This version of the form is not currently in use and is provided for reference only. Download this version of

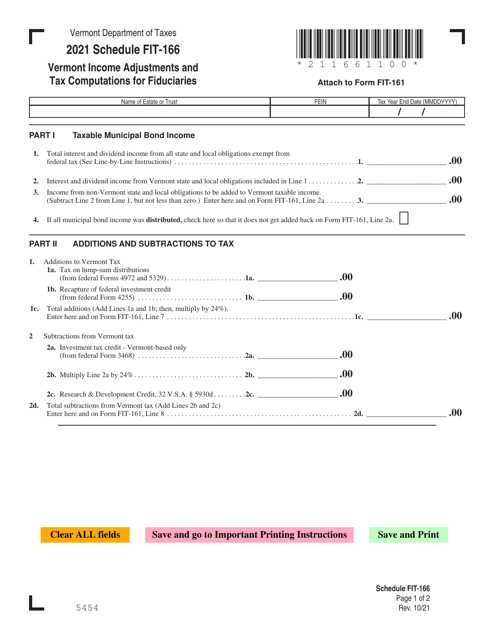

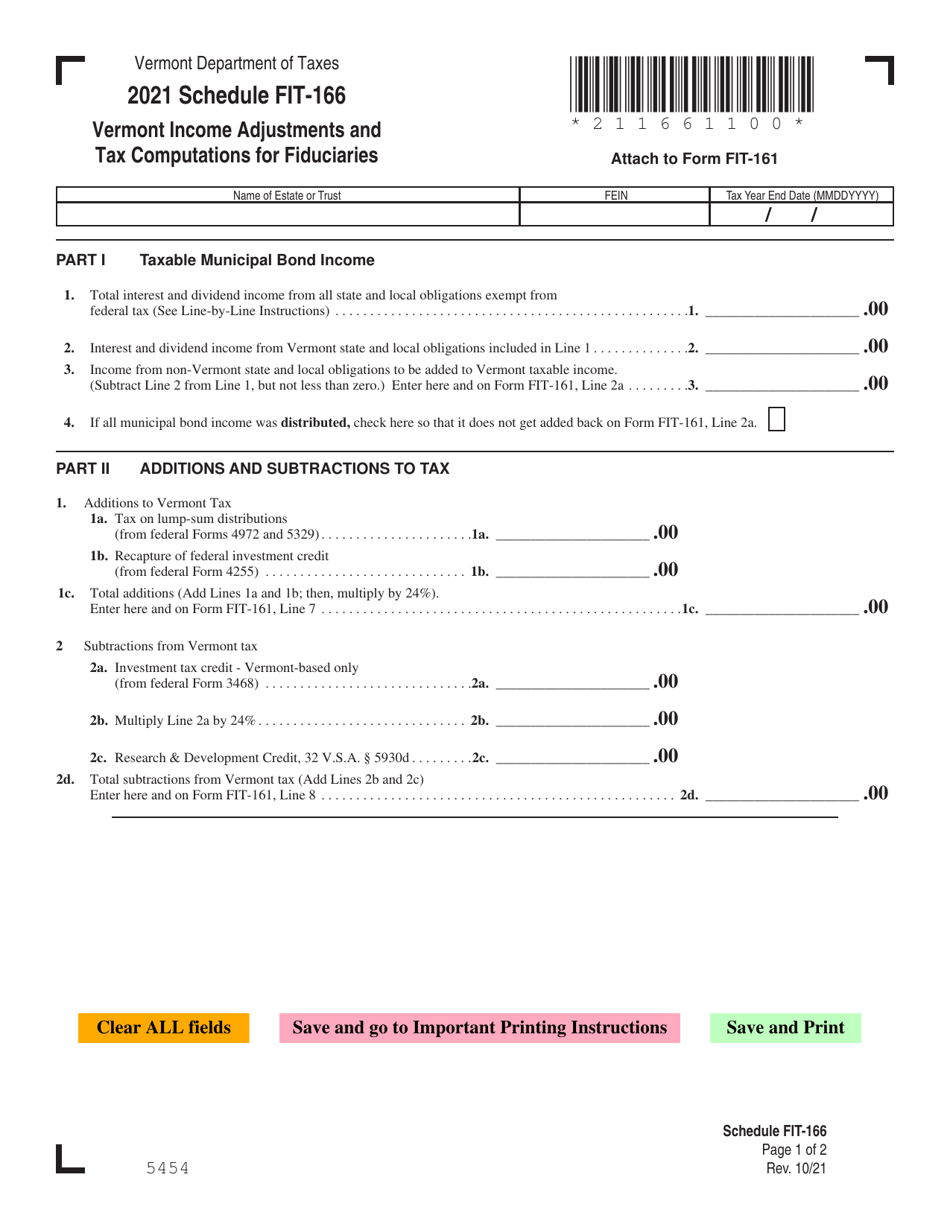

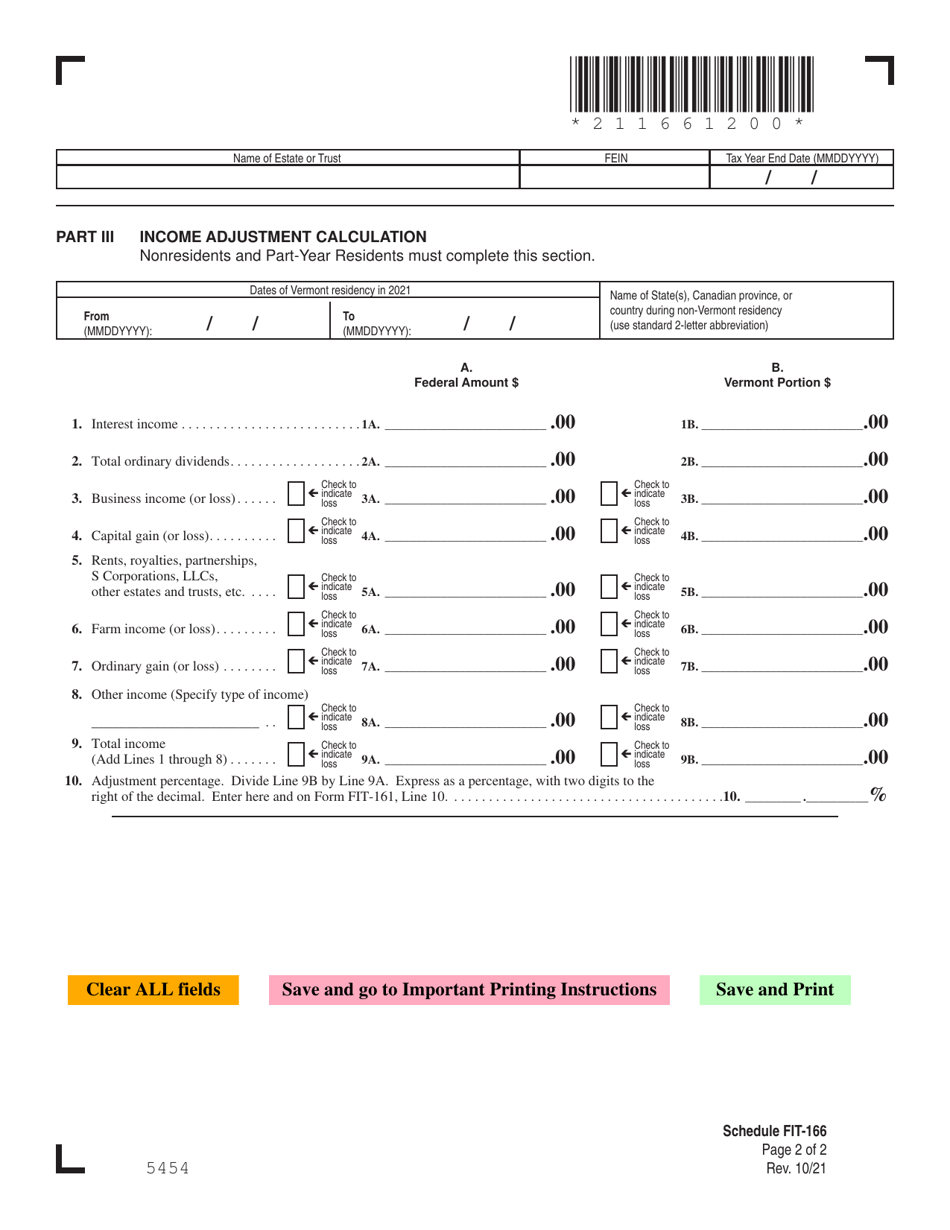

Schedule FIT-166

for the current year.

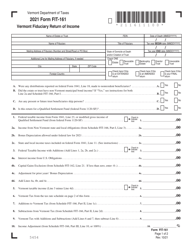

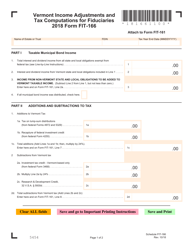

Schedule FIT-166 Vermont Income Adjustments and Tax Computations for Fiduciaries - Vermont

What Is Schedule FIT-166?

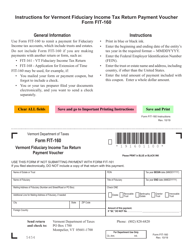

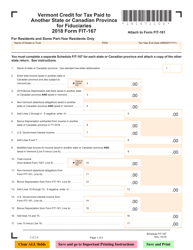

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is FIT-166?

A: FIT-166 is a form used in Vermont for reporting income adjustments and tax computations for fiduciaries.

Q: Who needs to file FIT-166?

A: Fiduciaries who are responsible for handling the income and taxes of estates or trusts in Vermont need to file FIT-166.

Q: What are income adjustments?

A: Income adjustments refer to deductions or additions made to the income reported by the fiduciary on the FIT-166 form.

Q: Why are tax computations required for fiduciaries?

A: Tax computations are necessary for fiduciaries to calculate the tax liability of the estate or trust they are managing.

Q: When is the deadline to file FIT-166?

A: The deadline to file FIT-166 varies each year, but it is typically due by April 15th or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any penalties for late filing of FIT-166?

A: Yes, there may be penalties for late filing of FIT-166, including interest charges on any unpaid tax liability.

Q: Are there any exemptions or deductions available on FIT-166?

A: Yes, there are various exemptions and deductions available on FIT-166, which can help reduce the tax liability for fiduciaries.

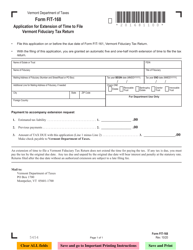

Q: Can I get an extension to file FIT-166?

A: Yes, you can request an extension to file FIT-166 by submitting Form EXT-166 to the Vermont Department of Taxes.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule FIT-166 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.