This version of the form is not currently in use and is provided for reference only. Download this version of

Form SC2210

for the current year.

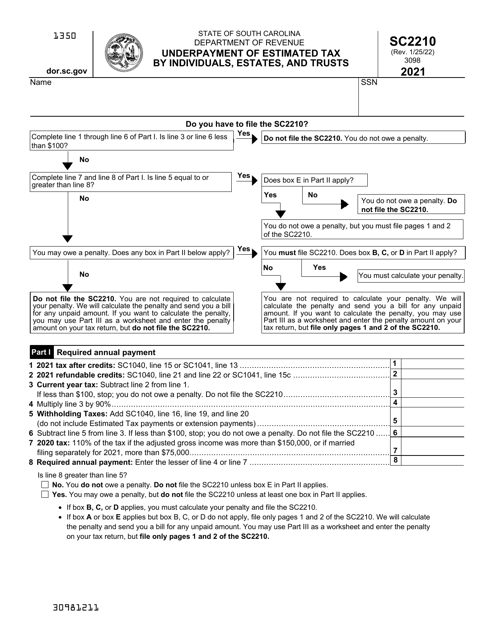

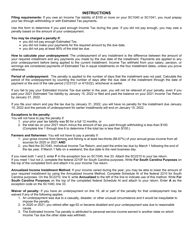

