This version of the form is not currently in use and is provided for reference only. Download this version of

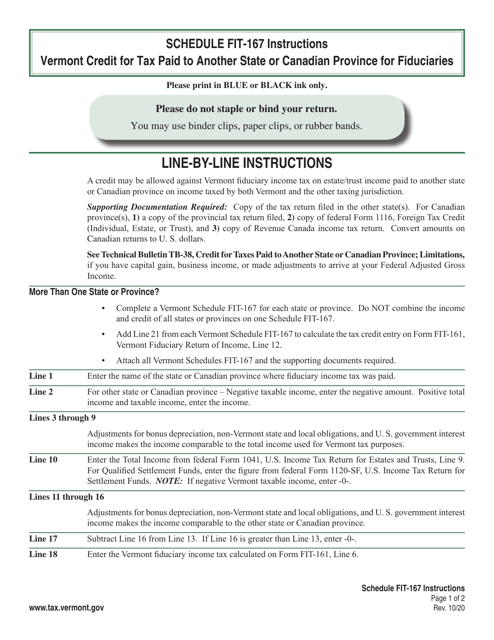

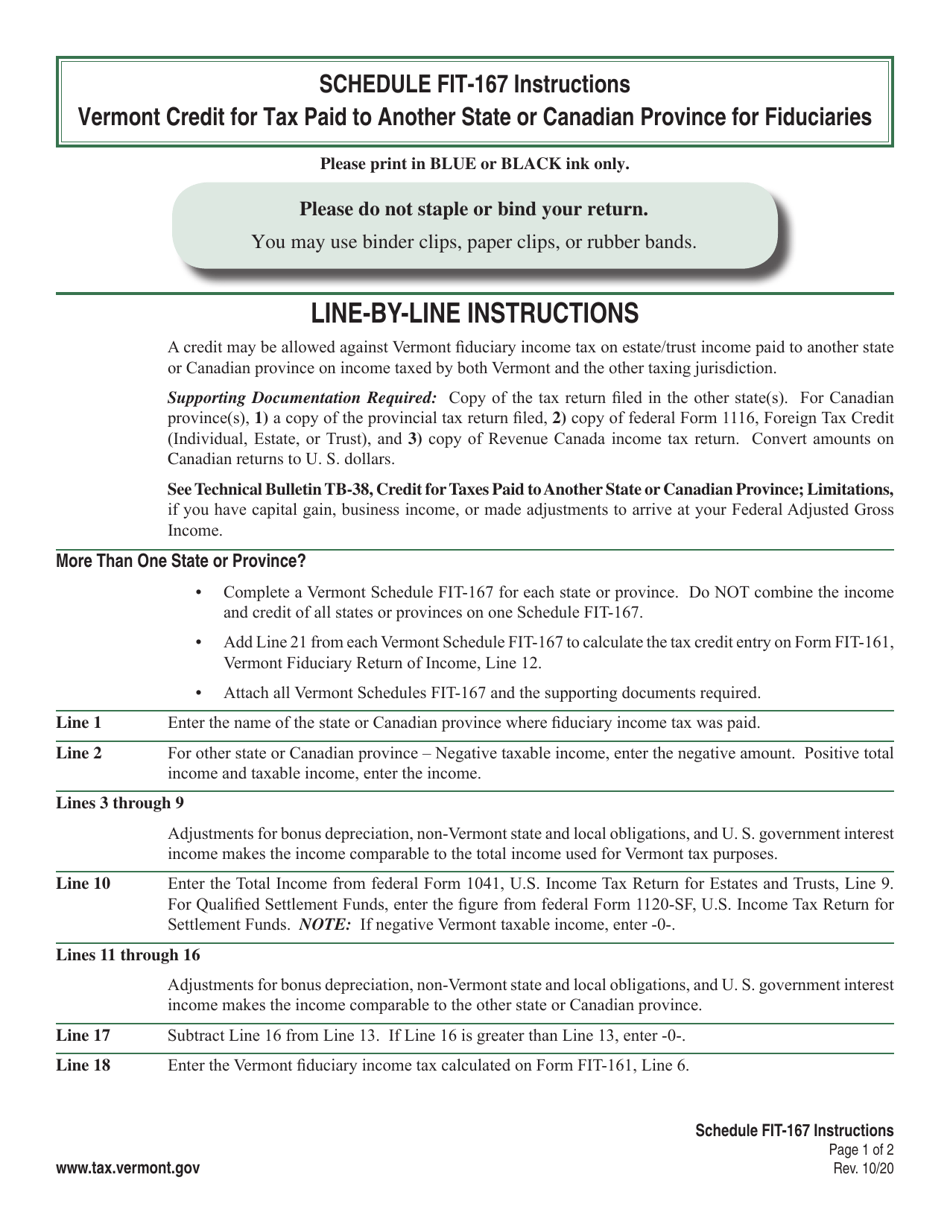

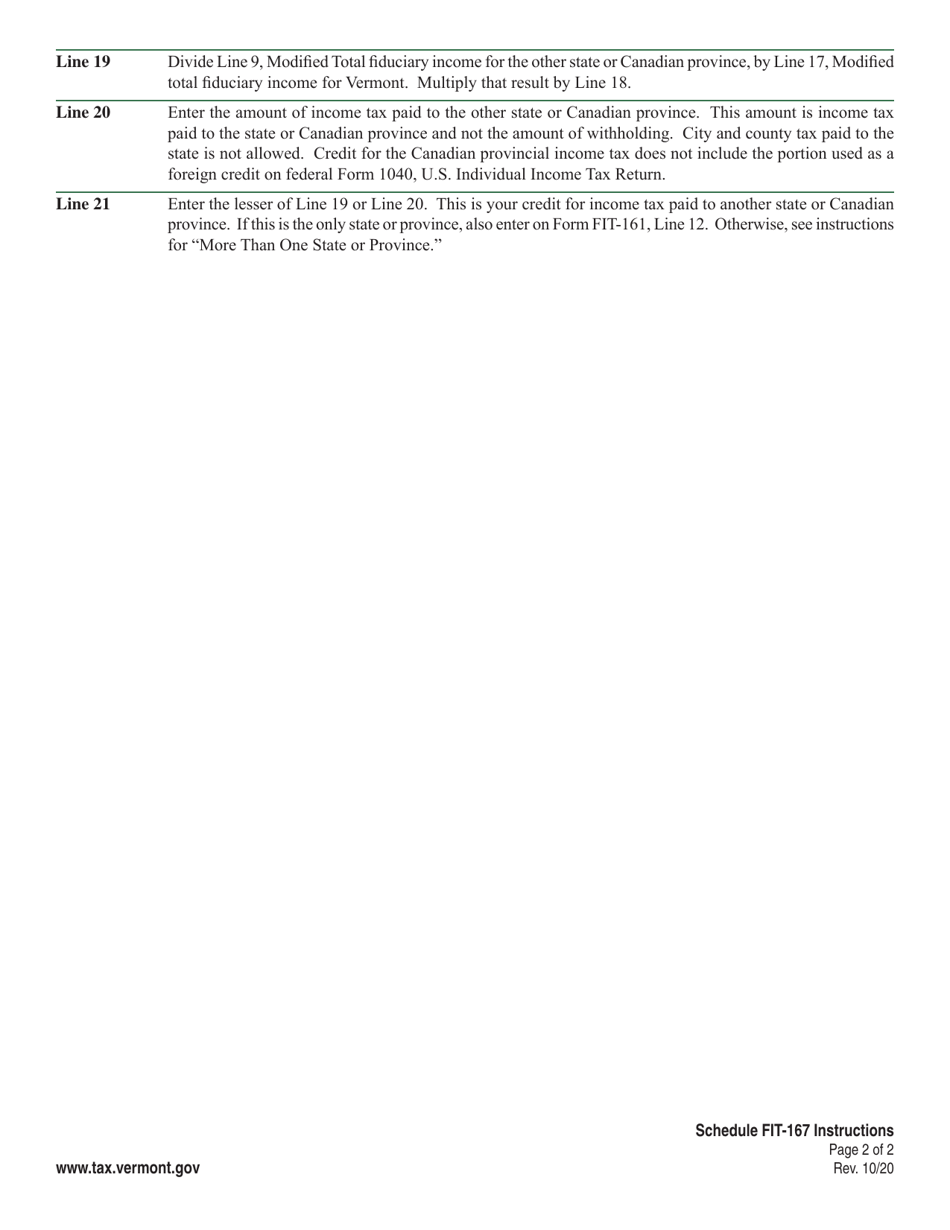

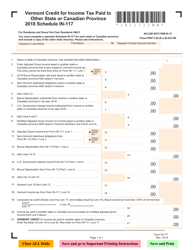

Instructions for Schedule FIT-167

for the current year.

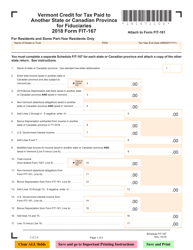

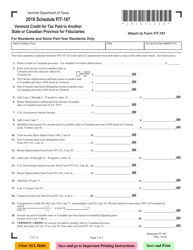

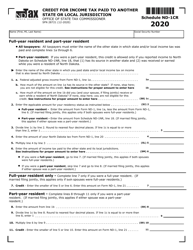

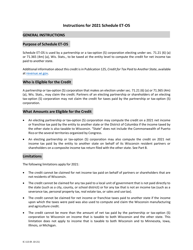

Instructions for Schedule FIT-167 Vermont Credit for Tax Paid to Another State or Canadian Province for Fiduciaries - Vermont

This document contains official instructions for Schedule FIT-167 , Vermont Credit for Canadian Province for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule FIT-167?

A: Schedule FIT-167 is a tax form for fiduciaries in Vermont.

Q: What is the purpose of Schedule FIT-167?

A: The purpose of Schedule FIT-167 is to claim a credit for tax paid to another state or Canadian province.

Q: Who should file Schedule FIT-167?

A: Fiduciaries who have paid taxes to another state or Canadian province should file Schedule FIT-167.

Q: What information is required to complete Schedule FIT-167?

A: To complete Schedule FIT-167, you will need information about the tax paid to the other state or Canadian province.

Q: When is the deadline for filing Schedule FIT-167?

A: The deadline for filing Schedule FIT-167 is the same as the deadline for filing the Vermont fiduciary income tax return, which is usually April 15th.

Q: Are there any penalties for late filing of Schedule FIT-167?

A: Yes, if you fail to file Schedule FIT-167 on time, you may be subject to penalties and interest on any tax owed.

Q: Can I e-file Schedule FIT-167?

A: Yes, you can e-file Schedule FIT-167 if you are also e-filing your Vermont fiduciary income tax return.

Q: Can I claim a credit for taxes paid to multiple states or Canadian provinces?

A: Yes, you can claim a credit for taxes paid to multiple states or Canadian provinces on Schedule FIT-167.

Q: Is Schedule FIT-167 only for Canadian provinces or also for other countries?

A: Schedule FIT-167 is specifically for tax paid to another state or Canadian province, not for other countries.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.