This version of the form is not currently in use and is provided for reference only. Download this version of

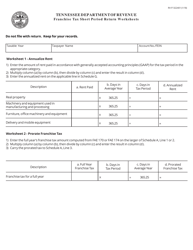

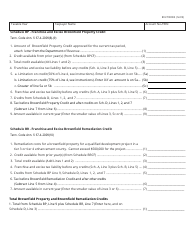

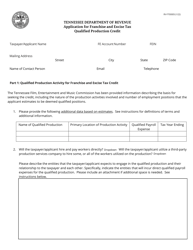

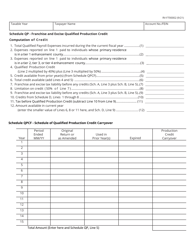

Form RV-F1402401 Schedule X

for the current year.

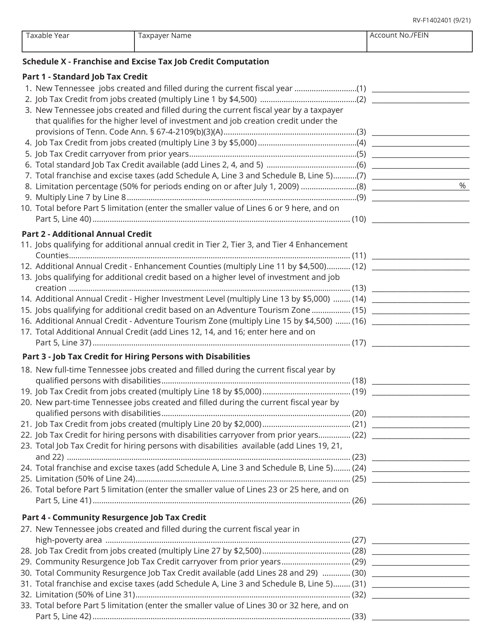

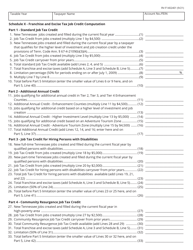

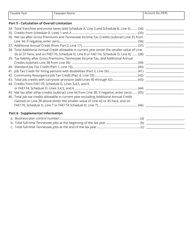

