This version of the form is not currently in use and is provided for reference only. Download this version of

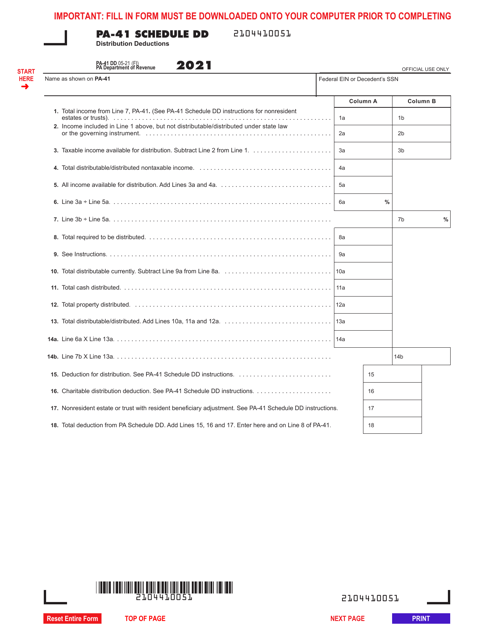

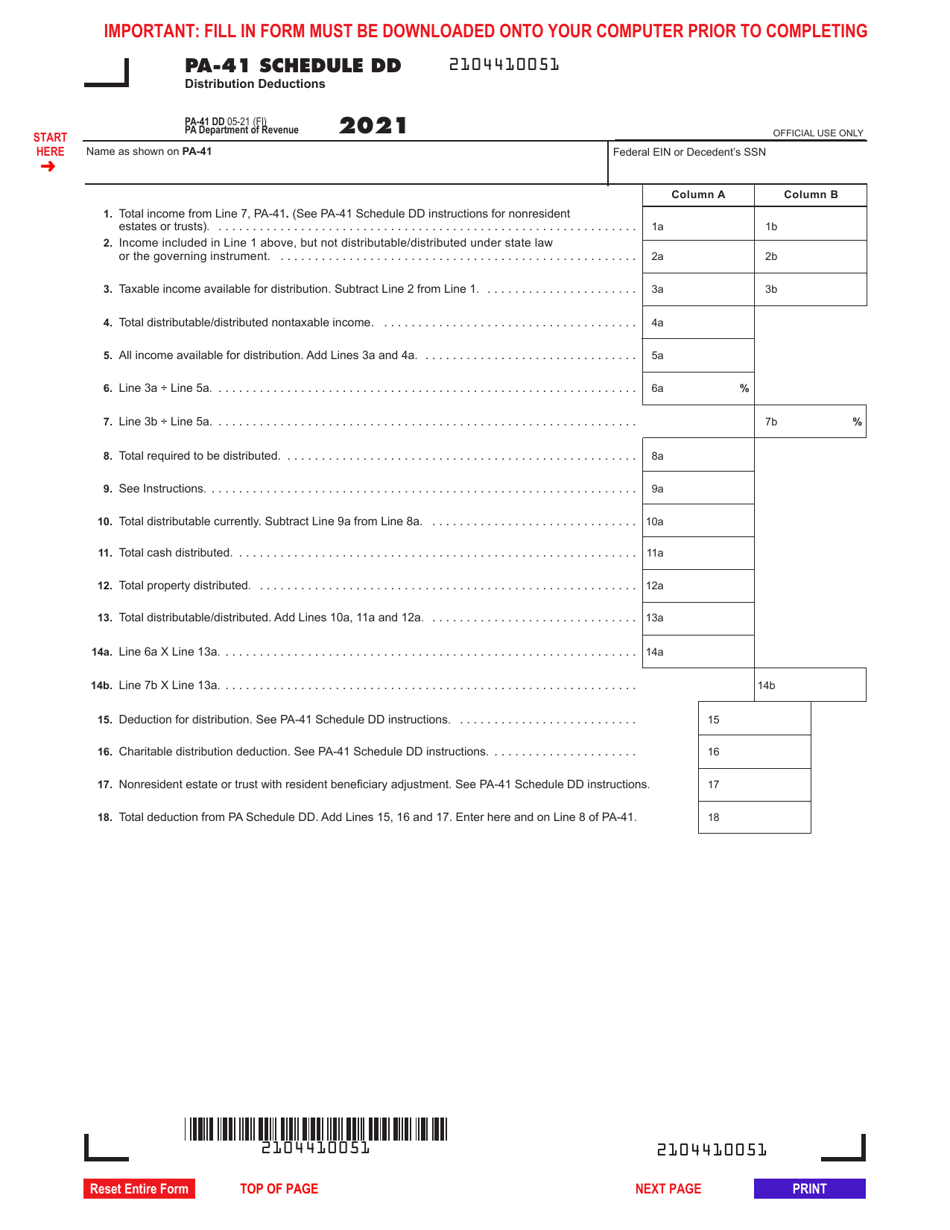

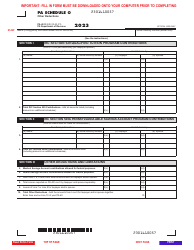

Form PA-41 Schedule DD

for the current year.

