This version of the form is not currently in use and is provided for reference only. Download this version of

Form I-319

for the current year.

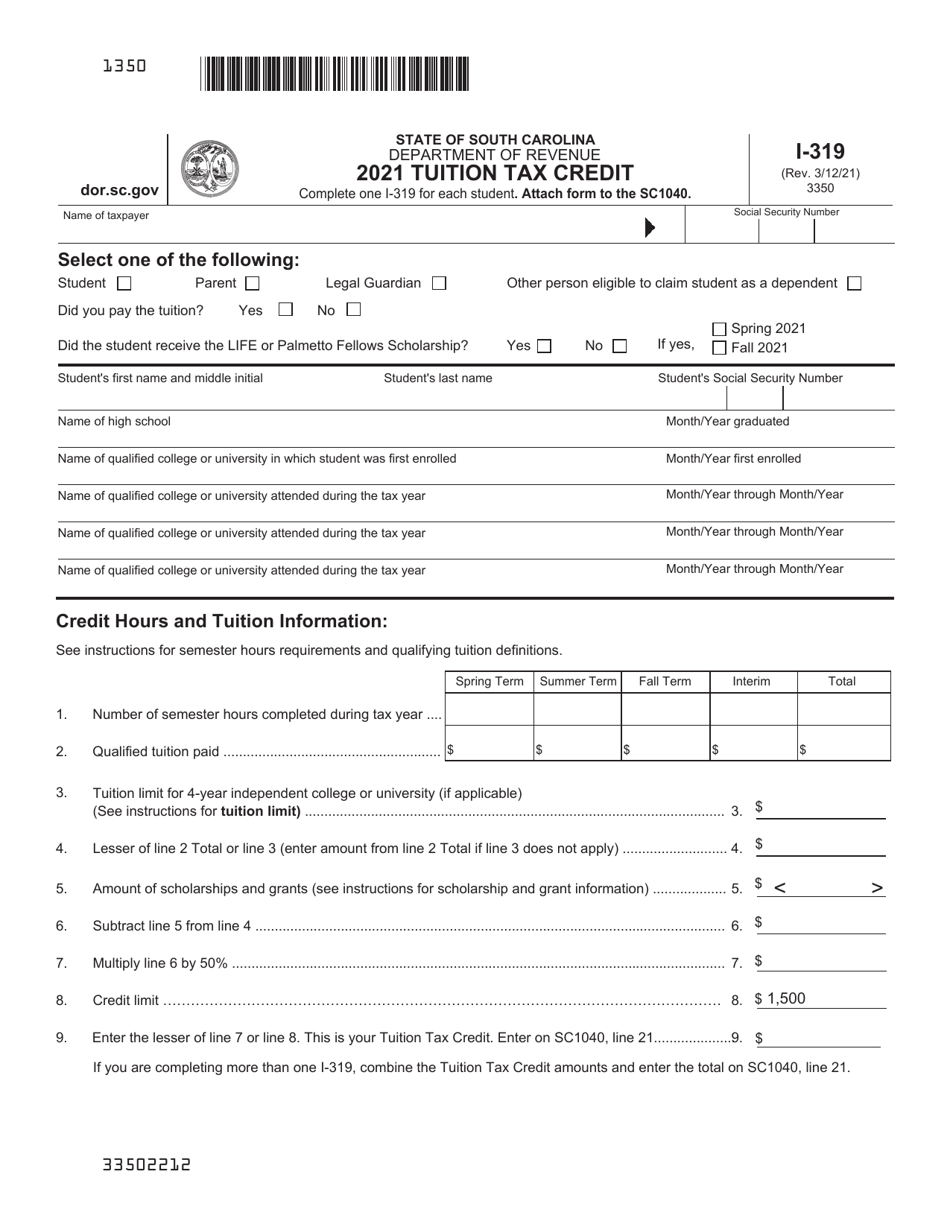

