This version of the form is not currently in use and is provided for reference only. Download this version of

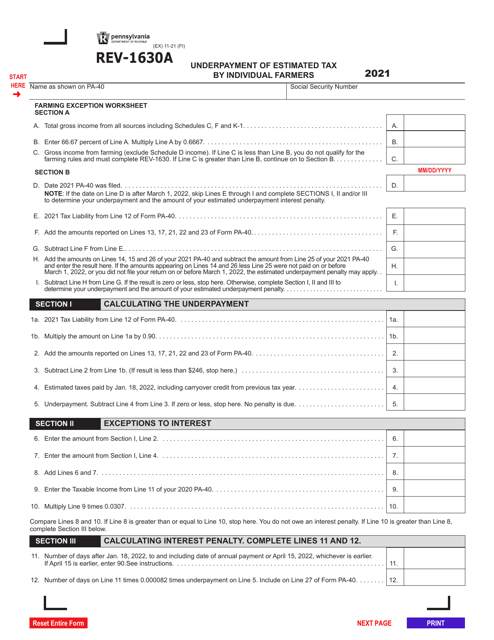

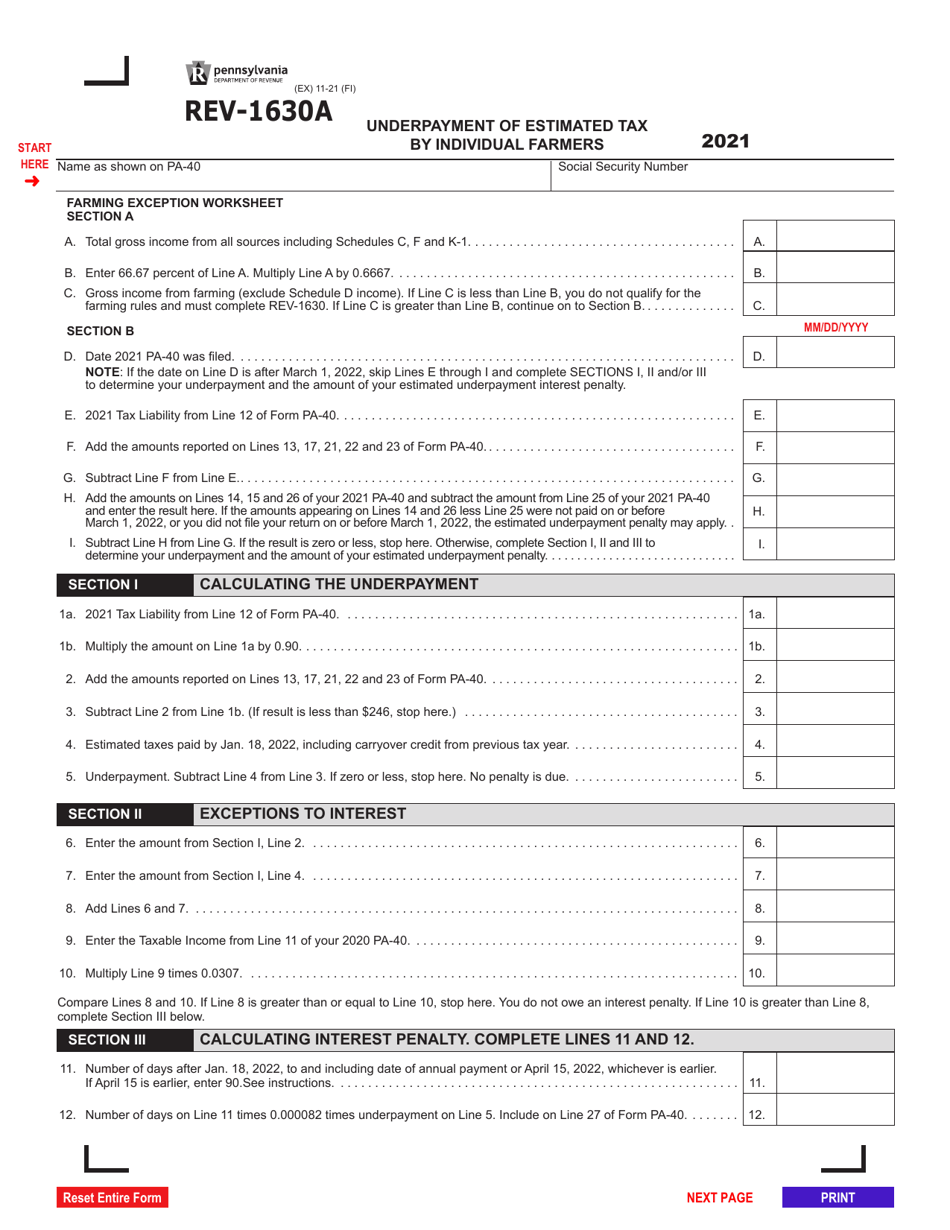

Form REV-1630A

for the current year.

