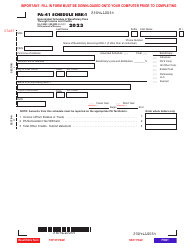

This version of the form is not currently in use and is provided for reference only. Download this version of

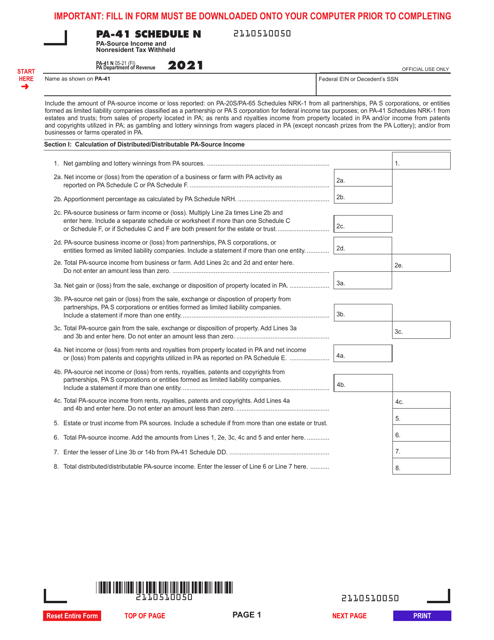

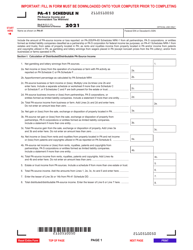

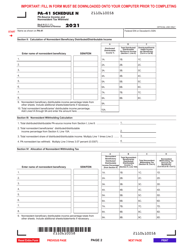

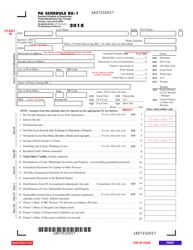

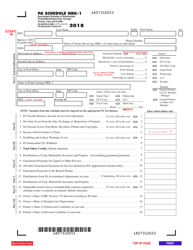

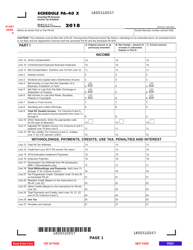

Form PA-41 Schedule N

for the current year.

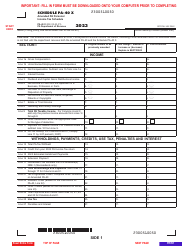

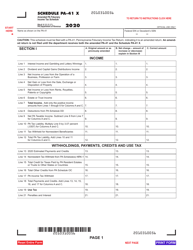

Form PA-41 Schedule N Pa-Source Income and Nonresident Tax Withheld - Pennsylvania