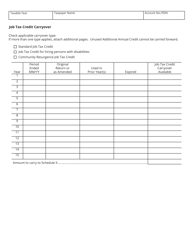

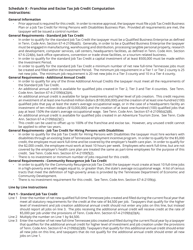

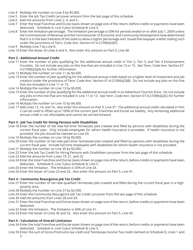

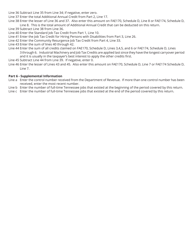

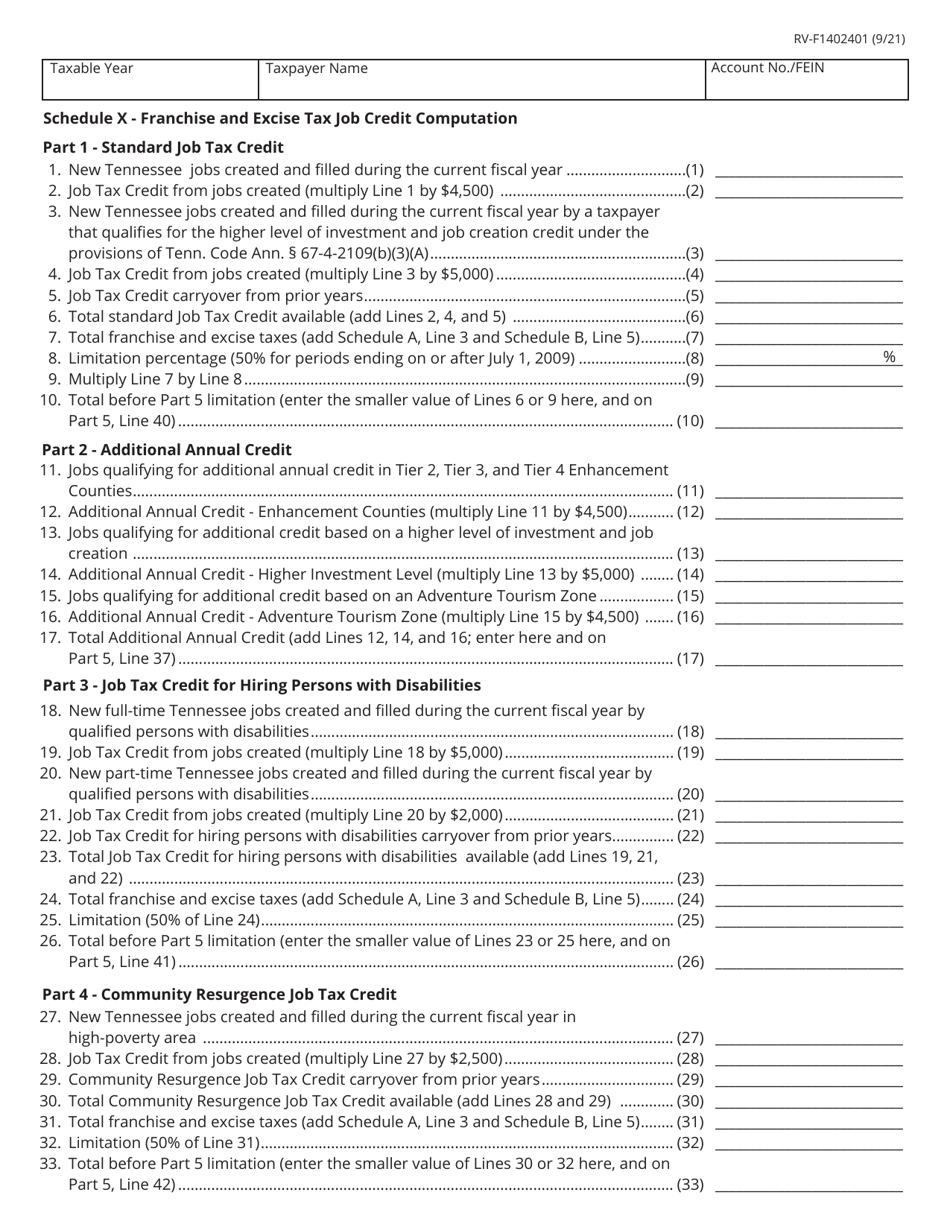

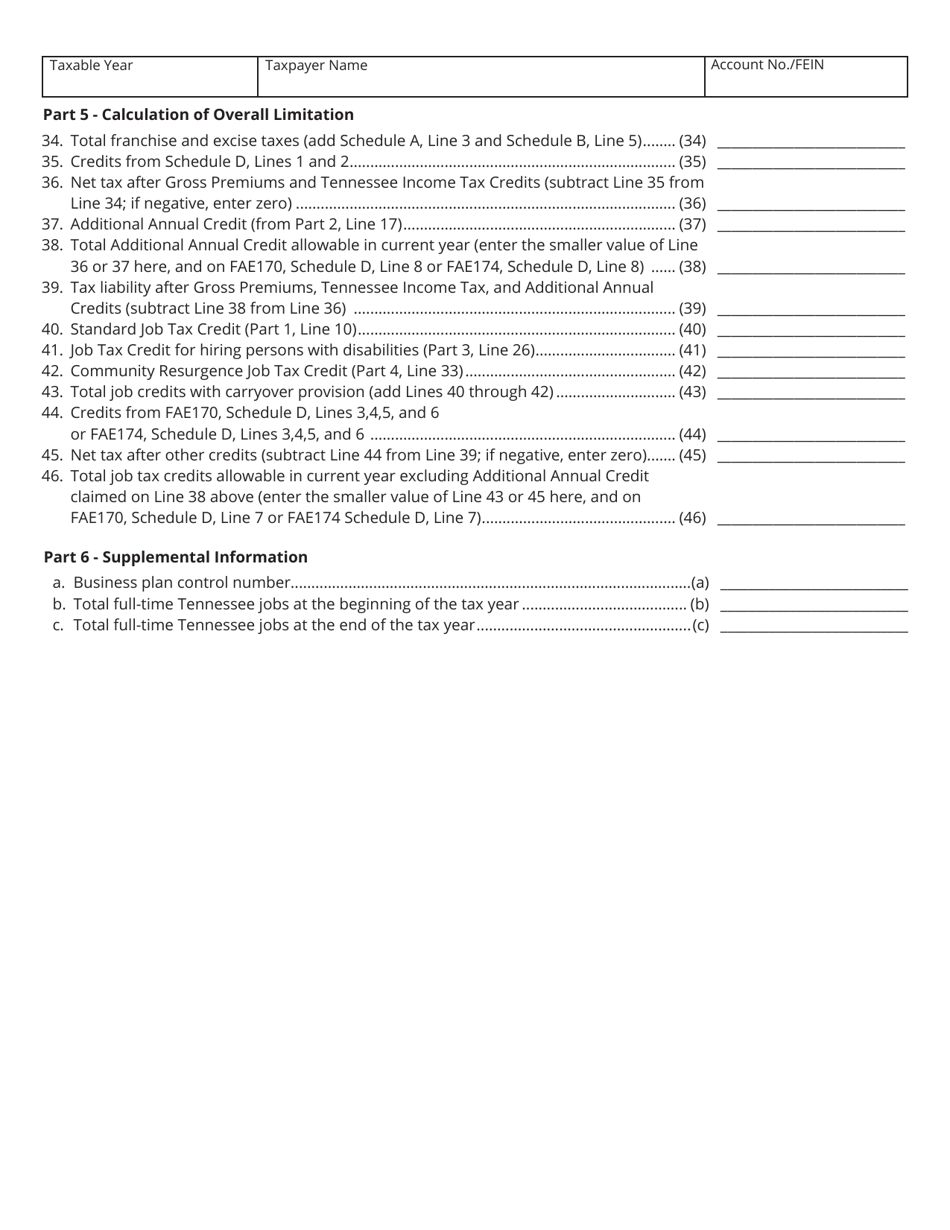

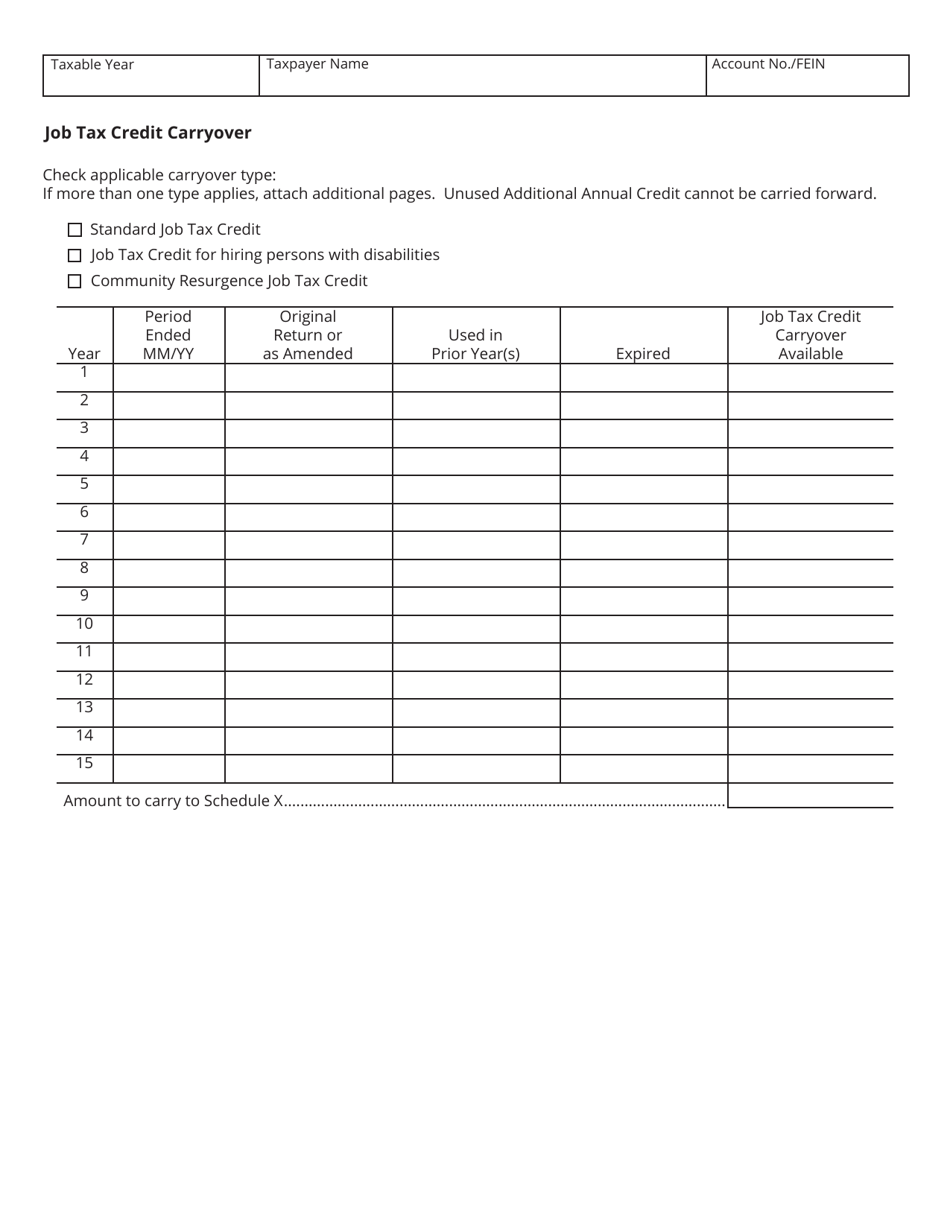

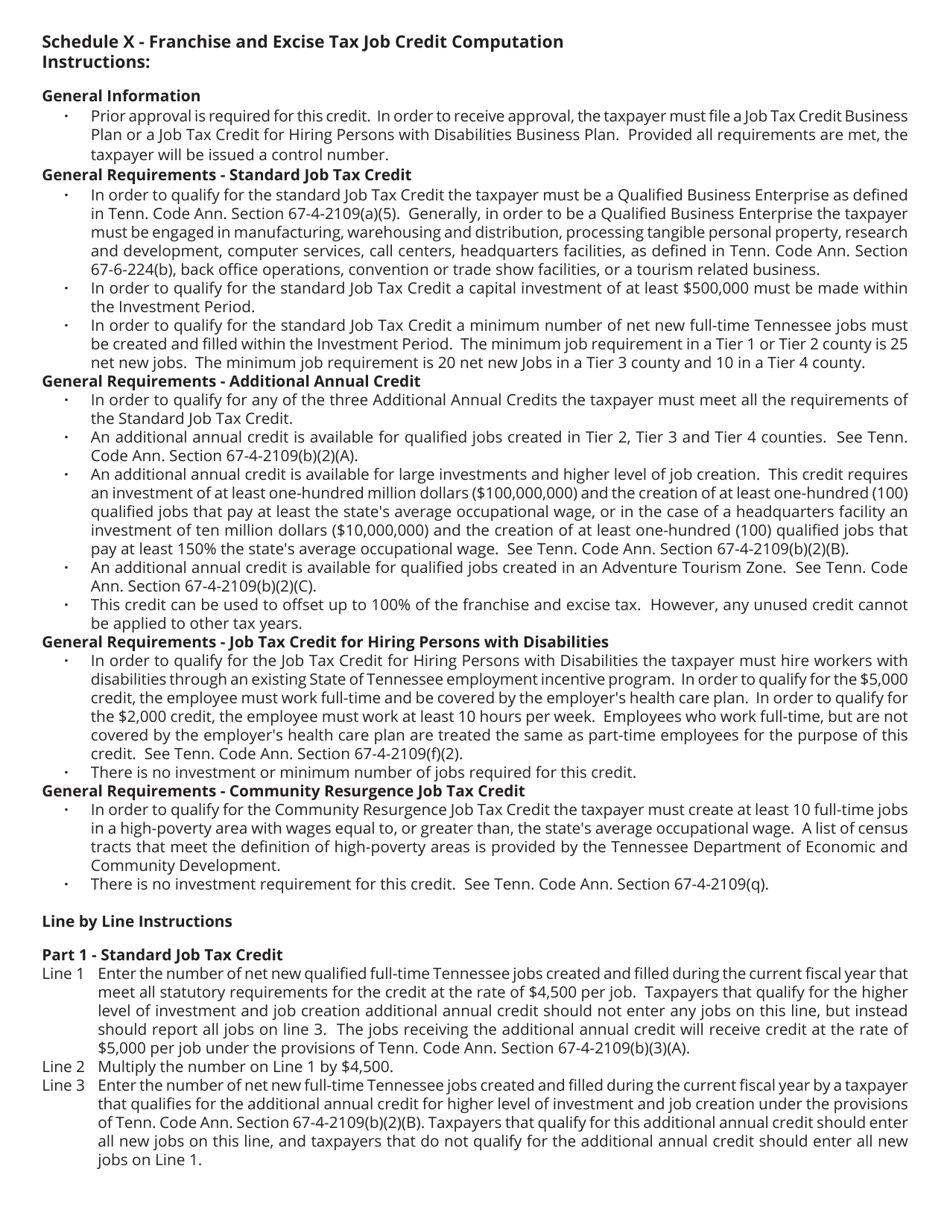

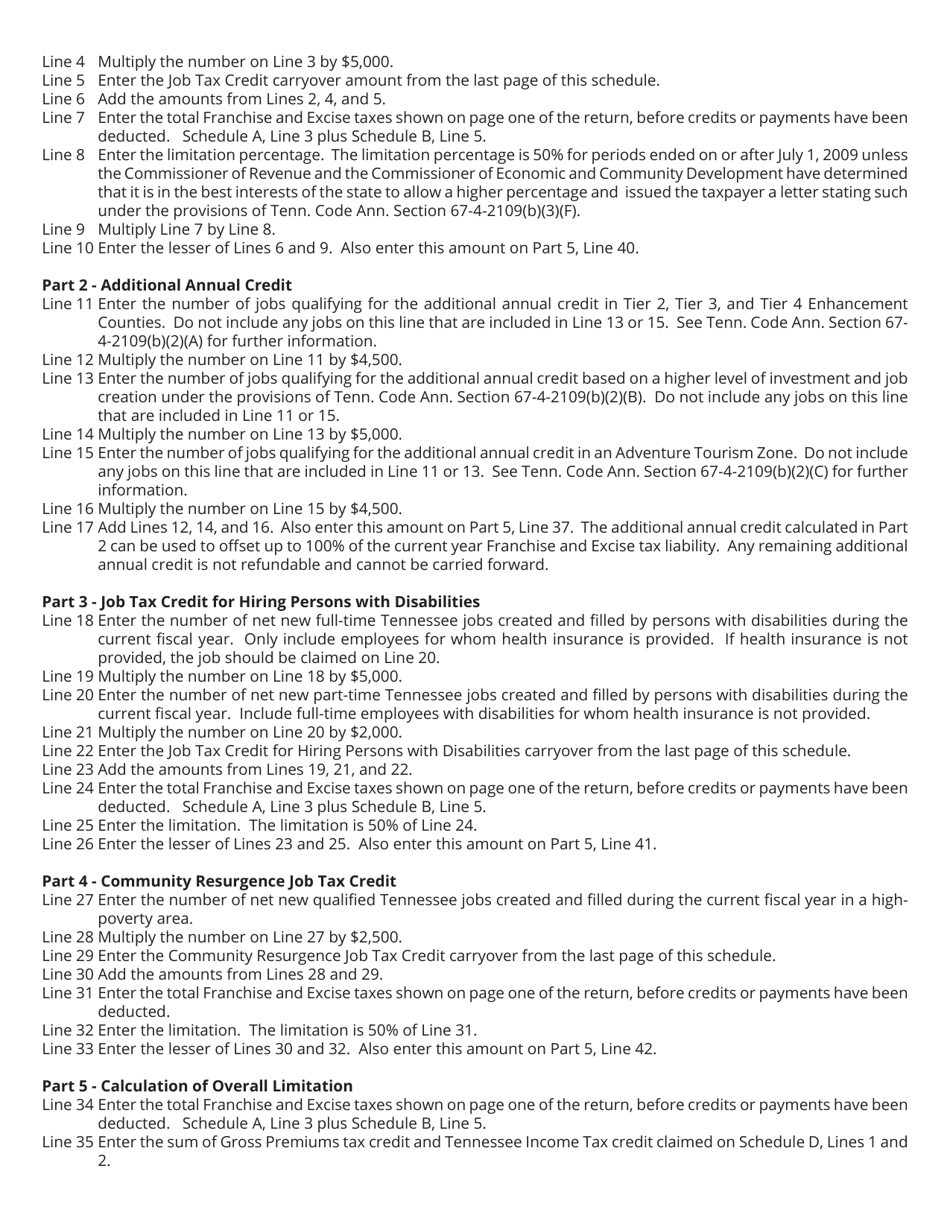

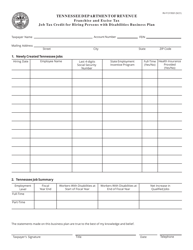