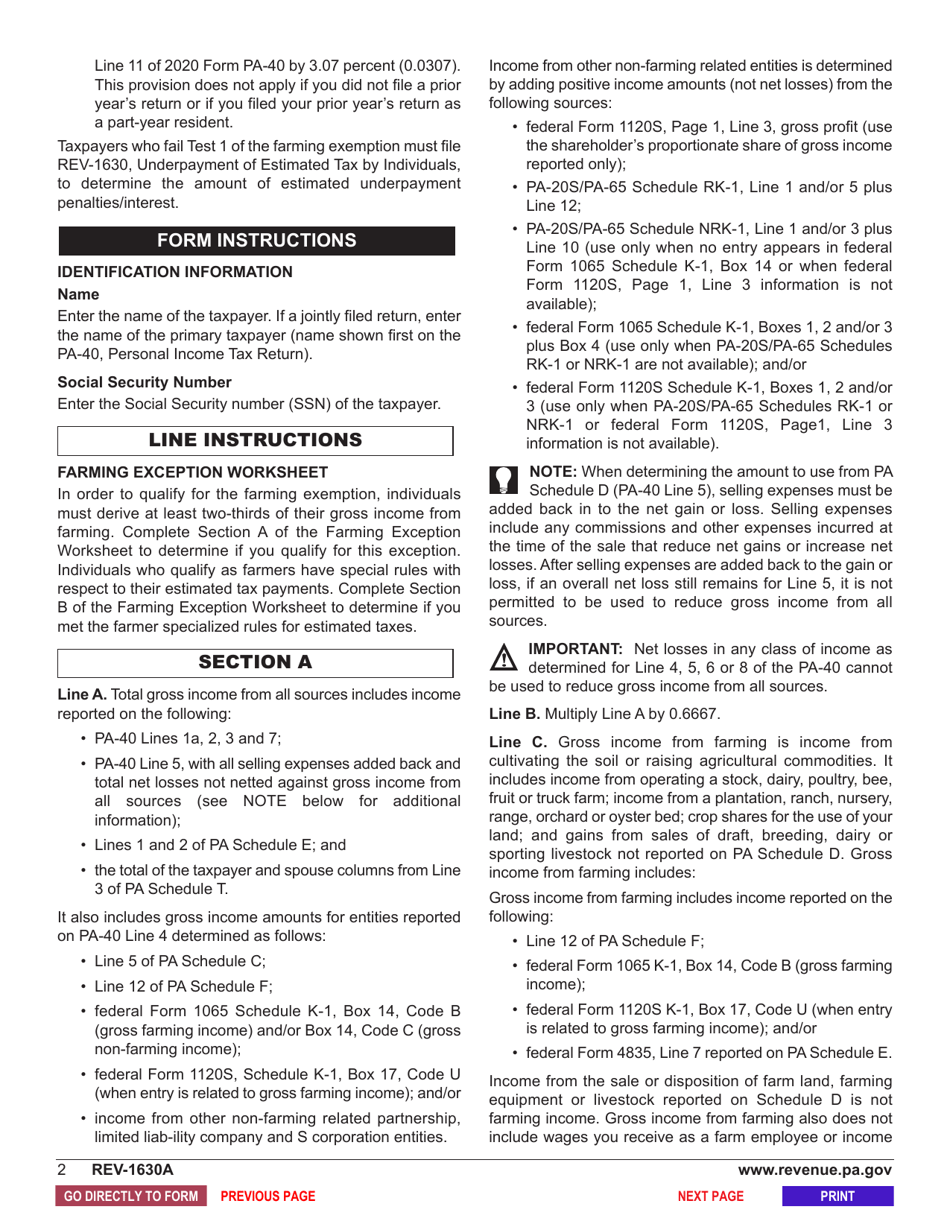

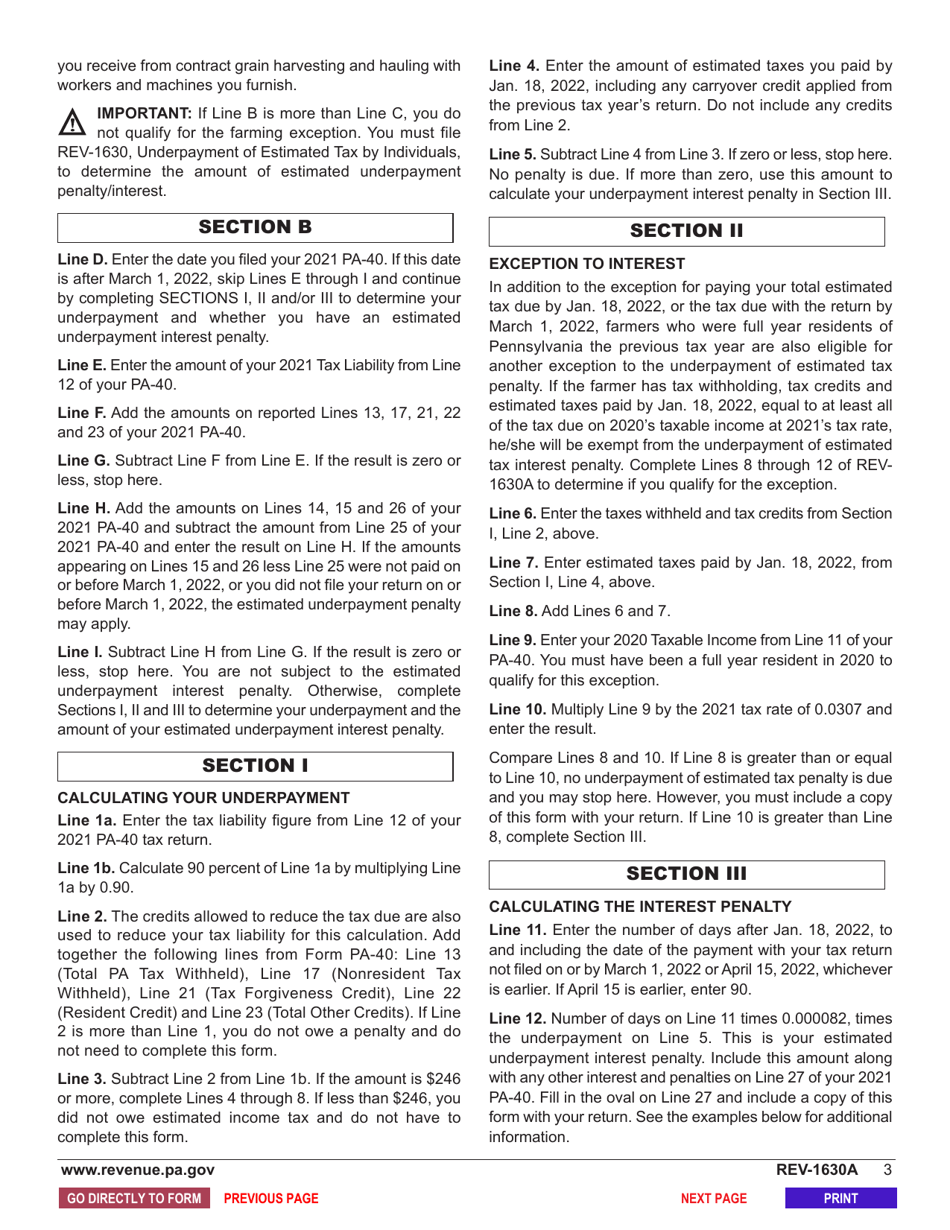