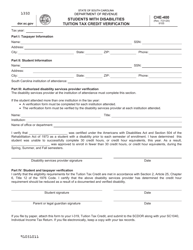

Form I-319 Tuition Tax Credit - South Carolina

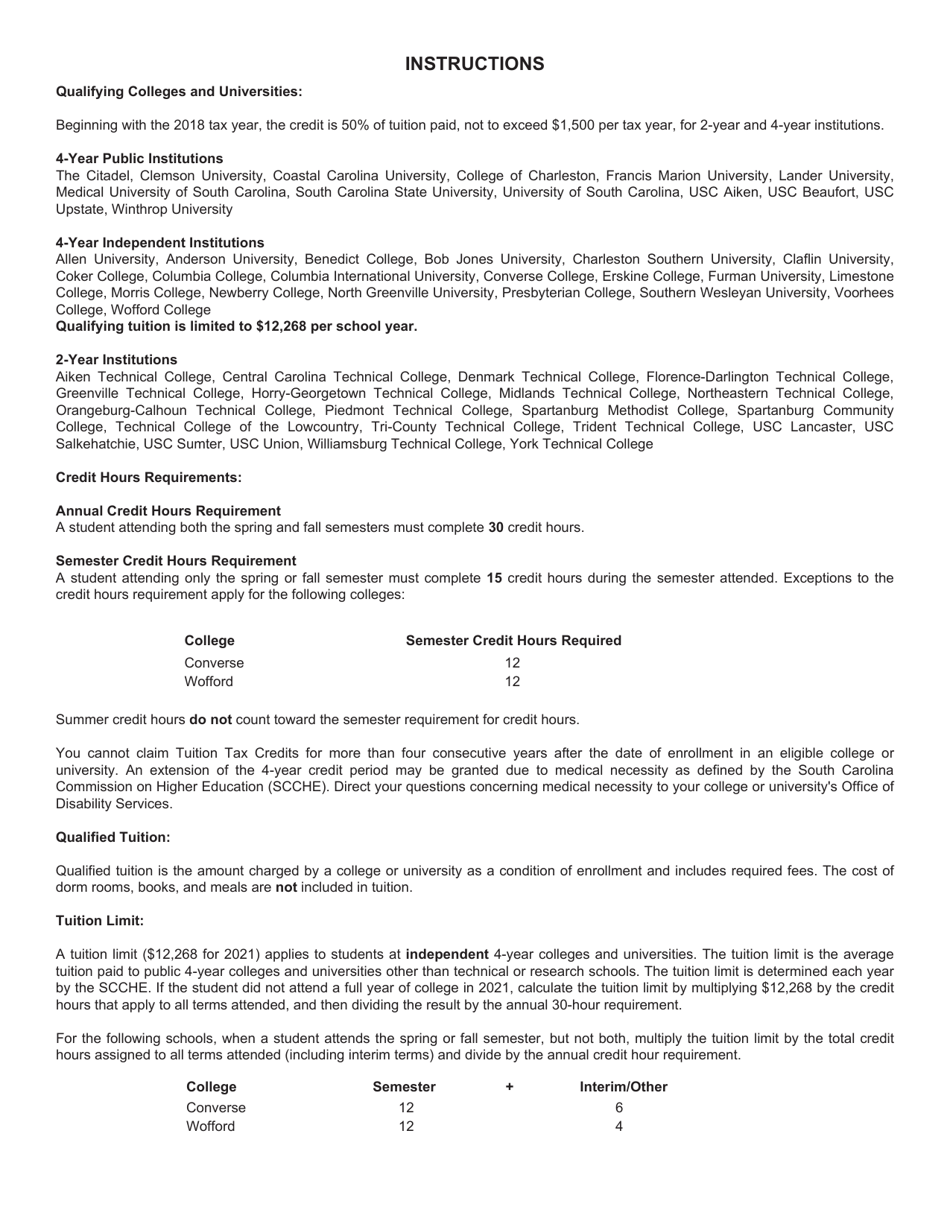

What Is Form I-319?