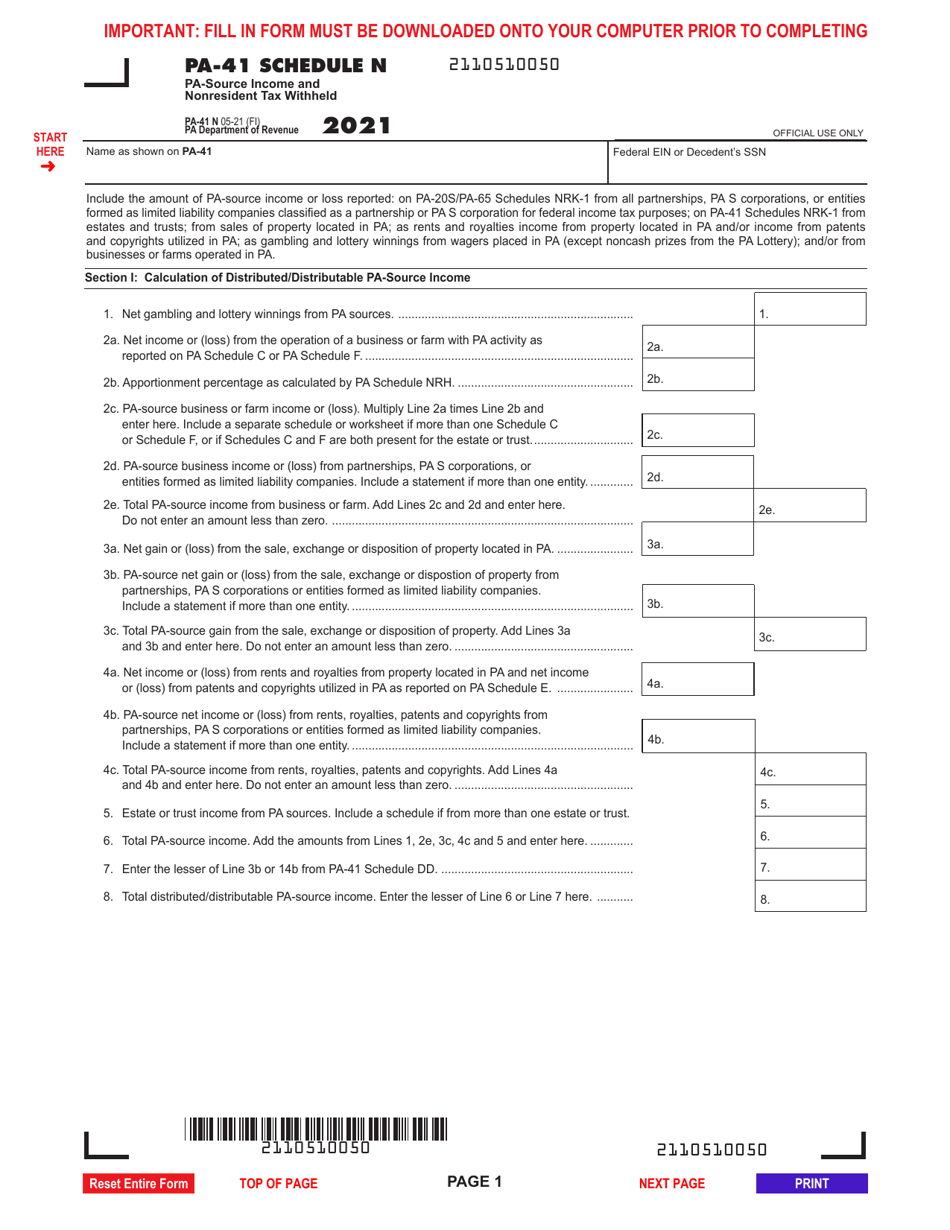

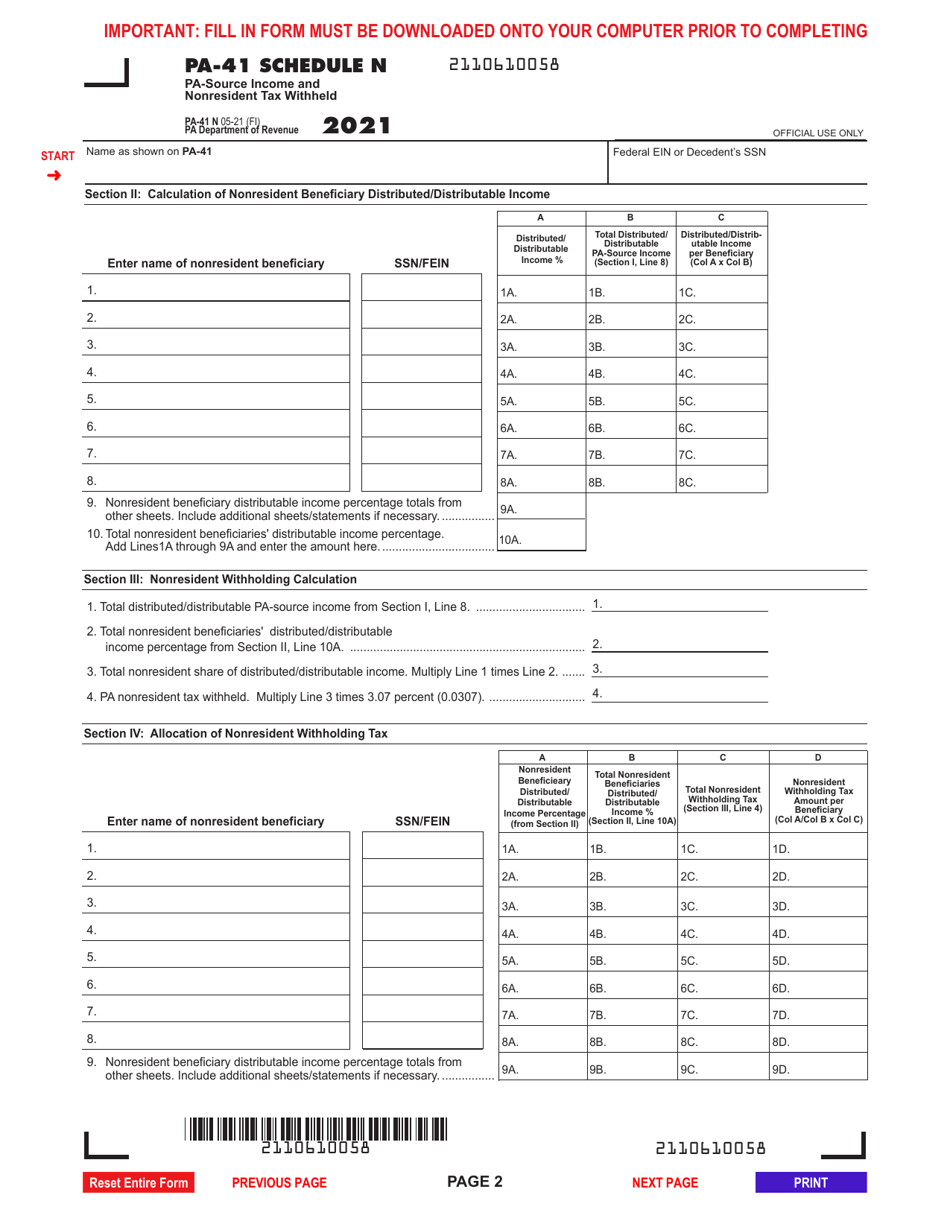

What Is Form PA-41 Schedule N?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule N?

A: Form PA-41 Schedule N is a tax form used in Pennsylvania to report Pa-Source Income and Nonresident Tax Withheld.

Q: What is Pa-Source Income?

A: Pa-Source Income refers to income earned or received from sources within Pennsylvania.

Q: Who needs to file Form PA-41 Schedule N?

A: Anyone who has Pa-Source Income or nonresident tax withheld in Pennsylvania may need to file Form PA-41 Schedule N.

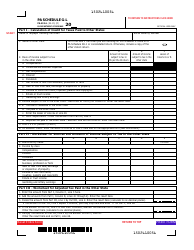

Q: What information is required on Form PA-41 Schedule N?

A: Form PA-41 Schedule N requires you to provide details about your Pa-Source Income and any nonresident tax withheld in Pennsylvania.

Q: When is the due date for filing Form PA-41 Schedule N?

A: The due date for filing Form PA-41 Schedule N is the same as the due date for filing your Pennsylvania tax return, which is usually April 15th.

Q: What happens if I don't file Form PA-41 Schedule N?