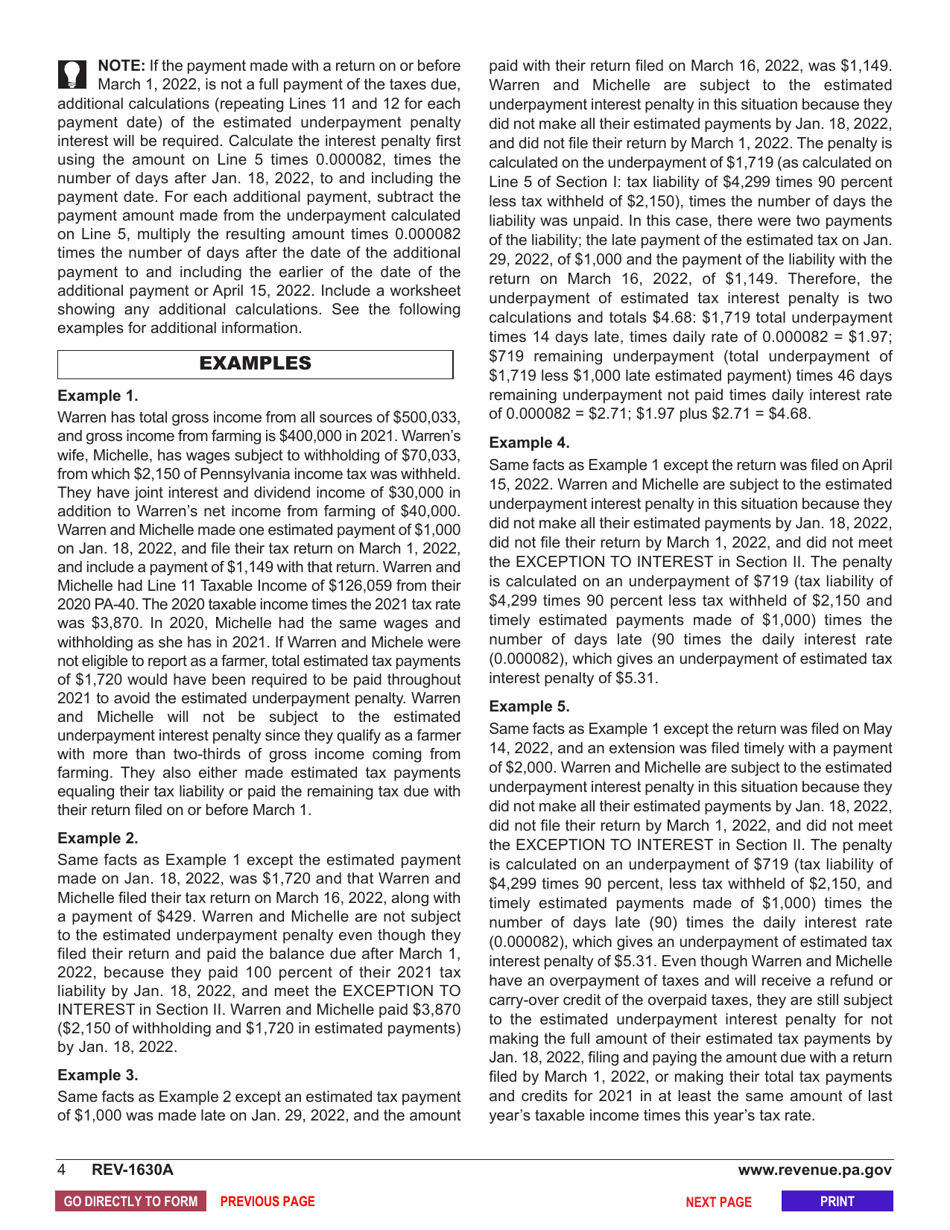

