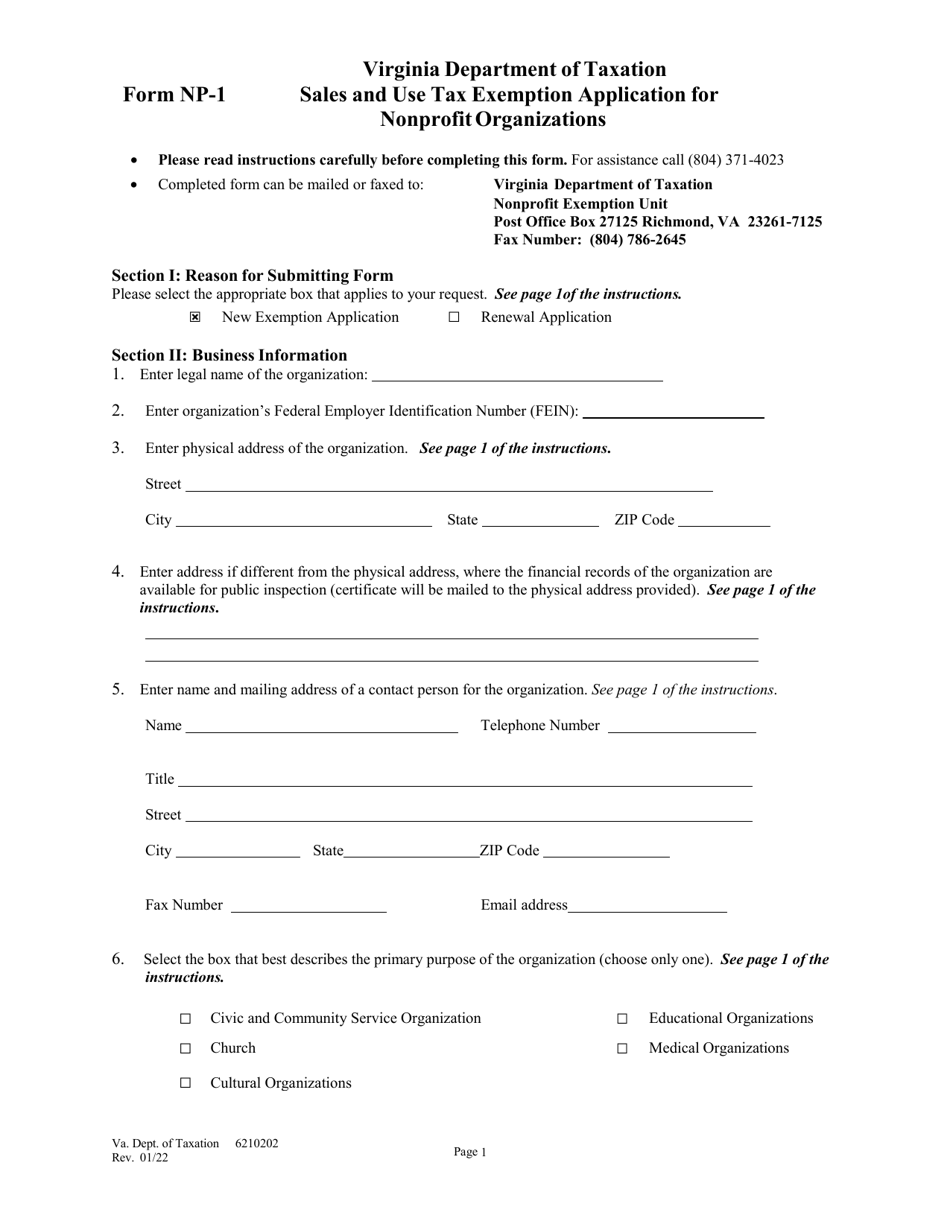

What Is Form NP-1?

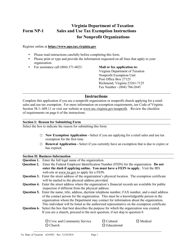

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

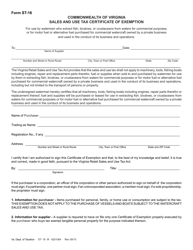

Q: What is the NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations?