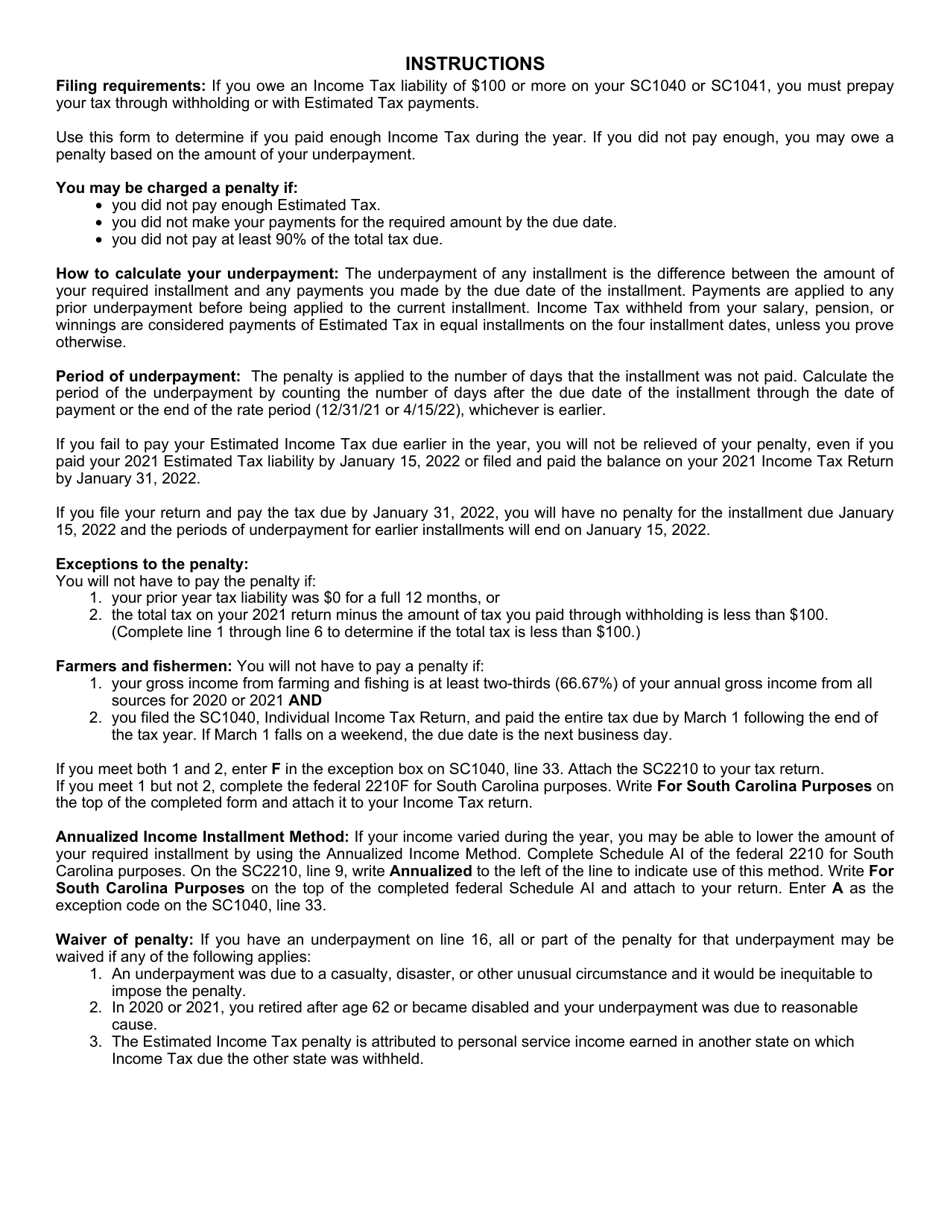

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina

What Is Form SC2210?

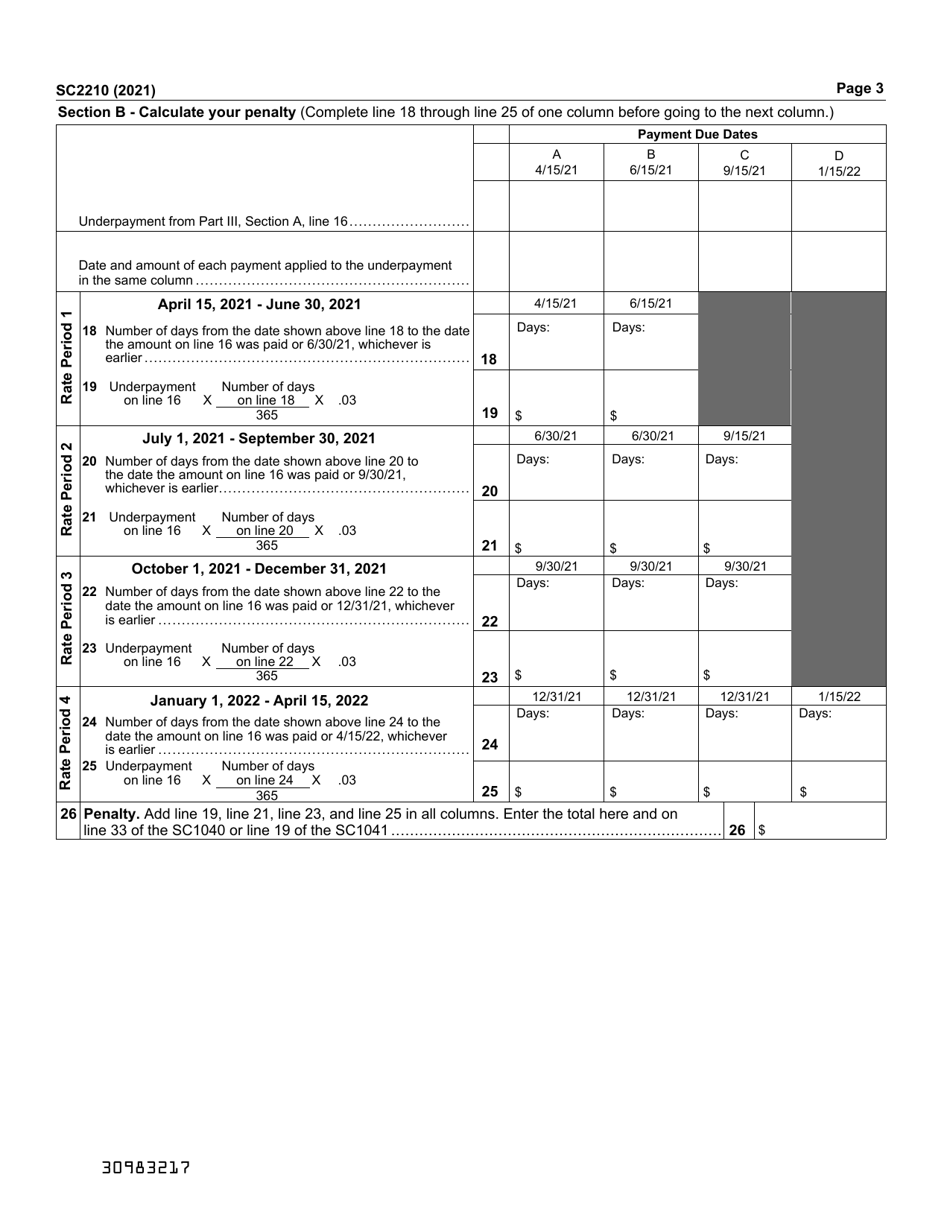

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC2210?

