This version of the form is not currently in use and is provided for reference only. Download this version of

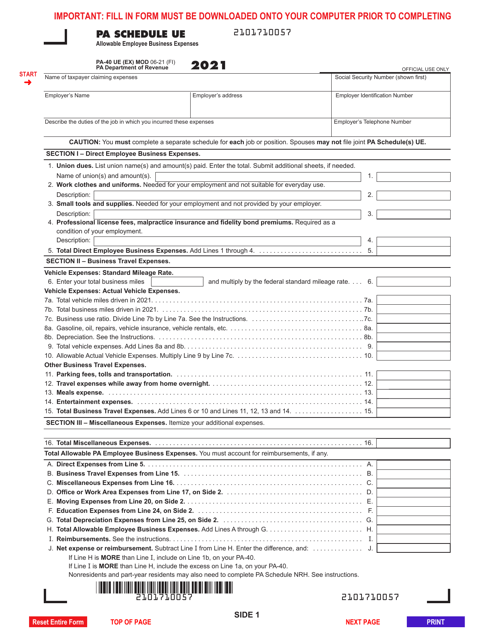

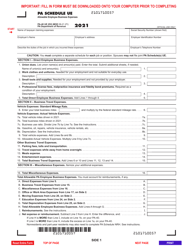

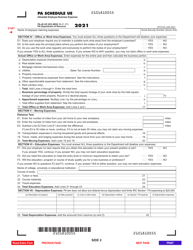

Form PA-40 Schedule UE

for the current year.

