This version of the form is not currently in use and is provided for reference only. Download this version of

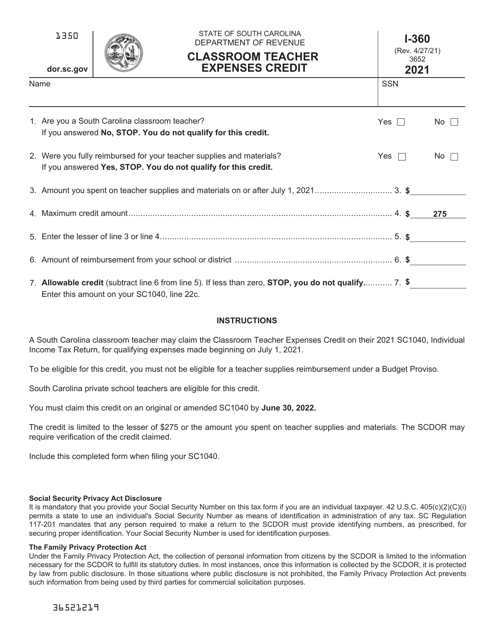

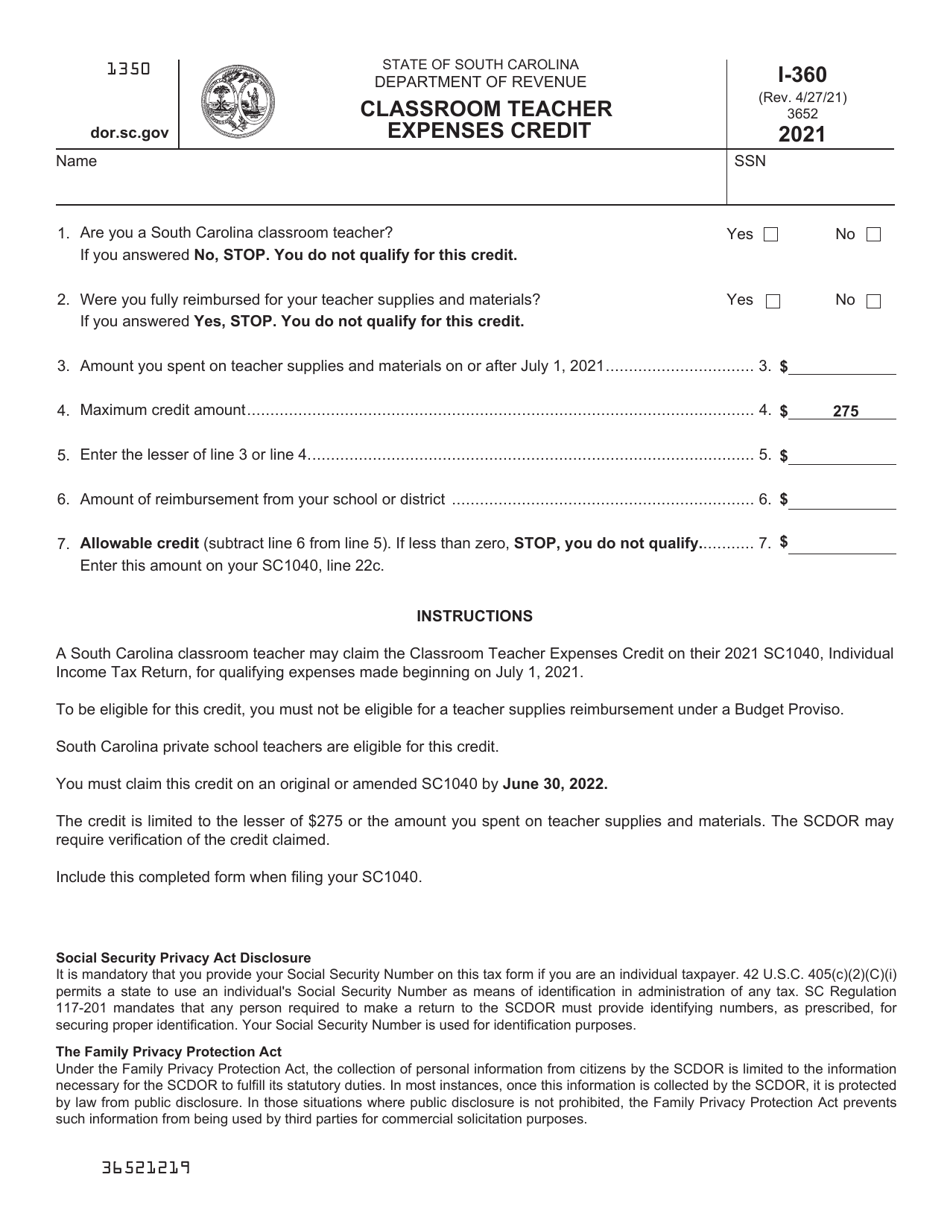

Form I-360

for the current year.

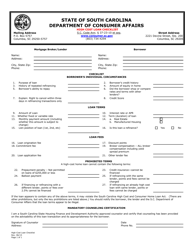

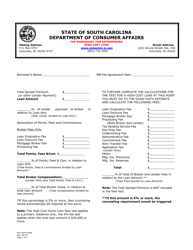

Form I-360 Classroom Teacher Expenses Credit - South Carolina

What Is Form I-360?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-360 Classroom Teacher Expenses Credit?

A: Form I-360 Classroom Teacher Expenses Credit is a tax credit offered in South Carolina for eligible classroom teachers.

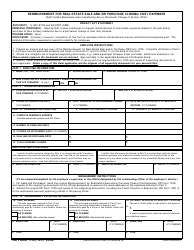

Q: Who can claim the Form I-360 Classroom Teacher Expenses Credit?

A: Only eligible classroom teachers in South Carolina can claim the Form I-360 Classroom Teacher Expenses Credit.

Q: What are the eligibility criteria for claiming this tax credit?

A: To be eligible, you must be a certified teacher in South Carolina, employed in a K-12 public school or an early childhoodeducation program, and have out-of-pocket expenses for classroom supplies.

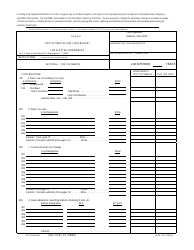

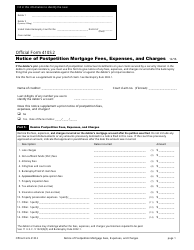

Q: What expenses are considered for this tax credit?