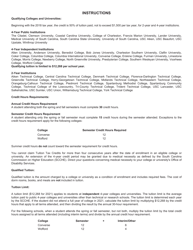

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

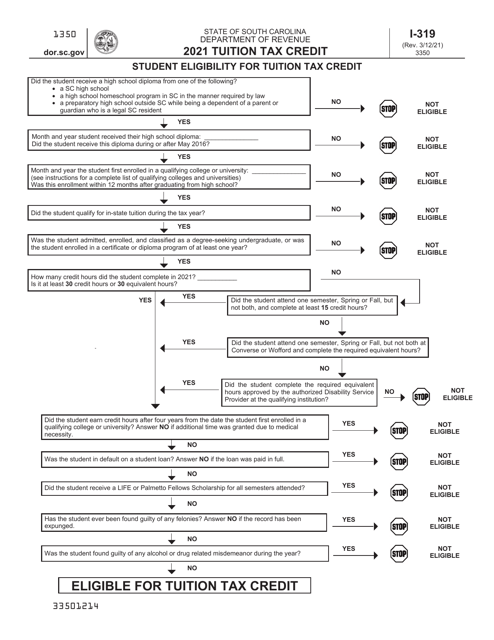

Q: What is Form I-319?

A: Form I-319 is the application for the tuition tax credit in South Carolina.

