This version of the form is not currently in use and is provided for reference only. Download this version of

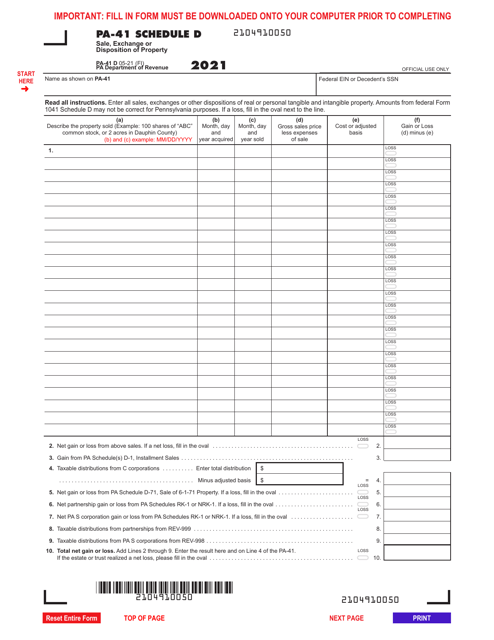

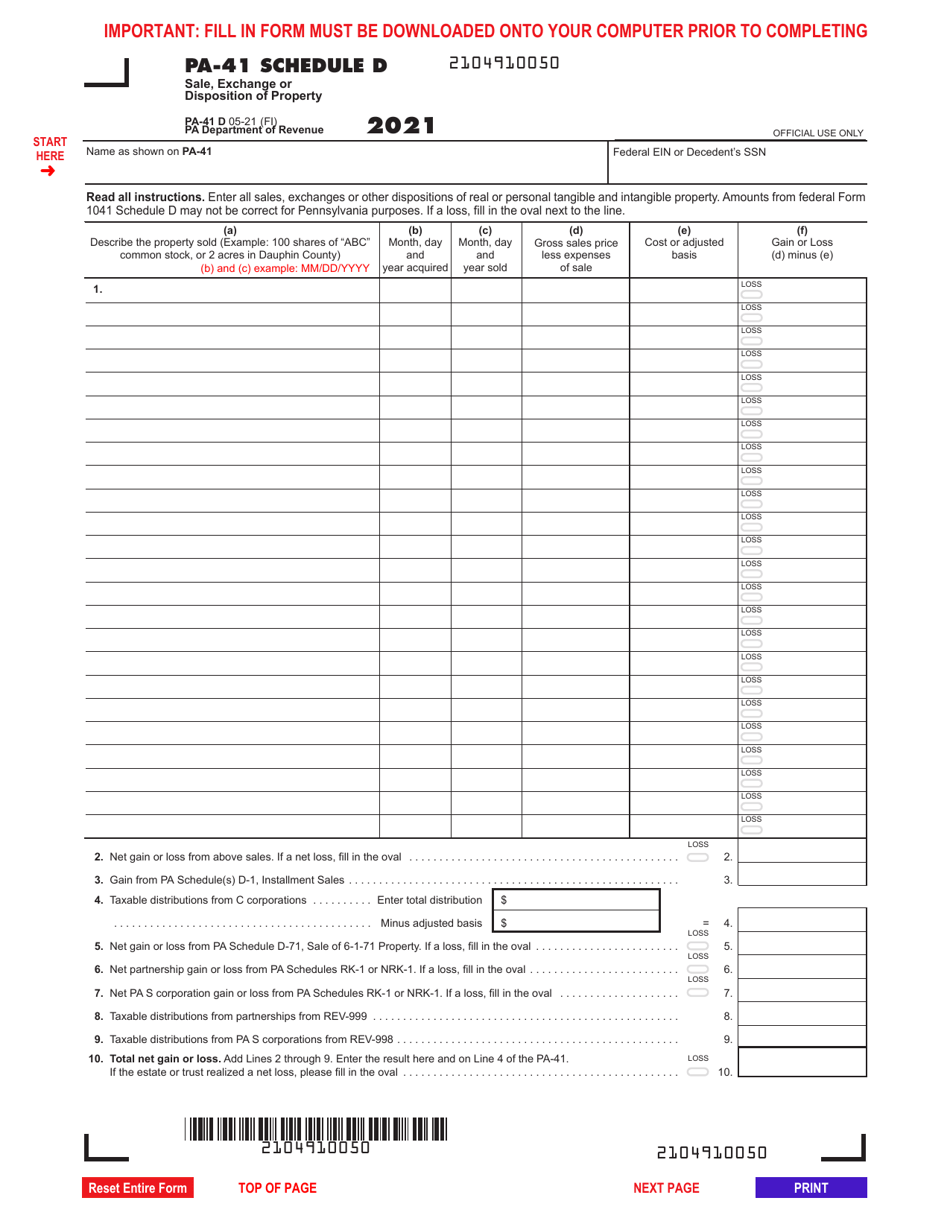

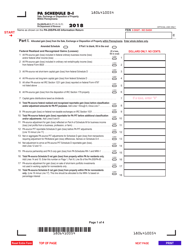

Form PA-41 Schedule D

for the current year.