A: If you have Pa-Source Income or nonresident tax withheld in Pennsylvania and fail to file Form PA-41 Schedule N, you may face penalties and interest on any unpaid tax amounts.

Q: Can I e-file Form PA-41 Schedule N?

A: Yes, you can e-file Form PA-41 Schedule N if you are filing your Pennsylvania tax return electronically.

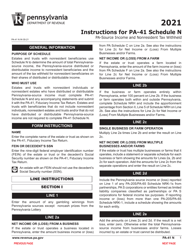

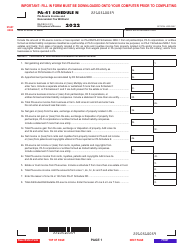

Q: Are there any specific instructions for filling out Form PA-41 Schedule N?

A: Yes, the Pennsylvania Department of Revenue provides instructions for filling out Form PA-41 Schedule N. Make sure to read and follow these instructions carefully to ensure accurate and complete filing.

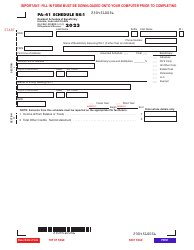

Q: Can I amend my Form PA-41 Schedule N?

A: Yes, if you need to make changes to your previously filed Form PA-41 Schedule N, you can file an amended return using Form PA-41 Schedule N and indicate the changes you are making.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule N by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.