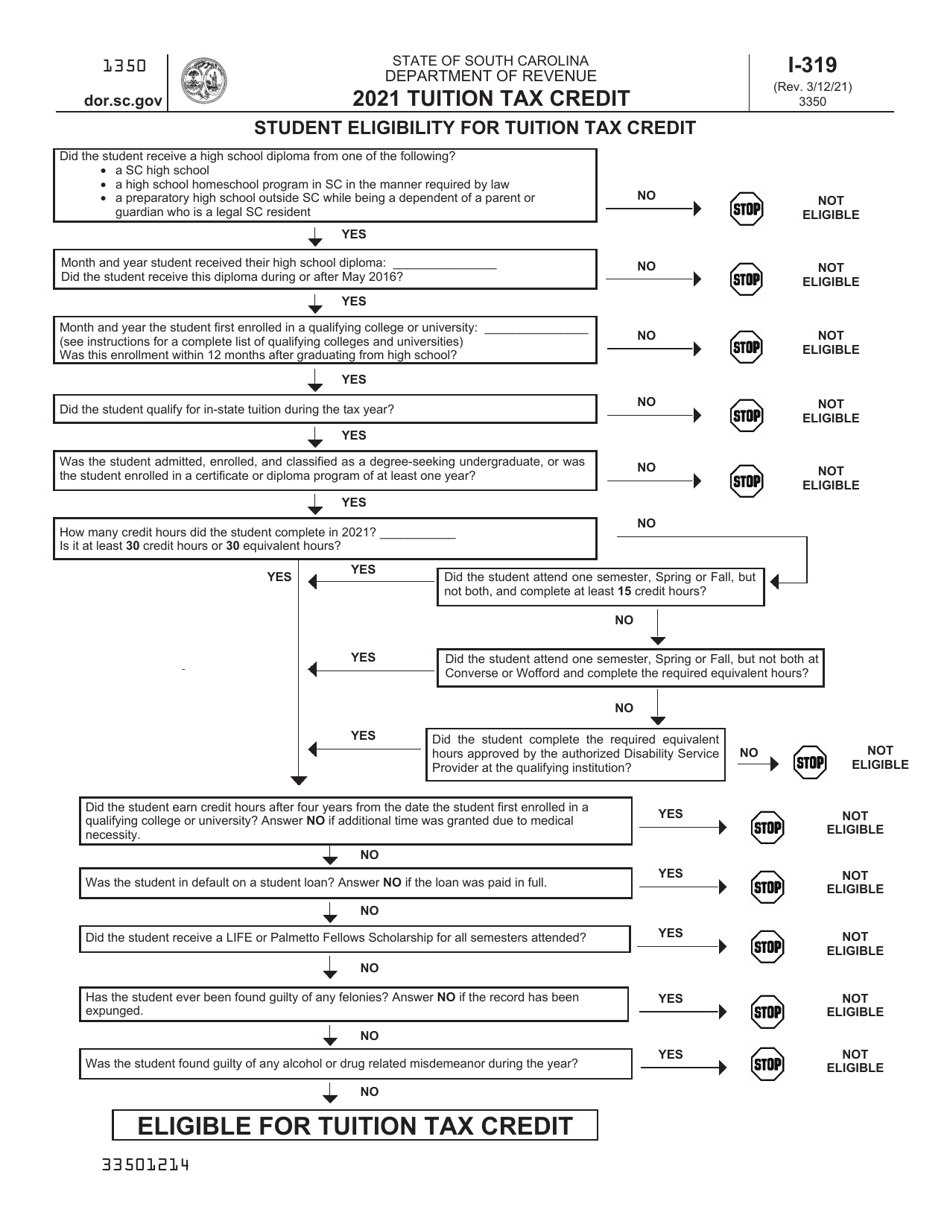

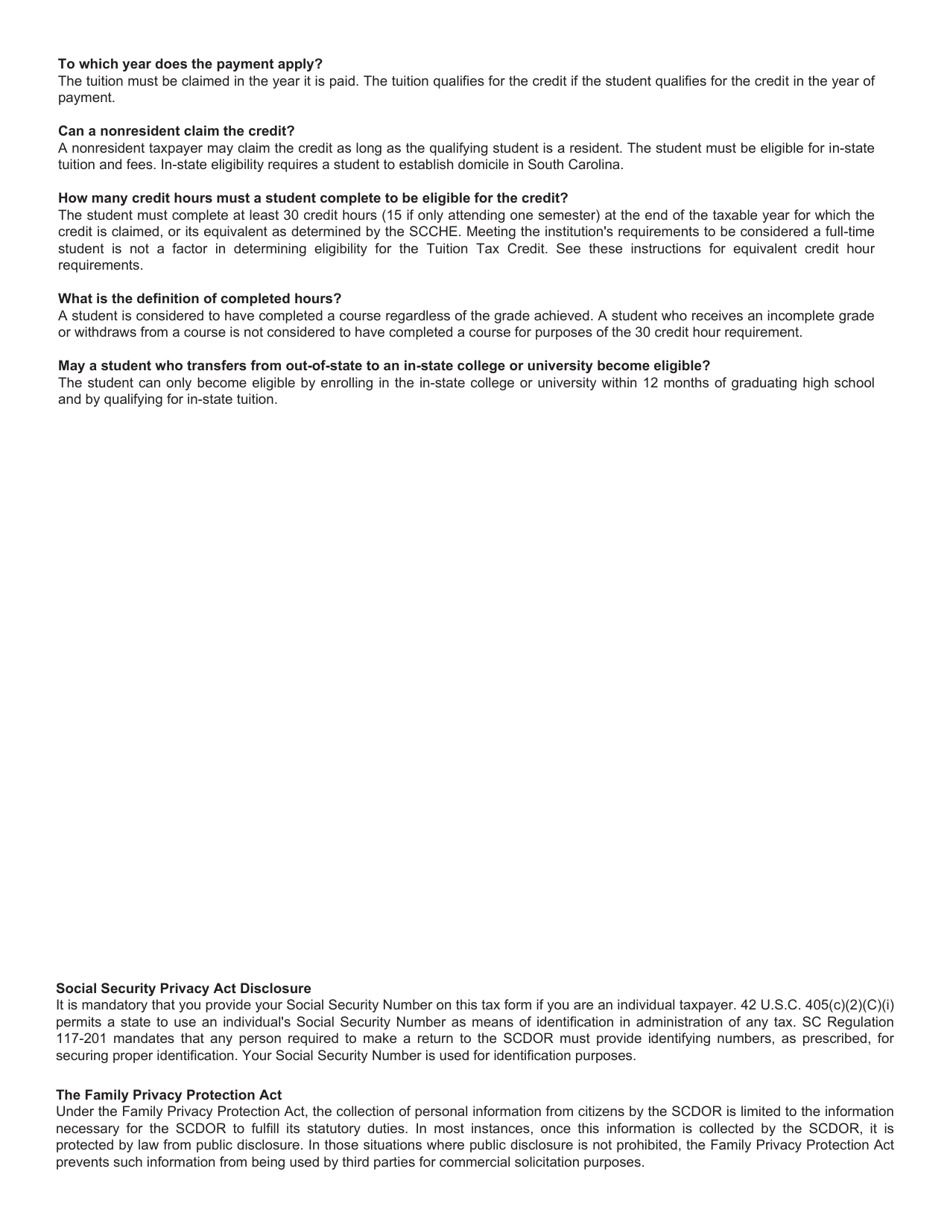

Q: Who is eligible for the tuition tax credit in South Carolina?

A: Eligibility for the tuition tax credit in South Carolina is based on certain criteria, including income and residency requirements.