Form PA-41 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-41 Schedule D?

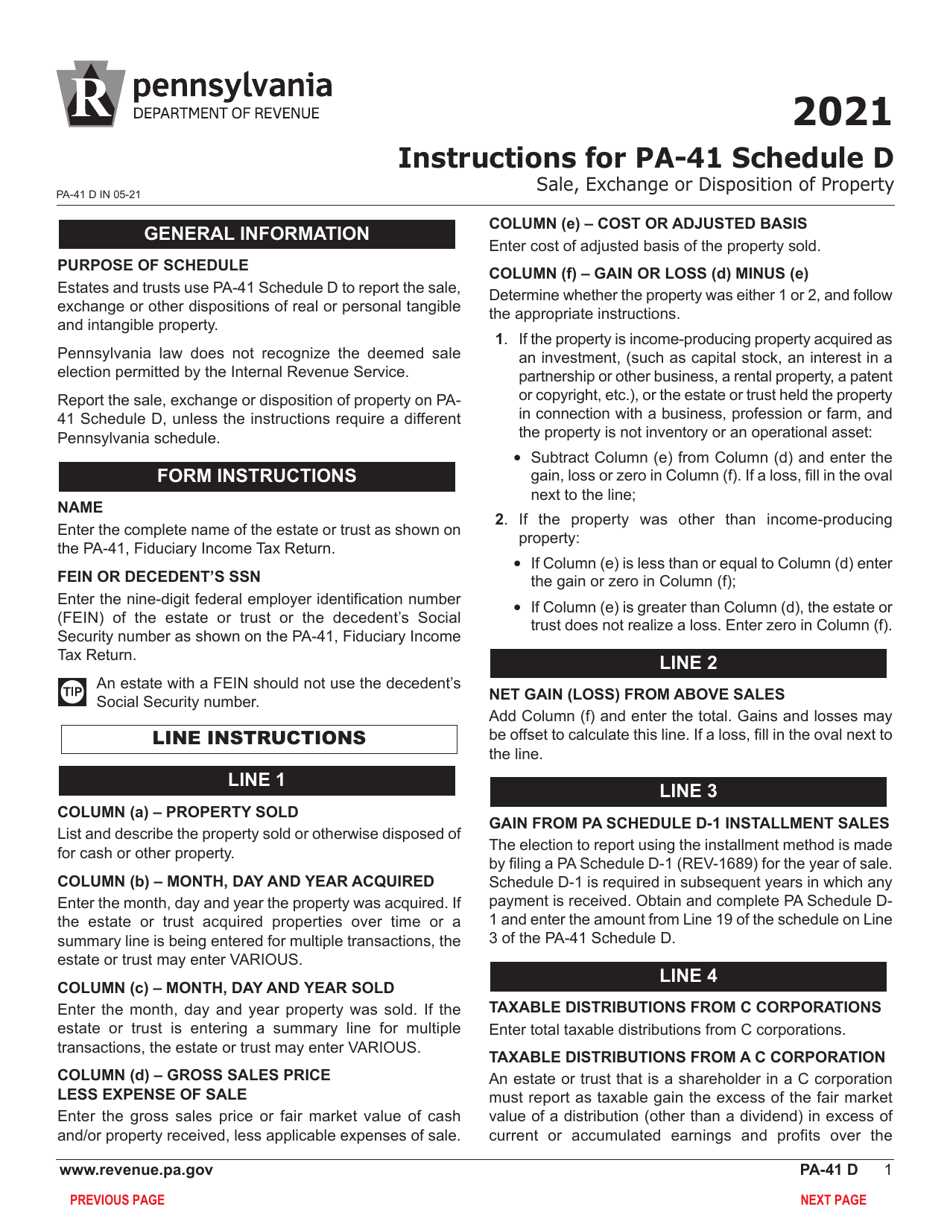

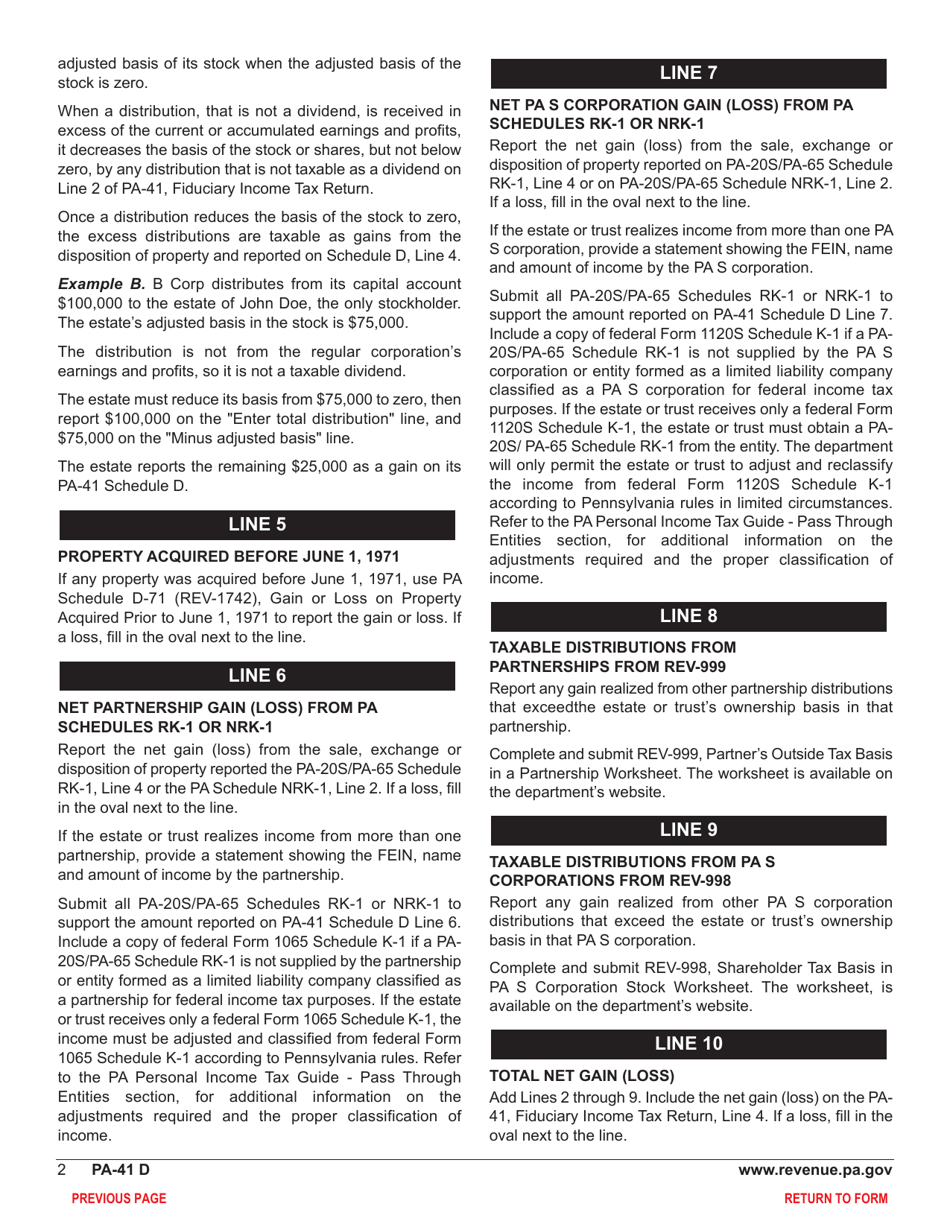

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule D?

A: Form PA-41 Schedule D is a tax form used in Pennsylvania to report the sale, exchange, or disposition of property.

Q: Who needs to file Form PA-41 Schedule D?

A: Anyone who has sold, exchanged, or disposed of property in Pennsylvania may need to file Form PA-41 Schedule D.

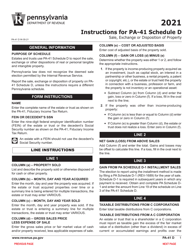

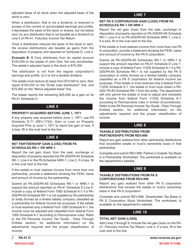

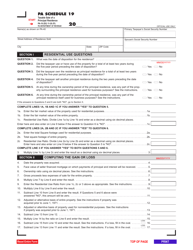

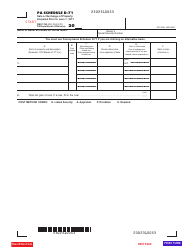

Q: What information is included in Form PA-41 Schedule D?

A: Form PA-41 Schedule D requires information about the property sold, exchanged, or disposed of, as well as details of the transaction and any relevant calculations.

Q: When is the deadline to file Form PA-41 Schedule D?

A: The deadline to file Form PA-41 Schedule D is typically the same as the deadline to file your Pennsylvania state income tax return, which is usually April 15th.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.