Form RV-F1402401 Schedule X Franchise and Excise Tax Job Credit Computation - Tennessee

What Is Form RV-F1402401 Schedule X?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RV-F1402401?

A: Form RV-F1402401 is the Schedule X for computing the Job Credit for Franchise and Excise Tax in Tennessee.

Q: What is the purpose of Schedule X?

A: The purpose of Schedule X is to calculate the Job Credit for Franchise and Excise Tax.

Q: What is the Job Credit for Franchise and Excise Tax?

A: The Job Credit for Franchise and Excise Tax is a credit that businesses in Tennessee can claim based on the number of qualified jobs created.

Q: Who can use Form RV-F1402401?

A: Form RV-F1402401 can be used by businesses in Tennessee that are eligible for the Job Credit for Franchise and Excise Tax.

Q: How does the Job Credit work?

A: The Job Credit is calculated by multiplying the qualified wages by the job credit factor, as specified on Schedule X.

Q: What are qualified jobs?

A: Qualified jobs are jobs that meet certain criteria set by the Tennessee Department of Revenue.

Q: Are there any deadlines for filing Form RV-F1402401?

A: Yes, Form RV-F1402401 should be filed by the due date of the Franchise and Excise Tax return for the corresponding tax year.

Q: Are there any additional requirements for claiming the Job Credit?

A: Yes, there may be additional requirements, such as documentation of qualified job creation and other supporting documents. It is recommended to review the instructions of Form RV-F1402401 for more details.

Q: Can I claim the Job Credit for previous tax years?

A: No, the Job Credit can only be claimed for the current tax year.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-F1402401 Schedule X by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.