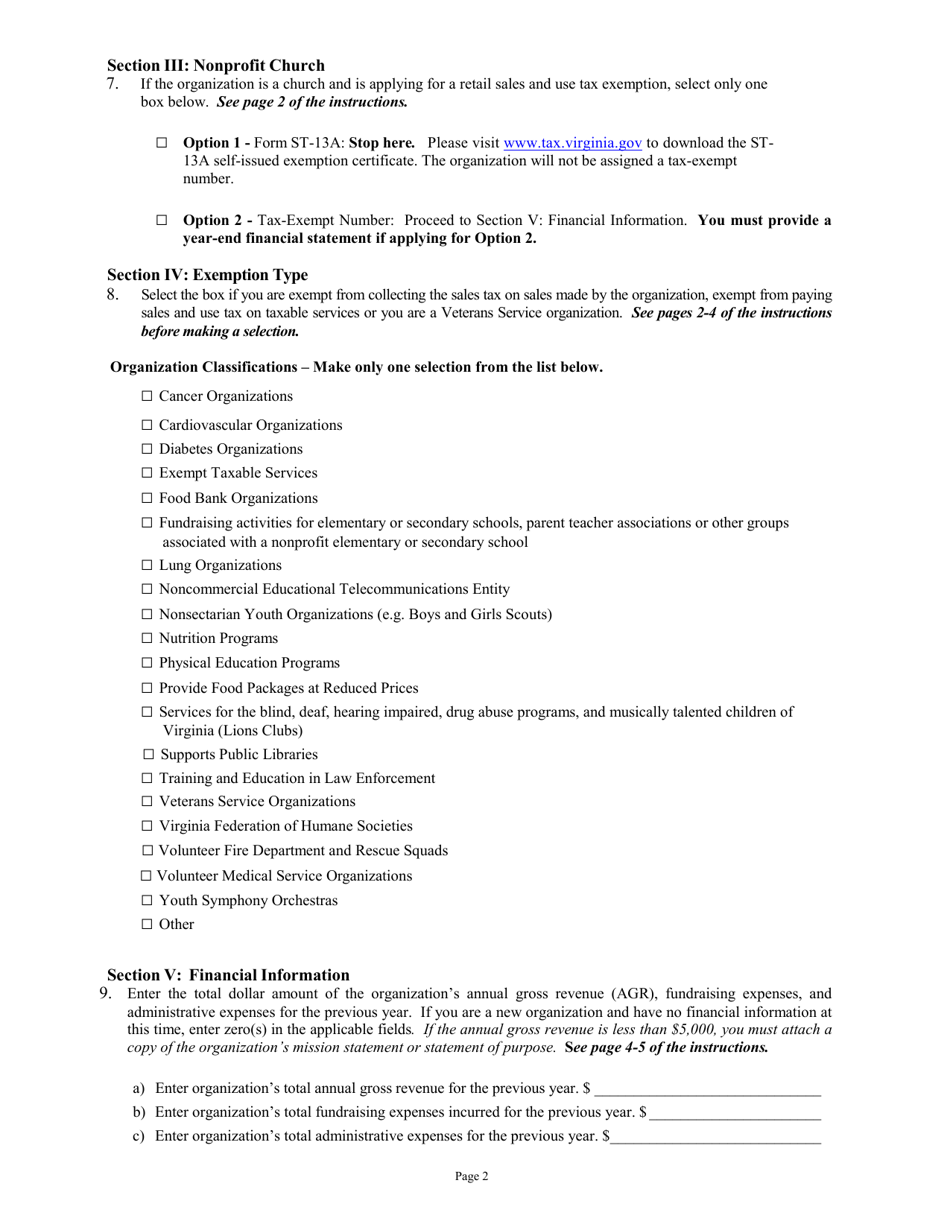

A: The NP-1 application is used to apply for sales and use tax exemption for nonprofit organizations in Virginia.

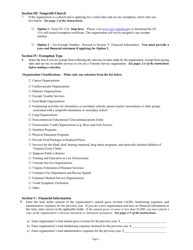

Q: Who can apply for the NP-1 Sales and Use Tax Exemption?

A: Nonprofit organizations in Virginia are eligible to apply for the NP-1 Sales and Use Tax Exemption.

Q: What is the purpose of the NP-1 application?

A: The purpose of the NP-1 application is to request exemption from sales and use tax for qualifying purchases made by nonprofit organizations.

