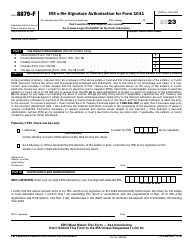

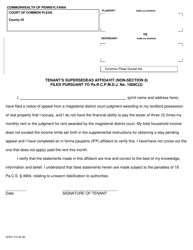

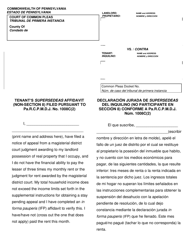

This version of the form is not currently in use and is provided for reference only. Download this version of

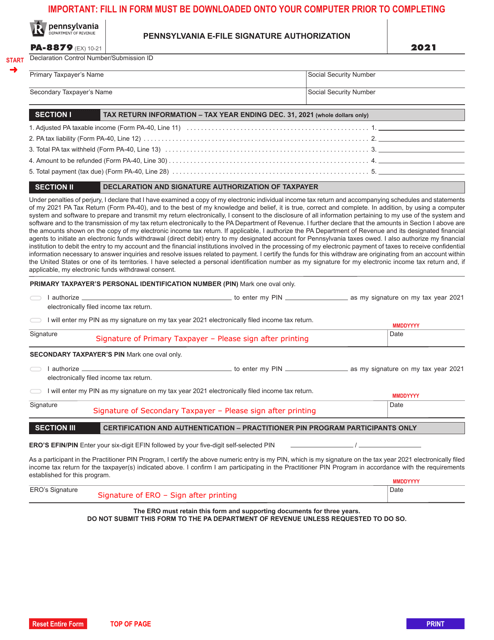

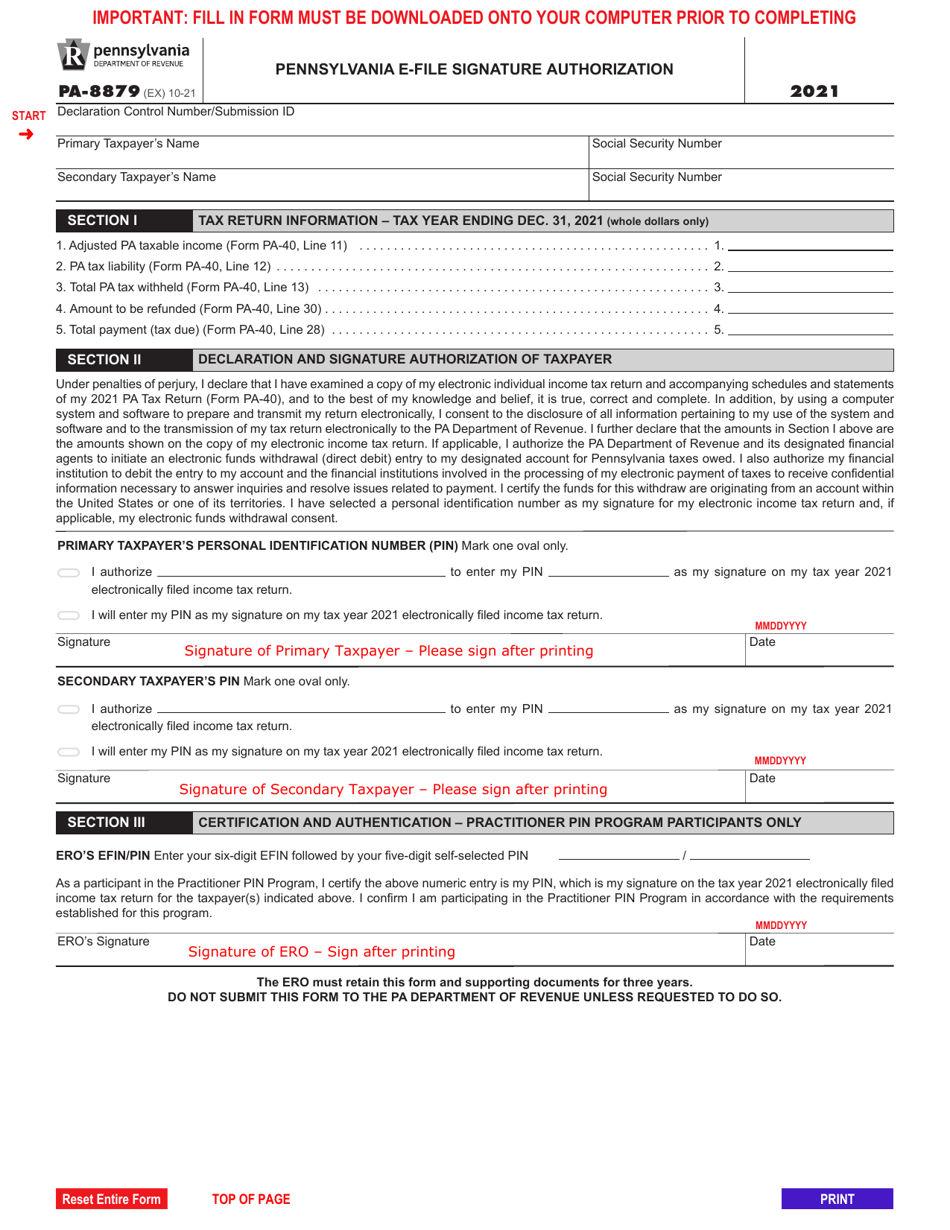

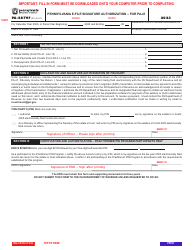

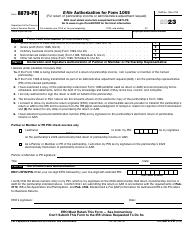

Form PA-8879

for the current year.

Form PA-8879 Pennsylvania E-File Signature Authorization - Pennsylvania

What Is Form PA-8879?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

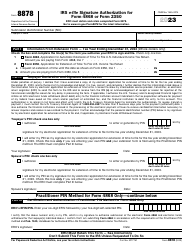

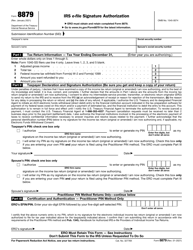

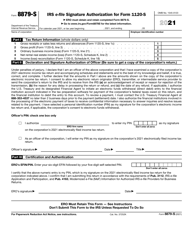

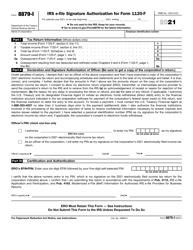

Q: What is Form PA-8879?

A: Form PA-8879 is an authorization form used in Pennsylvania to sign and authorize electronic filed tax returns.

Q: Why is Form PA-8879 needed?

A: Form PA-8879 is needed to authenticate the identity of the taxpayer and authorize the electronic submission of their tax return.

Q: Who needs to fill out Form PA-8879?

A: Form PA-8879 needs to be filled out by taxpayers in Pennsylvania who are filing their tax returns electronically.

Q: Can Form PA-8879 be submitted electronically?

A: No, Form PA-8879 cannot be submitted electronically. It must be signed manually and mailed to the appropriate address.

Q: What information is required on Form PA-8879?

A: Form PA-8879 requires the taxpayer's name, Social Security number, tax year, and signature.

Q: Can I use Form PA-8879 for multiple tax years?

A: No, Form PA-8879 is specific to the tax year it is filed for.

Q: When is the deadline to submit Form PA-8879?

A: The deadline to submit Form PA-8879 is the same as the deadline to file your tax return, which is typically April 15th.

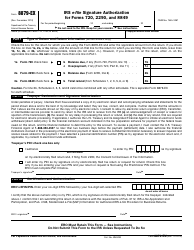

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8879 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.