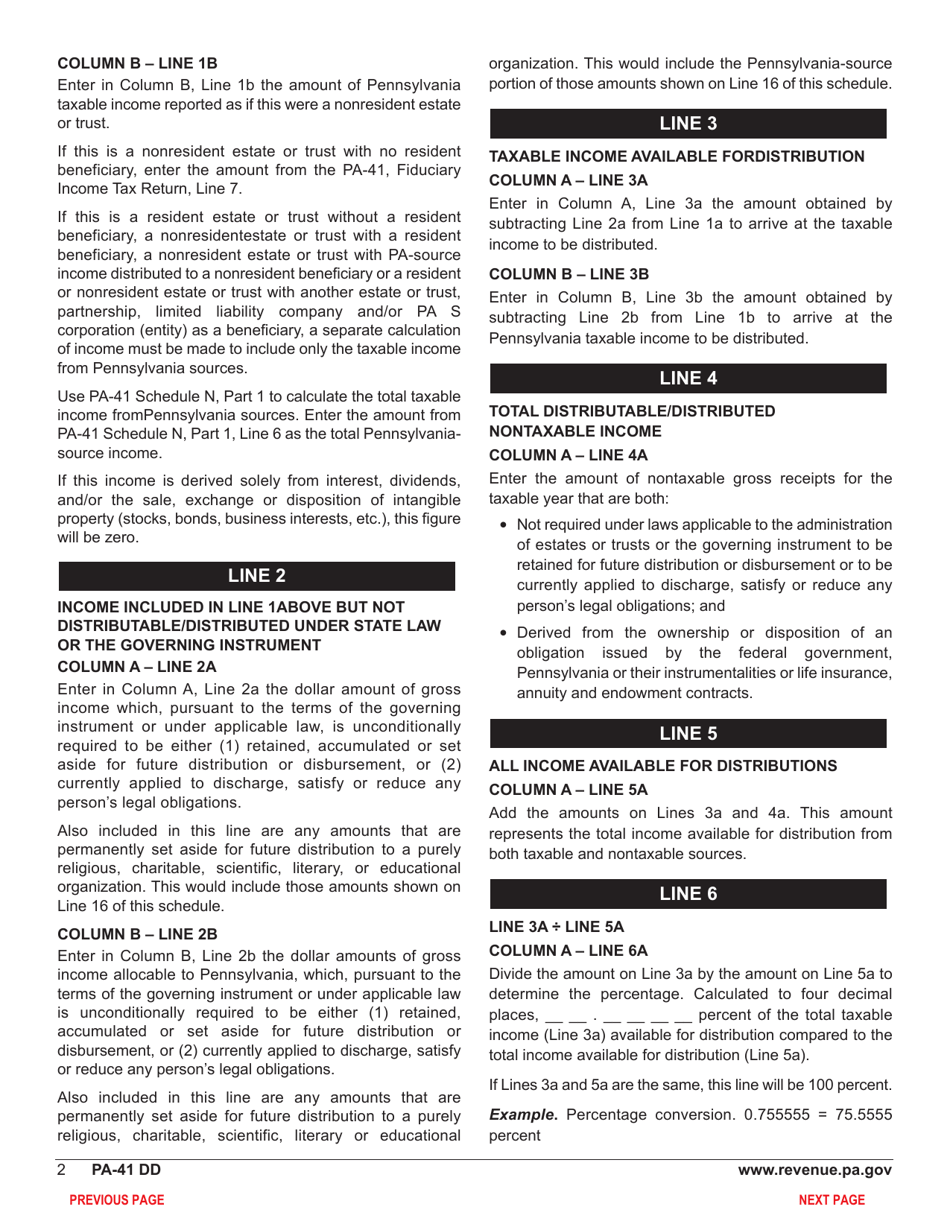

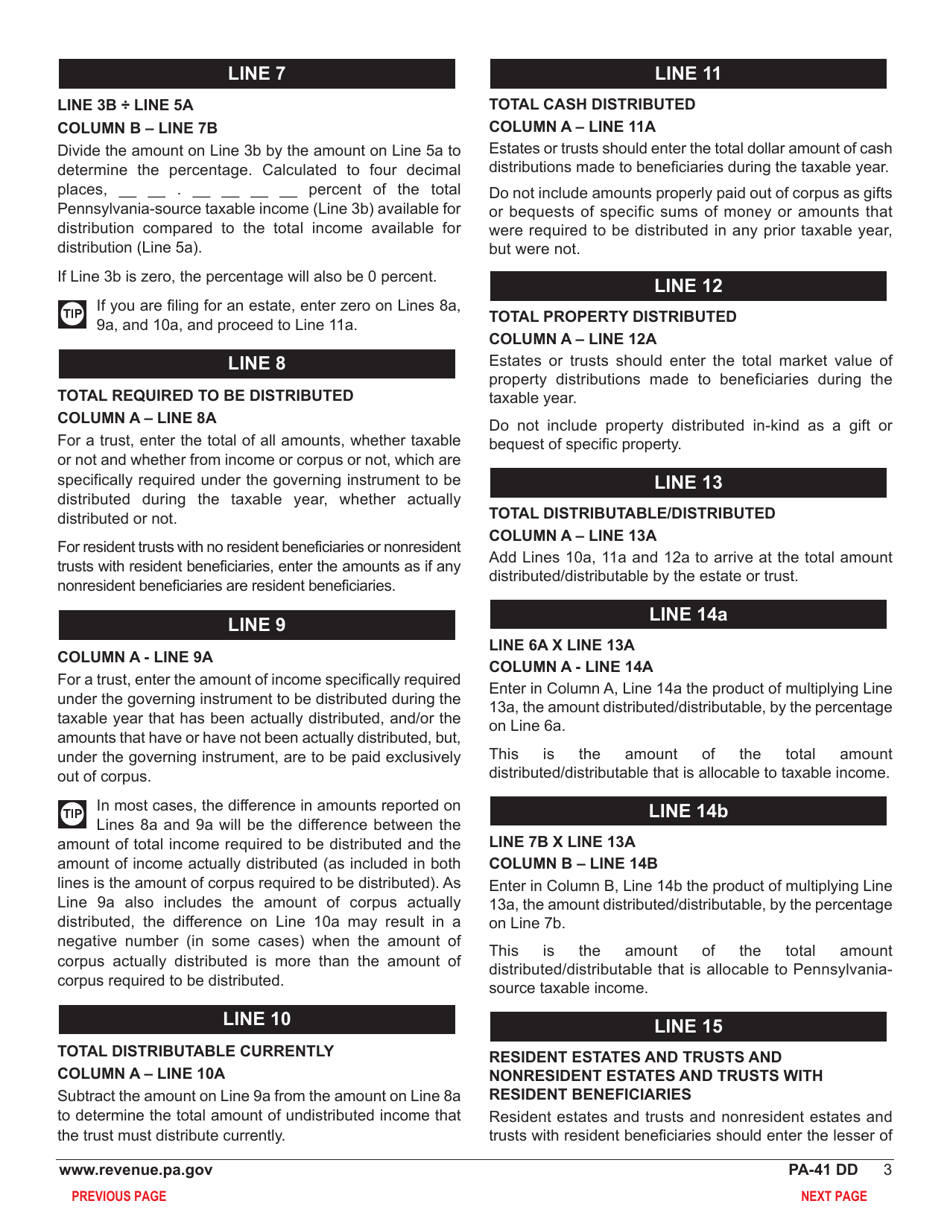

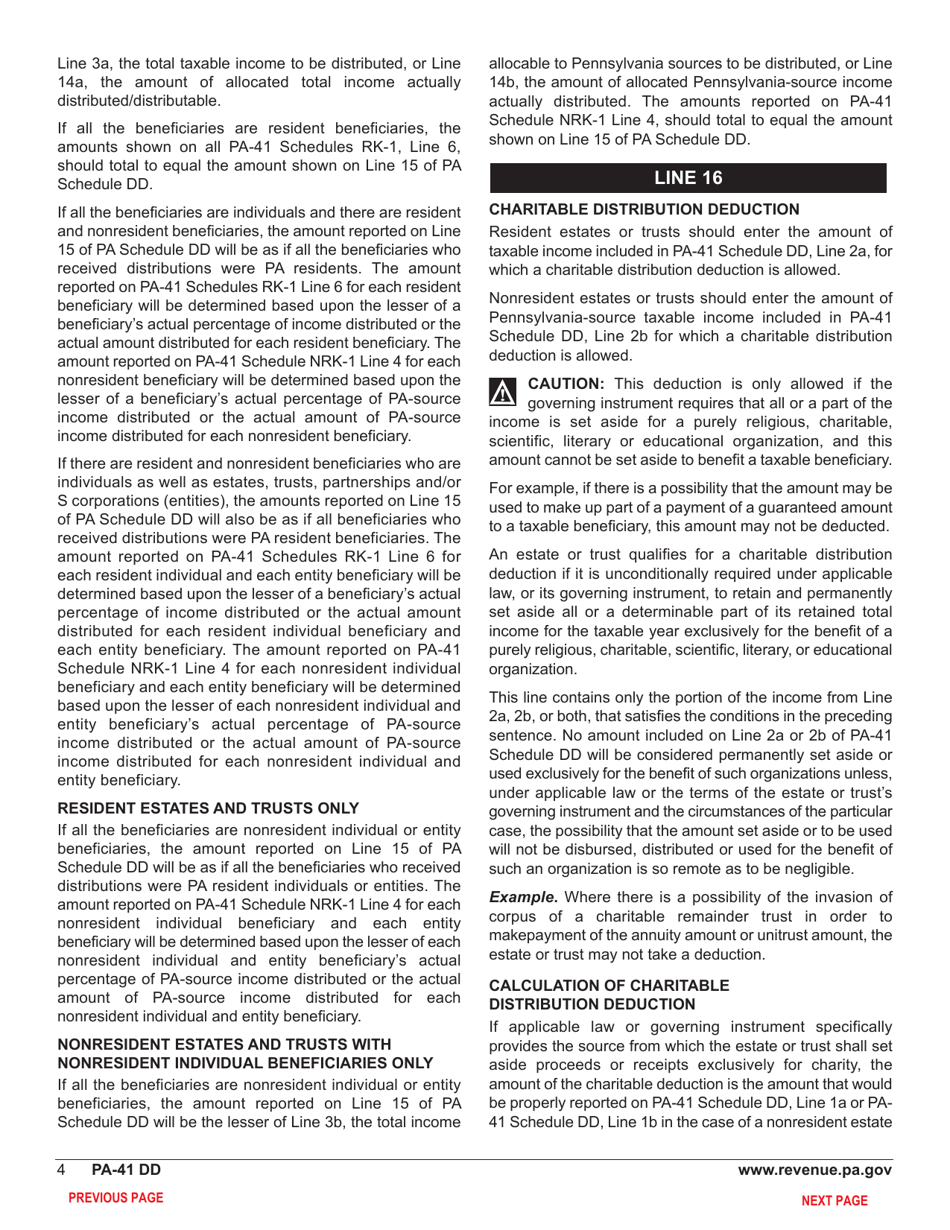

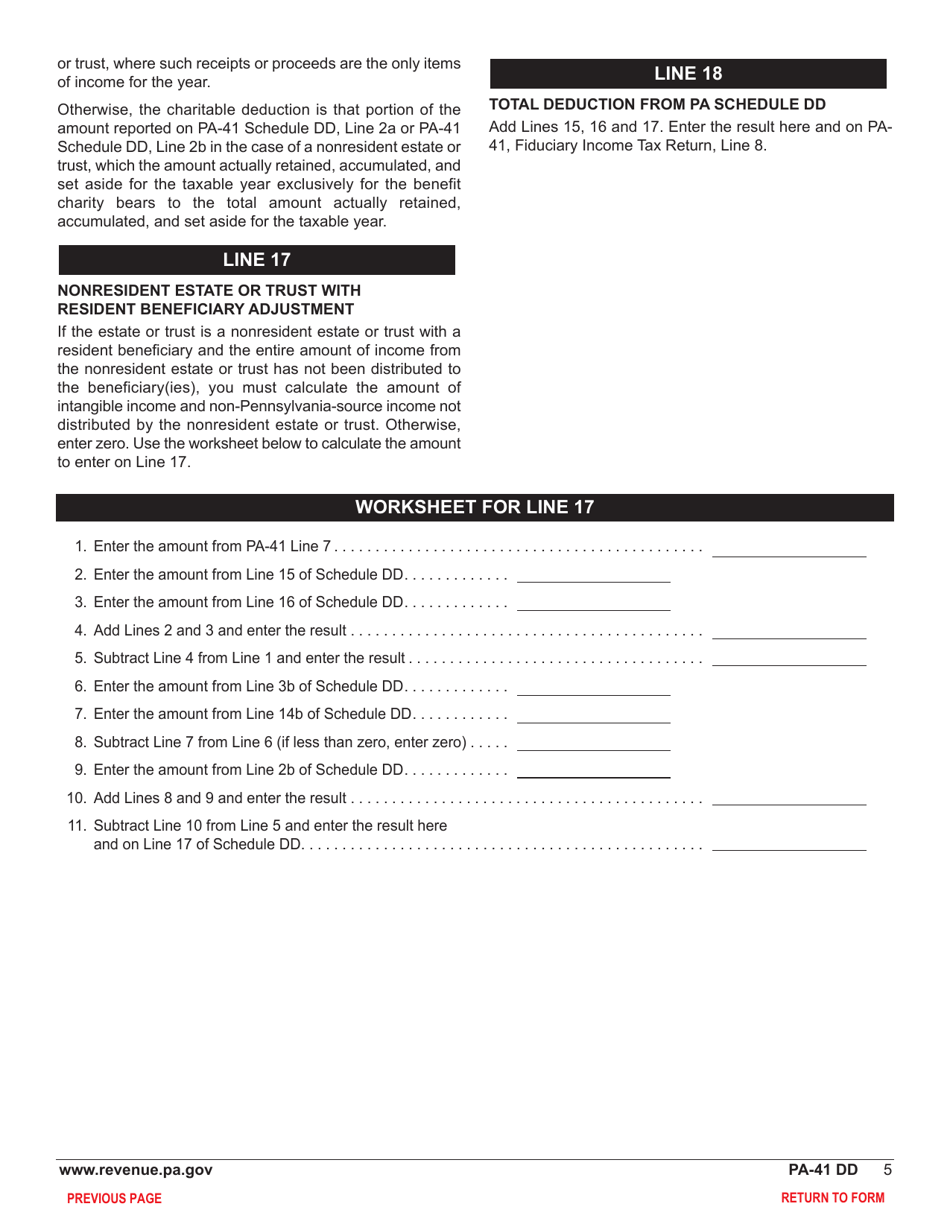

Form PA-41 Schedule DD Distribution Deductions - Pennsylvania

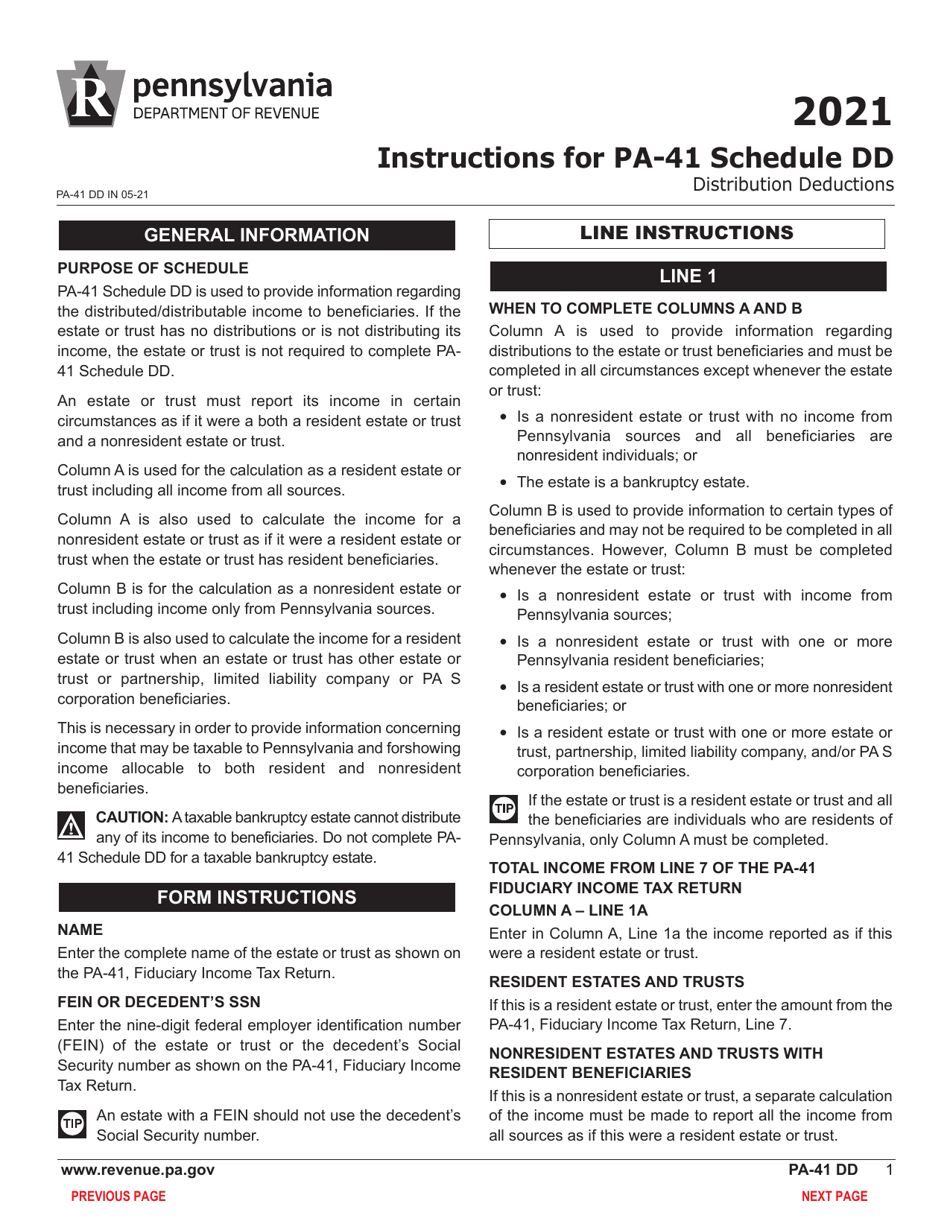

What Is Form PA-41 Schedule DD?

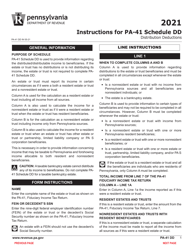

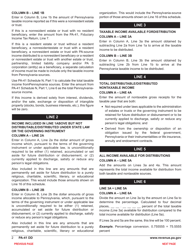

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule DD?