A: Expenses such as books, classroom supplies, and instructional materials that are not reimbursed by your school or any other source can be considered for this tax credit.

Q: How much is the tax credit amount?

A: The tax credit amount is up to $275 per eligible classroom teacher.

Q: How can I claim the Form I-360 Classroom Teacher Expenses Credit?

A: To claim this tax credit, you need to complete Form I-360 and include it with your South Carolina income tax return.

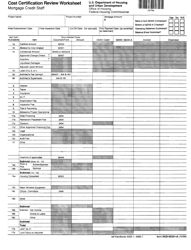

Q: Are there any documentation requirements for claiming this tax credit?

A: Yes, you will need to provide supporting documentation such as receipts or invoices that show the out-of-pocket expenses you incurred.

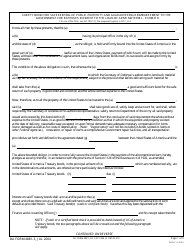

Q: Is there a deadline for claiming this tax credit?

A: Yes, you must claim the Form I-360 Classroom Teacher Expenses Credit on your South Carolina income tax return for the year in which the expenses were incurred.

Q: Can I claim this tax credit if I am not a certified teacher?

A: No, to claim this tax credit, you must be a certified teacher in South Carolina.

Form Details:

- Released on April 27, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-360 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.