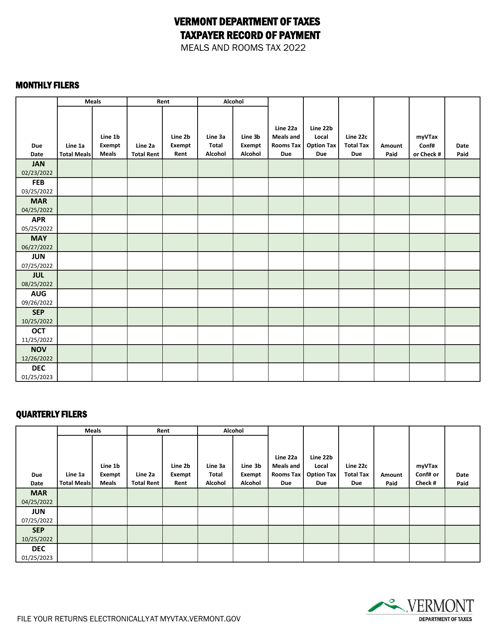

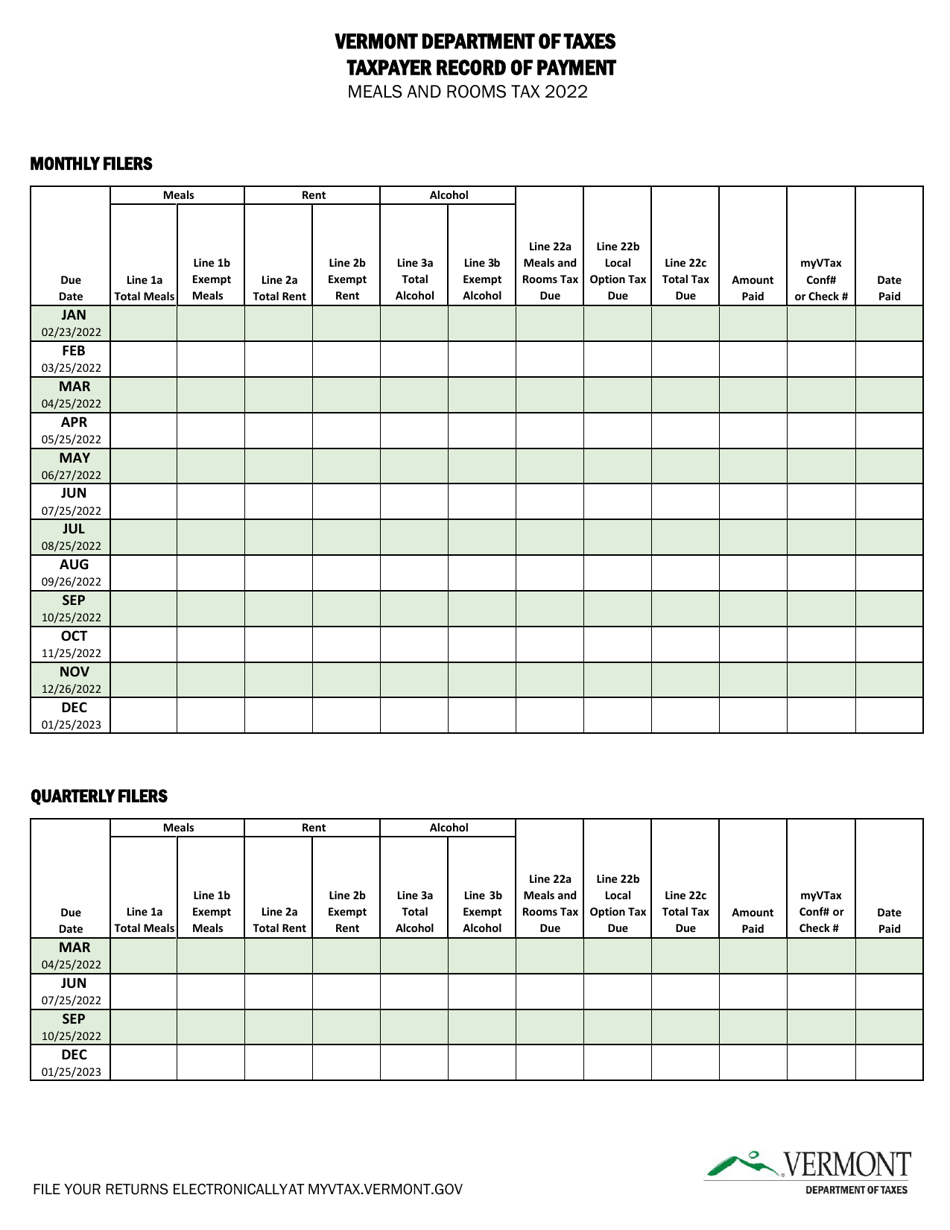

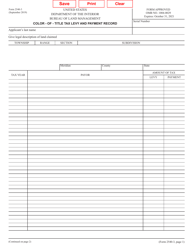

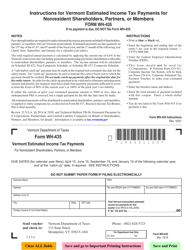

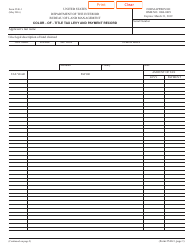

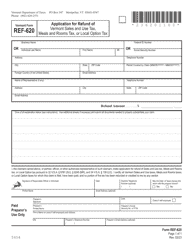

Meals and Rooms Taxpayer Record of Payment - Vermont

Meals and Rooms Taxpayer Record of Payment is a legal document that was released by the Vermont Department of Taxes - a government authority operating within Vermont.

FAQ

Q: What is the Meals and Rooms Taxpayer Record of Payment?

A: The Meals and Rooms Taxpayer Record of Payment is a document used by taxpayers in Vermont to keep track of their payments for meals and rooms tax.

Q: Who needs to fill out the Meals and Rooms Taxpayer Record of Payment?

A: Businesses that collect meals and rooms tax in Vermont are required to fill out the Meals and Rooms Taxpayer Record of Payment.

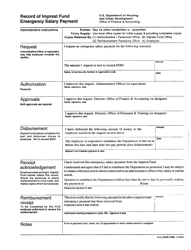

Q: What information is recorded in the Meals and Rooms Taxpayer Record of Payment?

A: The record includes details such as the taxpayer's name, address, tax account number, payment dates, amount paid, and any adjustments or credits.

Q: How often should I fill out the Meals and Rooms Taxpayer Record of Payment?

A: The frequency of filling out the form depends on your reporting period, which is determined by the Vermont Department of Taxes. Typically, it is done on a monthly or quarterly basis.

Q: Why is it important to fill out the Meals and Rooms Taxpayer Record of Payment accurately?

A: Accurate record keeping is important for tax compliance and auditing purposes. It helps businesses ensure they are meeting their tax obligations and provides documentation in case of an audit.

Q: Are there any penalties for not filing the Meals and Rooms Taxpayer Record of Payment?

A: Failure to file the required form or providing false information may result in penalties, fines, and other enforcement actions.

Form Details:

- The latest edition currently provided by the Vermont Department of Taxes;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.