A: Form PA-41 Schedule DD is a tax form used in Pennsylvania to report distribution deductions.

Q: What are distribution deductions?

A: Distribution deductions are deductions taken on qualifying distributions from certain investment companies.

Q: When is Form PA-41 Schedule DD filed?

A: Form PA-41 Schedule DD is filed with the Pennsylvania Department of Revenue along with Form PA-41, the Pennsylvania Fiduciary Income Tax Return.

Q: Who needs to file Form PA-41 Schedule DD?

A: Those who have received qualifying distributions from certain investment companies in Pennsylvania may need to file Form PA-41 Schedule DD.

Q: What information is required to complete Form PA-41 Schedule DD?

A: To complete Form PA-41 Schedule DD, you will need information about the investment companies and the qualifying distributions you received.

Q: Are there any special instructions or considerations when filling out Form PA-41 Schedule DD?

A: Yes, it is important to carefully follow the instructions provided on the form to ensure accurate completion.

Q: Is there a deadline for filing Form PA-41 Schedule DD?

A: Yes, Form PA-41 Schedule DD is generally due on the same date as the Pennsylvania Fiduciary Income Tax Return (Form PA-41).

Q: What happens if I don't file Form PA-41 Schedule DD?

A: Failing to file Form PA-41 Schedule DD or inaccurately completing the form may result in penalties or other consequences determined by the Pennsylvania Department of Revenue.

Q: Can I file Form PA-41 Schedule DD electronically?

A: Yes, the Pennsylvania Department of Revenue offers electronic filing options for Form PA-41 Schedule DD.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule DD by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.