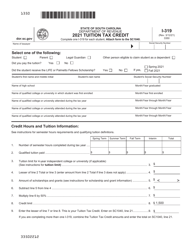

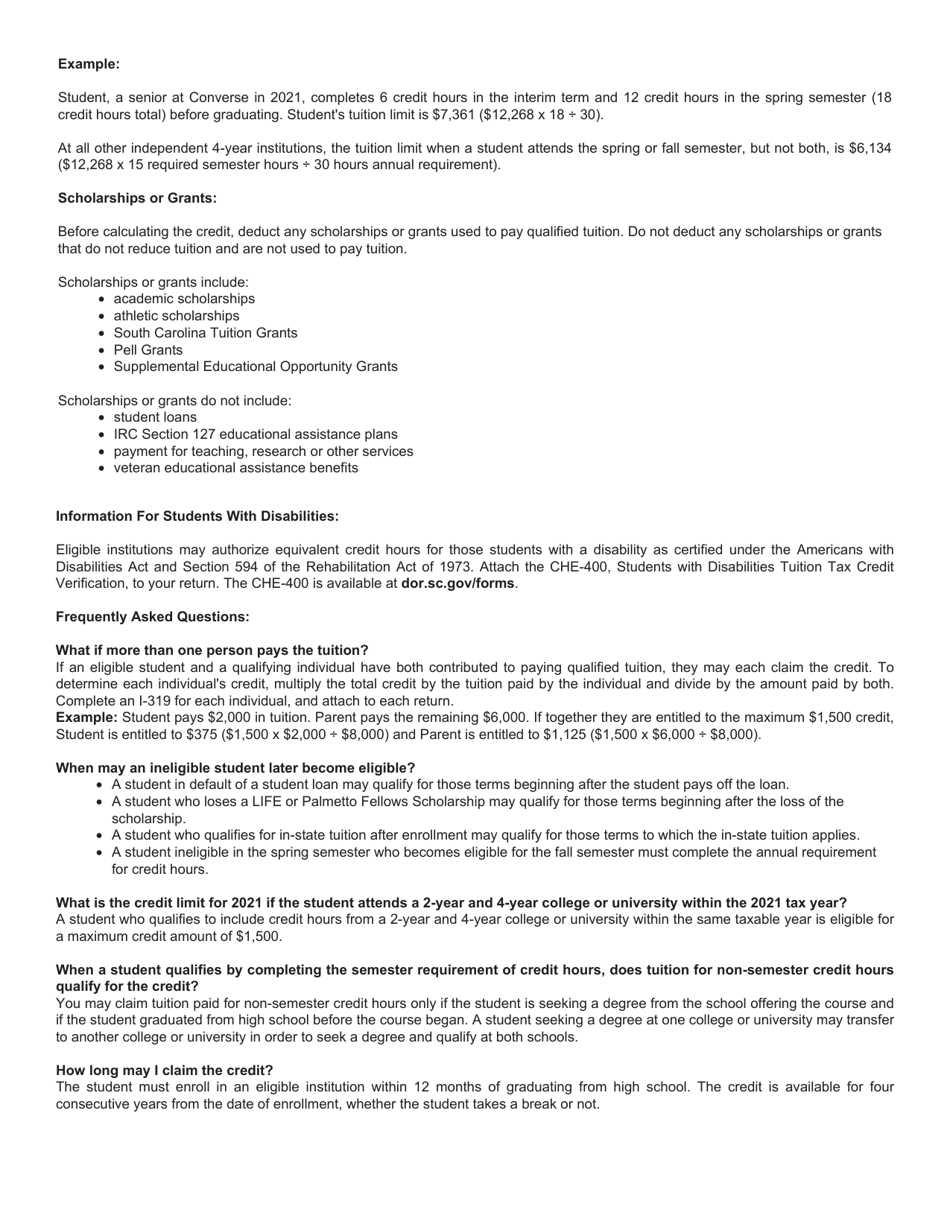

Q: What expenses are eligible for the tuition tax credit?

A: Eligible expenses for the tuition tax credit in South Carolina include tuition and certain fees paid to eligible educational institutions.

Q: How much is the tuition tax credit in South Carolina?

A: The amount of the tuition tax credit in South Carolina varies depending on the individual's circumstances and the available tax credits.

Form Details:

- Released on March 12, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-319 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.