A: Form SC2210 is a form used to calculate and report underpayment of estimated tax by individuals, estates, and trusts in South Carolina.

Q: Who needs to file Form SC2210?

A: Individuals, estates, and trusts in South Carolina who did not pay enough estimated tax during the year may need to file Form SC2210.

Q: When is Form SC2210 due?

A: Form SC2210 is generally due on April 15th of the year following the tax year in question.

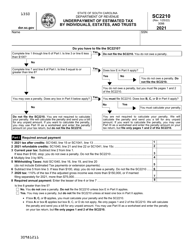

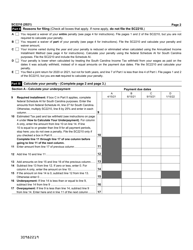

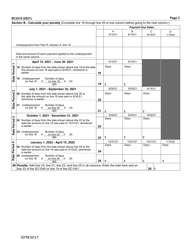

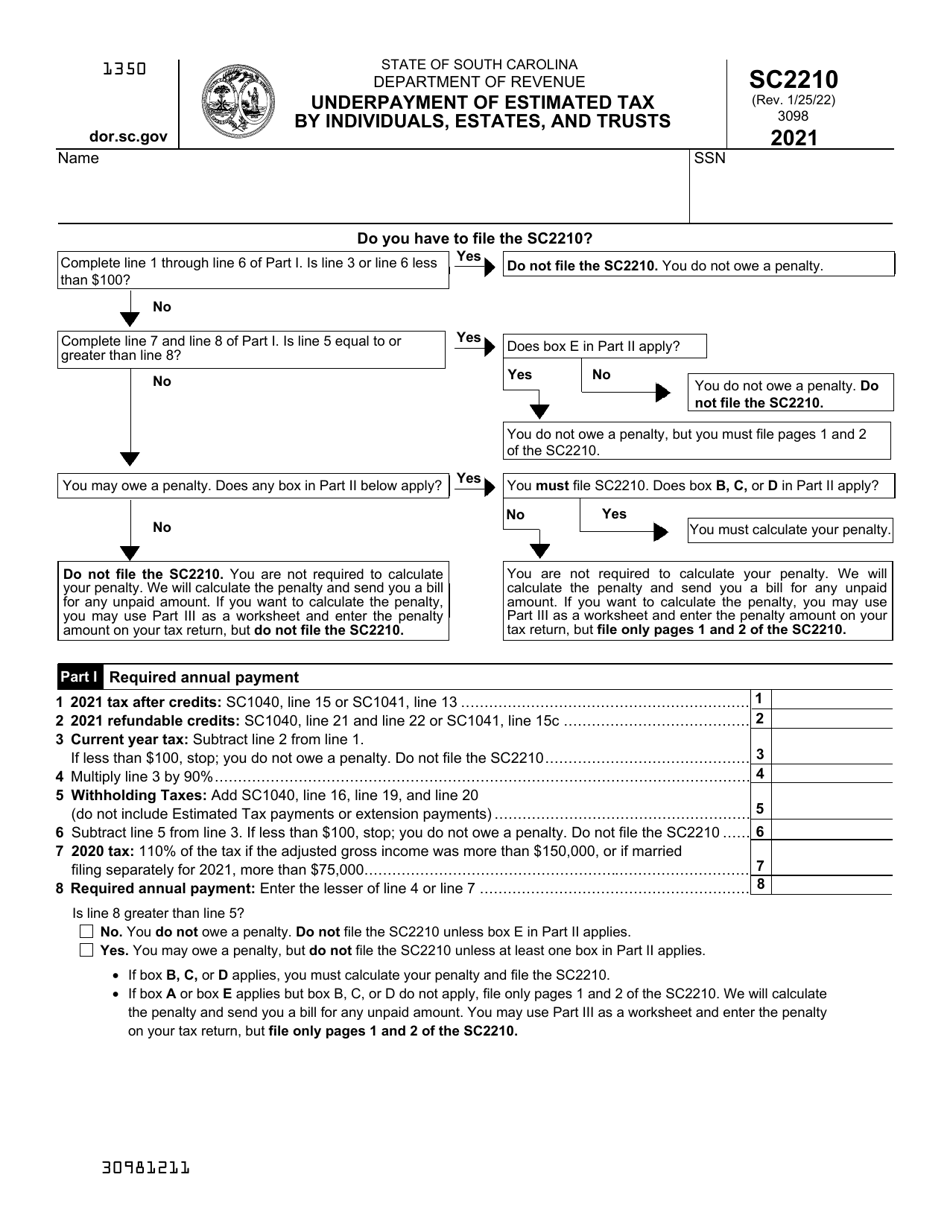

