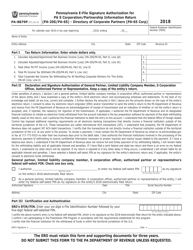

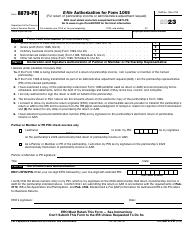

This version of the form is not currently in use and is provided for reference only. Download this version of

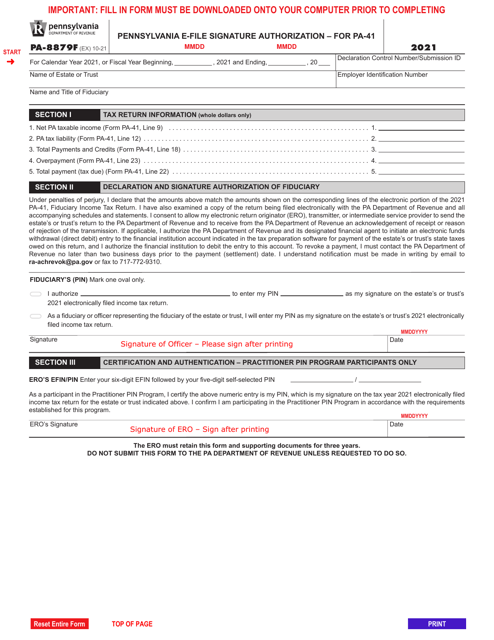

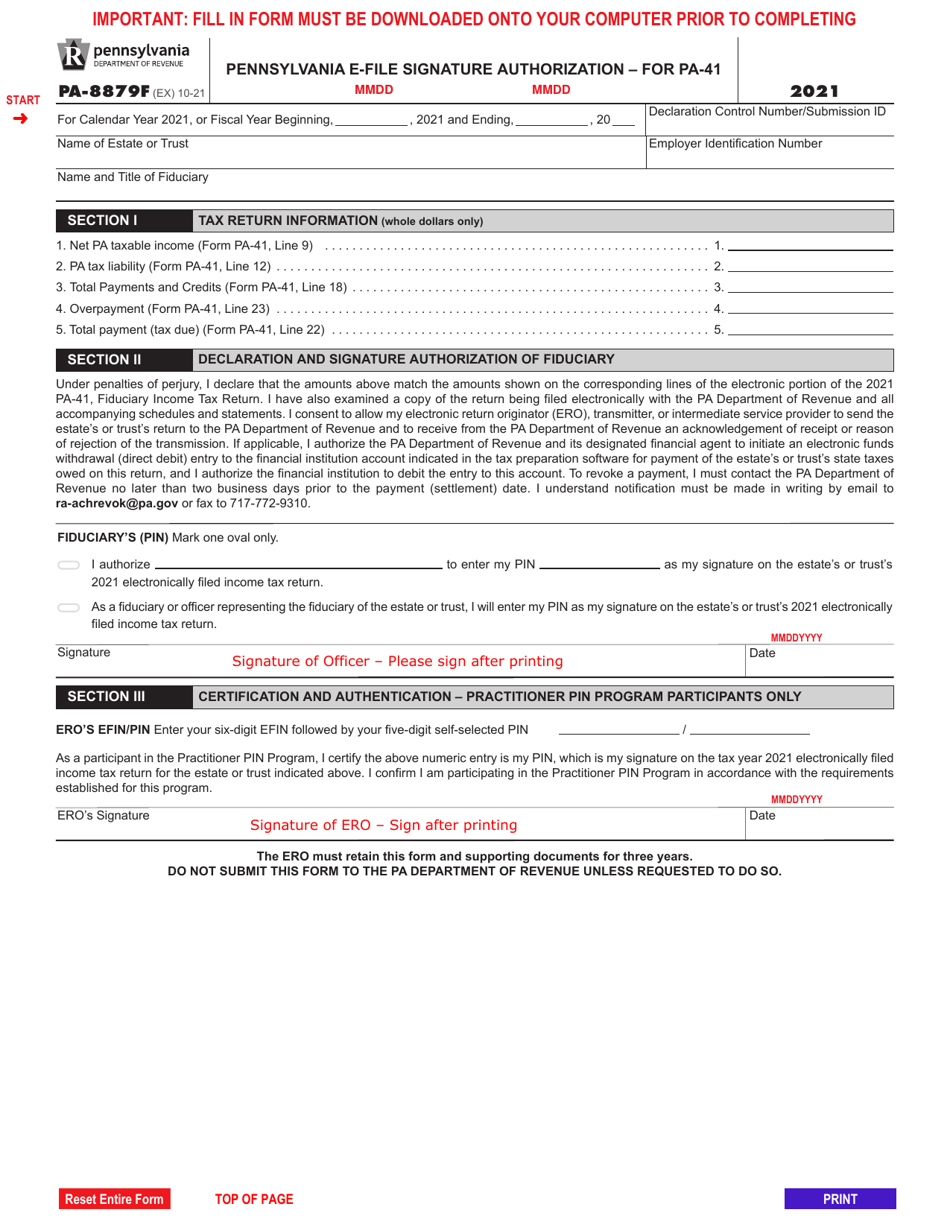

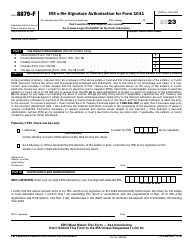

Form PA-8879F

for the current year.

Form PA-8879F Pennsylvania E-File Signature Authorization - for Pa-41 - Pennsylvania

What Is Form PA-8879F?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

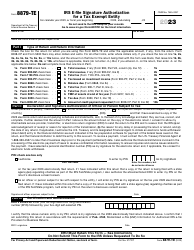

Q: What is Form PA-8879F?

A: Form PA-8879F is the Pennsylvania E-File Signature Authorization.

Q: Who needs to file Form PA-8879F?

A: Form PA-8879F needs to be filed by individuals or businesses in Pennsylvania who are filing their state tax returns electronically.

Q: What is the purpose of Form PA-8879F?

A: The purpose of Form PA-8879F is to authorize the electronic filing of state tax returns and to confirm the taxpayer's agreement with the information contained in the tax return.

Q: Is Form PA-8879F required for all taxpayers in Pennsylvania?

A: Form PA-8879F is required only for taxpayers who choose to file their state tax returns electronically.

Q: When should Form PA-8879F be filed?

A: Form PA-8879F should be filed before or along with the electronically filed state tax return.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8879F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.