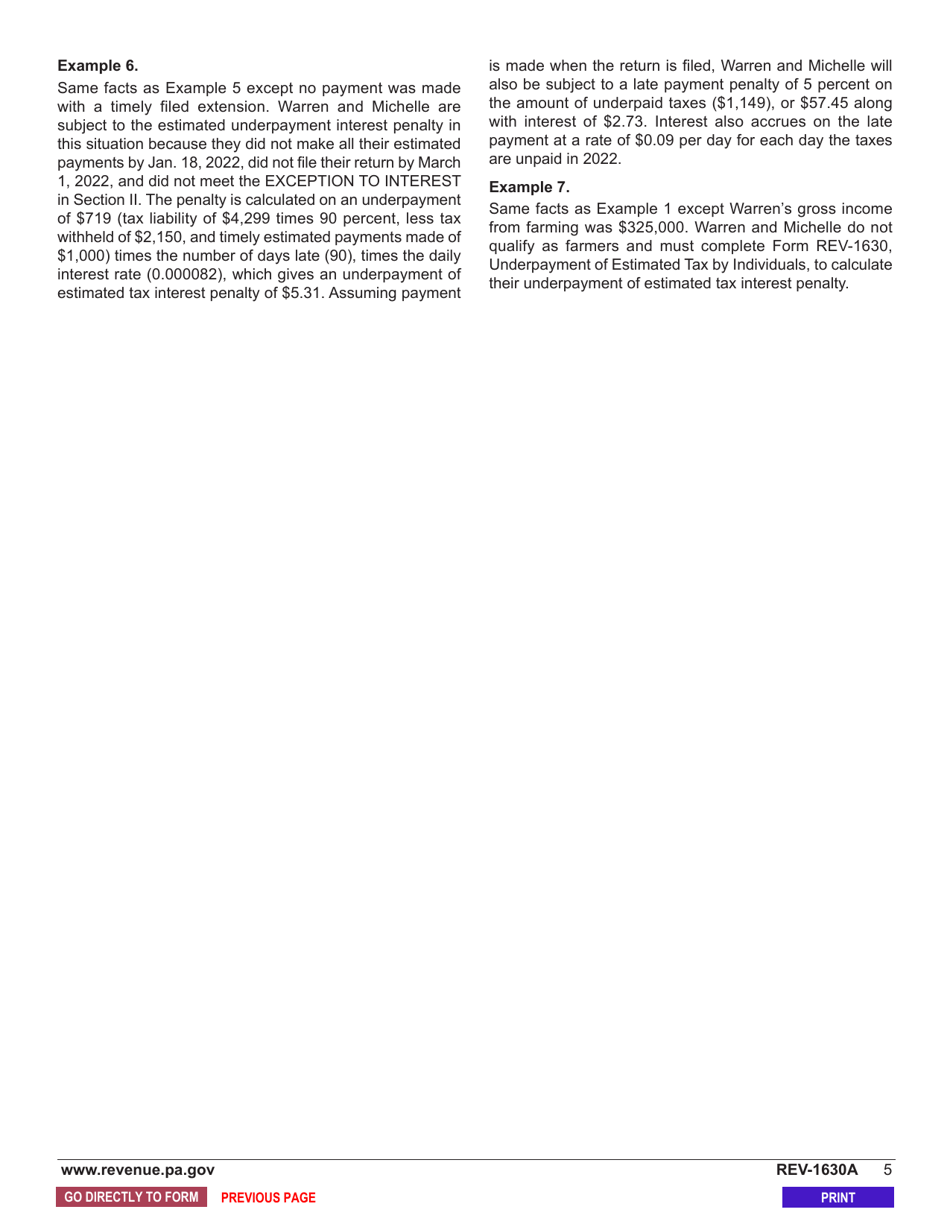

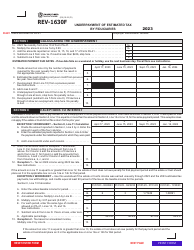

Form REV-1630A Underpayment of Estimated Tax by Individual Farmers - Pennsylvania