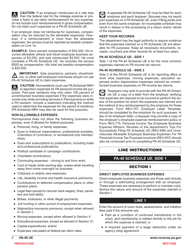

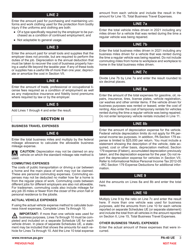

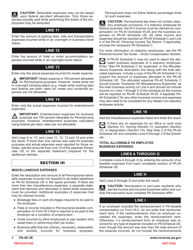

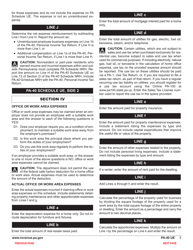

Form PA-40 Schedule UE Allowable Employee Business Expenses - Pennsylvania

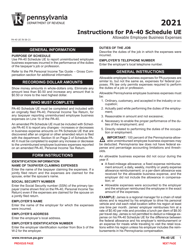

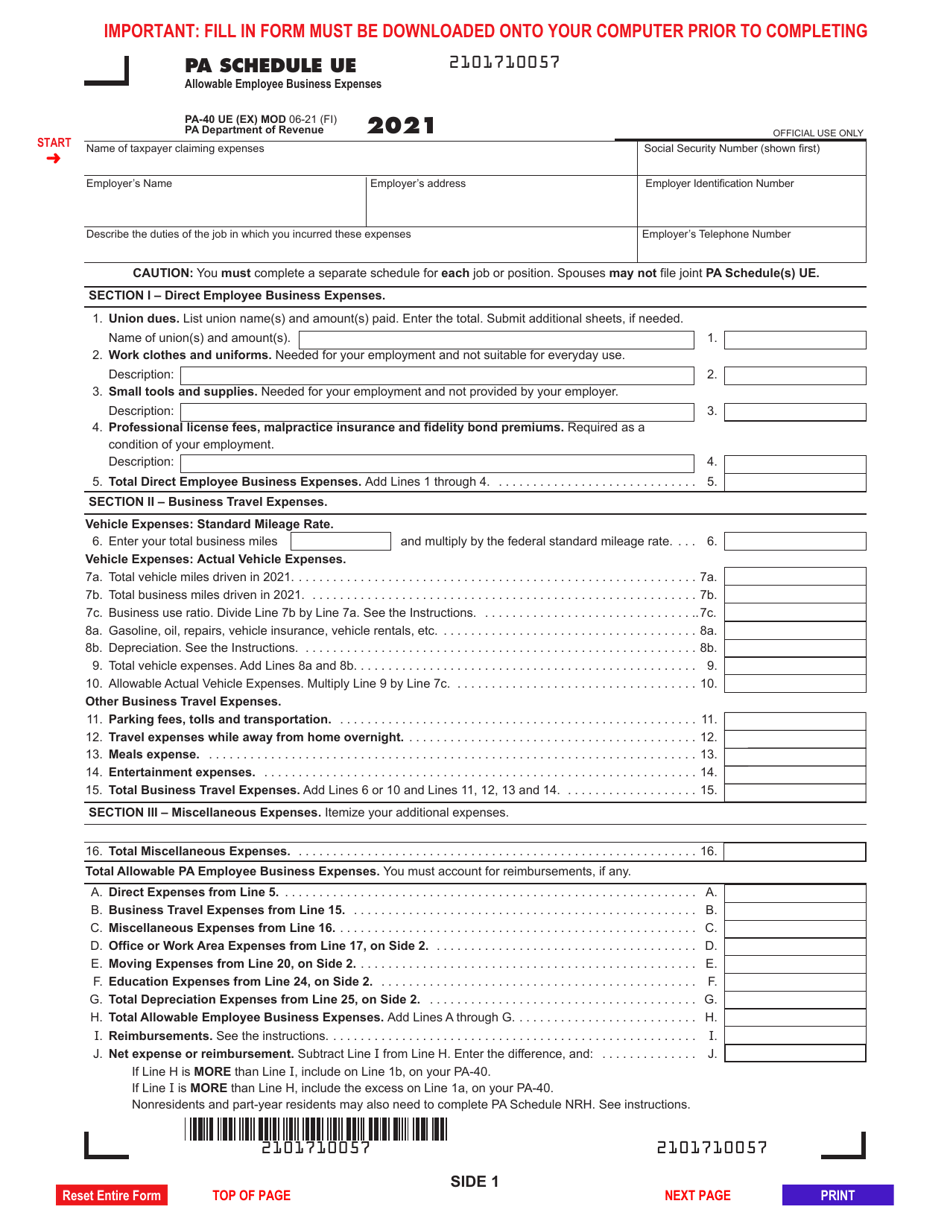

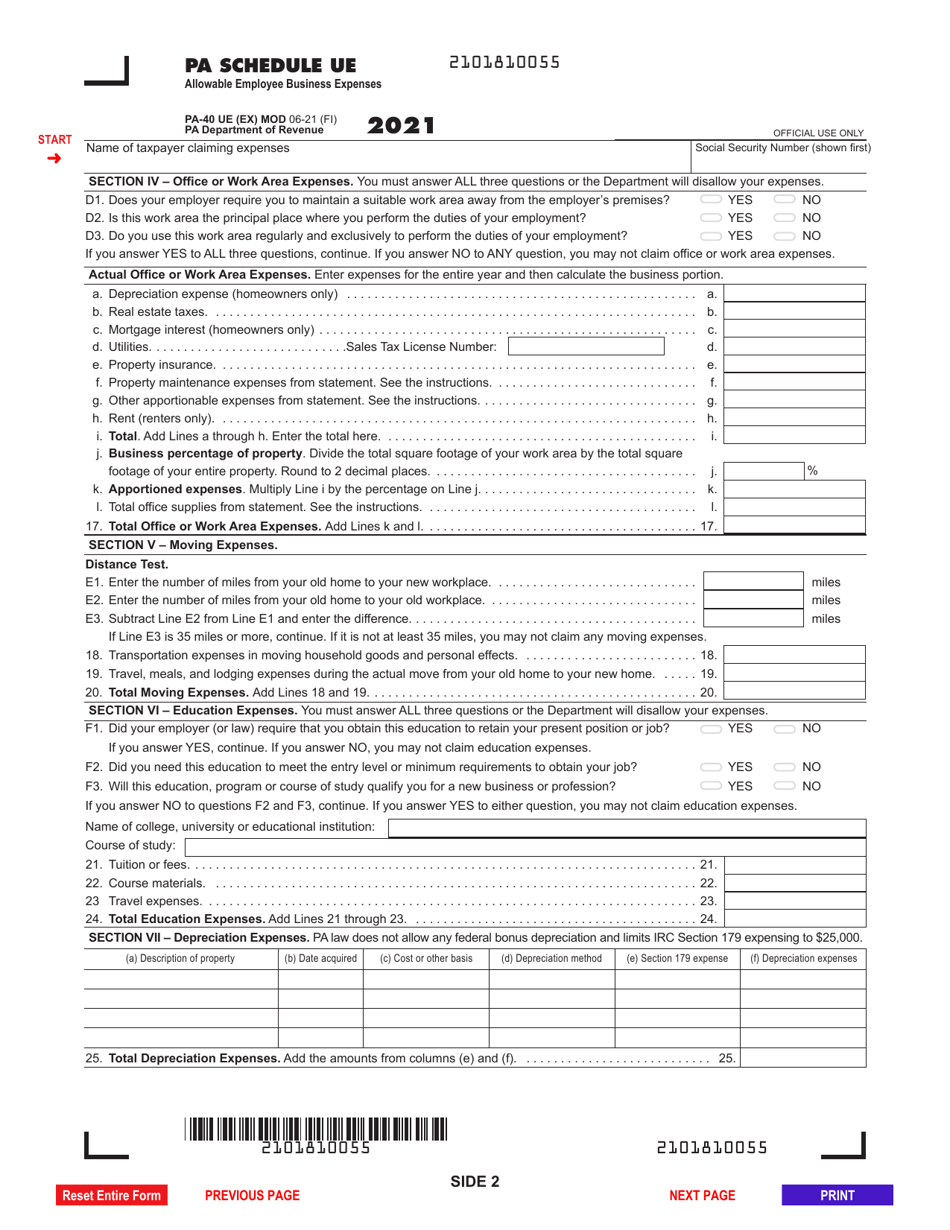

What Is Form PA-40 Schedule UE?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule UE?

A: Form PA-40 Schedule UE is a tax form used to report Allowable Employee Business Expenses in Pennsylvania.

Q: What are Allowable Employee Business Expenses?

A: Allowable Employee Business Expenses are expenses incurred by employees that are directly related to their job and necessary for their employment.

Q: How do I use Form PA-40 Schedule UE?

A: You can use Form PA-40 Schedule UE to report your allowable employee business expenses by filling out the required information on the form.

Q: Who needs to file Form PA-40 Schedule UE?

A: You need to file Form PA-40 Schedule UE if you are a Pennsylvania resident and have allowable employee business expenses to report.

Q: When is the deadline to file Form PA-40 Schedule UE?

A: The deadline to file Form PA-40 Schedule UE is the same as the deadline to file your Pennsylvania state income tax return, which is usually April 15th.

Q: What should I do if I have questions or need help with Form PA-40 Schedule UE?

A: If you have questions or need help with Form PA-40 Schedule UE, you can contact the Pennsylvania Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule UE by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.