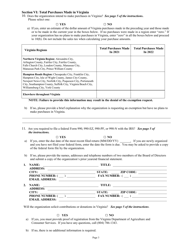

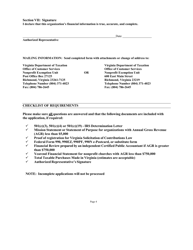

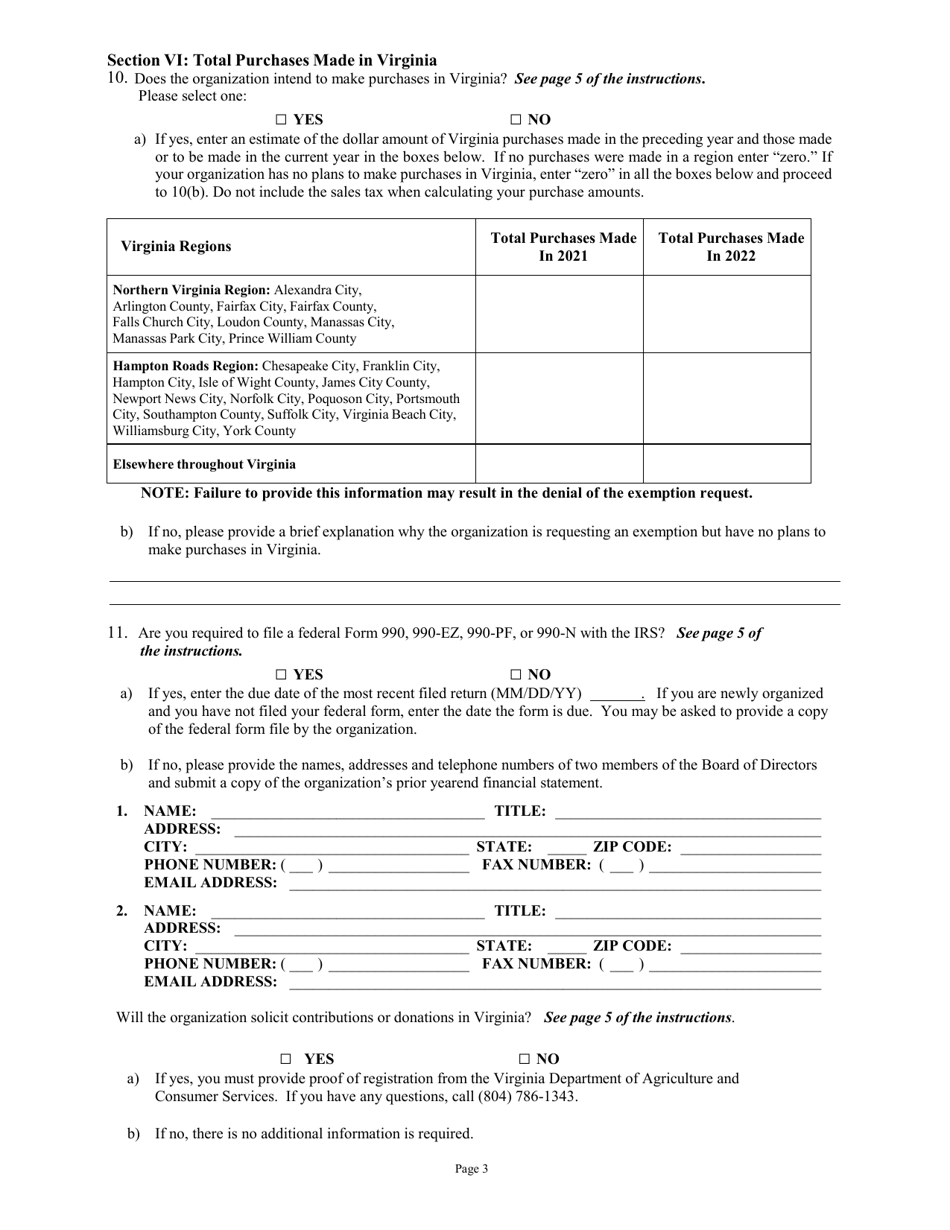

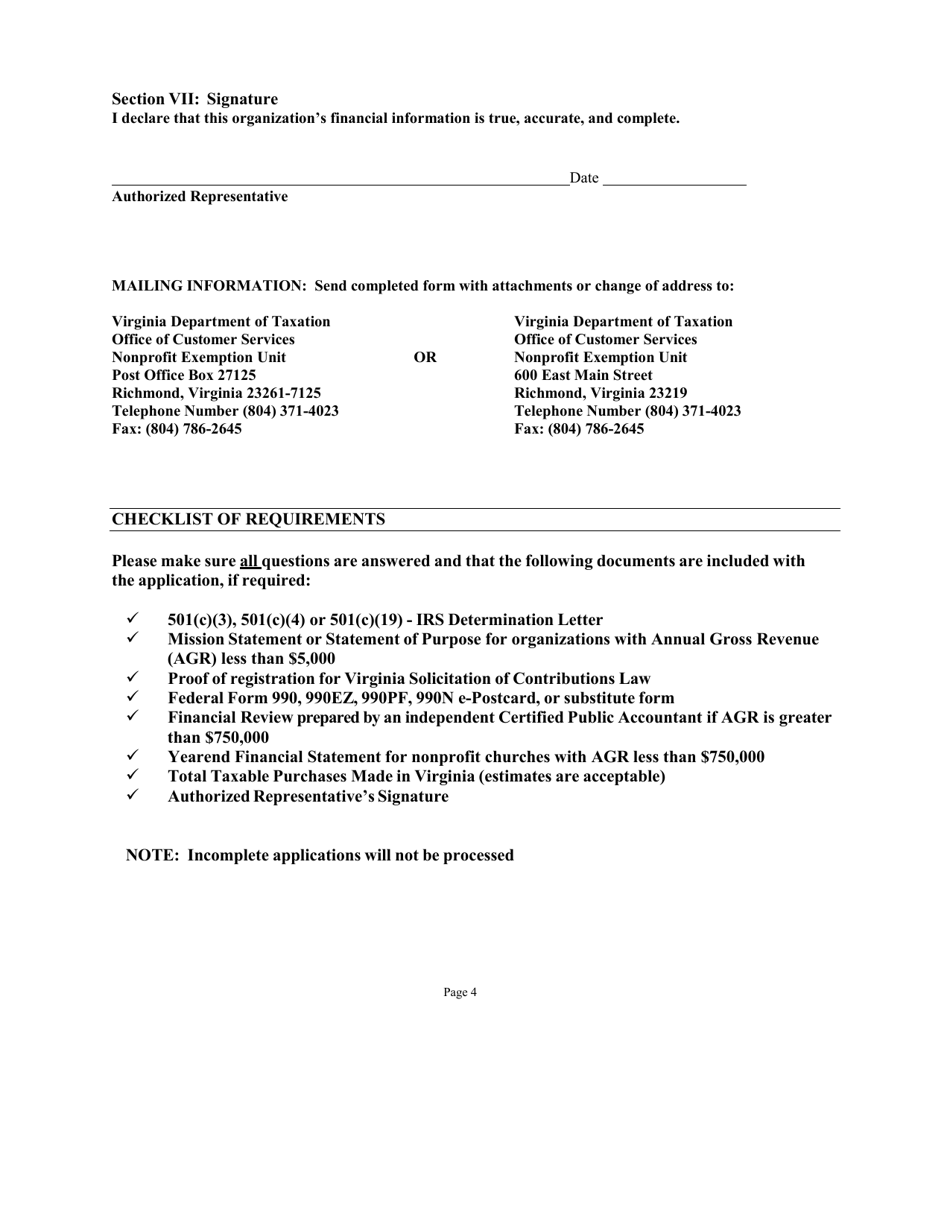

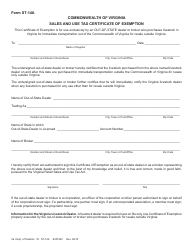

Q: What documents are required to be submitted with the NP-1 application?

A: The NP-1 application must be accompanied by the organization's articles of incorporation, bylaws, IRS determination letter, and financial statements.

Q: Is there a fee to submit the NP-1 application?

A: No, there is no fee to submit the NP-1 application.

Q: How long does it take to process the NP-1 application?

A: The processing time for the NP-1 application can vary, but it generally takes 4-6 weeks.

Q: How long is the NP-1 Sales and Use Tax Exemption valid for?

A: The NP-1 Sales and Use Tax Exemption is typically valid for a period of 5 years.

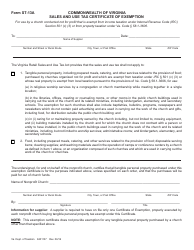

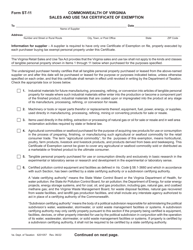

Q: What purchases are eligible for the sales and use tax exemption?

A: Purchases of tangible personal property and certain services directly used or consumed by the nonprofit organization in carrying out its exempt purpose may be eligible for the sales and use tax exemption.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.