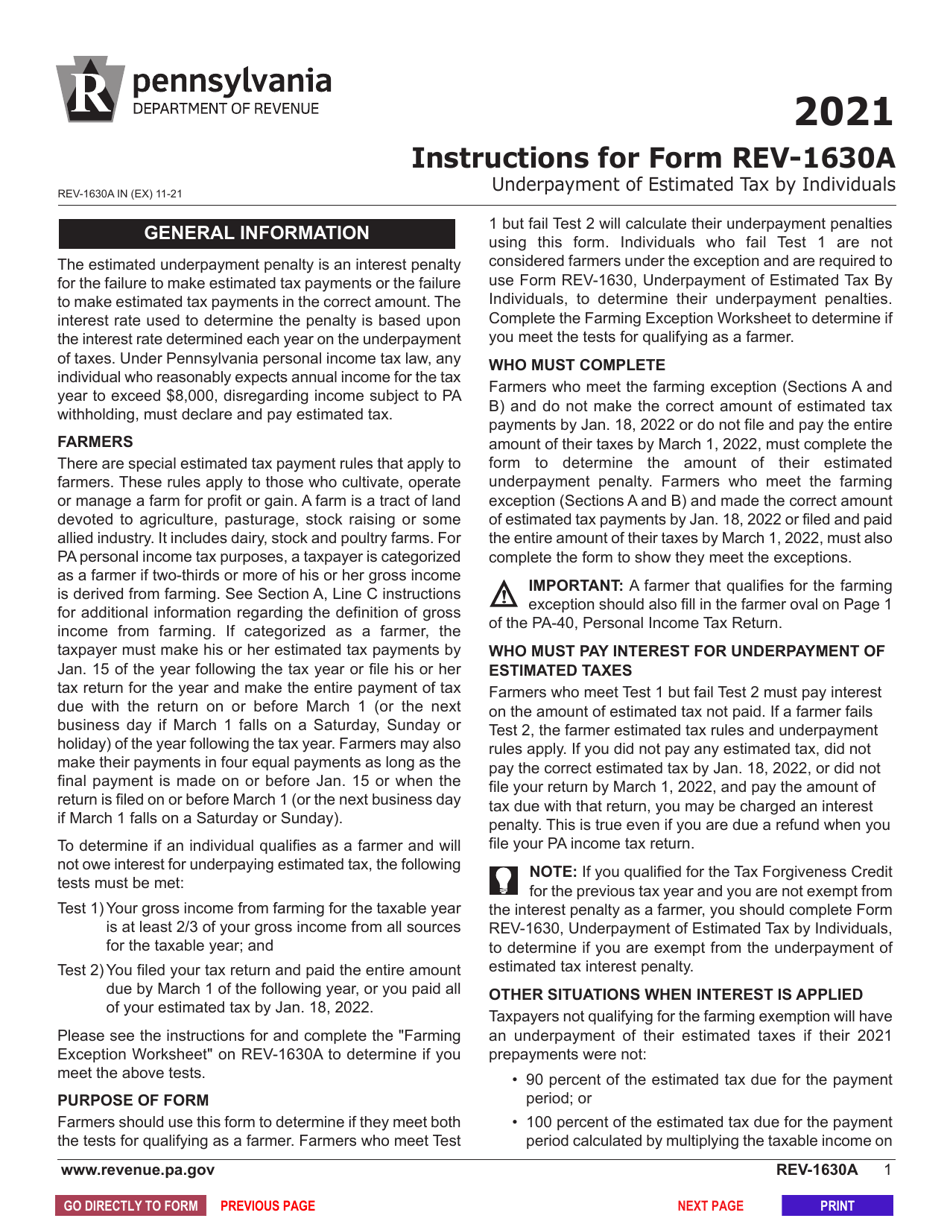

What Is Form REV-1630A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1630A?

A: Form REV-1630A is a tax form used by individual farmers in Pennsylvania to report underpayment of estimated tax.

Q: Who needs to file Form REV-1630A?

A: Individual farmers in Pennsylvania who underpaid their estimated tax during the tax year need to file Form REV-1630A.

Q: What is the purpose of Form REV-1630A?

A: The purpose of Form REV-1630A is to calculate and report the underpayment of estimated tax by individual farmers in Pennsylvania.

Q: When is Form REV-1630A due?

A: Form REV-1630A is due on the same date as your Pennsylvania personal income tax return, which is usually April 15th.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1630A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.