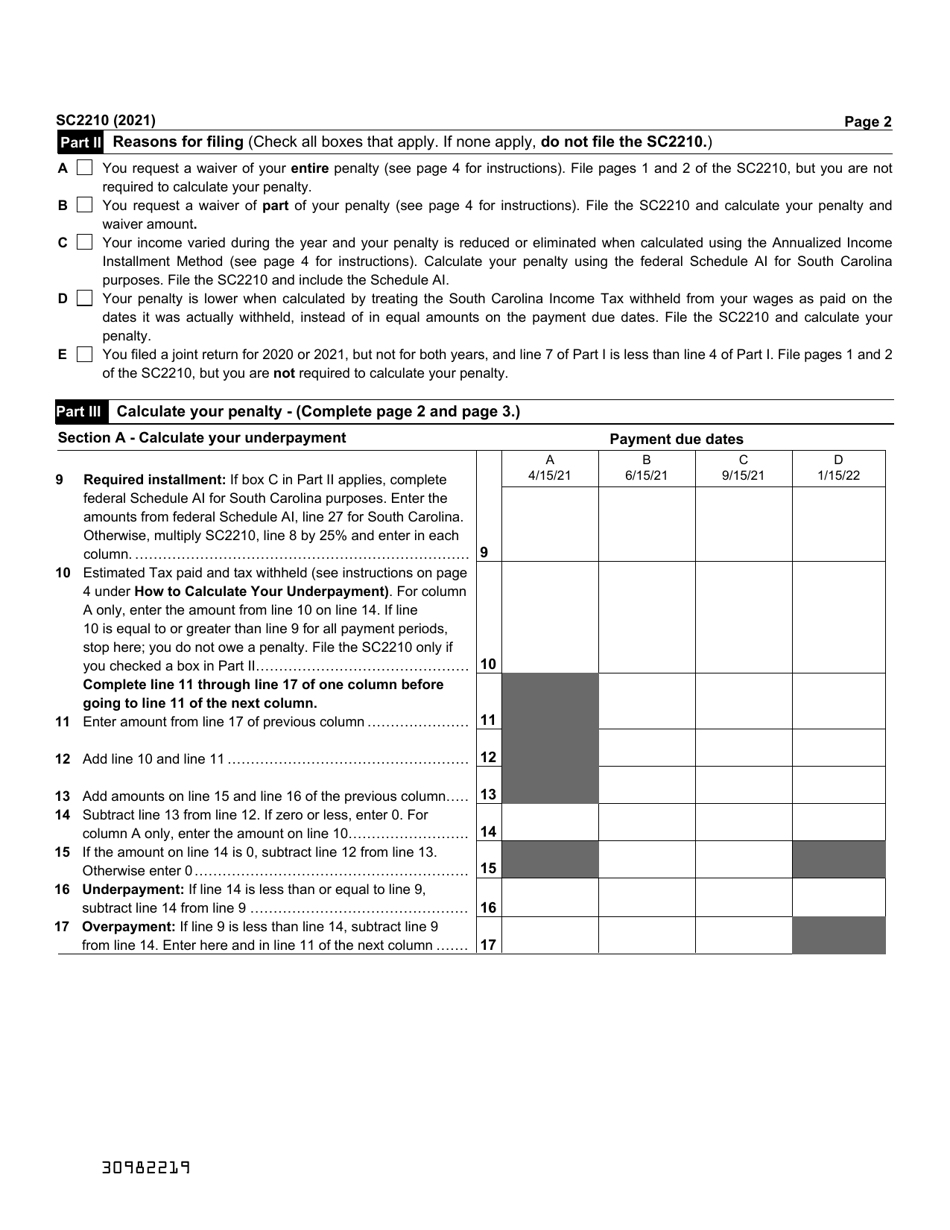

Q: How do I calculate the underpayment penalty?

A: The underpayment penalty is calculated based on the amount of the underpayment and the length of time it remains unpaid. You can use the instructions on Form SC2210 to calculate the penalty.

Q: Can I file Form SC2210 electronically?

A: As of now, South Carolina does not offer electronic filing for Form SC2210. It must be filed by mail.

Form Details:

- Released on January 25, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC2210 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.